Introduction to V2X

With the rise in the number of connected cars, autonomous driving, and 5G connectivity, the future of mobility has opened new dimensions in the way – vehicles, infrastructure, and pedestrians communicate with each other. This type of communication, which is essentially wireless between vehicles and its surroundings (including vehicles, pedestrians, devices, infrastructure, grid, and smart homes), is termed as Vehicle to everything (V2X).

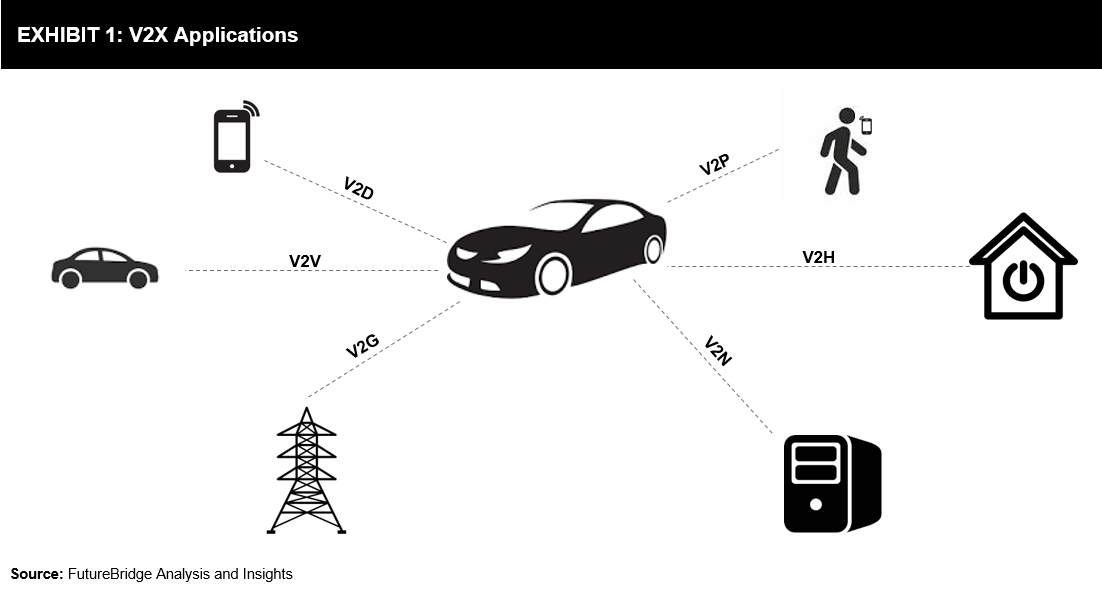

V2X can be used for various purposes (Exhibit 1) the two broad categories include safety and non-safety applications:

- Safety-related: Drivers, pedestrians, and vehicles are notified about the current road conditions and the surroundings. The advantages include collision warning, control loss warning, and ease of emergency vehicle maneuvering, wrong way/lane driving warning, and crash warning.

- Non-safety related: Traffic ‘flow’ and ‘efficiency’ can be improved through V2X. The advantages include:

- Traffic flow optimization by managing/controlling vehicle speed for smooth driving

- Co-operative Adaptive Cruise Control (CACC), where a vehicle takes the lead, and the rest follow. This helps a vehicle with V2X capability to join a CACC group further improving traffic congestion and improving efficiency.

So with the increasing popularity of V2X few important aspects to be looked at are:

So with the increasing popularity of V2X few important aspects to be looked at are:

- What is the current role of various stakeholders?

- within the automotive value chain like OEMs and tier 1 suppliers

- Others like network operators, cloud service providers, and traffic infrastructure providers?

- What would be the role of these stakeholders in the future, with the increasing adoption of V2X?

- What is expected in the future due to V2X?

Role of Stakeholders – Current vs. Future

The key stakeholders involved in the V2X value chain include – Communication System Providers (such as network operators), Connectivity Providers (such as cloud service providers), and Automotive Manufacturers & Suppliers (such as OEMs and Tier 1 suppliers).

Communication System Providers – current vs. future role:

- Currently, they are following an evolutionary path, where they are providing V2N (vehicle to the network) services, particularly the mobile network operators. They are able to support communication for connected vehicles in partnership with automakers. The types of services offered through the partnership include ‘vehicle information, ‘driving characteristics and behavior’, ‘location information’, and ‘OTA updates.’ At present, vehicle owners do not have the privilege to select their own network provider. For instance, Ford has tie-up with Vodafone in Europe.

- In the future, these network operators can extend their offerings and also support V2V (vehicle to vehicle), V2I (vehicle to infrastructure), V2P (vehicle to pedestrian) and improve V2N (vehicle to the network) applications.

