Introduction

The automotive sector in Europe employs 13.8 million people, in direct and indirect jobs, representing 6.1% of total EU employment. To keep the European automotive industry ahead in this changing competitive landscape, leaders will need to make significant changes in the environment, sustainability, and corporate governance fronts.

One of the biggest challenges faced by the industry is that of reducing emissions. In Europe, road transport is the second-largest source of CO2 emissions, accounting for around a quarter of total emissions (European Environment Agency, 2018). Approximately 95% of EU transport energy needs are covered by oil (European Commission, 2016).

In the absence of decarburization steps, the 2016 EU Reference Scenario highlights that by 2050 road transport could account for the largest share of CO2 emissions (European Commission, 2016).

The above trends contrast with the long-term goal to limit global warming to be below 2ºC above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5ºC, as embraced by the EU with the ratification of the Paris agreement in 2016.

Therefore, European Commission has reinforced the commitment to decarbonize transport on a low-emission mobility strategy that emphasizes the need to increase the transport system’s efficiency, deploy low-emission alternative energy for transport, and move towards low and zero-emission vehicles.

Strict EU regulation on CO2 reduction

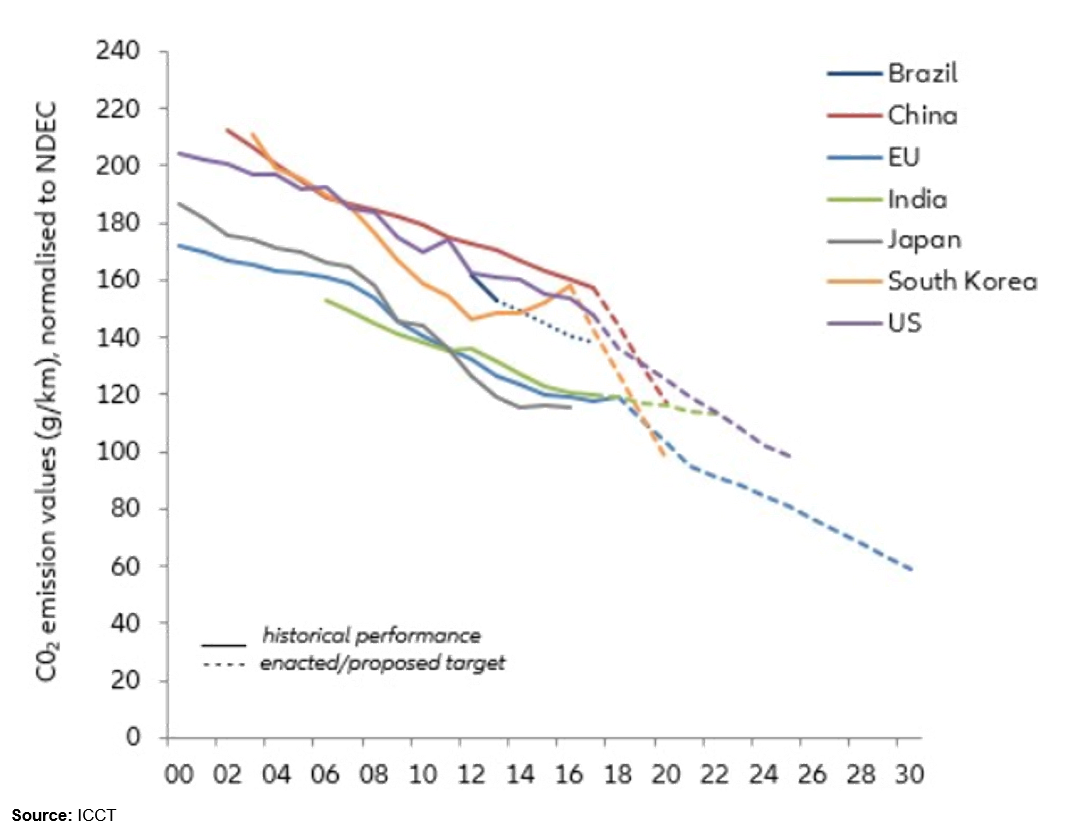

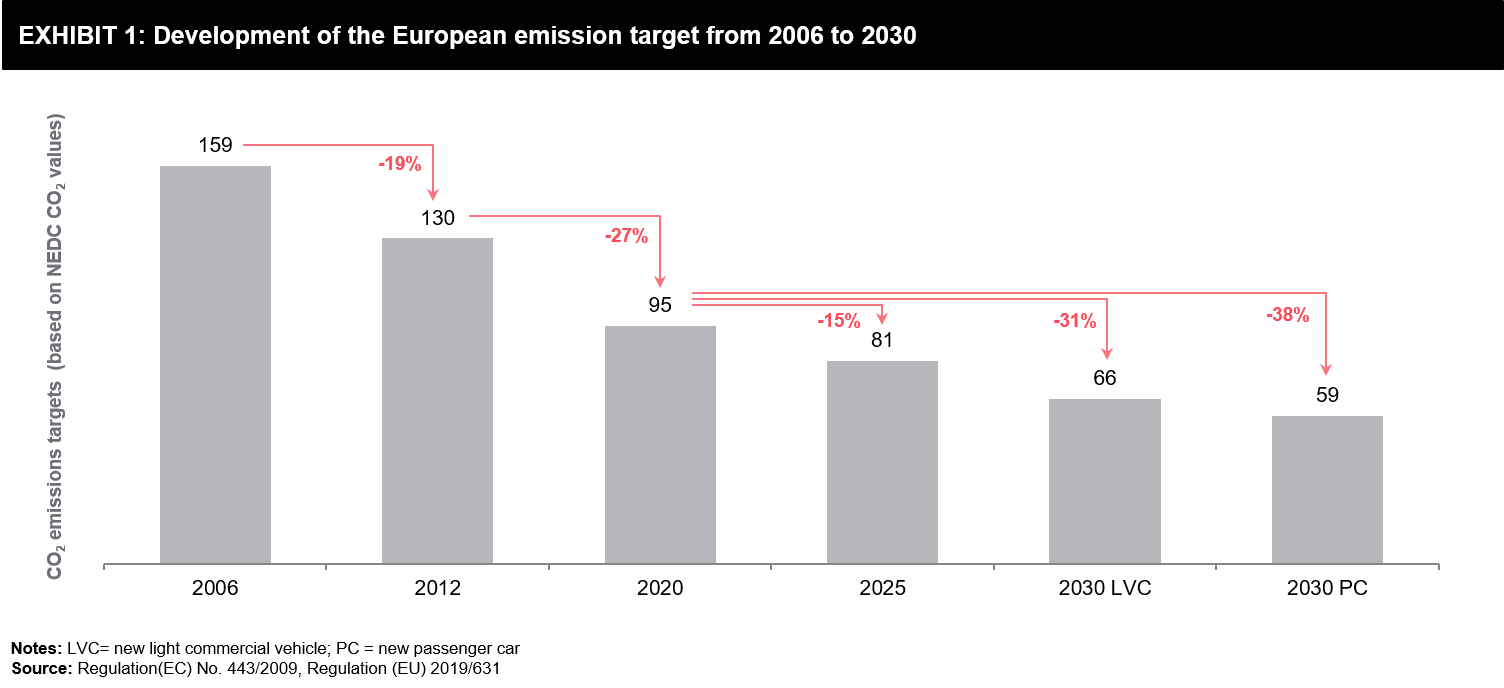

For Europe’s automakers, the major problem began at the beginning of 2020, when European Union emissions standards came into effect. According to these standards, it is required for an automaker to not exceed a fleet average of 95 grams of CO2 per kilometer. In 2018, emissions were targeted at 120g/km, which means automakers need a 21% reduction overall to avoid fines that could total as much as 33 billion euros this year, according to some estimates. Further, it will cost 95 euros to automakers for each gram CO2 over the limit per vehicle. EU is much more ahead in regulating the CO2 emission as compared to its global counterparts.

For Europe’s automakers, the major problem began at the beginning of 2020, when European Union emissions standards came into effect. According to these standards, it is required for an automaker to not exceed a fleet average of 95 grams of CO2 per kilometer. In 2018, emissions were targeted at 120g/km, which means automakers need a 21% reduction overall to avoid fines that could total as much as 33 billion euros this year, according to some estimates. Further, it will cost 95 euros to automakers for each gram CO2 over the limit per vehicle. EU is much more ahead in regulating the CO2 emission as compared to its global counterparts.

