Alternative Dairy Overview

Dairy is a necessary part of the food cycle, present in both foodservice and packaged goods, as an end product or as a critical input for products such as cheese, yogurt, butter, spreads, etc. Given its ubiquitous presence, dairy is a small universe of the food industry, and largely being influenced by the same trends affecting the broader food sector. However, dynamics are changing in the current world, consumers are getting concerned about the health and the environment. With the understanding of the impact of animal husbandry on the environment and health factors such as lactose intolerance, consumer attention has greatly shifted towards plant-based dairy alternatives.

Dairy is a necessary part of the food cycle, present in both foodservice and packaged goods, as an end product or as a critical input for products such as cheese, yogurt, butter, spreads, etc. Given its ubiquitous presence, dairy is a small universe of the food industry, and largely being influenced by the same trends affecting the broader food sector. However, dynamics are changing in the current world, consumers are getting concerned about the health and the environment. With the understanding of the impact of animal husbandry on the environment and health factors such as lactose intolerance, consumer attention has greatly shifted towards plant-based dairy alternatives.

Plant-based dairy alternatives are made from diverse protein sources such as soy, legumes, seeds, nuts, or cereals. Their production is thought to have lesser negative effects on the environment, as compared to normal dairy products. Typically, the carbon dioxide released in producing milk is estimated to be 2–3 times higher than for plant-based drinks. Alternative dairy provides plant-based substitutes to traditional dairy products such as milk, butter, cheese, etc. Approximately 15% of anthropogenic greenhouse gas emissions come from livestock, of which 40% are due to beef and dairy farming.

The trend is heavily influenced by sustainability and health issues coming out from cow’s milk. Dairy production has a significant environmental impact on soil degradation, air, and water pollution, and loss of biodiversity. Increasing cases of lactose intolerance, milk-related allergies, environmental concerns, high cholesterol content, and the presence of animal growth hormones in milk are driving the demand for dairy alternatives. Changing dietary patterns such as veganism and flexitarianism are also driving factors for the plant-based dairy market.

The trend is heavily influenced by sustainability and health issues coming out from cow’s milk. Dairy production has a significant environmental impact on soil degradation, air, and water pollution, and loss of biodiversity. Increasing cases of lactose intolerance, milk-related allergies, environmental concerns, high cholesterol content, and the presence of animal growth hormones in milk are driving the demand for dairy alternatives. Changing dietary patterns such as veganism and flexitarianism are also driving factors for the plant-based dairy market.

According to research published by Good food institute, plant-based food retail sales have increased by 11% in the past year and 29% in the last two years and reached $5.0 billion in 2019. Among plant-based foods, plant-based dairy is the most matured market and owns a 68% market with $ 3.4 billion. Roughly 40% of the plant-based segment is catered for plant-based milk and 28% belongs to other dairy products.

Plant-based yogurts achieved $162 million in sales, up by 55%, followed by plant-based cheeses up by 43% to $124 million, and plant-based creamers with the highest rise by 131% to $109 million.

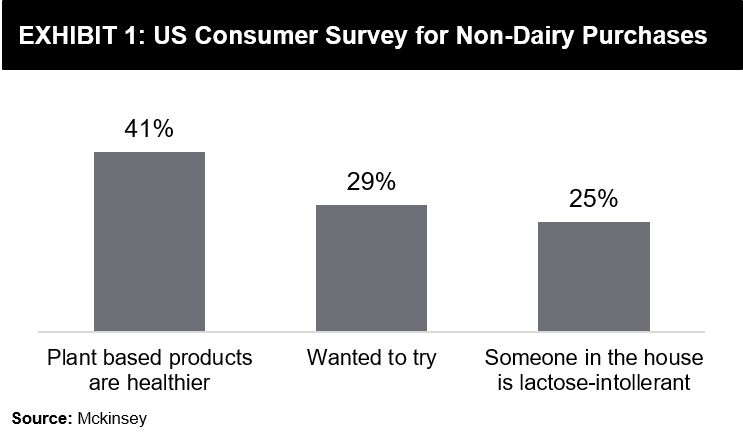

According to the consumer survey conducted in 2018 (Exhibit -1), 62% of US consumers have purchased/tried plant-based dairy products. 41% of the population expressed that they anticipate plant-based products to be healthier, whereas 21% of people have the desire to try the products

According to the consumer survey conducted in 2018 (Exhibit -1), 62% of US consumers have purchased/tried plant-based dairy products. 41% of the population expressed that they anticipate plant-based products to be healthier, whereas 21% of people have the desire to try the products

Plant-based milk alternatives have a smaller share of the overall market compared to dairy milk. However, the sales for the dairy alternative category have grown over the past year, along with an increase in dollar value for products. On the contrary, both dollars and units have declined for the dairy milk category overall.

Advantages of Plant-Based Dairy

Right from addressing challenges of allergies, plant-based products provides diverse benefits.

