Factors Triggering the Demand for Automated Packaging Systems

Automated packaging systems are machines used for packing items to reduce manual labor and minimize handling time and cost. These machines can be categorized into two types, namely, fully-automated, where all activities such as box erection, folding, sealing, and labeling are performed by the system, and semi-automated, where only one activity or a combination of a few activities mentioned above is performed by the system.

The global automation packaging industry has grown over the past 2–3 years, with product packaging being performed by robots or machines, thereby reducing product damage, cost, and manual labor. Products are typically packaged in boxes and pouches depending on the item type and weight. Box packaging (of corrugated sheets) is gaining popularity among end-users.

Automation in packaging is gaining acceptance due to the massive growth in the e-commerce sector. According to the United Nations Conference on Trade and Development, the global e-commerce sales was $29 trillion in 2017 and is expected to grow at a ~10% CAGR during 2018–2022. With significant growth in e-commerce, there is a need to automate packaging processes through fully- and semi-automated packaging systems.

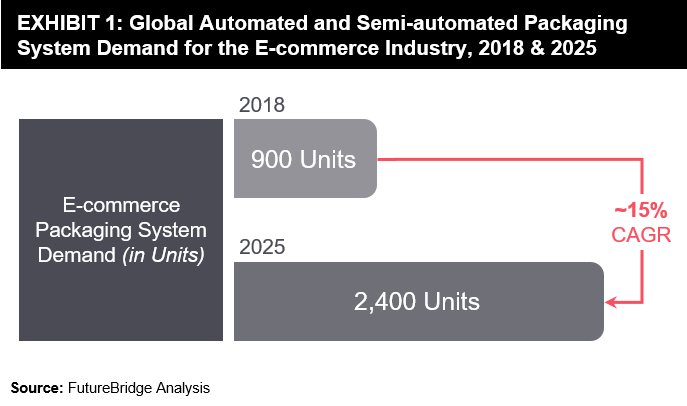

In recent years, the adoption of fully- and semi-automated packaging systems has increased in the packaging industry. According to FutureBridge, the market for fully automated and semi-automated packaging systems for e-commerce is expected to reach 2,400 units by 2025, growing at a CAGR of 15% (refer Exhibit 1). Fully automated packaging systems account for ~5% of the total market demand.

