Drug development is an expensive, tedious, and lengthy process that takes several years to reach completion. Further, the increase in the percentage of the aging population and the rise in the prevalence of various chronic diseases is creating a high demand for the development of novel and innovative therapies. On one hand, the accountability lies with established innovator companies to develop such therapies and to cater to the unmet needs of the patient population in a highly regulated framework. Whereas, on the other hand, the accessibility and affordability of these high-priced drugs remain a complex challenge even in the most intense and advanced healthcare setups.

Preemptive Strategies – Two-sides War between Innovator and Generic Companies

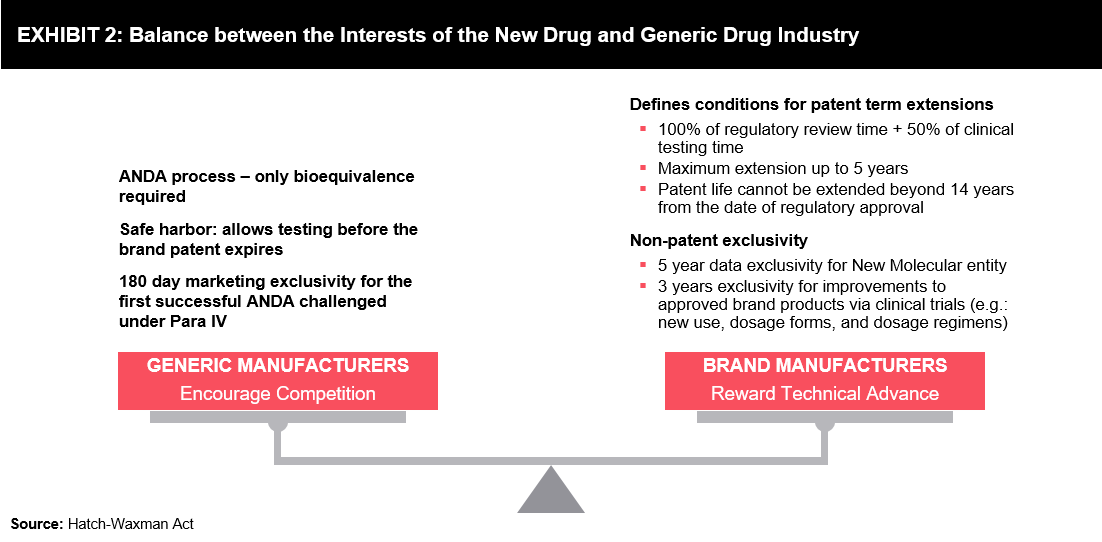

It is imperative to provide balanced provisions so that all stakeholders, including innovator companies, generic players, and patients, can gain equal benefits in the healthcare ecosystem. There have already been certain provisions such as regulatory exclusivities and patent term, which create a healthy competition in the pharmaceutical industry. The implementation of these provisions helps develop effective synchronization between innovators and generic companies. Innovator companies can generate returns for branded drugs through various data exclusivities (i.e., excludes third-parties to use clinical studies data or any other company to ask for market approval based on the data before the specified period) and patent term. Nevertheless, generic companies may advance in the competition through various certifications applicable under the Hatch-Waxman Act. This enables patients to benefit from the easy availability of low-cost medications, as a majority of prescriptions are dispensed as generics.

With the enactment of this Act, the number of generic drugs available to consumers has increased exponentially. As a result of this, innovator drugs lose more than 40% market share to their generic counterparts. Prior to this Act, only 35% of innovator drugs had to compete with their generic counterparts; currently, almost all drugs face generic competition.