Based on the average mass of the vehicles sold, each automaker has a different target, and only 95% of sales are measured in 2020, meaning that some high-polluting cars will not count. As per the standards, to calculate automaker’s specific emission target from this year onward, the following formula that considers the automaker’s specific average fleet weight (m) and the difference in comparison to the European reference weight (mref) shall be followed:

Specific CO2 emission target = 95 + 0.0333(m – mref)

Apart from measuring 95% of vehicle sales, the EU has other special flexibilities such as Super- credits, wherein vehicles emitting less than 50g/km are counted twice in 2020, 1.67 times in 2021, 1.33 times in 2022 (cap of 7.5g/km in the period 2020-2022 for each automaker). Besides, eco-innovations are also considered, which means savings of maximum 7g/km per year achieved through the use of innovative technologies or a combination of such are recorded.

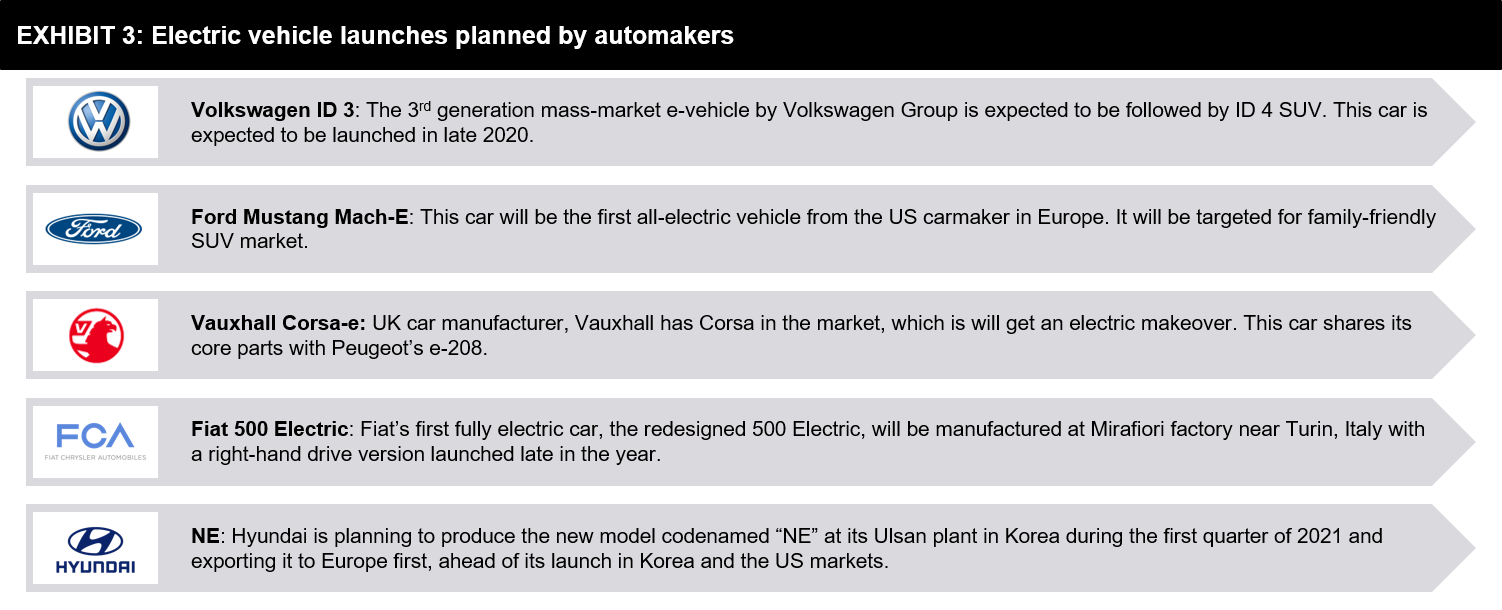

In response to these standards, automakers are shifting their portfolio from ICE to BEV and PHEV. Therefore, the regulatory push and changing customer demand towards electric vehicles explain increasing new low-emission vehicle launches by automakers in the future.

Based on Exhibit 1, it will become crucial in the coming years for automakers to take necessary measures to reduce CO2 emissions, especially in light of the additional reduction of 15% in 2025 and 37.5% in 2030 by the European Commission.

