Electric Vehicles (EVs) have made headlines across the globe over the last 5 years, primarily due to the negative impact of fuel-powered vehicles on the environment. EVs alone are not responsible for saving the environment but will be a significant step towards this goal. Apart from stringent emission norms formulated by various government bodies, automotive players are being forced to take responsibility for reducing the level of greenhouse gases. Automotive players worldwide have pledged that they would be converting their existing fleet of vehicles to EVs by 2030. However, this might seem to be quite an ambitious target for them. Fleet management companies that provide vehicles for their customers have already started marketing their role in how they are helping the environment by propelling the production of EVs over the next 10 years. A quick glance at the statistics of EVs sold worldwide in 2018 concludes that more than half of the EVs were sold in China, which makes China far ahead of the global market.

Following the Cultural Revolution of the 70s, China’s economy was paralyzed. The country opened its markets to the outside world with the aim of providing a stimulus to the economy. In the early 80s, foreign automakers were allowed in the market through a joint venture with a Chinese partner. As a result of this, there was a level of knowledge transfer to Chinese companies, which eventually allowed them to produce their own vehicles. These vehicles, however, were mainly cost-effective imitators of their foreign counterparts. Carmakers in the US and Europe had too much of a head start for China to catch up.

It was evident that the only way for China to make an impact in any market was to develop products that were technologically advanced and yet cost-effective. Electric vehicles were probably the most logical product to target, as the world had not adopted the technology in large numbers, and thus, competition was relatively less for China. EVs demanded less mechanical complexity but more electronics. China had already become a leader in electronic manufacturing, so, in a way, was already on the same road towards EV deployment.

In 2001, China started off with the “863 EV Program,” which focused on fuel cell, hybrid EVs, and pure EV technology. In 2008, nearly 366 new energy vehicles were sold. These numbers were encouraging; however, China needed to increase its production output and also bring in schemes to increase the adoption of EVs. The country also had high sales of IC engines that contributed to China becoming the largest producer of emissions in the world. This encouraged the government of China to launch a series of policies and incentives to promote the development of EVs. The government made it extremely difficult to obtain a license plate with the aim of dissuading individuals from owning a vehicle. Beijing had been following a lottery system to award such license plates with a 0.2% chance of an individual winning. In Shanghai, the license plates are auctioned for about $14,000, which, in several cases, was greater than the price of domestically-produced vehicles.

In the case of EVs, the government of China started offering subsidies for buyers, in addition to free driving licenses. Since then, China has been committed to EVs and to the mass development of public charging stations. Since 2013, approximately 500 electric vehicle companies were launched in China to support the government’s vision and to acquire subsidies offered to generate supply. Companies such as BYD, Geely, BAIC, Chery, and SAIC came into existence and greatly influenced the EV market with their technologies and products. Similarly, several R&D institutes such as Tsinghua University, Beijing Institute of Technology, and Tongji University were established, which presently have their own centers focusing exclusively on electric vehicle research. By the end of 2017, 214,000 charging stations were installed by the government of China, along with 232,000 private charging stations.

