Why there is hope for the Auto Industry

Automotive Market Slowdown – Overview

The automotive industry is expected to decline at a faster pace than expected. This leads to massive economic threats, as the automotive industry is one of the world’s largest economic sectors, which is labor- and capital-intensive. The dynamics of this industry have an impact on global growth, employment, and overall development.

There is a new term in the industry – “Peak Car,” predicting that the peak has reached or will be reached in the next few years, and it is all downhill from there. There are a lot of contributing factors enabling this effect, including –

- Urbanization with good public transport infrastructure

- Ease and availability of car-share/car-pool/TSN services

- Lack of interest in owning/maintaining a vehicle, particularly in the new generation demographic

- Slowdown in the global economy and/or reduction in disposable income

- Electric/newer generation cars with very long on-road life

- Robo-taxi to offer fully automated rides, without attendants in vehicle

Despite these factors and the current slowdown in the automotive industry, it is believed that the industry will recover by 2020-2021. Although the above-mentioned factors are very critical and will have a negative impact, there are other trends that could still revive the plunging auto industry, at least in the short-term.

Some of the driving factors for recovery could be –

- Increase in market sales in developing nations, where current market penetration is less

- Emerging economies are likely to drive growth by 2020 and beyond

- OEMs are better positioned to cope with the current market conditions than they were during the last global slowdown (2008-2009)

- Urbanization will boost demand for shared mobility, indirectly increasing car sales (although shared mobility reduces the count of car required, they boost miles driven, and thus, scrapping a car much faster than the personally-owned ones)

- Electrification and digitization will create new ways to monetize vehicles; although this will also bring challenges for OEMs to re-define cars

Developed market stagnating, but developing market holds huge potential

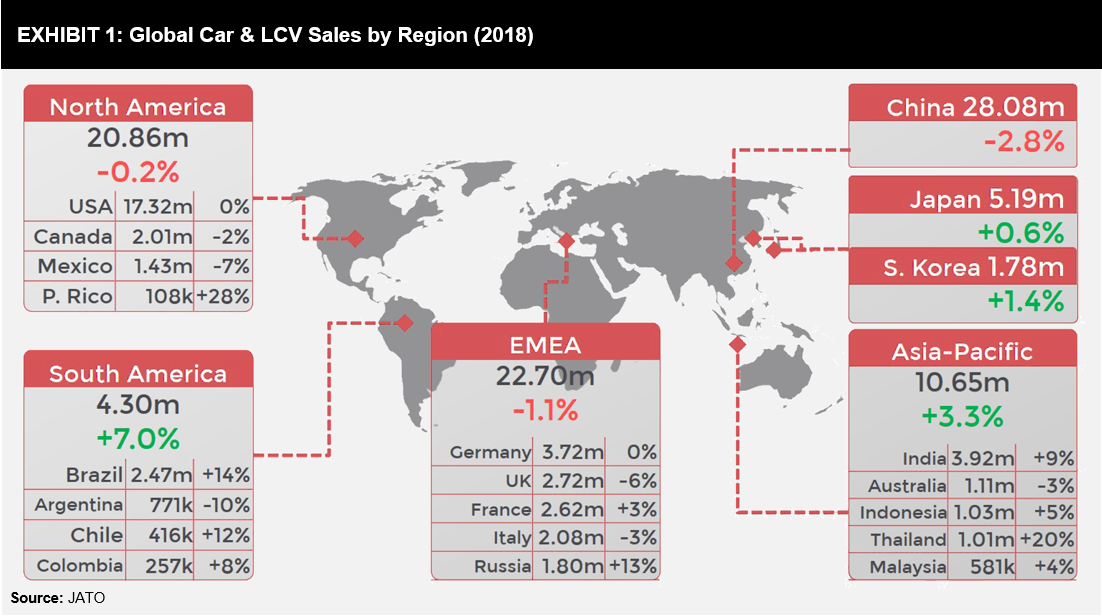

It has been observed that automotive sales are declining in Europe and North America; however, an increase in automobile sales is observed in developing nations, particularly in Southeast Asian countries (refer Exhibit 1).

