We are slowly witnessing a shift from the laboratory to the factory of cell-cultured meat products but major challenges still remain with cost, regulation, and scale-up proving difficult.

We are slowly witnessing a shift from the laboratory to the factory of cell-cultured meat products but major challenges still remain with cost, regulation, and scale-up proving difficult.

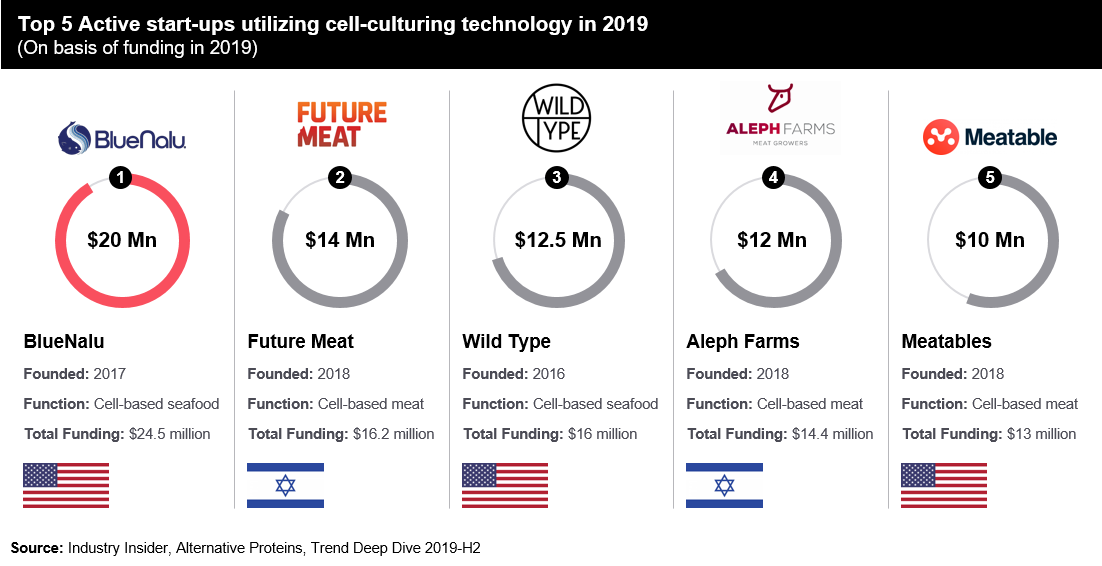

Our Industry Insider subject matter experts have identified rapid growth in cell-culture investment in recent years. Following major successful funding rounds for companies like BlueNalu, Future Meat Technologies, and Wild Type, the total investment reached $80 million in 2019, a 120% increase from 2018.

This is likely to continue in 2020, with California-based Memphis Meats already after securing $161 million in the category’s first Series B round. This breakthrough round was the largest to date for the cell-based meat industry.

In this piece, we take a look at the top 5 active start-ups utilizing cell-culturing technology based on their recorded investment in 2019.

BlueNalu – The seafood equivalent to Beyond Meat

BlueNalu is a US-based start-up that plans to produce seafood alternative products using a unique proprietary technology of cellular agriculture. The company aims to fight the problems of overfishing, acidification, and other environmental effects by developing products using cellular aquaculture. In less than 2 years in development, BlueNalu has grown fillets of yellowtail fish which can be served raw, acidified or cooked. BlueNalu’s fish appears unique in its ability to withstand different cooking methods, a competitive manufacturing advancement.

In September 2019, BlueNalu raised one of the largest early-stage funding rounds in the emerging “alternative meat” sector of $20 million. The funding came from Agrinomics, an Aim-listed food investment backed by Mr. Mellon, and green venture funds. This brings total funding for BlueNalu to $24.5 million.

Future Meat Technologies – Creating hybrid products

Future Meat Technologies, which was founded in 2018 and based in Israel, is trying to do for lab-grown meat what Beyond Meat and Impossible Foods have done for plant-based meat. Future Meat’s process uses the rapid growth of connective tissue cells, called fibroblasts, to reach high densities before turning the cells to cultured muscle and healthy fats. The company says it aims to introduce hybrid products – combining plant proteins for texture and cultured fats that create the distinct aroma and flavor of the meat.