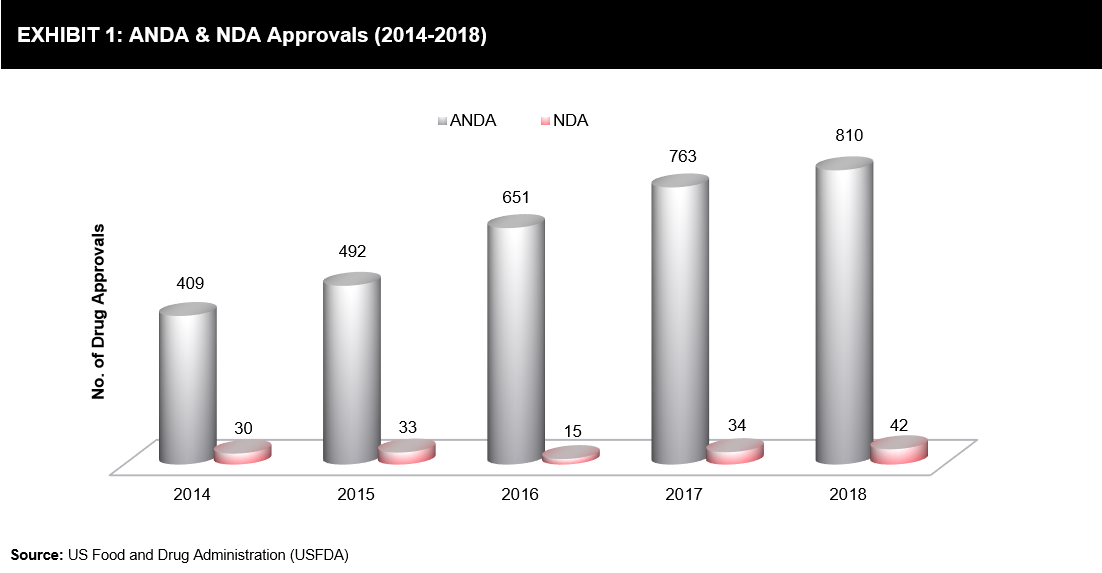

New drug approvals increased over the last two years, wherein 42 New Drug Applications (NDAs) were granted by the FDA in 2018 as compared to 34 approvals in 2017. Similarly, the approval rate of generic drugs increased from 763 approvals in 2017 to 781 approvals in 2018 (refer to Exhibit 1). In the last 5 years, NDA was led by 40% and the Abbreviated New Drug Application (ANDA) by more than 90%.

Besides patents, data exclusivity is another tool for innovator companies to reserve market exclusivity, which enables them to keep the price of the product high. This can successfully block or delay the launch of equivalent competitor products during the data exclusivity period, irrespective of patent protection. In some instances, the period of data exclusivity may extend beyond the patent term, which protects the same product. Provisions of the Hatch-Waxman Act balance the interests of innovators and generic drug manufacturers. (Refer to Exhibit 2)

innovator company can benefit from higher pay-offs and greater incentives for innovation if market exclusivity can sustain for an extended period of time.

