Shared Mobility, the Next Mode of Transportation in Automotive

Shared mobility refers to the usage of a vehicle collectively by commuters for transportation without owning it. The vehicles used for shared mobility include cars, vans, e-bikes, motorcycles, and scooters.

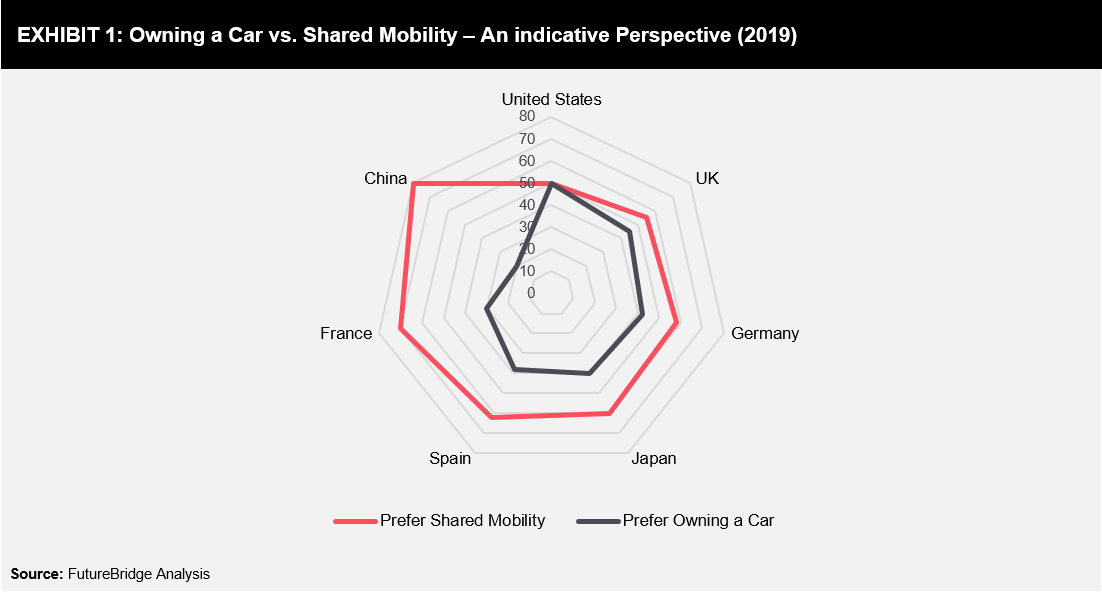

According to research findings, for about ~2 months on average globally, commuters owning a car (private vehicle) do not use their vehicles at all. Shared mobility offers economic efficiency over car ownership. Hence, more and more commuters across the globe are convinced with the concept of shared mobility (refer to Exhibit 1). This is evident across major economies across the globe, where commuters are looking for cheaper options and they are not averse to the idea of car sharing.

The above representation indicates that other than the US, most of the key economies across the globe prefer shared mobility over owning a vehicle.

Cheaper options in terms of car sharing and ride sharing are increasing the popularity of shared mobility day-by-day. For instance, SOCAR (a Malaysia-based car-sharing service provider), in its website mentions savings of ~300 USD a month vs. owning a car.

So with the increasing popularity of shared mobility few important aspects to be looked at are:

- Will vehicle sales drop significantly in the next 5 to 10 years?

- What is expected of shared mobility in the next 5 years? What is the future ahead?

- Which are the evolving business models due to shared mobility?

- What changes are expected from OEMs, Tier1, 2 and 3 suppliers, mobility service providers (like UBER and DiDi)?

