M&A Opportunity Assessment in Mining Drilling Fluids Space

Listen to this Article

mins | This voice is AI generated.

mins | This voice is AI generated.

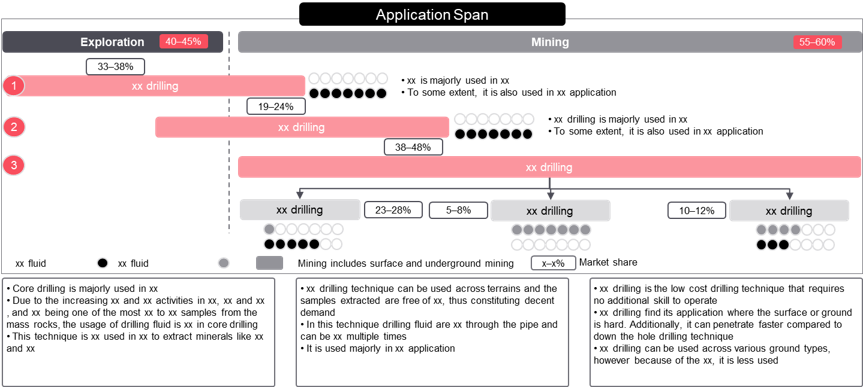

Our client, a leading mining equipment manufacturer, wanted to expand its portfolio into the drilling fluids space through an inorganic route. The client wanted our support to understand the market attractiveness of drilling fluids. It further wanted to identify and qualify key mining drilling fluid manufacturers aligned with attractive market segments for potential acquisitions.

With our help, our client was able to gain thorough understanding on most attractive drilling fluids sub-segments and best-fit partners in these segments. FutureBridge answered several strategic questions including:

The mining industry is constantly evolving with vertical and horizontal integration of value chain pillars across products, technologies and services.

The mining industry is constantly evolving with vertical and horizontal integration of value chain pillars across products, technologies and services.

FutureBridge conducted extensive primary, secondary research and expert consultations across selected industries to develop a concise view of the drilling fluids landscape and actors. Primary research included interviews with mining drilling fluid manufacturer, mining contractors, end users, thought leaders, independent consultants and analysts.

FutureBridge further distilled out the most attractive sub-segments based on different criteria (market size, growth rate, trends, gross margin, popular fluid type, competition intensity, customers’ geographic concentration, EHS compliance, synergy to existing client’s business). In addition, FutureBridge shortlisted 3–5 best-fit targets in the most attractive drilling fluids segments for the client for deeper due-diligence. The work FutureBridge carried out enabled our client to formulate a suitable business expansion strategy on attractive segments and best-fit targets.

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur long-standing clients include some of the worlds leading brands and forward-thinking corporations.