China has reported a slowdown in the economy in 2018 that has impacted car sales and manufacturing output in this country. In response, the government of China has introduced measures to boost the economy, including lower income tax and VAT.

Global sales of pure electric vehicles soar by 92% in H1 2019

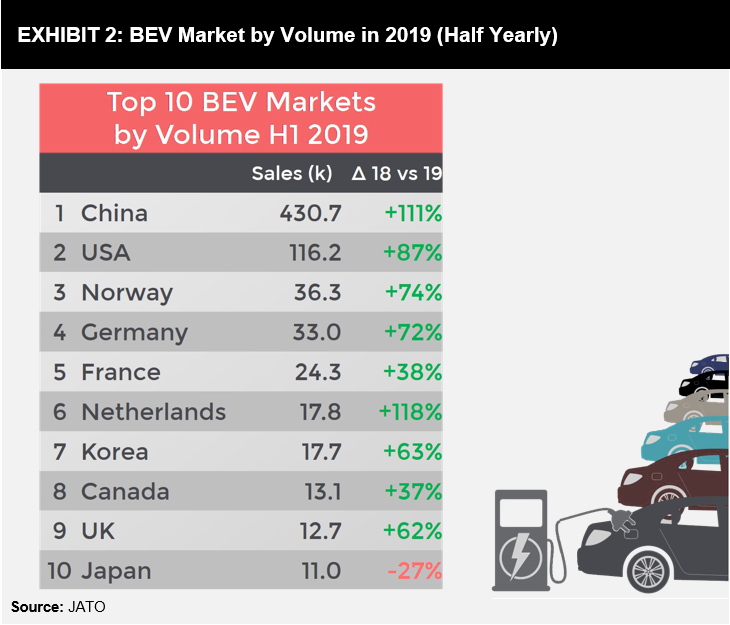

During the first six months of 2019, the global sales of pure electric vehicles increased by 92% to 765,000 units. This is a substantial increase, considering the challenging situation faced by the automotive industry worldwide.

The dynamism seen so far is expected to continue or even accelerate in the second half of 2019 (refer Exhibit 2). Volkswagen introduced ID.3 first standalone BEV in Sept 2019; Mercedes EQC will be available for sale in early 2020; Fiat announced in July 2019 investment of $788 M to build new 500 EV; Peugeot introduced e-208 for sale in September 2019; Chinese manufacturers are rapidly releasing more models.

Electrification/Digitization of vehicles means challenges and opportunities for OEMs

Digitization and connectivity are becoming the key focus areas to create more value for consumers. There is a rise in data monetization-related efforts in the automotive industry, which can help OEMs and other potential players generate direct revenue by trading data as well as data-driven services and boosting product/operation efficiencies by using advanced analytics or adding non-tangible value to the brand.

The electrification and hybridization of vehicles serve to be a lucrative opportunity for growth, with some markets particularly supportive of the trend. Norway is one such example – electric vehicles in this country have outsold petrol and diesel cars for the first time in March 2019.

However, while more electric vehicles will help combat climate change, the manufacturing process puts pressure on carmakers. Electrification, whether through hybridization or developing battery electric vehicles, is a critical path the industry is witnessing. An example of this would be Volkswagen working on the latest MEB modular electric vehicle platform. This has resulted in the company investing in new technologies, thereby increasing cost and restructuring its manufacturing operations.

Emerging economies are likely to drive growth in 2020 and beyond

The per capita car consumption in Asian countries is presently very low; however, it is expected to increase in the near future. Developing countries are witnessing advancements with respect to industries and infrastructure that are happening at a slow pace. As manufacturing countries, such as China, become cost-competitive, industrialization will follow in the developing countries by boosting individual income. Vehicles are still a necessity, and with a rise in the economy, the automobile market is expected to pick-up pace.