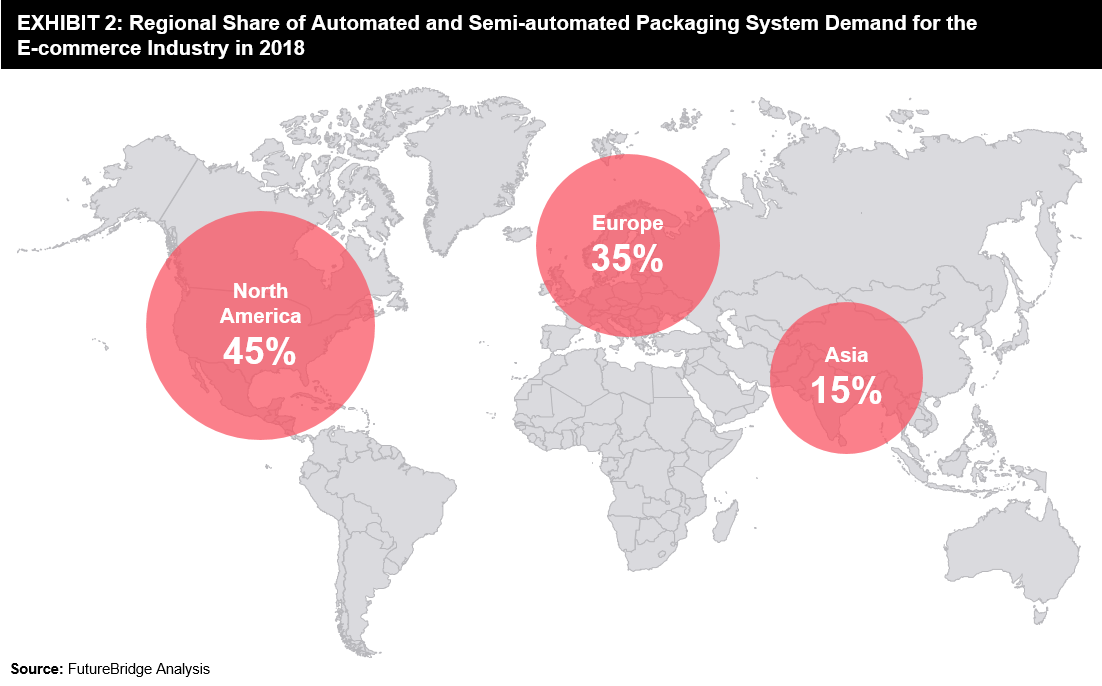

North America accounted for the largest share of automated and semi-automated packaging systems demand due to the growing e-commerce market in the US (refer Exhibit 2). Asia, where labor cost is cheaper as compared to North America and Europe, has the lowest adoption rate. Packaging system users in Asia prefer manual labor over automated systems, as the payback period for such investments is higher than in North America or Europe.

The regional share is expected to be similar in the mid- to long-term (2–5 years); however, FutureBridge predicts that China will be a lucrative market for automated and semi-automated packaging systems, owing to the ‘Made in China – 2025’ campaign, where the focus is on automation and intelligent manufacturing.

Market Trends Impacting Distribution Channels

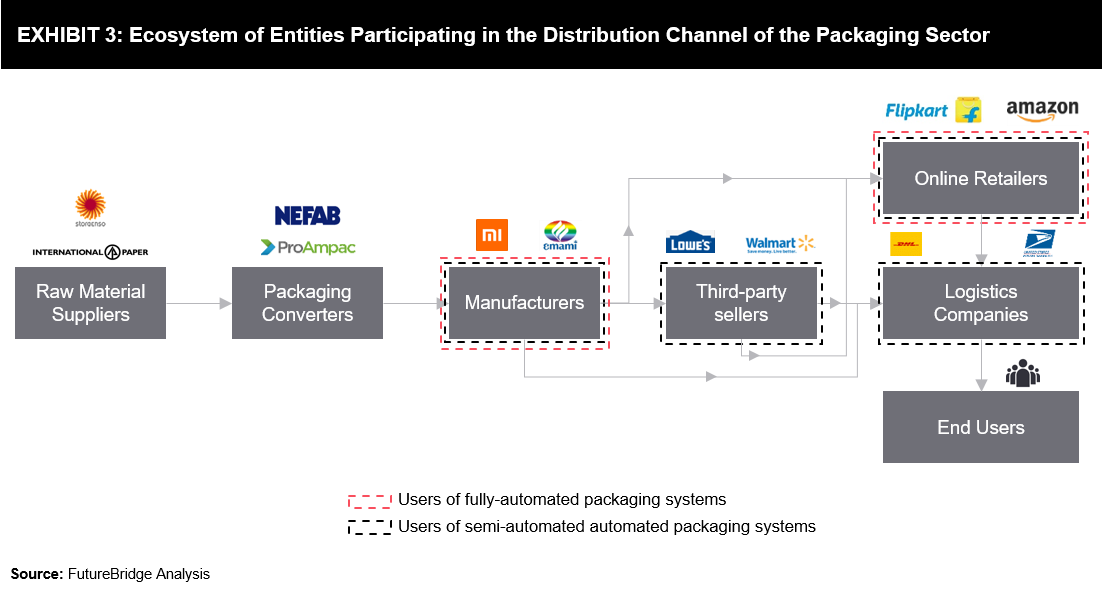

Semi-automated systems are used by manufacturers, third-party sellers, online retailers, and logistics companies. Fully-automated systems that comprise a very niche segment of the packaging systems market are used by online retailers, such as Amazon (refer Exhibit 3). In addition, consumer goods manufacturers responsible for delivering items directly to end users through their online portals use fully-automated systems for item packaging.

Growth in Corrugated Board Packaging

The market for corrugated materials accounts for more than 80% of the packaging materials used by the e-commerce industry. At present, the global e-commerce industry employs an estimated amount of $19.5 billion of corrugated materials for product packaging, annually.

