Increasing Demand for Electric Vehicles

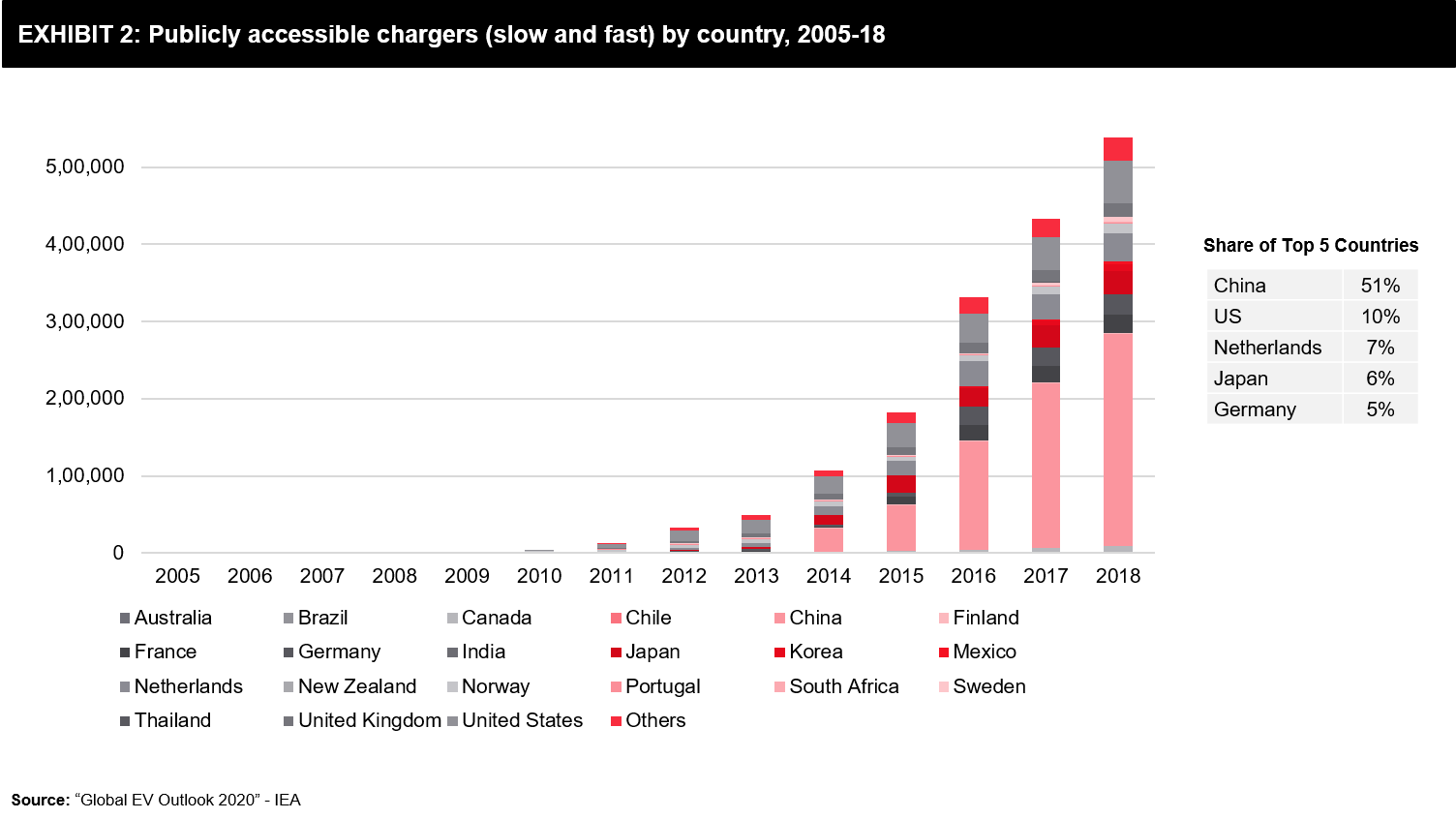

The adoption of electric vehicles across the globe is increasing significantly, driven by countries like China, the US, Norway, Germany, and the UK. The sales of electric vehicles grew by 56% in 2017 to reach about 1.17 million units from 752 thousand units in 2016. The year 2018 saw a further increase, where electric vehicle sales grew by about 68% to reach sales of 1.97 million units. This change towards the cleaner battery power from the internal combustion engine is driven majorly by two factors, policies and regulations, and technological progress in vehicle electrification. Automakers and policymakers worldwide are optimistic about the transition to electric mobility.