- Reduced calorie

- Reduced fats and cholesterol

- Increase protein content

- Lower sugar content

- Lower Sodium

- Mineral composition (varies from sources)

Product Launches

Improvements in the plant-dairy formulation, coupled with nutrient enrichment, sensory profile improvements, offer a great deal of opportunity for the industry to convert this niche to a major product category. This is providing capitalizing opportunities for this consumer appetite for plant proteins in a variety of plant-based dairy products.

Notable Products from Startups:

Plant-based products have great acceptance in China, US, and Europe. With the significant activity in innovations and resulted in increased product launches, the following are well established and innovative products in the market.

Oatly, a renowned brand in the plant-based dairy brand is developed by Swedish scientists from Lund University when they discovered digestive fibers from oats can be enzymatically hydrolyzed into the liquid format. The company was founded in the ’90s and since then it has grown significantly. The net revenue sales for 2018 was 1028 million SEK, which is whooping 65% Growth. The five active markets for Oatly are Sweden (39%), the UK (24%), Finland (18%), Netherlands (5%), Germany (5%), and other markets (9%).

Tomm’Pousse, a French startup working on plant-based cheese, using Cashew Nut and Soy as a base, followed by the traditional fermentation process. Today, the Tomm’Pousse range of plant-based alternatives is made up of twelve specialties. The company provides both bulk and retail supply of plant-based cheese.

Ripple Foods manufactures dairy-free milk products with less sugar. The company offers plant-based Greek yogurt and milk. Ingredients used in these products are Ripptein, the company’s proprietary pea protein, sunflower oil, algal oil, organic cane sugar and live active cultures of Bifidobacterium Bifidum, L. Acidophilus, etc.

LiQ produces alcohol-infused ice cream. The products are sweetened with cane sugar and stevia and contain real fruits with milk from free-range cows. The packaging is 100% biodegradable and the product is claimed to be locally produced.

Notable Products from Dairy Leaders

Nestlé has launched an instant coffee drink with an almond drink as a delicious alternative to dairy. This On-the-Go coffee alternative almond latte is made with 100% high-quality Arabica beans and almond. It is claimed to provide delightful froth without the dairy ingredients for the ultimate coffee shop-style experience. The range was initially launched in the United Kingdom and Ireland before and subsequently rolled out in several markets across Asia, Europe, Latin America, and Oceania.

While capitalizing Oat’s popularity in plant-based alternative space, Danone has launched delicious yogurt alternatives combining gluten-free oats with live and active cultures to create creamy yogurt. These plant-based yogurt alternatives do not contain, nuts, or soy. The yogurt range comes in four flavors: Vanilla, Mixed Berry, Strawberry, and Mango.

Though base for Daiya was started 20 years ago, the real success came after perseverance until 2009, when Daiya Cheddar Style and Mozzarella Style Shreds debuted in 2009. Today Daiya has a diversified portfolio containing shreds, blocks, sauce, cream cheese, yogurt, dressings, etc.

Unilever debuted with its ‘first launch in plant-based indulgence through the iconic Magnum brand. The bars have the base made with coconut oil and pea protein and encased in non-dairy Belgian chocolate. The product is available in two decadent flavors, Classic and Almond,

Conclusion

Industry Outlook

Consumers and especially, Millennials and GenZs continue to look for healthier and more environmentally friendly products, keeping the demand for plant-based alternatives to traditional dairy products will only continue to rise. This brings great opportunities to the players interested in the segments. However, the segment also demands innovation for sensory attributes and better consumer experience. Following is the list of opportunities for the players’ active in the domain.

Though there are a variety of alternatives out there, from almond, cashew nuts, and soy, oat is becoming the next big thing in both milk and yogurt category. Oat provides multiple benefits such as when used for yogurt, it contains almost twice as much protein as almond milk and it does not much additives to achieve the proper consistency.

According to the research, companies with diversified portfolios are quite successful. The outperformers have 2X the product differentiation of their peers. The major route for differentiation is through innovations responding to changing consumer dynamics.

Challenges and Opportunities

Sensory Attributes:

In most of the cases, plant-based ingredients lack dairy-based characteristics such as richness, mouthfeel originated from milk fats. This is a major concern.

Even with years of presence in the markets, consumers still look at these products with skepticism and have a major challenge in accepting taste variation between plant-based and their counterparts from the traditional dairy category. Several players are looking at diverse approaches including, the use of enzymes, clean label texture modifiers, flavors, etc. Still, space is ever demanding and would need a great level of detail.

In other aspects, companies can also get the most out of the inherent flavors of the product to give elevated consumer experience.

Functionalization/Enrichment

Plant-based dairy is perceived as a healthy alternative and demands a great deal of expectations from these products. Companies must identify the technologies to stabilize added healthy ingredients along with inherent ingredients. The functionalization of these products also provides a great opportunity for the brands as they can make themselves distinct from the crowd.

Calling Out Sustainability

Sustainability is one of the major driving factors for consumer’s attraction for plant-based products. Thus, calling out the sustainability aspect of one’s product and demonstrating the benefits over traditional dairy counterparts through several benchmarking matrices can give an added advantage to the consumer.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.