Steep Path of “Value-Based Healthcare” Offers Indispensable Outcomes

Listen to this Article

mins | This voice is AI generated.

mins | This voice is AI generated.

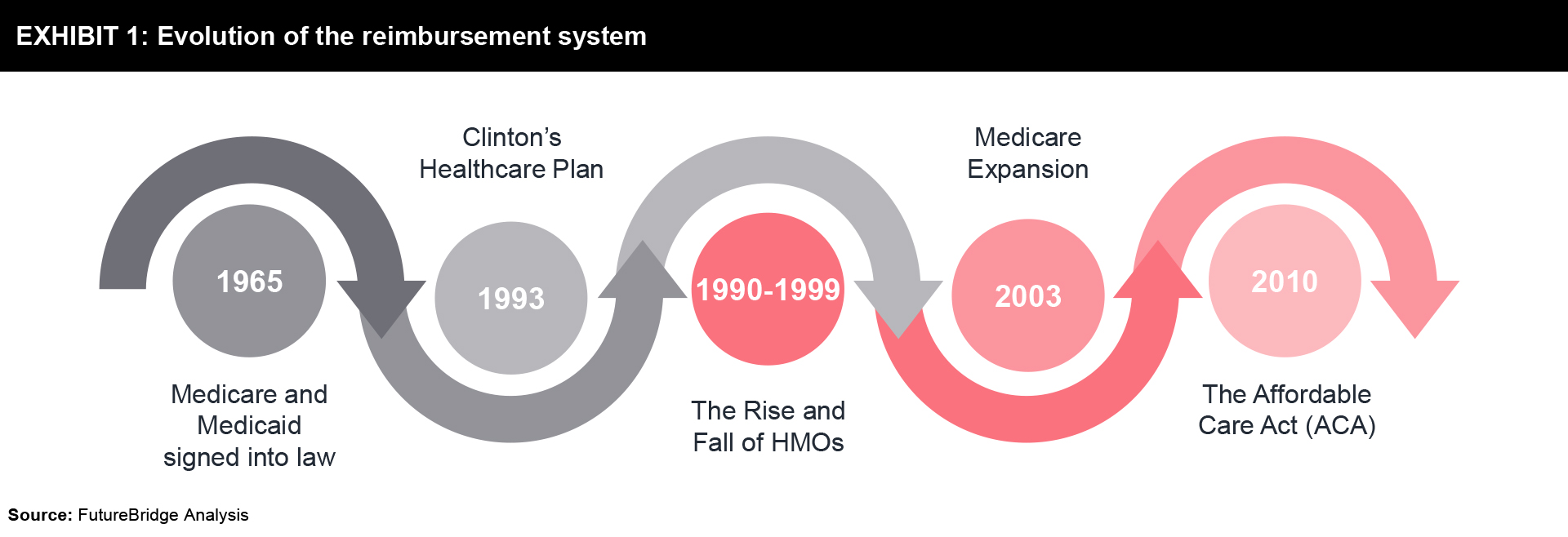

The healthcare industry has witnessed a gradual evolution in the past few decades. Historically, the industry has been reimbursing its providers by paying fees for the services rendered, also known as Fee-for-service (FFS) model. The stakeholders have gradually started to realize that coupling reimbursement to patient outcome & experience is the only way ahead, also known as the Value-based healthcare (VBHC) model. Moreover, legislation like the Affordable Care Act has reinforced and strengthened the VBHC model as it renders the FFS model inherently inefficient. In the FFS model, the incentive lies in providing more services, irrespective of the outcome of those services, which makes it inefficient. It is believed that the VBHC model would be an answer for the inefficiency of the FFS model.

The VBHC model has its roots in the Health Security Act that was introduced by President Bill Clinton in 1993 when he established a Task Force on National Health Care Reform to develop this universal healthcare initiative. It was in favor of universal coverage but used the FFS model for physician reimbursement. The proposed bill could not stand the scrutiny and it was repealed in 1994 on grounds of being too complex and costly. Later, the already established and successful ‘managed care’ model which was run through ‘Health Maintenance Organization (HMOs)’ also started failing due to a variety of reasons like reduced pharmaceutical co-pay, diminishing profitability of managed care organizations, etc. This led the Obama administration to revive the HSA by introducing Patient Protection and Affordable Care Act (PPACA) in 2010, which emphasized the use of the VBHC model for physician reimbursements. Refer to Exhibit 1 to understand the evolution of the reimbursement system in the US.

The VBHC model has its roots in the Health Security Act that was introduced by President Bill Clinton in 1993 when he established a Task Force on National Health Care Reform to develop this universal healthcare initiative. It was in favor of universal coverage but used the FFS model for physician reimbursement. The proposed bill could not stand the scrutiny and it was repealed in 1994 on grounds of being too complex and costly. Later, the already established and successful ‘managed care’ model which was run through ‘Health Maintenance Organization (HMOs)’ also started failing due to a variety of reasons like reduced pharmaceutical co-pay, diminishing profitability of managed care organizations, etc. This led the Obama administration to revive the HSA by introducing Patient Protection and Affordable Care Act (PPACA) in 2010, which emphasized the use of the VBHC model for physician reimbursements. Refer to Exhibit 1 to understand the evolution of the reimbursement system in the US.