Consumer products, including electronics, books & media, fashion, toys, and sports equipment, are packed using corrugated materials. The demand for corrugated packaging is expected to increase with a rise in global e-commerce. Thus, fully-automated and semi-automated packaging system manufacturers can strategize to target online retailers in the distribution channel for selling their equipment.

Increasing Emphasis on Personalized Packaging

Online retailers are focusing on printing personalized messages on secondary packaged items to enhance the buying experience. The use of personalized packaging within secondary packaging is expected to increase in the near future.

According to a printing industry research association, the volume of ink used for inkjet printing in corrugated packaging is expected to increase from 4 million liters in 2017 to 16.4 million liters in 2022, growing at a CAGR of 32.4%.

The adoption of digital printing in packaging has been growing on account of its convenience over conventional presses. Unlike analog printing, digital printing allows corrugated packaging converters to execute on-demand printing with shorter press runs and quick turnarounds, thereby improving the packaging supply chain.

Digital inkjet printing also offers higher image quality compared to other printing techniques, including flexography and lithography. Improved image quality acts as one of the key factors influencing the purchasing decision of buyers, thereby making the concept of corrugated packaging attractive to end-users. Digital inkjet printing has been implemented in corrugated packaging by multiple end-user industries, including food & beverages, pharmaceuticals, electronics, and automotive.

Key Manufacturers of Fully-automated and Semi-automated Packaging Systems

Strategic Areas for Packaging System Manufacturers

Packaging system manufacturers encompass the opportunity to target three entities in the distribution channel, which include consumer goods manufacturers, online retailers/fulfillment centers, and logistics companies.

Focus on Providing Systems that can Determine Right-weight and Right-size of Packaging

According to FutureBridge analysis, approximately 50% of boxes shipped have empty space. This is because the combination of items to be shipped is infinite and the type of packaging solution in the form of box size and shape available is minimal. These factors further add to the cost and void space per shipment.

Due to the introduction of dimensional weight pricing in 2015 by FedEx and UPS, consumer goods manufacturers, online retailers/fulfillment centers, and logistics companies are continuously working on ways to reduce the weight and size of corrugated boxes. This, in turn, would help reduce the cost of shipping items. Hence, providing systems that can process right-size and right-weight packaging boxes will be an important aspect to consider over the next 1–5 years.

Focus on Offering New Business Models

Packaging system manufacturers can offer innovative business models to compete in the corrugated packaging market. For instance, instead of selling corrugated packaging systems to online retailers and consumer goods manufacturers, packaging system manufacturers may provide these systems free-of-cost. Revenue can be generated through a supply agreement of corrugated materials with online retailers and consumer goods manufacturers.

Packsize, a Utah-based packaging system manufacturer, follows a similar business model, offering machines to its customers free-of-cost. The manufacturer only charges for its proprietary z-fold corrugated material used for making boxes.

This business model can be beneficial for companies providing corrugated materials as well as system manufacturers. Through this model, companies can enter into a long-term relationship/supply contract with online retailers and consumer goods manufacturers, thereby generating a steady revenue stream.

Focus on Acquisition and Partnerships

Partnership with logistics companies: Packaging system manufacturers can partner with logistics companies, such as DHL, UPS, and FedEx, as the latter is in the process of integrating their software with manufacturers and third-party sellers to instantly track e-commerce orders. In addition, logistics companies are also focusing on automating their warehouses, which would boost the demand for fully- and semi-automated packaging systems.

Acquiring manufacturers with similar synergies: Packaging system manufacturers should focus on acquiring companies, which can help expand their reach and product offerings. In May 2019, Sealed Air acquired Automated Packaging Systems, a manufacturer of pouch packaging systems. This acquisition helped Sealed Air expand the breadth of its automated solutions and sustainable packaging offerings.

The rising popularity of automated packaging systems across e-commerce retailers has presented manufacturers with an ideal opportunity to enter the market. These systems are capable of solving challenges faced by the e-commerce industry by increasing fulfillment efficiency, reducing freight costs, lowering labor costs, and utilizing limited packaging materials. In conclusion, packaging manufacturers can become an essential part of the booming e-commerce industry by offering automated packaging systems.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.