Impact on Vehicle Sale due to Shared Mobility

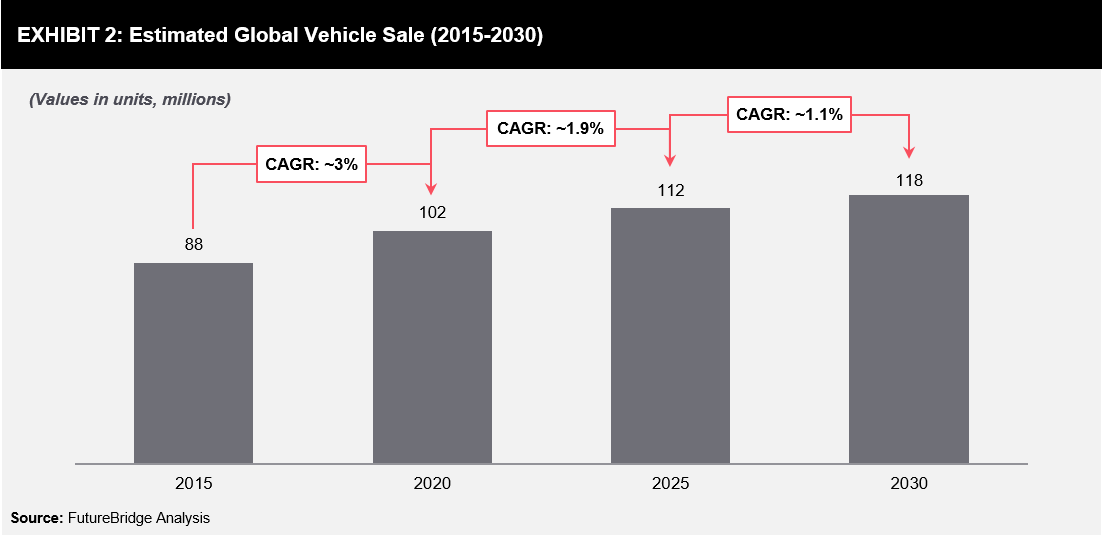

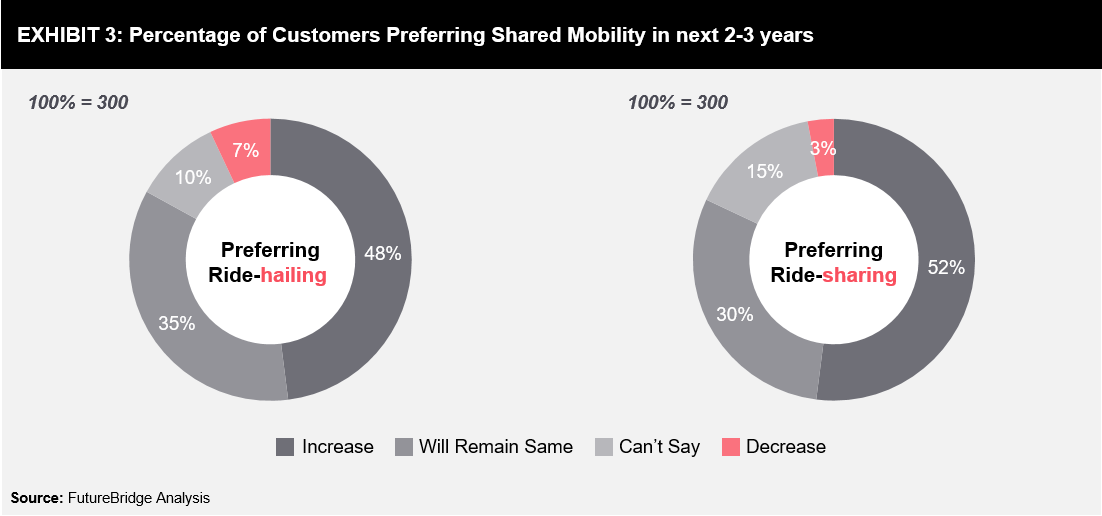

According to research findings, vehicle sales will still have a growth in the next 5–10 years; however, the rate of growth will be lower (refer to Exhibit 2). While vehicle sales growth was at 3–4% CAGR during 2015–2020, the growth rate is expected to lower by 2030, one of the key reasons will be commuters looking to share a vehicle than owning one (refer Exhibit 3).

The trend towards shared mobility may differ across regions (Asia, North America, and Europe); however, globally, the popularity among commuters is increasing. Commuters in the next 2–3 years are expected to show a growing interest towards shared mobility services.

The Future of Shared-mobility

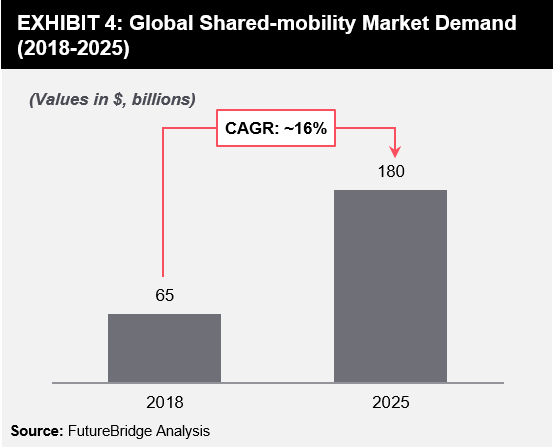

The market demand for shared mobility is poised for significant growth in the next 5–7 years (refer to Exhibit 4). The market is expected to grow at a 16% CAGR from 2018, to reach $180 billion in 2025. This is a scenario that can be considered as least aggressive; however, with the increasing demand of self-driving taxis, the market can grow at a much higher rate >20% CAGR during the same period.

With a rise in environmental concerns, traffic congestion and preference towards autonomous driving the market for shared mobility is expected to witness a steady increase. Globally, Asia is one of the largest markets for shared mobility. Within Asia, China and India will be the most promising markets due to the large population. China is a leader in ride-hailing services and some of the leading players like Uber and DiDi already have gained a strong foothold in the country through joint ventures, collaborations, and M&As.

With the growing demand for shared mobility, new business models are expected to emerge where collaborations and partnerships are evident between OEMs and mobility service providers (such as ride-hailing and ride-sharing providers). These new business models are expected to shape-up based on customer preferences, regulations and technological advancement across key economies worldwide.