EU Carbon Emissions Target Analysis

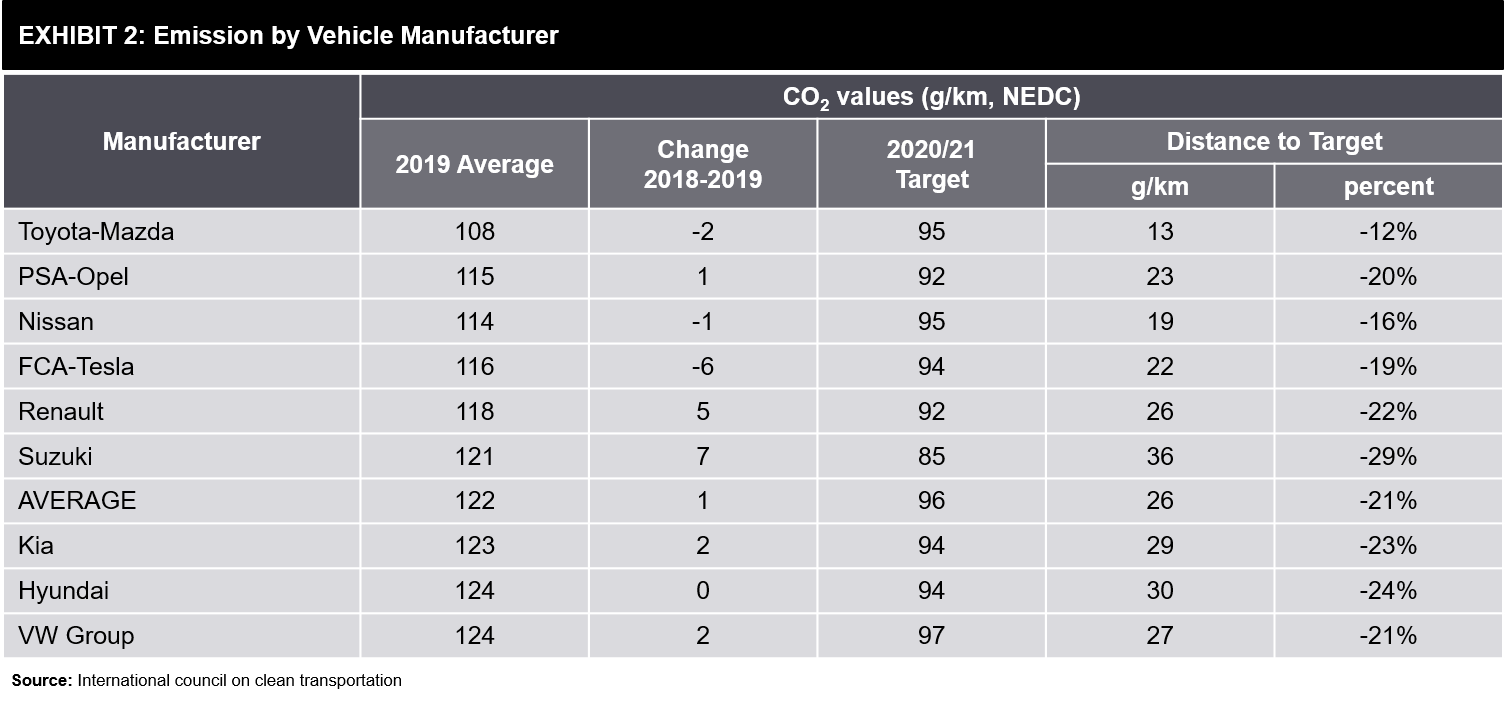

Looking at the EU targets, none of the top ten automakers has reached the goal. Therefore, they could face annual fines in the range of €20Million (Toyota) to €4.5 Billion (Volkswagen), aggregating to €11.4 billion for the top automakers.

According to the Auto Emissions Report, Daimler AG is furthest away from achieving the 2021 EU target of 95g/km average fleet emissions, whereas Toyota Industries is the closest to lowering its carbon footprint – but still faces significant fines.

Further, the report also puts a light on the most polluting cars on average in the last year, that were produced by Group PSA, which would cost €1.3 billion to offset. Based on EU sales, Renault Clio was the most polluting model sold last year.

Also, by analyzing the running costs of manufacturers’ flagship models, Mercedes-AMG GT was the most polluting model last year, whereas the Peugeot 508 was the most environmentally friendly.

WLTP emissions test causing hindrance

As per the EU regulations, since 2017, the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) laboratory test is used to measure fuel consumption and CO2 emissions from passenger cars and their pollutant emissions. Previously, the New European Driving Cycle (NEDC) lab test was used.

Due to evolutions in technology and driving conditions, NEDC became outdated, and the European Union developed WLTP.

