In the last decade or so, the global community has realized the need for efforts to mitigate climate change both individually and collaboratively. Businesses have increasingly understood the magnitude of climate risks to their businesses and the need for urgent climate action. The Voluntary Carbon Market is emerging as another major path to Net Zero, complementing direct technology interventions to reduce carbon emissions.

The carbon market concept was first formally introduced in 1997 under the United Nations Framework Convention on Climate Change (UNFCCC)’s Kyoto Protocol on climate change which had more than 150 nations signatories. The Kyoto Protocol laid down the foundation of Market Based Instruments (MBIs) for emission reduction, one of which was the Clean Development Mechanism (CDM) which allowed a country with an emission reduction or limitation commitment to implement or fund a project that can earn certified emission reduction (CER) credits to meet Kyoto targets. A carbon market mechanism allows investors and corporations to trade both carbon credits and carbon offsets simultaneously which mitigates environmental crisis, while also creating new market opportunities.

There are primarily two types of carbon markets – the compliance market and the voluntary market. The compliance carbon markets are deployed as part of the country’s national strategy through an obligation to reduce their emission within the limit agreed upon under global accords like Kyoto Protocol or Paris climate change accord. Some examples of compliance carbon market are European Union Emission Trading System (EU ETS), Western Climate Initiative (WCI), and Regional Greenhouse Gas Initiative (RGGI).

However, voluntary carbon markets (VCM) work differently, in voluntary markets businesses and companies participate in the mechanism to lower their carbon footprint as part of their initiatives such as Roadmap for Net Carbon Zero. It functions outside of compliance markets and enables companies and individuals to purchase carbon offsets voluntarily with no intended use for compliance purposes.

It not only helps them to offset their hard-to-abate emissions but also channelizes the investment to the developers/entities where they can invest in carbon offset projects such as tropical forests. VCM also enables the participants to experiment with new technologies, allows project developers to develop and implement projects that might be too small or not viable for the compliance markets, volunteer easily and gain experience with carbon inventories, avoidance, reductions, storage, and carbon markets. This encourages participation, learning, and innovation through research and development. Overall, VCM presents an opportunity to protect and expand carbon sinks, incentivize negative carbon production, and increase the flow of carbon from the atmosphere in a short-term period.

How VCM works?

