Developing a portfolio of product choices to address consumer demands related to health and zero/low-calorie alternatives

Why does sugar reduction matter?

Several beverage manufacturing companies across the globe are aiming to reduce sugar in their products to meet regulatory and consumer expectations. Investments in research and development of products with less sugar content have recently been prevalent. Reducing sugar includes strategies that allow the reformulation of products or the introduction of new ingredients to replace added sugars. Companies aim to provide healthier beverage options for consumers with zero/low calories. The World Health Organization recommends people consume no more than 25 grams of free sugars per day.

Increased consumption of sweetened beverages

High sugar content in food and beverages is a global concern. According to the CDC (Centers for Disease Control and Prevention), the average intake of sugar is 17 teaspoons for adults aged 20 and older. Sugary beverages are the main sources of added sugar in the American diet. Excessive consumption of sweetened beverages is associated with obesity, weight gain, type 2 diabetes, heart disease, kidney disease, liver disease, cavities, and even arthritis.

An SSB (Sugar-Sweetened Beverage) contains caloric sweeteners such as sucrose, high-fructose corn syrup (HFCS), or fruit juice concentrates among others, which are added to the beverages.

An SSB (Sugar-Sweetened Beverage) contains caloric sweeteners such as sucrose, high-fructose corn syrup (HFCS), or fruit juice concentrates among others, which are added to the beverages.

However, few authorities have developed specific definitions based on sugar content per volume used for regulatory purposes. For example, the New York City Board of Health defines SSBs as having ≥25 calories or 6.25g of added sugar per 8 fl oz (~237ml), whereas in the UK the definition for taxation is ≥5g of added sugar per 100ml.

SSBs are consumed widely on a global scale. Intake levels are above the recommended daily limits for free sugar in many high-income countries and on the rise in low-income and middle-income countries. Prospective clinical trials evaluating intermediate risk factors provide robust evidence for an association between SSBs and weight gain. SSBs may promote weight gain by adding additional liquid calories to the diet, induced by the rapid absorption of glucose.

Taxing sugar-sweetened beverages

According to the World Health Organization, the prevalence of overweight in pre-school-aged children is increasing fast in low- and lower-middle-income countries. People who consume sugary drinks regularly (1 to 2 cans per day or more) have a 26% greater risk of developing type 2 diabetes than people who rarely consume such drinks. The number of people with diabetes has risen to 537 million in 2021. The total number of people living with diabetes is projected to rise to 643 million by 2030.

According to the World Health Organization, the prevalence of overweight in pre-school-aged children is increasing fast in low- and lower-middle-income countries. People who consume sugary drinks regularly (1 to 2 cans per day or more) have a 26% greater risk of developing type 2 diabetes than people who rarely consume such drinks. The number of people with diabetes has risen to 537 million in 2021. The total number of people living with diabetes is projected to rise to 643 million by 2030.

Governments have taken action to improve the availability and access to healthy foods. Taxing sugary drinks can potentially help reduce the consumption of sugars. Studies have shown that taxation on sugary drinks is an effective intervention to reduce sugar consumption [2]. For example, a tax on sugary drinks that raise prices by 20% can lead to a reduction in consumption of around 20. In Mexico, implementing taxation on sugary non-alcoholic beverages led to a decline of about 7.6% in the purchase of sugary drinks [2].

Food and beverage companies working towards sugar reduction

Many food manufacturing companies have committed to reducing sugar in their overall product portfolio to meet the nutritional criteria of the WHO. Danone, The Coca-Cola Company, Nestle, PepsiCo, and many multinationals have invested in research and development for the launch of healthier alternatives with lesser or no-added sugars. With a whopping 83%, Danone exceeded its target of volumes without added sugar. The company has been progressing in sugar reduction across all categories. In dairy products, the reduction of added sugar reached 14% between 2014-2021.

