Changing Workforce in the Autonomous Driving Economy

Over the years, there has been considerable innovation and changes taking place in the automotive industry. This is quite evident from various OEMs focusing on electrification, battery technologies, and connected technologies. The shift towards an autonomous driving environment presents new opportunities as well as some pertinent challenges. A number of companies have been working on their own autonomous driving programs worldwide, each trying to perfect the functioning of autonomous vehicles. Interestingly enough, the market is no longer a playground for the legacy automotive OEMs, but technology companies are also eyeing a stake in the autonomous driving economy. 2018’s launch of Alphabet’s Waymo self-driving taxi service in the US, Arizona, is one such example of a tech company focusing on autonomous driving. Players such as Uber, Tesla, GM Cruise, Baidu, Volvo, and Ford are also planning to launch their self-driving taxi service in a few years. With all of these developments, it is not just the car that is going to witness some changes in terms of design and functionality, but the entire ecosystem as well as individuals working in that ecosystem. The use of an autonomous vehicle logically dictates that there would be more miles on the meter, greater wear, and tear, more intricate technologies, components, etc., being implemented in the vehicle. There have been immense changes in the background in terms of knowledge requirements, new business opportunities, and infrastructure requirements. Individuals from telecommunications, infrastructure development, and semiconductor industries will be an even more essential part of the autonomous driving economy. As such, a number of changes are expected to take place in the automotive ecosystem, some of which are discussed below.

New Road Infrastructure Requirement

New road infrastructure will be the most essential area under urban planning that would require attention to facilitate a smooth adoption of autonomous vehicles. It will be imperative to rethink road infrastructure in terms of various systems, such as communication, traffic management, and road design. For example, a road designer will have to focus on redesigning the road to accommodate sensors that could communicate with autonomous vehicles. Location, durability, and proper functioning of the sensor will be of utmost importance. On these lines, individuals managing the road infrastructure will no longer be limited to the design and maintenance of the road, but rather the systems/components that would be embedded in the road.

Training for Vehicle Engineers of the Future

With an eye on these changing job responsibilities, there will be a growing need for education with respect to service technicians specific to automated vehicles. As already agreed by various automakers, dealers, industry groups, and academicians, there is a significant gap in nurturing future talent; therefore, various major players in the industry, especially in the US, are taking a number of initiatives to close the gap.

Robert Bosch, a well-known autonomous vehicle technology developer, took a step forward by opening its automated vehicle testing labs in Michigan, to electronics students from Schoolcraft College in Livonia. The initiative would enable learning by having a hands-on exposure to software and electrical integration of sensors in automated vehicle prototypes.

In a similar fashion, Toyota partnered with Washtenaw Community College in the US, Ann Arbor, to bring in various middle and high school students to its R&D center. This partnership allowed Toyota to influence and align the curriculum to the needs of technicians. Along with Washtenaw and Macomb community colleges, there are about 15 Michigan schools that have joined the education consortium formed by the American Center for Mobility, a non-profit testing and product development operation designed to enable safe validation of automated vehicles. In the coming years, to make students future-ready, it can be expected that there would be more partnerships among automakers, academicians, and research institutes.

New Business Models for Sales of Cars

In terms of business, automated vehicle adoption will affect various stakeholders of the value chain, such as retailers, manufacturers, and suppliers. Interestingly, it is expected that the job scenario will drastically change the retail sector, as various online integrated sales channels are developing on a daily basis. For instance, to purchase or sell a car, there is already a demand for sales personnel, as most of the transactional discussions are taking place online using chat-bots.

A US-based company named Caravan aims to cut overhead costs by eliminating the hassle between buyers and sellers by having online transactions. Recently, Caravan launched as-soon-as-next-day vehicle deliveries to Lakeland and North Port, Florida, which would take about 10 minutes to deliver cars to area residents.