OEMs are better positioned to cope with market conditions than they were in 2008-2009

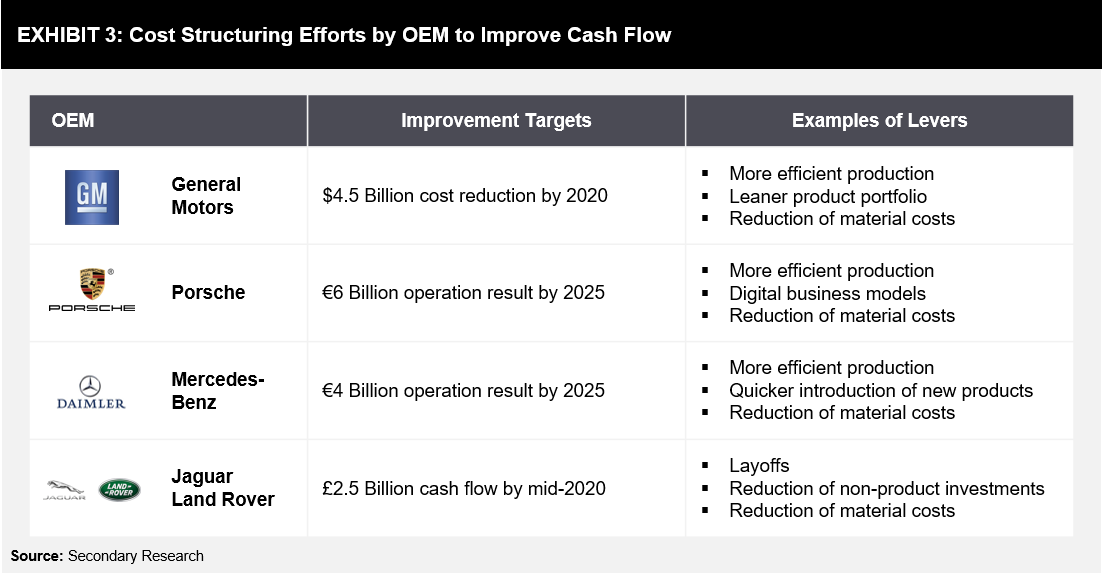

OEMs have announced large cost-saving programs. Cost-saving programs are one of the most promising measures for OEMs to handle their current challenges. Nearly all large cost-cutting programs have a material cost reduction element, and thus they are targeting the supplier base. Suppliers have to define measures to defend themselves against cost-saving programs and to handle their financing requirements in parallel.

Recent efficiency programs of major OEMs are listed in Exhibit 3.

Ride-Sharing will contribute a more substantial chunk of car sales in future

A shared car travels longer distances, resulting in high wear and tear, and thus, the life of a shared car is low as compared to a privately-owned car. Urbanization is expected to boost the demand for shared mobility, indirectly increasing car sales. There is a clear indication that the negative impact of shared car availability (people choosing not to buy due to availability of sharing models) is much less as compared to the positive impact of shared cars (people choosing shared cars over public transport).

Challenges for OEMs

Price-cost Gap Narrows

Price and regulatory pressures mean that OEMs in the established markets of Europe, North America, Japan, and South Korea have a little margin of error when it comes to making the right decisions on how to differentiate themselves.