Growth of new electric vehicle sales (both BEV and PHEV) reduced drastically in the year 2019 owing to economic uncertainties in China and the US. With growth rates of about 38% to 68% over the last five years, the market only managed a growth rate of about 15% in 2019, with sales reaching approximately 2.26 million units across the globe. Part of this reduced growth can be attributed to the Chinese government’s subsidy cut of about 50% on new EV purchases. The subsidy cut of about 50% on new vehicle purchases began in June, which significantly hampered the sales of EVs in Q3 2019. The government’s initial plan was to cut the subsidy entirely from 2020 on new purchases; however, with the drastic reduction in EV sales, they announced a two-year extension of the subsidies till 2023, which will further boost the EV market.

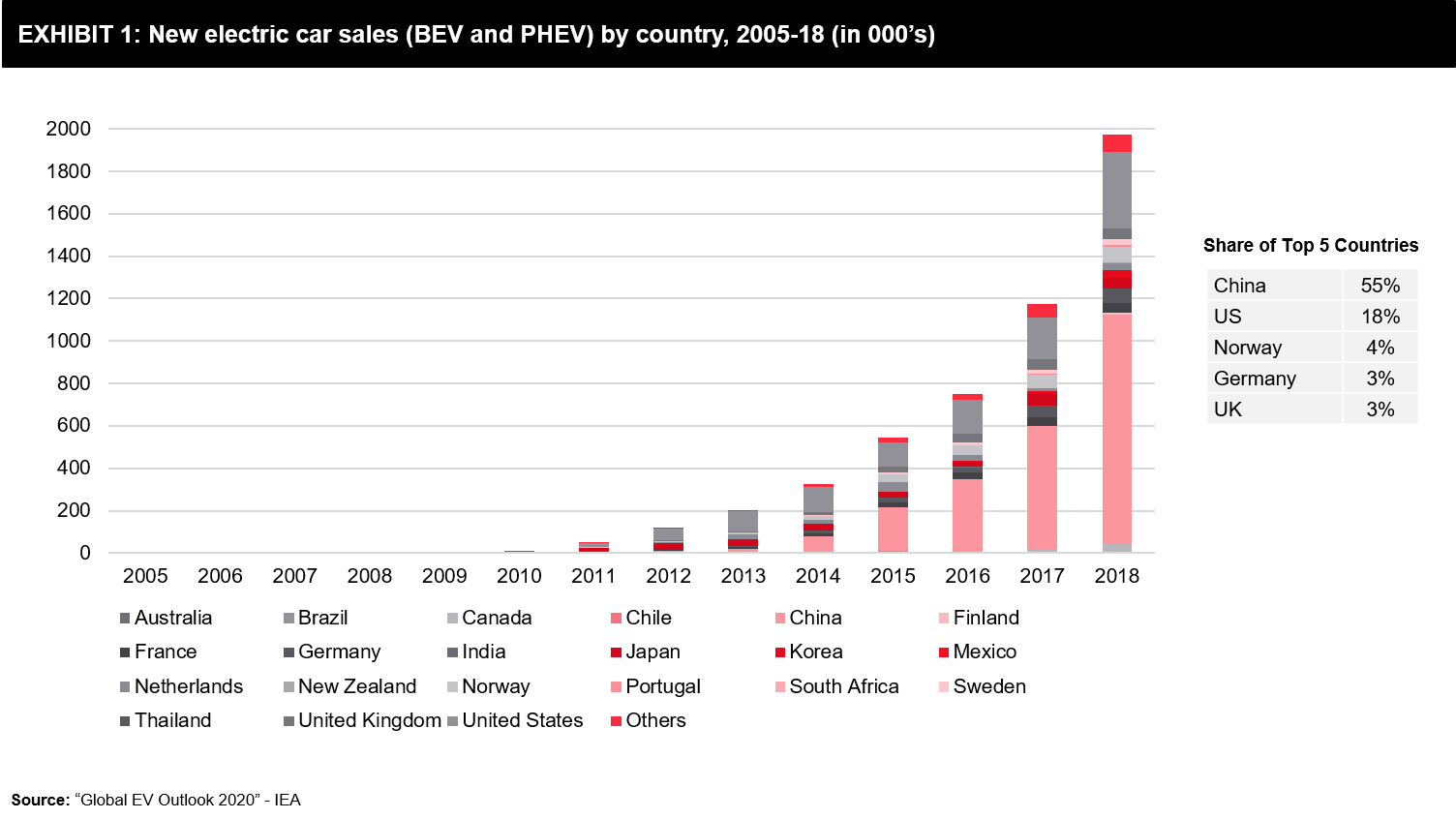

The rise in EV sales has also influenced the growth of public charging infrastructure across the globe. The surge of publicly accessible chargers, both slow and fast chargers, started in 2014 when the charging units grew by about 