- Within V2V, the network operators will not interact with short-range V2V communications like DSRC (dedicated short-range communication) or C-V2X. However, these communication systems are able to benefit from vehicle specific information within a small and isolated range. In this case, a network operator can broadcast data like road construction work or other hazards beyond the direct V2V communication range. Hence, the mobile network operators can think of an option for offering these services as well as think about how they can participate in the short V2V communication range, which improves vehicle safety.

- Within V2I, the network operators may take up the opportunity to support in setting up RSU’s (road side units) in remote/rural areas, which are isolated. Setting up of RSU’s (an important component of short range communication protocol), would be easier in the urban set-up with the existing fibre connectivity. Hence, there lies an opportunity for the mobile operators in supporting backhaul for the isolated RSU’s.

- Within V2P,mobile network operators can create opportunities by participating in the communication pathway for Vulnerable Road Users (VRUs). Through this, the mobile network operators can help in providing critical alerts that can help to stop a collision. They will play a key role where the VRUs are hidden and cannot be detected by on-vehicle sensors.

- Within V2N,the mobile operators, in collaboration with the OEMs, can work towards offering the vehicle owner a choice to choose the operator. Though this may mean creating competition within the network operators, however, this will also result in providing wide network coverage, reliability, and reduced latency. Some of these issues will also get answered through 5G network coverage.

Connectivity Providers – current vs. future role:

- Cloud service providers currently support the V2X ecosystem by providing SIM card management, data management, analytics platforms, etc. With the introduction of 5G, the role of cloud service providers will increase, where they can efficiently support mobile network operators due to the availability of a dynamic network.

Automotive Manufacturers & Suppliers (such as OEMs and Tier 1 suppliers):

- Currently, services like in-vehicle services information, driver information, and location information are offered by OEMs. These systems are continuously running through improvements through additions in safety functions, comfort functions, etc. For instance, smart sensors have also evolved with time and are now able to fulfil a wide range of safety and comfort-related activities.

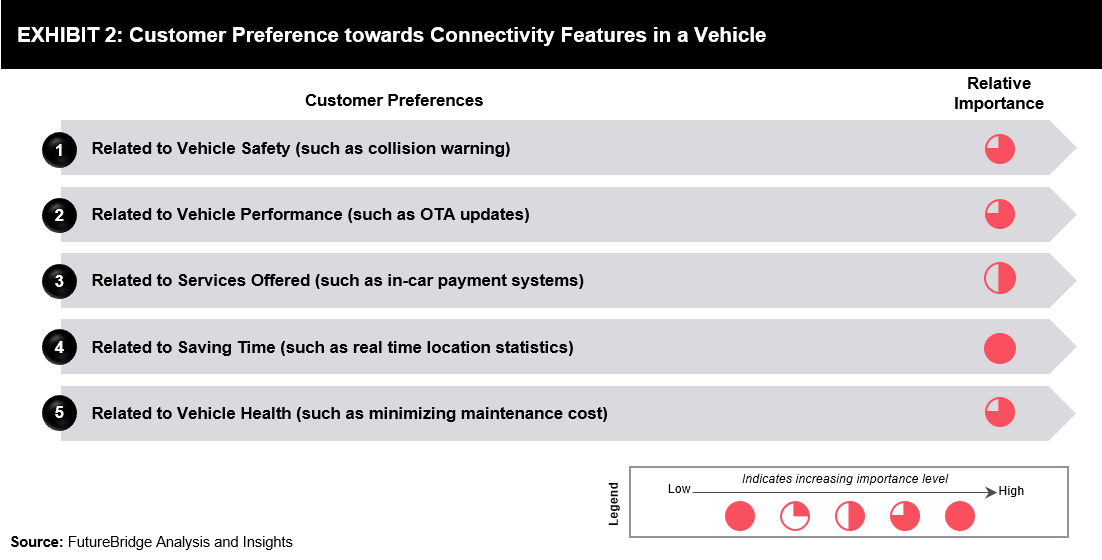

- In the future, more seamless services are required, as part of customer preferences (primarily safety and comfort), for instance – connecting the vehicle with a customer’s daily use items like calendar, banking account, in-car payment systems, insurance companies, and parking service providers.

- Hence, the OEMs need to provide quality services to their customers at a competitive cost. With 5G making inroads across the globe, the OEM with a user-friendly and cost-effective system will have an early advantage and is expected to achieve widespread market acceptance.

All the current, as well as future roles, suggest – the future of mobility is moving towards ensuring passenger safety and comfort, thereby indicating traction towards fully autonomous driving.