Several core brands of PepsiCo are expanding into markets in which zero-sugar and lower-sugar beverages are available. In 2021, Pepsi Zero Sugar (Pepsi Black or Pepsi MAX) was available in 118 markets, an increase from 28 in 2015. Many brands including Pepsi, 7UP, Mountain Dew, and Mirinda have been reformulated with fewer added sugars and this strategy is aimed to be continued and implemented across most brands. A brand called Bubly was launched to meet the added sugar reduction goal, which is a line of zero-sugar flavored sparkling water. In addition to this, PepsiCo continues to develop a lower sugar portfolio for Pure Leaf Unsweetened in the United States and Lipton Zero in the European market.

Challenges in sugar reduction

The major challenge for the industry in reducing sugar is maintaining product attributes like taste, texture, and functionality. The F&B industry is taking on this challenge on multiple fronts that include technologies, policies, and reformulation strategies. Artificial sweeteners have mixed notions across consumer segments. Artificial sweeteners are either considered good for health or bad based on the perception of the consumer. The plant-based or naturally derived sweeteners carry the immense potential to change this notion.

Multinational organizations like PepsiCo, Nestle, Coca-Cola, Mondelēz International, ADM, Kraft Heinz, The Kellogg Company, Ingredion, and many others are aiming to reformulate products across different categories like juices, candies, chocolates, dairy, confectioneries, cereals, snacks and much more.

Making a sweet-tasting product with conventional sugar has been the norm. But companies are now challenged both by consumers and new regulations to manufacture healthier products. This requires companies to innovate and reformulate to meet expectations. Manufacturing a sweetener that is like conventional sugar is a complex task. It requires good quality, high-sweetness intensity ingredients, with necessary sensorial attributes. This increases the overall cost of the final product. Therefore, companies in the global sweeteners industry are determined to find solutions for the increasing demand for sugar-reduced products.

Up- and coming sugar reduction solutions for beverages

Manufacturers across the globe are actively trying to reformulate high-sugar food and beverages into more natural, healthier, and sustainable choices. Multiple new ingredients can replace sugar across different food and beverage applications. Sweetener manufacturers are actively innovating to provide solutions for food and beverage applications that improve the product’s taste, texture, and nutritional quality.