Rise of New Business Models

Shared mobility is expected to generate three business models. Some companies have already started working on some models, while others are still under investigation. Three key models, which are expected to emerge globally are:

- Purpose-built vehicles for mobility on demand are expected to gain popularity

- Vehicle-as-a service is likely to be more prominent

- Contract manufacturing may pick up pace

Purpose-built Vehicles for Mobility on Demand Expected to Gain Popularity

A new emerging market segment, which players across the automotive ecosystem are looking into is purpose-built vehicles. It is gaining popularity, as the cost of a conventional vehicle is costlier than vehicles used solely for ride-sharing purposes. According to industry experts, the cost of purpose-built vehicles can be even 25% lesser than conventional ones.

According to findings, the market for purpose-built vehicles is expected to reach 2–2.5 million by 2025, growing at ~20 CAGR during 2020–2025. This clearly indicates that this segment will have opportunities for early market entrants.

In regards to this, many OEMs and mobility service provider companies have already taken initiatives through collaborations or partnerships to make a strong foothold. For instance:

- In 2019, Ford and Volkswagen announced that they are working with Argo AI (an autonomous vehicle technology platform provider) to introduce autonomous vehicle technology in the US and Europe. Both the companies are expected to independently integrate Argo AI’s self-driving systems into purpose-built vehicles to support people and goods movement initiatives. In 2021, Ford is expected to introduce a service for commercial transport through a purpose-built vehicle.

- In the same year (2019), China’s DiDi (a leading mobile transportation platform), set-up JVs with BAIC and Volkswagen to develop purpose-built vehicles. The JV is expected to focus on fleet operations, fleet sales, fleet management, fleet leasing, and repair & maintenance services.

- Again in 2019, Toyota announced investment plans of $600 million in DiDi to develop connected and electric vehicle technologies (including purpose-built vehicles) in China.

- Also in 2019, Ola (a ride-hailing start-up) announced plans to enter into a collaboration with automakers (name not disclosed), to develop custom-made electric vehicles.

- In 2018, China’s DiDi signed an agreement with Continental to develop custom-made connected, electric cars for ride-hailing services.

The above examples indicate that both OEMs and mobility service providers are increasingly collaborating among themselves to work towards autonomous mobility and develop purpose-built vehicles.

Vehicle-as-a Service is Likely to be More Prominent

This is another model that is expected to be increasingly provided by OEMs once purpose-built vehicles are a reality. In this, they may increasingly provide vehicle-as-a-service to shared mobility service providers such as UBER, Ola and DiDi through collaborations/JVs.

The services may include insurance, leasing, repair & maintenance, financing, and operation of the mobility service provider’s vehicle fleet. Essentially, OEMs may act as a vehicle as well as service provider and the mobility providers (like UBER and DiDi) will act as a medium of connection between commuters and the vehicle.

This model may also give rise to new pricing models like ‘fixed-weekly’ or ‘fixed-monthly’ subscription based on the number of days/months the vehicles are used. In addition, ‘pay-per-km’ can also be an option, where the commuters can pay based on the number of kilometers traveled.

Contract Manufacturing may Pick up Pace

Mobility service providers like UBER and DiDi are expected to collaborate with contract vehicle manufacturers and build their own custom-made vehicles for ride-hailing or ride-sharing services. In this case, the mobility service providers may have their own branded vehicle fleet. OEMs may not be involved in this model at all and the mobility service providers may own the vehicle fleet as well as provide maintenance services.

All the above business models hint towards a dominant position for the mobility service providers like UBER and DiDi in the shared mobility value chain. In regards to this, below are few aspects, which OEMs and Tier 1, 2 and 3 suppliers can focus on or look into:

OEMs

- Fully autonomous vehicles making in-roads are not expected before 2025; hence, OEMs should focus on purpose-built vehicles and try to make a market entry at the earliest.

- OEMs should look to collaborate or get into JVs with mobility service providers so that they are able to keep up with the changing consumer needs. This will help OEMs to gain/maintain market share.

- OEMs may think of transforming their operations and also become fleet operators, where they can develop their own purpose-built vehicles and also act as a connection between the commuters. The mobility service providers will still exist; however, OEMs can still maintain their market share by operating their own fleet i.e. run their own ride-sharing and ride-hailing services.

Tier 1, 2 and 3 suppliers

- Amidst OEMs, Tier 1, 2 and 3 suppliers also may focus on the emerging business models to remain active in the mobility value chain. Tier 1, 2 and 3 suppliers may look to collaborate and partner with the OEMs and upgrade themselves to provide/develop components for purpose-built vehicles.

- In addition, the suppliers can also work towards becoming fleet operators and run their own fleet of vehicles offering ride-hailing and ride-sharing services.

In order to remain competitive in the value chain, OEMs and Tier 1, 2 and 3 suppliers are expected to respond towards commuter preferences across different regions and work towards developing innovative solutions (such as purpose-built vehicles) for shared mobility.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.