120% to 107,000 units. It grew by 70%, 81%, 31% and 24%, respectively from 2015 till 2018. The highest growth of publicly accessible chargers was observed in 2019, where it grew by 58%, to about 850,000 units.

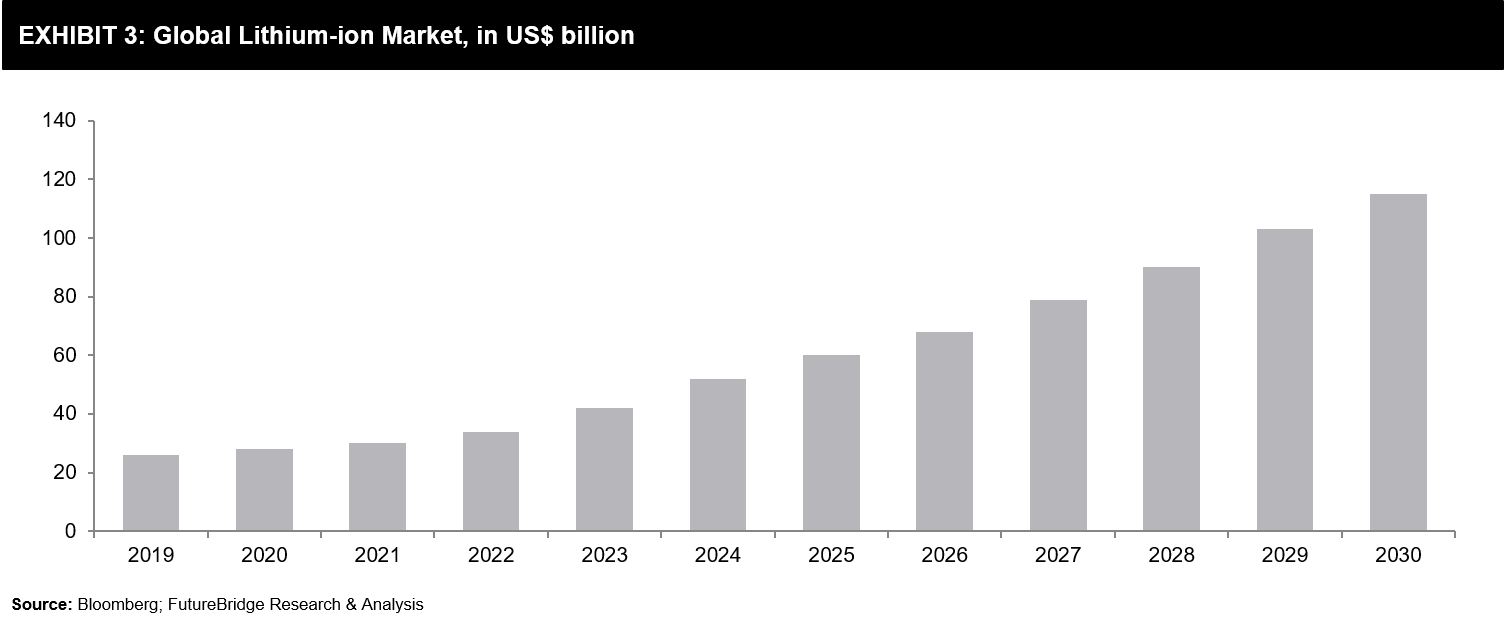

Though the government policies and regulations and technological advancements are driving the EV market across the globe, its adoption rate is highly dependent on its overall cost. The overall cost of an electric car depends on various components such as battery packs, power distribution modules, converters, controllers, chargers, cables, etc., as well as other indirect costs. However, the price of the battery packs accounts for more than 50% of the vehicle’s production cost. Therefore, advancements in battery packs, production methodologies, features, capacities, etc. play a significant role in EV pricing. Lithium-ion, Nickel, and Cobalt are some of the key materials used in battery production. Exhibit 3 below provides the market forecast for Lithium-ion batteries, which explains the correlation between the battery market and EV sales.