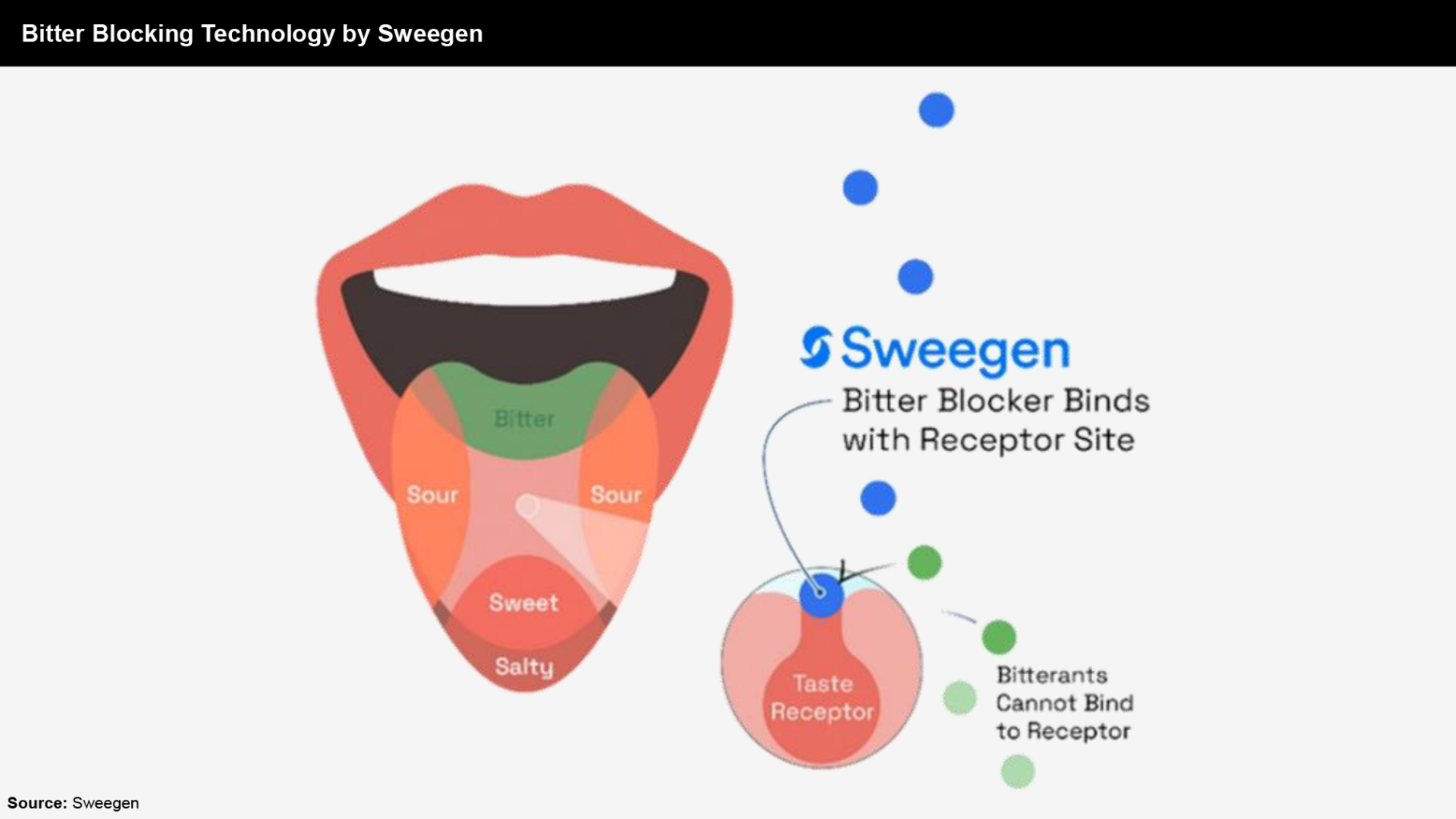

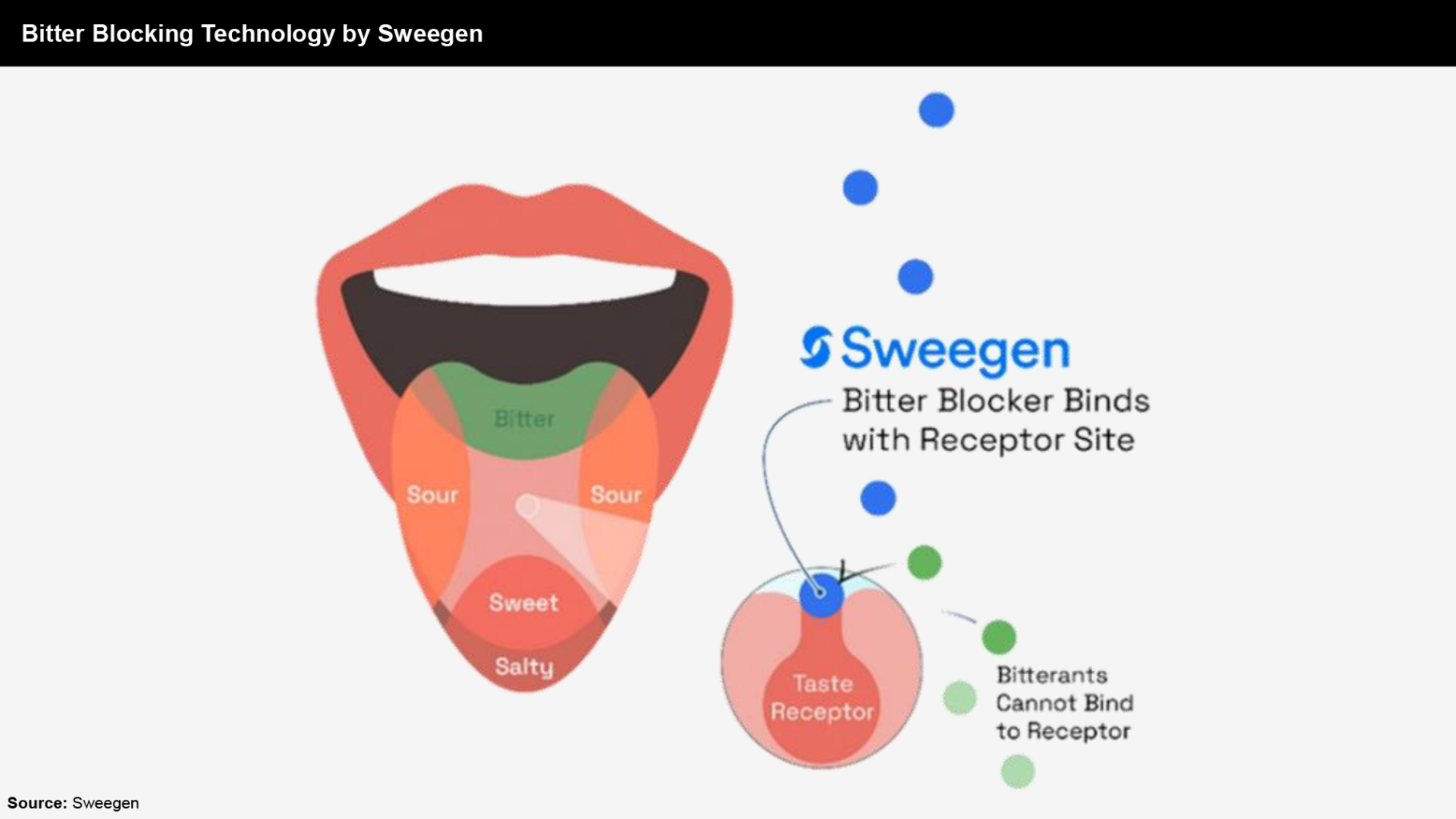

Taste modulators and enhancers create nutritional products with good taste, preserve flavor and aroma, and enhance the texture and overall mouth feel. Companies aim to deliver reduced sugar with a clean taste using innovative technologies. For example, Sweegen’s bitter-blocking technology reduces bitterness associated with functional ingredients in health and wellness products.

Other companies are crafting natural sweetener solutions. For instance, sweet proteins are an up-and-coming solution to tackle the aftertaste and provide additional nutritional content. Sweet protein developers are utilizing precision fermentation and computational protein design to produce sweet proteins for industrial-scale applications.

Another sugar alternative we are watching closely is rare sugars. Rare sugars are low-calorie and high in sweetness, but currently, they come at a high cost. Newer companies are resolving this issue by using lower-cost and sustainable plant-based ingredients. These ingredients help to streamline complex processes in the manufacture of rare sugars. The rare sugar, Tagatose, from American Sugar Refining Group, was found to be suitable for ice-cream formulations providing a similar taste profile to sucrose. Combining tagatose with other sugar distillates can optimize the overall sweet profile.

Stevia continues to be an area of busy activity in beverage applications, but the recent focus has been to solve the aftertaste challenges that stevia produces. Therefore, players are innovating with stevia to take it to over 90% purity, using fermentation and enzymatic bioconversion technologies. Major players include Cargill, Ingredion, ADM, Beneo, and many others.

Monk fruit is another ingredient that offers promising sugar reduction qualities. Monk fruit-based sweetener companies are working towards capturing true fruit goodness by innovating new extraction techniques to provide a natural taste and low-calorie product. These sweeteners are ideal for applications in juices and carbonated beverages. Firmenich, Senomyx, and Monk fruit Corp are all actively involved in developing new processing techniques using monk fruit.

Conclusion

Global beverage manufacturing companies are continuously working towards reducing sugar across their product portfolio to achieve nutritional targets. Juices, plant-based milk, dairy products, carbonated beverages, and flavored water are some of the product segments which have applied sugar reduction strategies. Sweetener companies are innovating exciting new ingredients and technologies for companies to leverage their expertise in the research and development of products with less sugar. This allows the beverage industry to provide healthier alternatives to drive and support consumer expectations.

References

- The role of sugar-sweetened beverages in the global epidemics of obesity and chronic diseases. April 2022

- Taxes on sugary drinks: Why do it?

- Added sugars

- Will the consumption tax on sugar-sweetened beverages help promote healthy beverage consumption? Evidence from urban China. June 2022

- Sugar: Why it matters?

- Improving the global nutritional profile of our products

- Sweegen: Where we play

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.