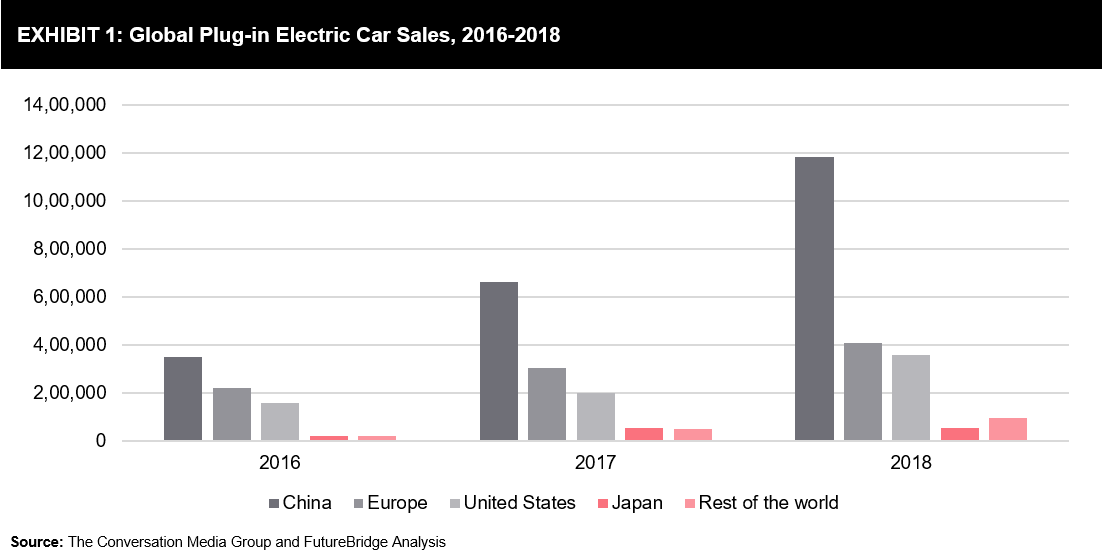

The government of China made electric vehicles as one of the 10 pillars of “Made in China 2025”, a state-led plan for the country to become a global leader in high-tech industries, and introduced policies to generate demand. It raised billions of dollars to subsidize the manufacturing of electric vehicles and batteries while encouraging businesses and consumers to buy them. BYD Auto received about $590 million as subsidies from both the local and central government and has also received a backup from the business tycoon, Warren Buffet. All these factors have played a major role in the evolution of BYD from being a battery maker to a significant player in the global market of electric vehicles, making it the world’s second-largest EV maker preceded by Tesla. By 2015, electric vehicle sales in China surpassed the US levels. In 2018, the sale of cars topped 1.1 million cars in China, which was more than 55% of all electric vehicles sold in Europe, the US, Japan, and the rest of the world (refer Exhibit 1).

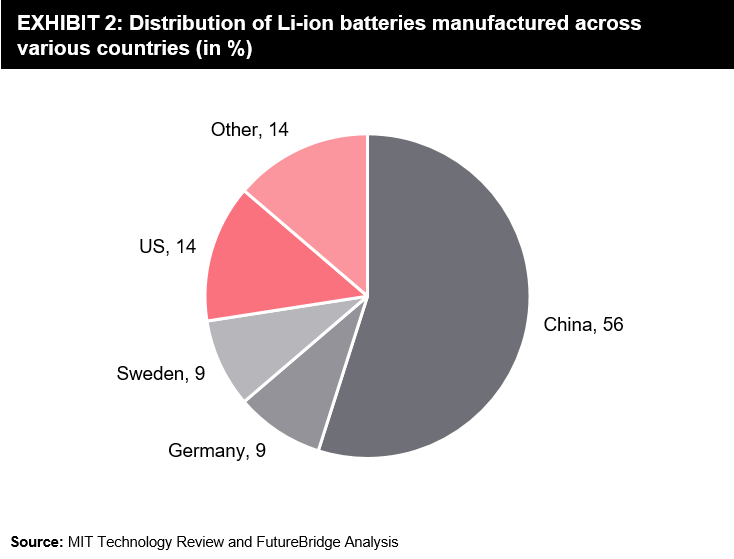

A key element of an electric vehicle’s price is the cost of its batteries. As China already makes more than half of the world’s electric vehicle batteries, the market for electric vehicles in this country is booming. CATL, the world’s largest EV battery maker, supplies batteries to Chinese and foreign carmakers that include state-owned BJEV, Volkswagen, Daimler, BMW, Honda, and Shanghai-based startup, NIO. The world’s biggest EV manufacturer, BYD, is also the country’s second-biggest battery supplier, as it makes batteries for its own electric cars. Both BYD and CATL might supply batteries to Toyota cars soon. About 56% of the total lithium-ion batteries manufactured globally come from China. It is believed that China will produce as much as 70% of the world’s electric vehicle batteries by 2021. More than 50% of the world’s cobalt reserves and production are in the Democratic Republic of Congo, a majority of which is dominated by China. About four-fifth of cobalt sulfates and oxides used to make cathodes for lithium-ion batteries are refined in China.

China is completely dominating the electric vehicles market. CATL plans on selling 10% of its company stakes to raise $2 billion for adding a new battery production facility in China, which would be larger than Tesla’s Giga-factory 1 in Nevada and South Korea’s LG Chem Ltd. All cars manufactured in China, including the ones from Volkswagen, BMW, and Hyundai will be fitted with lithium-ion batteries manufactured in the CATL production facility. In parallel to this, China is also working on a separate Giga-factory, which will have the potential to produce half-a-million electric vehicles per year.

A reflection of China’s journey in the automotive domain clearly reveals that earlier, the country was nowhere on the automotive radar; however, within a short span of time, China was able to become a serious contender to its American and European counterparts. Moreover, the country was able to establish its footprint in the EV market due to substantial government funding and various subsidies as well as anti-IC engine policies that were enacted over the years.

Moving ahead, China has become the leading supplier of basic raw materials for EV batteries. In this regard, China, which initially was far behind the American and European carmakers is now way ahead and is reinforcing its foothold through technology innovations. In the near future, automotive players in China are looking forward to capturing the global market, either through the introduction of advanced vehicles or products in EVs.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.