It is estimated that the Lithium-ion battery market will reach about USD 115 billion in 2030, owing to increasing sales of electric vehicles, as a vast majority of the electric vehicles use Lithium-ion batteries.

The Cost Paradigm

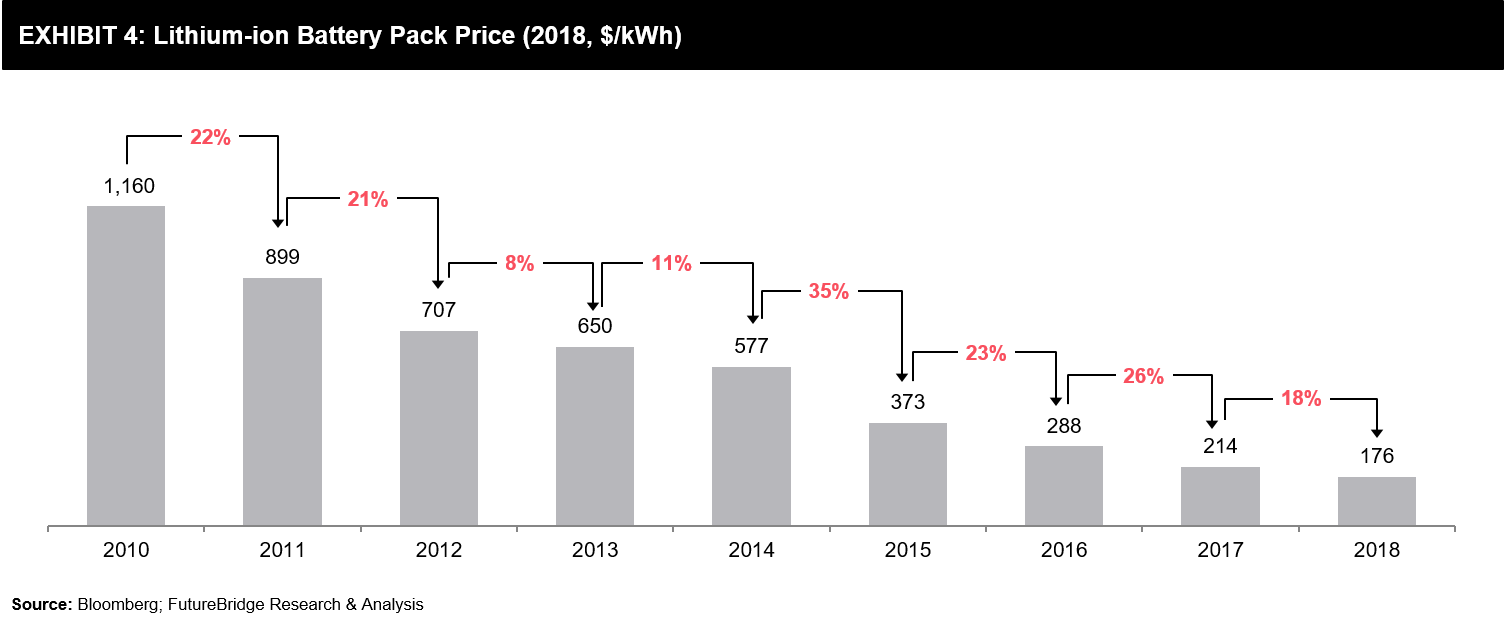

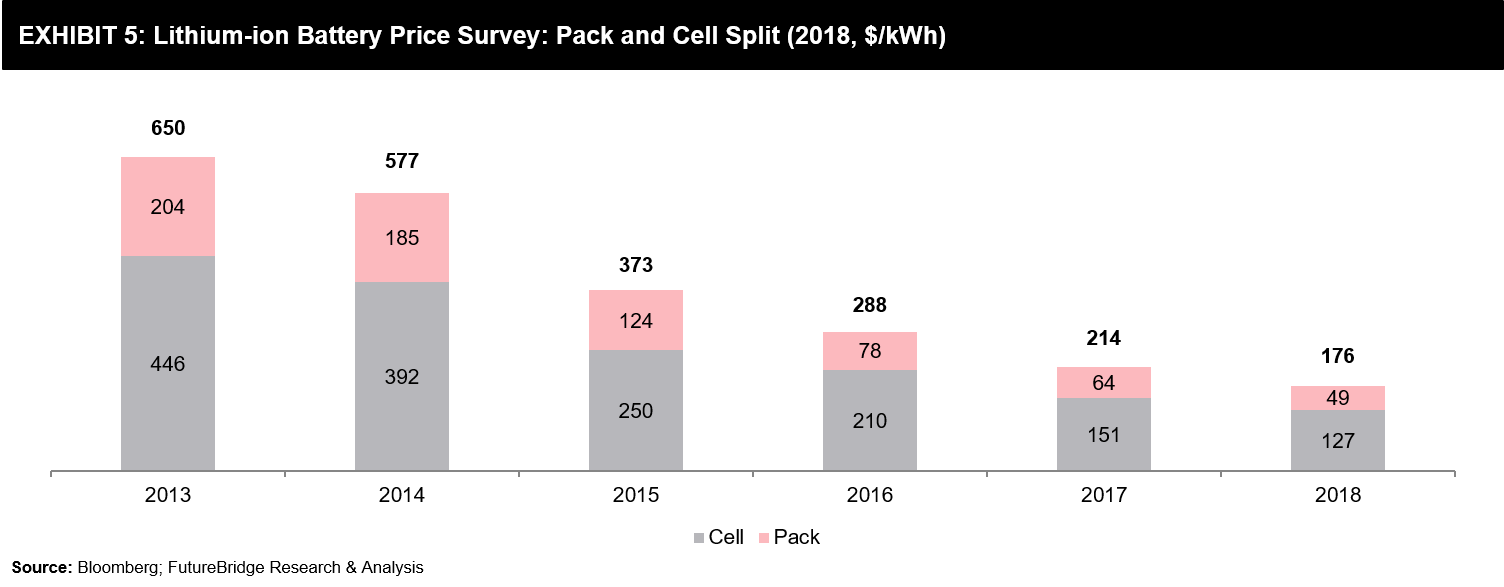

The cost of batteries for electric vehicles has significantly fallen in the last decade. The average price of the battery pack used in the electric vehicle was around US$156 per kilowatt-hour in 2019, which is a reduction of about 86% from its value in 2010, which was about US$1,100/kWh. With such an exponential decrease in battery pack prices, automakers are involved in developing electric vehicle models with longer ranges. This is achieved by increasing the battery pack size. In the light-duty vehicle segments, the average size of the battery pack has now moved up to 44 kWh from 37 kWh in 2018, wherein, it’s about 50 to 70 kWh in the electric cars segment. The reducing battery pack price is also expected to increase the share of battery electric vehicles relative to plug-in hybrid electric vehicles.

As per Bloomberg, the current prices, in reality, could be lower than this, as several pack prices are lower than this. Bloomberg estimates the prices based on the volume-weighted average method. Therefore, publicly available prices make a huge difference. For ex., Tesla’s pricing, in this case, is very important, as it ships large volumes of electric vehicles, which would have a higher impact on the average. There could be other companies that may have lower prices, but the overall average would be less due to their lower volume sales. While several automakers do not accept the prices mentioned, in reality, there is a trend of falling battery pack prices in the market.

Battery prices are expected to increase based on the underlying metal or mineral prices. As per Bloomberg’s price sensitivity analysis, a 50% increase in lithium prices would have an impact of less than 4% on the overall price of nickel-manganese-cobalt 811 battery pack price. Similarly, a 100% increase in the price of cobalt will only impact about 3% on the battery pack price.