Past vs. Present: Profit per Vehicle Comparison

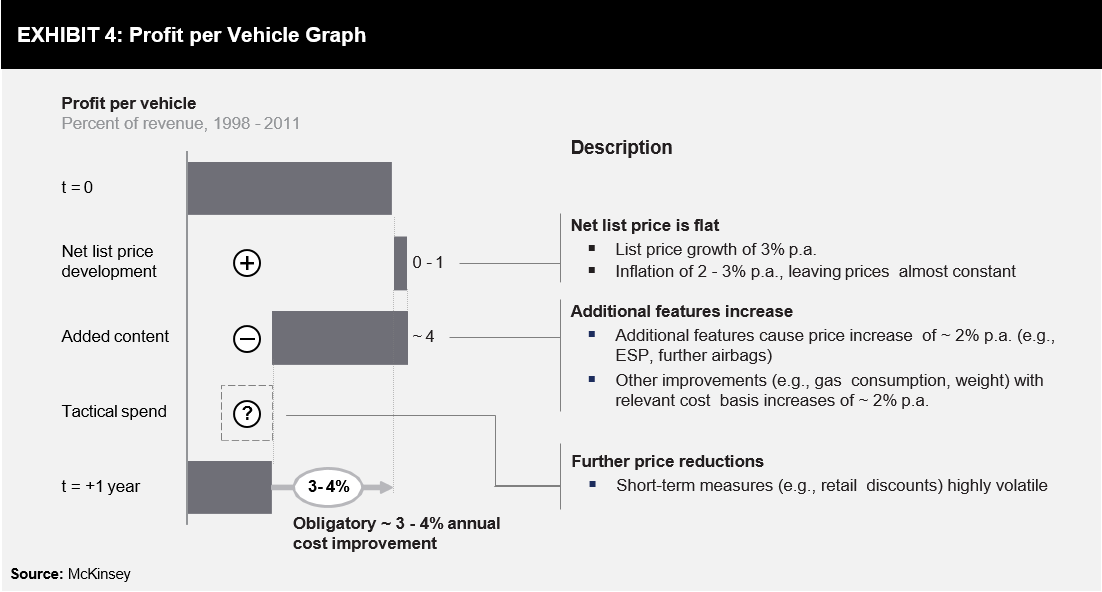

More and more features and improvements have been added due to several factors, such as competition, customer demands, and regulations. The net effect has been a decline in profit per vehicle (refer Exhibit 4).

However, tighter regulations for emissions or safety will add further costs to the average vehicle. Evidence suggests that the share of this regulation-driven content will increase to 60% in North America and Europe (up from 40%).

An increase in the share of regulation-driven content will narrow the price-cost gap, and thus, OEMs will face difficulties in prioritizing among differentiating features and basic customer demands. Therefore, OEMs need to find ways to impose mark-ups for mandated capabilities to tighten annual cost improvement beyond 3–4%.

Rising Complexity encourages more Platforming

Car buyers worldwide continue to be more and more demanding, seeking region-specific features, performance, and styling, as well as an element of uniqueness even in mass-market products as a way of differentiating and emphasizing individual taste and status. Most automakers respond to this demand with an increasing number of derivatives, subject to mark-ups compared with standard models.

It is not uncommon to have 20 or even more such derivatives, as companies seek to profit from different market niches. In effect, derivatives share common non-consumer facing product elements (e.g., common chassis underpinning, body structures, and core components) to make differentiation of consumer-facing features profitable. Continuing to create even more derivatives will simply exert pressure on the profitability of OEMs.