With current small-scale production costs of $150 per pound of chicken and $200 per pound of beef, Future Meat Technologies says it plans to release its hybrid products at a competitive cost level from its pilot production facility by 2021 and launch a second line of 100 percent cultured meat products at a cost of less than $10 per pound by 2022.

In October 2019, Future Meat received $14 million in a Series A funding round which was led by S2G Ventures, a Chicago-based venture firm that was also behind the initial public offering of US plant-based meat substitutes producer Beyond Meat, and EmeraldTechnology Ventures, a Swiss-based venture capital firm. This funding will be used to expand the company’s R&D efforts and build the world’s first cultured meat production plant near Tel Aviv with operations set to begin in 2020.

Wild Type – Salmon sourced from the lab

Founded in 2016, Wild Type is a San Francisco-based startup growing salmon in a lab. The company plans to initially release minced salmon and lox and work its way up to full-size filets. As with most cellular agriculture (or aquaculture) companies, it can only produce relatively small pieces of lab-grown meat due to scaffolding challenges and other growth constraints.

Wild Type’s salmon can also only be served raw. If it’s heated above 212°F, it will become too flaky to fall apart. According to Bloomberg the company plans to debut a new version of the salmon that can be cooked in the next few months. The company hopes to enter the market with prices competitive to farmed fish, at $7 – 8 per pound. However, at present the process is expensive, with the quantity served at the event costing over $200 to produce.

Wild Type raised a $12.5 million Series A funding round in October 2019. The round was led by CRV with participation from Maven Ventures, Spark Capital and Root Ventures, the last two of which had previously invested in Wild Type. This would bring the total amount of funding raised by the company to $16 million.

Aleph Farms – Brings lab-meat to space

Aleph Farms, an Israeli cellular meat startup formed in 2017, produced cultivated beef steaks by mimicking a natural process of muscle-tissue regeneration occurring inside the cow’s body, but under controlled conditions. The company claims its tech is unique because it can grow all four elements of meat – muscle, fat, blood vessels and connective tissue – together.

The start-up unveiled its first-minute steak in 2018 and has been working to bring their unique process to commercial scale. Aleph Farms plans to begin building bio-farms and move toward a limited consumer product launch with steak grown under controlled conditions within three-to-five years.

Last year, Aleph Farms announced it had successfully produced meat on the International Space Station, 248 miles (339 km) away from any natural resources, to demonstrate that meat can be “grown” in any conditions.

In May 2019, the cultured meat startup raised $12 million in a Series A funding led by Singaporean investor VisVires New Protein. Aleph Farms will use the funds to get its prototype products into the commercial marketplace.

Meatable – Bringing pork to the cell-cultured market

Based in the Netherlands, Meatable is a start-up that uses cellular agriculture to grow cell-based meat. Meatable has licensed a technology dubbed OPTi-OX, which involves engineering induced pluripotent stem cells for specific cell types then ‘reprogramming’ them to adult stem cells. The process yields consistent, homogeneous, rapid cell batches–in other words, a full steak in a matter of weeks. Meatable announced that they will showcase a prototype of their first product this summer: a cell-based pork chop. The cell-culture media will be a plant-based formulation that does not require fetal bovine serum which is an expensive serum derived from animal blood used by other players competing in this space.

In December 2019, Meatable received $10 million funding from existing seed round investors, including BlueYard Capital, and prominent angel investors Taavet Hinrikus, the CEO and founder of European unicorn TransferWise, and Albert Wegner, Managing Partner of Union Square Ventures. They plan to use the new funding to ramp up the development of a small-scale bioreactor for 2020, and they’re aiming to have an industry-scale plant up and running by 2025.

Will clean meat ever arrive? And when it does, can it really save the planet?

As “clean meat” start-ups continue to push the boundaries of technology and science, this could have a major impact on food production, providing a greener, more sustainable alternative to large-scale meat production. Nevertheless, significant technical limitations remain as the sector works to build a commercial scale.

The product will evolve continuously in line with new discoveries and advances that optimize the production, quality, and efficiency of cell division. It remains to be seen whether this progress will be enough for artificial meat to be competitive in comparison to conventional meat and the increasing number of meat substitutes.

Based on start-up claims, we should expect cultured meat in the market over the next two to five years as they work towards scaling up production and bringing down costs. Therefore, the next few years should prove significant to the cultured meat industry as they prepare to launch competitive products on the main stage.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.