NEDC determines test values based on a theoretical driving profile, whereas WLTP is based on real-driving data gathered worldwide. Therefore, WLTP better represents driving profiles.

The WLTP driving cycle has four parts with different average speeds: low, medium, high, and extra high. Each part contains a variety of driving phases, stops, acceleration, and braking phases. WLTP is also used to determine the car’s lightest (most economical) and heaviest (least economical) version for a certain car type by testing each powertrain configuration.

However, the automakers consider the WLTP test as an obstacle, even when realizing 2020 targets. They have observed that the test is more representative, more rigorous, and “could add +5% CO2” when correlated with NEDC test values.

Encompassing the change in the boundary conditions, rendering the 2021 target of 95g/km has become even more severe. In response, the automakers are shifting their portfolio focus from ICE operated vehicle to BEV and PHEV, in tandem with ICE optimization.

Automaker’s Response: Bringing EV to the limelight

To reach the targeted level of CO2 emissions, carmakers have very little choice than to switch from ICE powertrain to non-ICE powertrain. This is pushing many carmakers to rejig their product portfolio to add more low or zero-emission hybrid and electric vehicles. Around 4.8 million hybrid and electric vehicles are expected to be sold in Europe by 2026, reaching the market share of 33%, which was just 11% in 2020. While the share of the conventional vehicle decreases, it is expected that automakers’ portfolio will consist of 80% electric and hybrid vehicles.

Starting from the top automakers in Europe, namely such as Hyundai, PSA Group, Volkswagen, and others are focusing on launching an electric version for their respective brand segments.

Hyundai is planning to produce the new model codenamed “NE” at its Ulsan plant in Korea during the first quarter of 2021 and exporting it to Europe first, ahead of its launch in Korea and the US markets. PSA has started to have electric models, with electric versions of the Peugeot 208 small hatchback and 2008 small SUV, the Opel/Vauxhall Corsa small hatchback, and the DS 3 Crossback small SUV about to go on sale. The Japanese automaker, Mazda, will initiate the selling of the MX-30 full-electric crossover this year. After September 2020, Volkswagen Group is planning to launch its most awaited electric car model named ID3, which is expected to have mass acceptance in Europe.

Apart from focusing on electric and hybrid vehicles, one solution, for this and next year’s targets, is to reduce diesel vehicles from the portfolio since any future emissions gains for diesel will be marginal and expensive.

Carmakers are taking on numerous initiatives to reduce their CO2 emissions, which can help them reduce the penalty they will have to pay if they do not meet the emission targets. Here are the key initiatives that are taken by key players in the European market.

Implications of CO2 compliance for OEMs

As of this year, meeting the stricter EU emission targets by various automakers will be challenging. It has been estimated that meeting the emission targets and averting significant penalty can be made only through flexibilities such as the application of super-credits and phase-in flexibilities for this year. Also, this regulation allows newly registered passenger cars with emissions of less than 50g/km to be counted twice in 2020.

Based on these flexibilities support, the majority of the automakers will potentially reach EU emission targets. However, it is expected that 13 out of 21 automakers will spend the maximum in super-credits (7.5g/km) this year. Apart from this, although the emission target will be met in the future, however, it is expected that automakers limit their penalty payments to €3.3bn in 2021.

To ensure CO2 compliance and successfully transform the industry for a green future, automakers need to combine long and short term measures on the following lines:

- Technical measures: In context of e-mobility, it is essential to increase the driving range as well as optimize the time to charge the vehicle.

- Quick transition to BEV: In light of the upcoming emission targets, it will be critical for automakers to increase BEVs in their portfolio; simultaneously, they should also support the quick development of charging infrastructure.

- Having production and delivery in place: It is essential to prioritize the production and delivery of hybrid and electric vehicles in order to gain market share.

- Demand stimulation: It is equally important and challenging to stimulate the demand for electric vehicles, to do so, automakers have to use sales aids.

Simultaneously, support from government authorities will also enable a quick transition to a greener portfolio and increase the demand for electric and hybrid vehicles through investments and incentives.

References

- New CO2 emission regulations in Europe A perfect storm for car manufacturers

- CO2-EU update-aug2020.pdf

- MarketMonitor-EU-Fact%20Sheet-20200428.pdf

- PA-CO2-Report-2019-2020.pdf

- how-automakers-plan-avoid-co2-fines-europe

- https://ec.europa.eu/- transport/vehicles/cars

- European-union-greenhouse-gas-inventory-2018

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.