Greening gets more expensive

Tougher Emission Regulations will Encourage OEMs to Invest in e-mobility

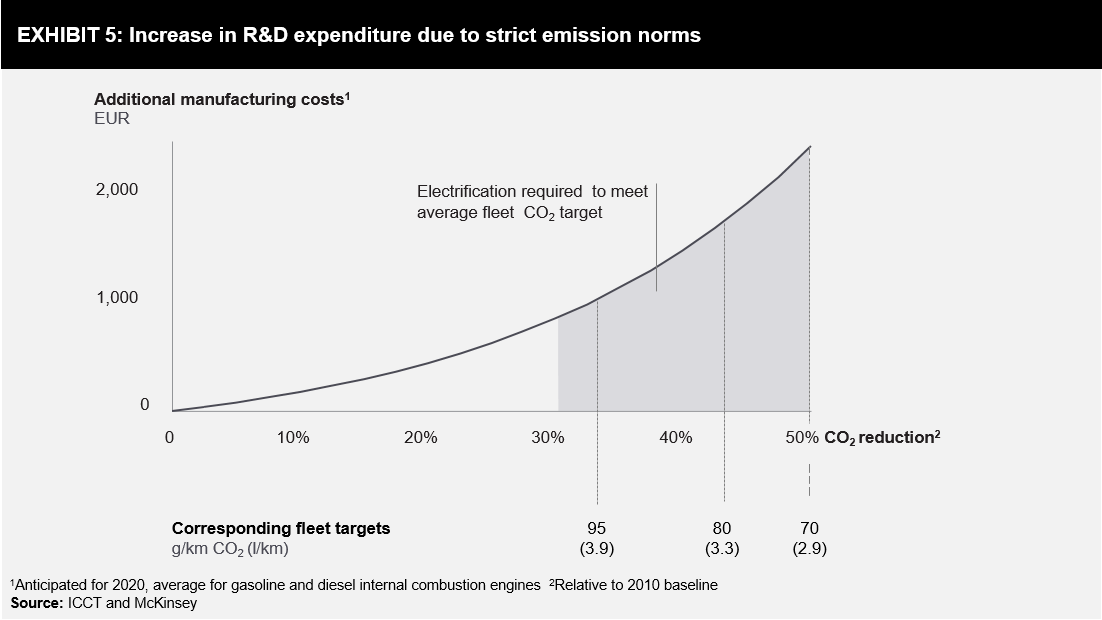

Carbon dioxide regulation is likely to continue to tighten in several regions worldwide. China, India, the US, and Japan have enacted laws to reduce emissions. One immediate result of such laws will be the higher cost for R&D. Since all easy measures have already been implemented, such as diesel particulate filter, oxidation catalyst etc., the price of reducing future emissions is bound to be high. In Europe, the 2020 target might be reached with the help of advanced conventional technologies; however, to meet the overall fleet targets, more electrification could be necessary (especially for premium players). This will propel OEMs to invest more in e-mobility, such as electrical/hybrid powertrains, batteries, and lightweight and aerodynamic drag-reducing technologies.

Significance of the Global Used Car Market

The used car market across the world is growing. The main reason for the same has been the advent of organized players in the market in developing nations, which has taken care of the trust deficit, plaguing the used car market in those countries for ages.

Growing second-hand markets (in China, the US, and the UK) will maintain the price differential with new vehicles and continue to surpass new-vehicle deliveries in most mature markets, where the ratio of used-vehicle to new-vehicle sales stand between 2 and 2.5. This will act as a challenge for OEMs to sell more new cars in the near future.

Future Outlook

It is time for market leaders to review their M&A pipeline and identify promising strategic partners that can fill gaps in the portfolio, indirectly keeping the future mobility needs in the loop. A slowdown can present attractive opportunities to acquire critical talent and capabilities inside and outside the traditional automotive sector. Well-placed investments will enable an automaker to leap ahead of slower-moving peers and gain a significant edge in innovation, development, and time-to-market. Companies that use the period before a slowdown to prepare themselves for it will be better positioned to seize attractive opportunities when they arise.

It is increasingly clear that the automotive industry is in intermediate stages of a slowdown. But while contractions are a time of uncertainty, the industry is expected to introduce significant value-generating opportunities around digitization and services. Businesses that act quickly and decisively to embrace a new and more strategic business decision will not only rebound faster from the downturn but also come out of it stronger than they were before.

References

- Global-car-market-remains-stable-during-2018-as-continuous-demand-for-suvs-offsets-decline-in-sales-of-compact-cars-and-mpvs/

- Global-sales-of-pure-electric-vehicles-soar-by-92-in-h1-2019/

- Donald-trump-asks-general-motors-to-stop-manufacturing-cars-in-china

- Porsche-is-said-to-target-6-8-billion-profit-push-for-e-cars

- Annualreport.daimler.com – combined-management-report -economic-situation

- Jaguar-land-rover-returns-profit-revenues-rise-8-second-quarter-20192020-financial

- PDF -McK The road to 2020 and beyond

- McK The road to 2020 and beyond