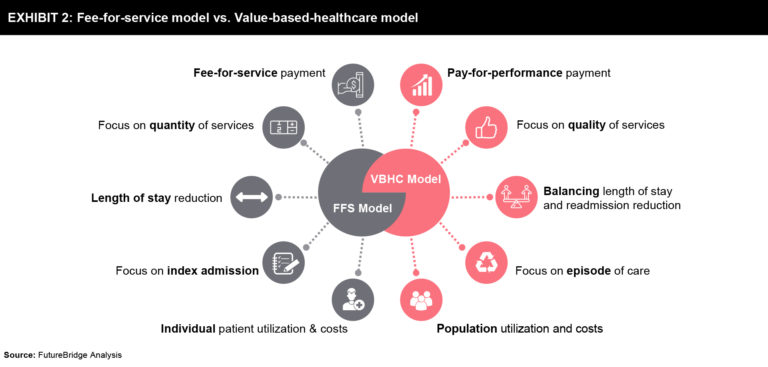

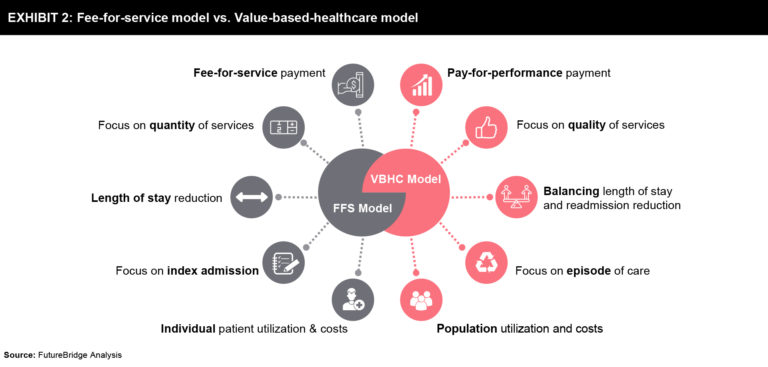

Simply put, in the VBHC model providers (including hospitals and physicians) are reimbursed based on patient health outcomes. Value-based care agreements reward providers for helping patients to improve their health, reduce the adverse effects and prevalence of chronic disease, and live healthier lives in an evidence-based way.

Exhibit 2 explains the key differences between FFS and VBHC models:

The improvement in the well-being of the citizen and reduced individual & federal spending on healthcare will ultimately boost the economy of the nation. All in all, it is assumed to be beneficial to society at large, profiting each stakeholder in one or the other way.