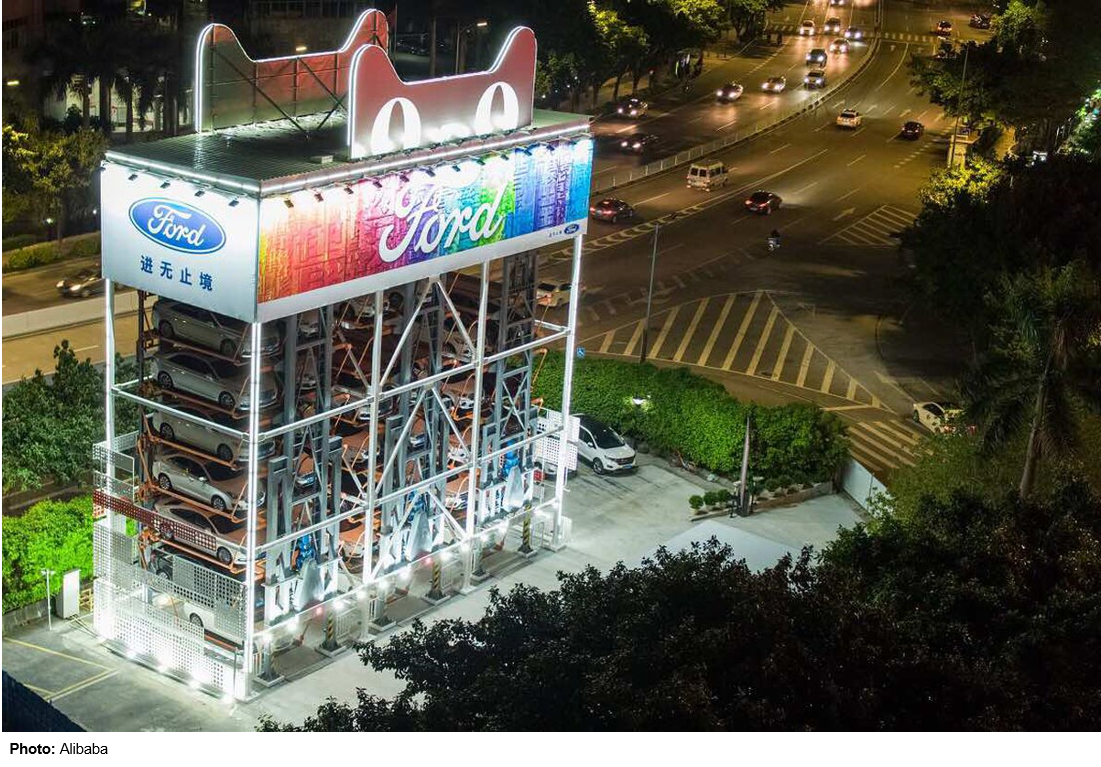

Another instance of a similar model is that of Alibaba, who partnered with Ford to sell vehicles in China that led to an integration of its online sales platform with offline retail. The project consisted of a car vending machine and Alibaba’s Taobao app. The process is initiated once the customer scans a car that they want to test and potentially buy using the app. The customer then heads to an unmanned vending machine facility and using face ID, the ordered car is dispatched. Within three days of test-driving, the customer can buy the car using the app or can arrange to test a different model. In 2017, Alibaba launched this car vending machine in Guangzhou, and in the coming years, it plans to open another center in Shanghai and in Nanjing. These developments are currently focused on selling traditional car models, i.e., non-autonomous; however, it is expected that automated vehicles will be sold based on the same business model.

In view of such instances of online mode of vehicle sales, there can be a number of different scenarios for the sales of vehicles, specifically focused on automated vehicles. A few of these scenarios are listed below.

Automaker Owned Sales Center

Similar to the model adopted by a mobile phone company-owned store, there will be an automaker owned sales point to take care of customer requirements. An automaker owned sales point will have an expert technician who will be equally focused on the hardware and software aspect of the vehicle. The expert technician will be supported by a lower-skilled technician who can conduct oil changes, rotate tires, and other rudimentary tasks.

Online Car Repairing and Maintenance

Companies such as Caravan are currently focusing on online buying and selling of cars; however, the aspect of servicing cars is yet to be addressed by these companies. In such a scenario, an online service technician will run a diagnosis via the internet, and based on the results, the car will be serviced via software updates or depending on the hardware requirement. The technician will be responsible for resolving issues associated with the vehicle in person. In addition to this, an expert service center can also be placed at the car vending machine.

Another interesting area to look at is the change that is expected across industries that will have considerable interest in autonomous vehicles. 5G technology is one such example that will be a major influence on the mass adoption of automated vehicles, as it enables automated vehicles to communicate with others on the road seamlessly. Sensors of an automated vehicle generate unprecedented amounts of data that are much more than mobile phone devices streaming full HD videos. Handling, processing, and analyzing this data require a much faster network compared to the existing 4G technology.

Another area that will affect the automotive industry is blockchain technology. The proliferation of automated vehicles with traditional vehicles will make blockchain implementation even more crucial. For instance, blockchain payment systems using automated vehicles will be seamless and secure compared to traditional gateway payment systems that are less secure. The proliferation of these technologies will increase the potential of cyber-attacks in autonomous vehicles, and hence, automakers are dedicatedly looking to partner with cybersecurity companies and also have their own team focused on building better intrusion prevention technologies.

On one side, due to digitization as well as connected and autonomous vehicles, there will be a redundancy of certain jobs/functions that are present today. On the other side, based on the development and implementation of 5G, blockchain, and cybersecurity technologies, new opportunities will emerge. 5G technology job opportunities will be around deployment and maintenance, whereas, blockchain and cybersecurity areas will be around designing and implementation of these technologies. As such, OEMs, tier suppliers, and research institutes are already working towards building the vehicle of the future as well as training personnel and ensuring that the required skill set is available.