Focus on Optimal Drug Life Cycle Management

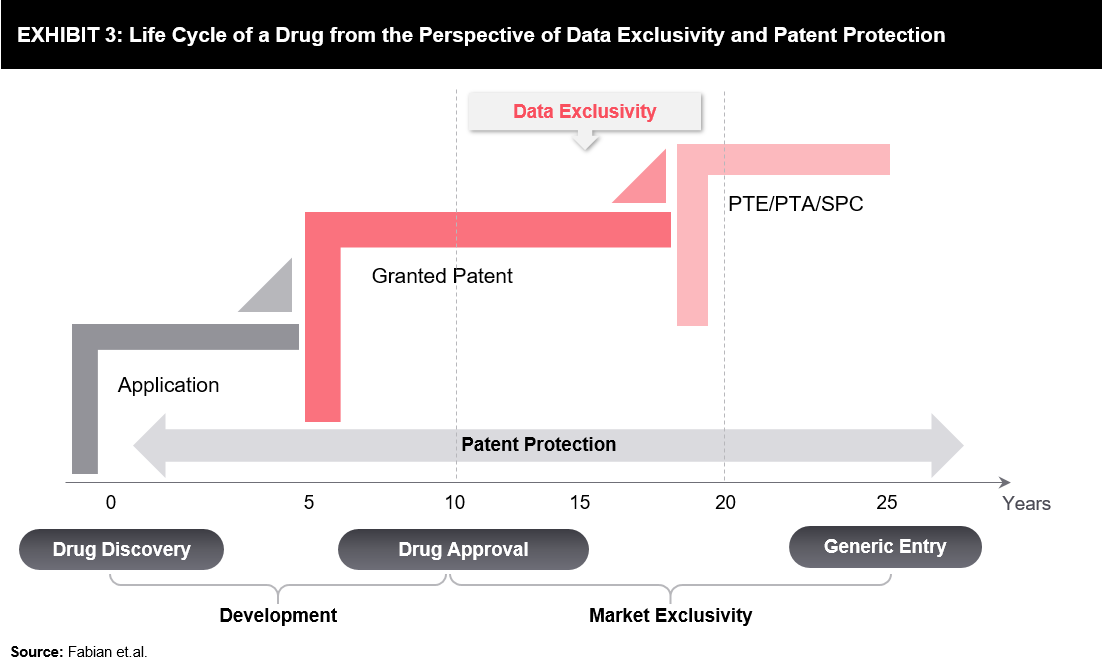

A pharmaceutical product undergoes various stages in its life cycle – from preliminary concepts to marketed products used by patients and healthcare professionals. A typical drug life cycle is presented below (refer to Exhibit 3). Generic entry may occur earlier due to certain regulatory

At every stage of the product life cycle, which includes innovation, access, decision-making, and product use, regulators play a crucial role through their interface with healthcare providers.

- Encouraging the development of innovative products

- Classifying products based on acceptable benefit and risk profile

- Boosting public confidence regarding the use of approved products

- Evaluating the performance of the product, if it meets the desired outcome

Strategies to Maximize Drug Life Cycle

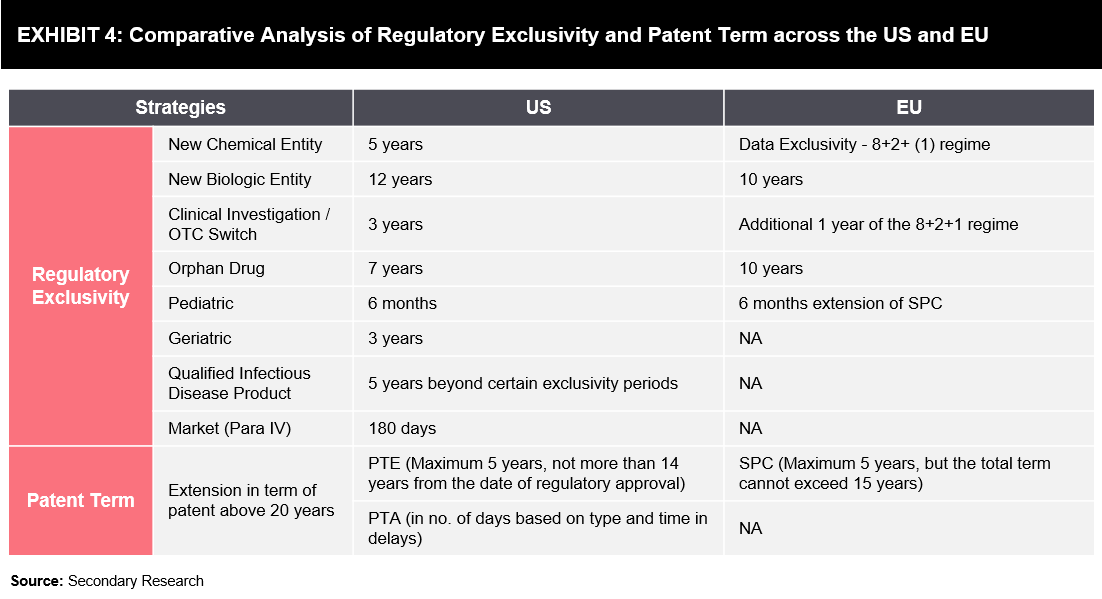

Exhibit 4 below highlights various strategies of patent offices and regulatory bodies, through which pharmaceutical companies leverage their competitive positions in the highly regulated market with the aim of maximizing the drug life cycle.

- New Chemical/Biological Entity: Granted to drugs/biologics that contain no active moiety and have been approved by regulatory authorities

- Clinical Investigation: Granted to drugs when application or supplement contains reports of new clinical investigations conducted or sponsored by an applicant and essential for approval

- Orphan Drug Exclusivity: Granted to drugs designated and approved for the treatment of rare diseases or conditions

- Pediatric Exclusivity: Granted when the sponsor has conducted and submitted pediatric studies on the active moiety

- Geriatric Exclusivity: Granted when the sponsor has conducted and submitted geriatric studies on the active moiety

- Qualified Infectious Disease Product (QIDP) Exclusivity: A QIDP is defined in section 505E (g) as an antibacterial or antifungal drug for human use intended to treat serious or life-threatening infections, including those caused by –