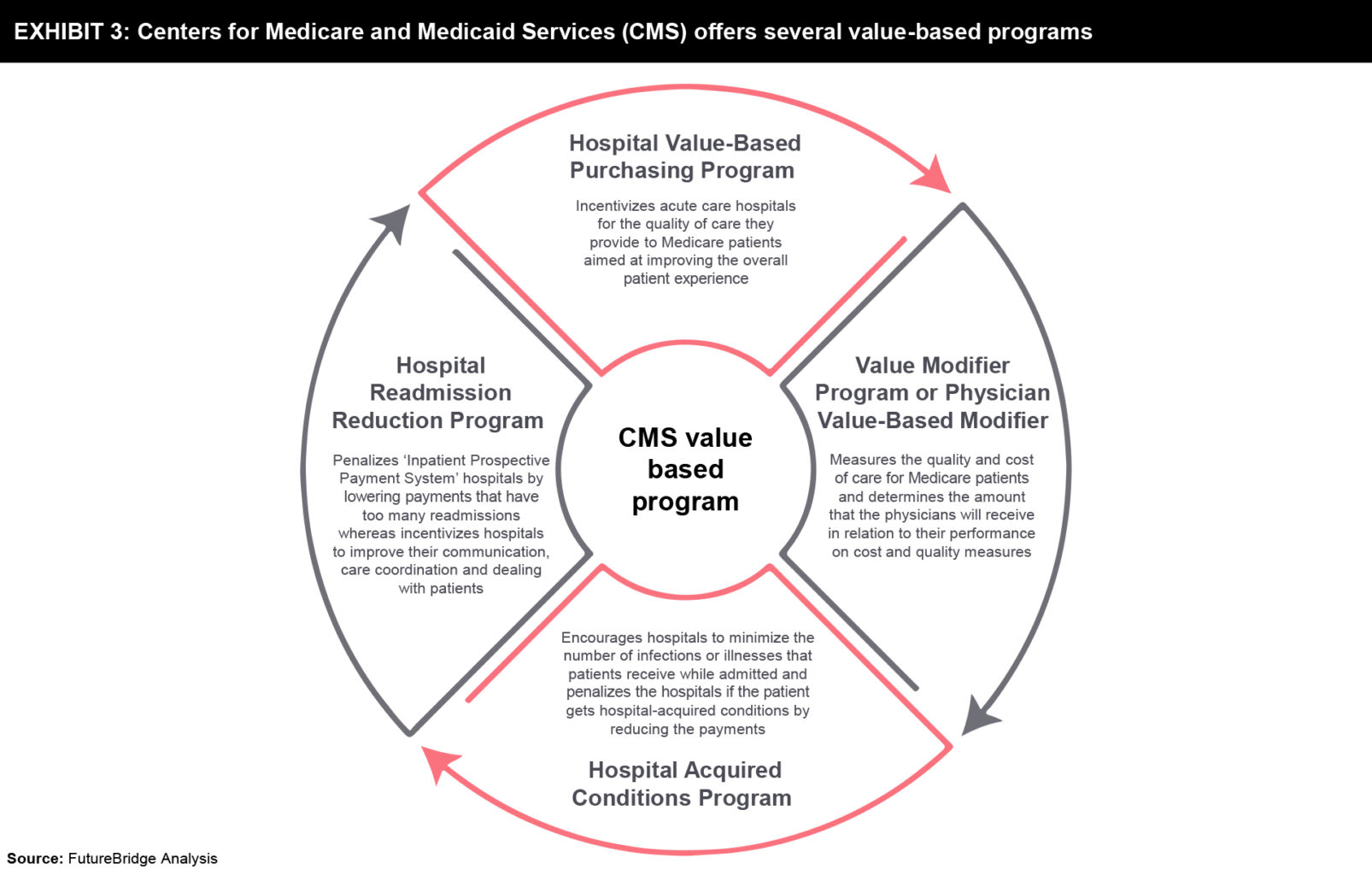

The Centers for Medicare and Medicaid Services (CMS) offers several value-based programs that are summarized in Exhibit 3.

Though VBHC is the buzz word and it seems to benefit all the relevant stakeholders, there are very few players currently existing in the market who have deployed the VBHC model. Owing to the complexity of the model, many are running pilots to test the feasibility of the model. Refer to Exhibit 4 to understand the engagement of entities in VBHC activities.

One such example is Aetna, which has vowed to have a value-based healthcare model deployed for 75% of all claims by 2020. In 2017, the company reported that 7.2 million plan members (representing roughly 53% of the company’s claim) already received care through VBHC initiatives1.

Another example is from the medical devices industry where Medtronic is running a pilot project in Latin America. With the help of enhanced care coordination enabled by its products and monitoring system, it has been able to reduce the mortality rate related to segment elevation myocardial infarction by 30%2.

Though there are many challenges associated with the implementation of the VBHC model. Below are some of the key challenges faced by it:

Shifting to VBHC from the FFS model is not easy and this shift might take longer than expected. The model lacks standardization and clarity in terms of the patient-reported outcomes and measuring the performance of the care provided on its basis. This has left most of the stakeholders of the industry confounded. Moreover, the lack of skilled staff is only worsening the problem. Nevertheless, as the healthcare sector is evolving, many stakeholders including physicians are acknowledging the long-term benefits associated with the VBHC model and are gradually showing their willingness to take the short-term financial hit associated with the VBHC model. However, to make it successful, the need is for the industry to come together and define & adopt the standards, develop the infrastructure and train the staff & patients. Technology has an immense role to play in the success of the VBHC model. It will be interesting to see how the industry leverages the technology to address the key issues identified and successfully implements the VBHC model which is the ultimate solution to reduce the cost curve and improve the quality of care.

References

Though VBHC is the buzz word and it seems to benefit all the relevant stakeholders, there are very few players currently existing in the market who have deployed the VBHC model. Owing to the complexity of the model, many are running pilots to test the feasibility of the model. Refer to Exhibit 4 to understand the engagement of entities in VBHC activities.

One such example is Aetna, which has vowed to have a value-based healthcare model deployed for 75% of all claims by 2020. In 2017, the company reported that 7.2 million plan members (representing roughly 53% of the company’s claim) already received care through VBHC initiatives1.

Another example is from the medical devices industry where Medtronic is running a pilot project in Latin America. With the help of enhanced care coordination enabled by its products and monitoring system, it has been able to reduce the mortality rate related to segment elevation myocardial infarction by 30%2.

Though there are many challenges associated with the implementation of the VBHC model. Below are some of the key challenges faced by it:

Shifting to VBHC from the FFS model is not easy and this shift might take longer than expected. The model lacks standardization and clarity in terms of the patient-reported outcomes and measuring the performance of the care provided on its basis. This has left most of the stakeholders of the industry confounded. Moreover, the lack of skilled staff is only worsening the problem. Nevertheless, as the healthcare sector is evolving, many stakeholders including physicians are acknowledging the long-term benefits associated with the VBHC model and are gradually showing their willingness to take the short-term financial hit associated with the VBHC model. However, to make it successful, the need is for the industry to come together and define & adopt the standards, develop the infrastructure and train the staff & patients. Technology has an immense role to play in the success of the VBHC model. It will be interesting to see how the industry leverages the technology to address the key issues identified and successfully implements the VBHC model which is the ultimate solution to reduce the cost curve and improve the quality of care.

References

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur long-standing clients include some of the worlds leading brands and forward-thinking corporations.