Road Ahead

Demand Side:

Increasingly, consumer preference towards the connected vehicle is increasing across the globe. According to a survey finding (refer to Exhibit 2), features such as saving time, safety, performance, and vehicle health are some of the key features that are increasingly looked upon by the consumers. By region, Asia is emerging out to be one of the leading locations for vehicle connectivity. Along with Europe and North America, Asia will also be a region to look at as far as V2X is concerned. Thus, with the growing preference towards vehicle ‘safety’ and ‘performance’, V2X adoption is expected to increase, thereby moving towards the path of fully autonomous vehicles in the future.

Supply Side:

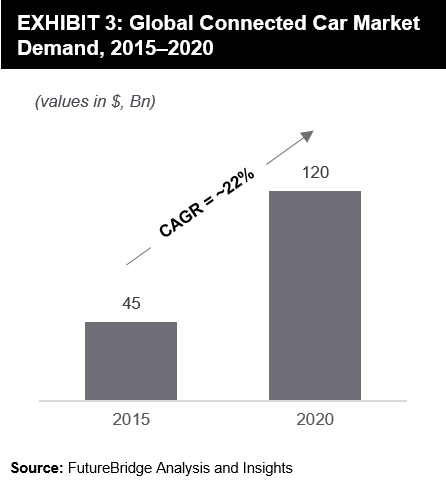

V2X penetration is dependent on the sale of connected cars across the globe. As per estimates (refer Exhibit 3), the connected car market has grown at >20% CAGR during 2015–2020, and the growth rate is either expected to be similar or higher, going forward till 2025–2030. Connectivity is one of the fastest-growing segments in IoT, and with the rising demand, revenue potential in this technology segment can be significant.

- What is the current role of various stakeholders?

With the increasing connected vehicles on roads, V2X adoption is expected to increase. As per estimates, in 2018, more than 100,000 DSRC-equipped vehicles were sold. Some of the OEMs who were most active in DSRC technology include Toyota and GM. Countries that were at the forefront were the US and China. Now with C-V2X technology coupled with 5G gaining momentum, 50–60 million C-V2X equipped cars are expected to be on roads by 2035.

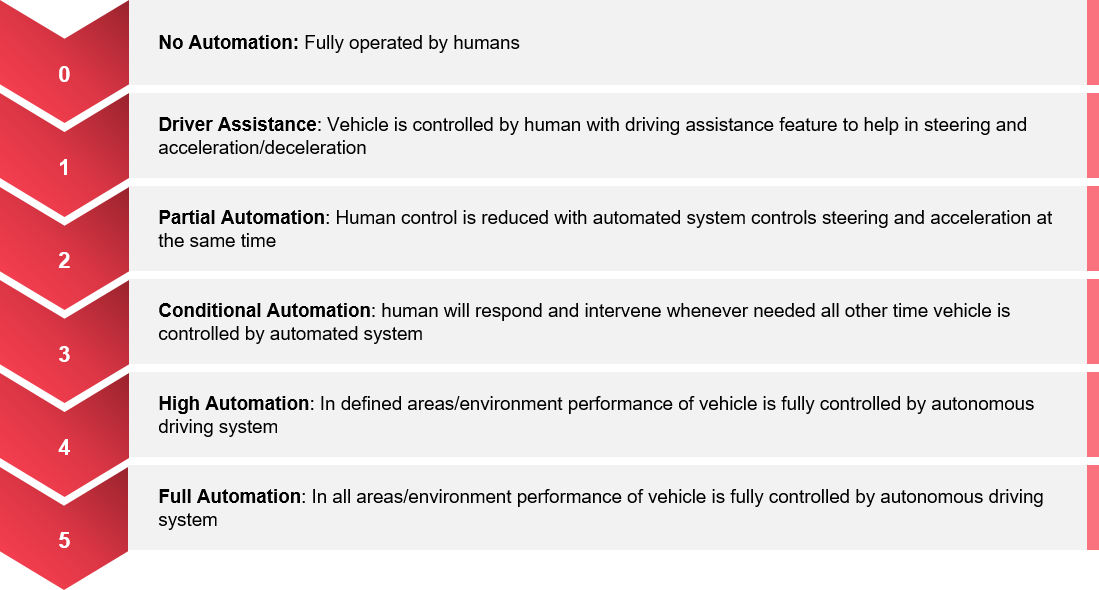

One of the key challenges that fully autonomous vehicles face across the world is safety. The goal is to reach level 5 (refer to the appendix for definition by levels), which indicates – in all areas/environments, performance of the vehicle is fully controlled by the autonomous driving system. While full autonomy is still not a reality, FutureBridge believes that with the growing adoption of V2X and 5G, the scenario is going to change. The automotive industry is expected to witness cars with auto-pilot mode by 2030–2035 when around 7–10% of the connected cars are expected to be fully autonomous.

Appendix

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.