The Road Ahead

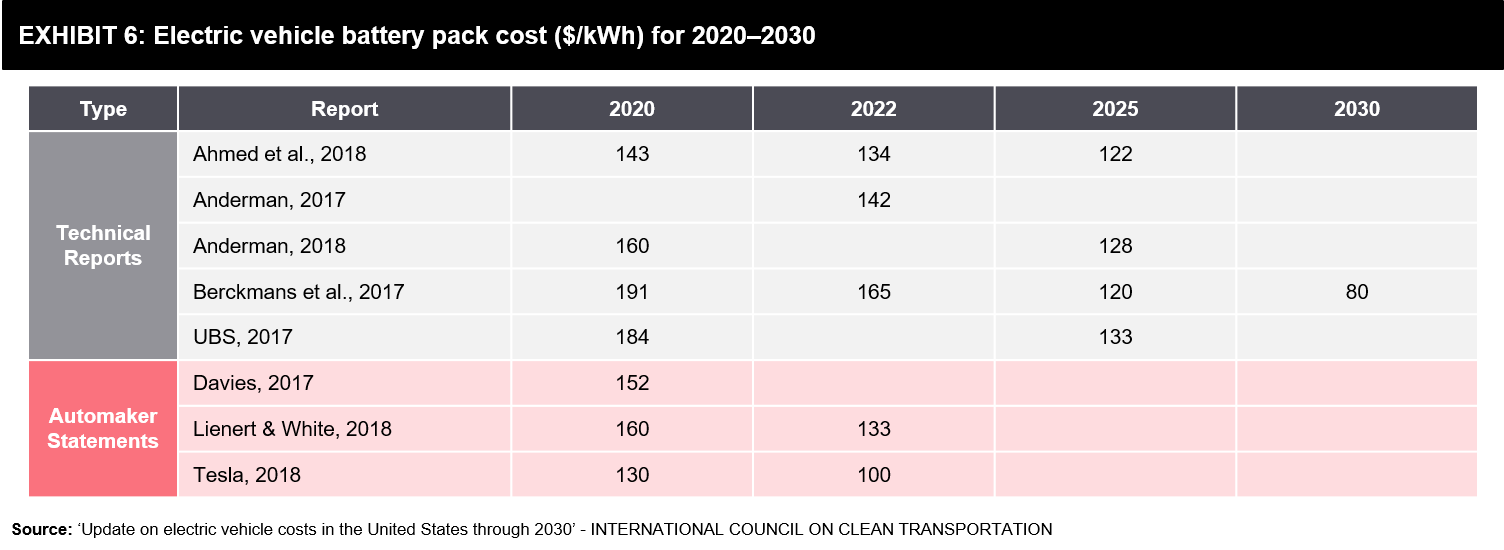

The price of battery packs is following a downward trend, and by 2030 the cost of battery packs could fall as low as 80 US$/kWh. Several major players in the market also back the estimations. Exhibit 6 below summarizes the battery pack price estimation for the road ahead, as estimated by automakers, and estimates from technical reports.

According to UBS, the overall cost of the components of an electric powertrain in EV accounts for about 40% of the production cost. This cost would be reduced by around 26% by 2025 due to the declining cost of battery packs. A battery pack costing about US$11,500 in 2017 would cost around US$8,000 in 2025, with no compromise on the capacity or the range.

If that cost is achieved, the total cost of ownership, between EV and ICE vehicles, will be at par.

References

- http://www.avere-france.org/Uploads/Documents/1592385579525e5999e87f780c79b80d5eb7f996c6-Global_EV_Outlook_2020.pdf

- https://theicct.org/sites/default/files/publications/EV_cost_2020_2030_20190401.pdf

- https://about.bnef.com/blog/battery-pack-prices-fall-as-market-ramps-up-with-market-average-at-156-kwh-in-2019/

- https://about.bnef.com/blog/behind-scenes-take-lithium-ion-battery-prices/

- https://www.greencarreports.com/news/1126308_electric-car-battery-prices-dropped-13-in-2019-will-reach-100-kwh-in-2023

- https://www.reuters.com/article/us-autos-tesla-batteries-exclusive/exclusive-teslas-secret-batteries-aim-to-rework-the-math-for-electric-cars-and-the-grid-idUSKBN22Q1WC

- https://www.forbes.com/sites/robday/2019/12/03/low-cost-batteries-are-about-to-transform-multiple-industries/#719352a10541

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.