- An antibacterial/antifungal-resistant pathogen, such as a novel or emerging infectious pathogens; or

- Qualifying pathogens listed by the Secretary under” section 505E (f) of the 57 FD&C Act

- Market Exclusivity (Para IV): Granted to the first company that submits an ANDA, while the FDA has the exclusive right to market the generic drug for 180 days

- Patent Term Extension (PTE): Aims to restore a portion of the patent term that is lost while the patent holder is awaiting regulatory approval of the safety and efficacy of the product

- Patent Term Adjustment (PTA): USPTO adds days to a patent’s lifespan based on delays that occur from the USPTO during the patenting process

- Supplementary Protection Certificate (SPC): An intellectual property right that serves as an extension to a patent right; SPC aims to offset the loss of patent protection for pharmaceutical and plant protection products, as these products require prior submission of clinical data for obtaining marketing approval

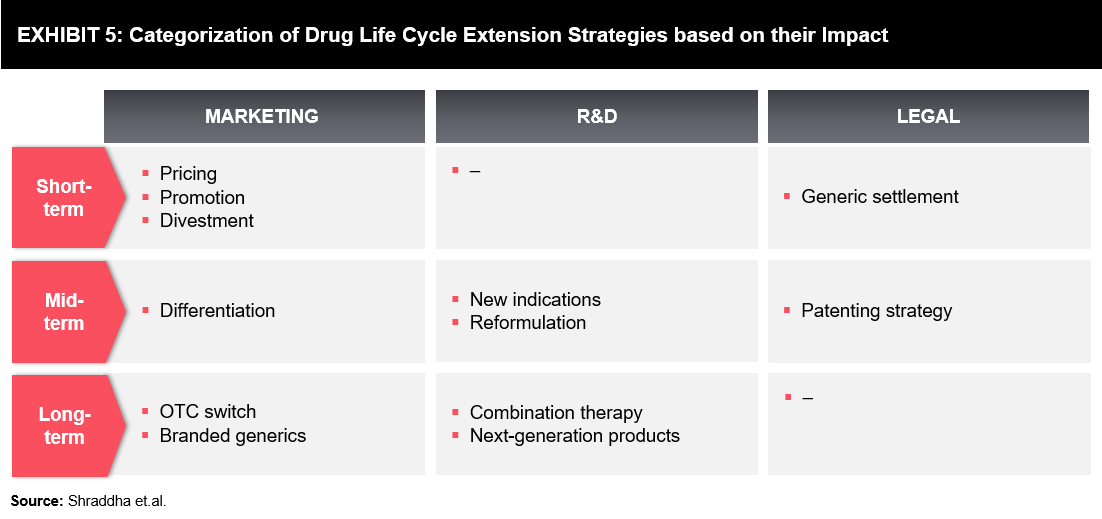

The pharmaceutical industry is continuously developing new strategies to increase returns from an already approved drug, before and after its patent has expired. Strategies are typically segregated into short-term, mid-term, and long-term (refer to Exhibit 5).

Every aspect of the above-mentioned strategies, including marketing, R&D, and legal, play a vital role in the extension of the drug life cycle. This can be well understood by a few indicative case examples as outlined below:

- Under the differentiation (marketing strategies for the mid-term), branded companies can retain sales after generic entry by providing more value-added drugs (e.g., improved packaging, easy-to-swallow pills, new coatings, new flavors, or patches) without compromising on pricing pressure and extending the patent of the drug.

- Drugs with evolved new indications have an increased chance of competing in different markets. For example, Sildenafil (Viagra) was initially developed for angina; however, in 1998, the drug was approved for erectile dysfunction, and in 2003 for pulmonary arterial hypertension (brand name Revatio). Furthermore, the drug received an additional 6 months of pediatric exclusivity on rare lung disorder for children.

- Next-generation products can build on the brand equity of the previous generation product. However, it may need to differentiate itself enough to encourage customers to switch. Nexium, a single-isomer version of the first generation drug, Prilosec, is one such example.

Future Outlook

Despite various strategies on product life cycle management developed by the pharmaceutical industry, the effective implementation of these strategies is yet to be materialized, as pharmaceutical companies are struggling to overcome challenges associated with drug development cost, pricing pressure, stringent regulations, and market competition. These challenges will increasingly affect the industry’s growth in the future if due attention is not paid equally to R&D, legal, and marketing activities.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.