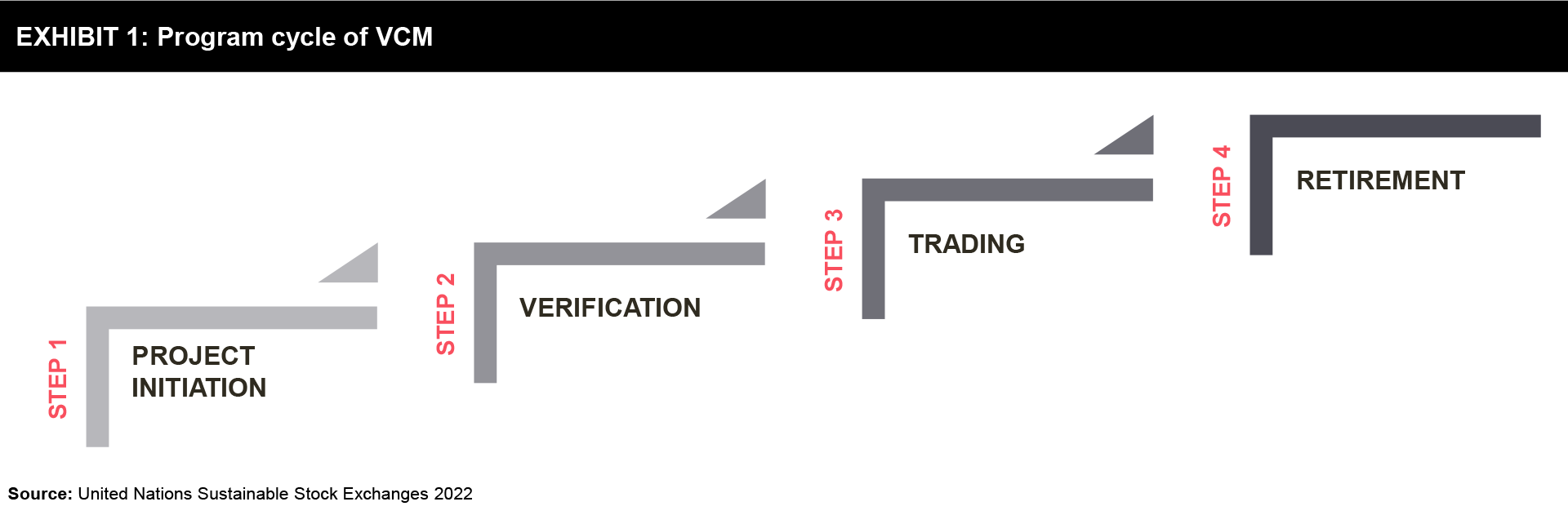

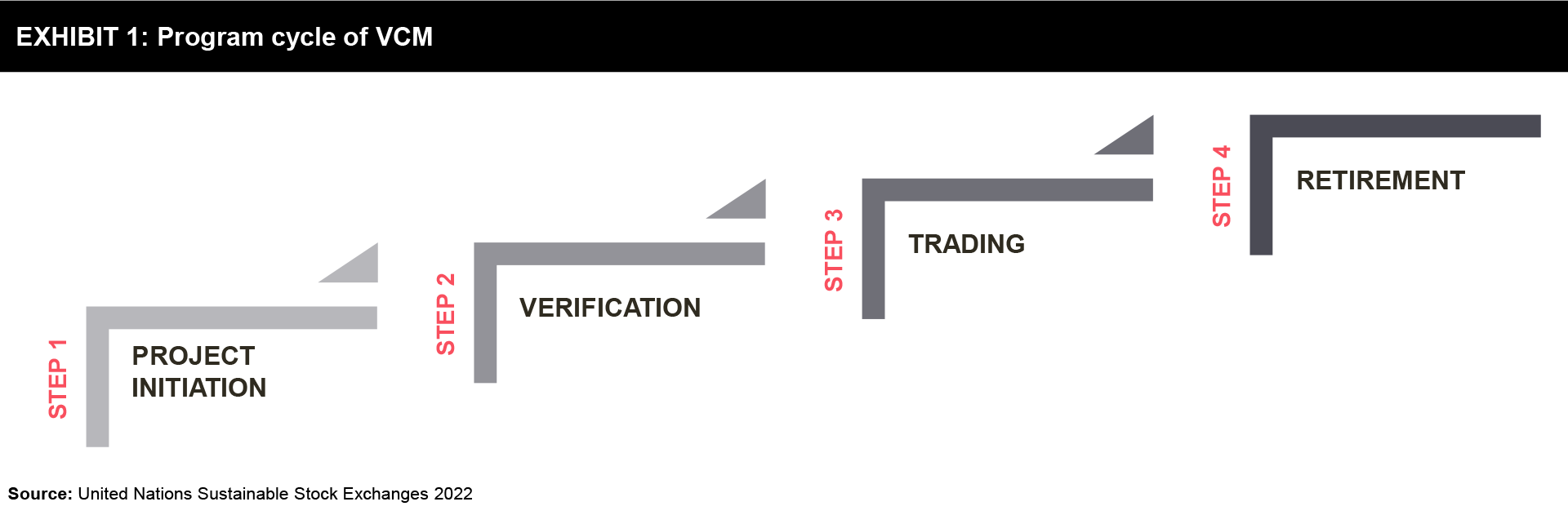

The project or program cycle includes the whole process through which VCM projects or programs are designed, carbon credits are issued and traded, and the steps involved are as shown below:

1. Project initiation:

Credits are generated from projects, a bundle of projects, programs, or public policies that aim to achieve environmental benefits. Each credit developed represents one ton of carbon dioxide equivalent (CO2e) that is sequestered or has not been emitted and the project developed mainly falls under the two broad groups:

- GHG avoidance/reduction from existing sources.

Funding the implementation of lower-carbon technologies such as renewable energy or avoiding practices that cause emissions such as reducing deforestation.

- GHG removal/sequestration.

Which involves taking CO2 out of the atmosphere and using or storing it.

The stakeholders involved in the project cycle choose the VCM standard (explained below) and an approved methodology under which the project is developed. The prepared project documentation is verified by an independent third-party auditor (Validation/Verification Body, VVB), and upon proper validation, the project is registered. Projects can begin implementation after the completion of their registration.

2. Verification:

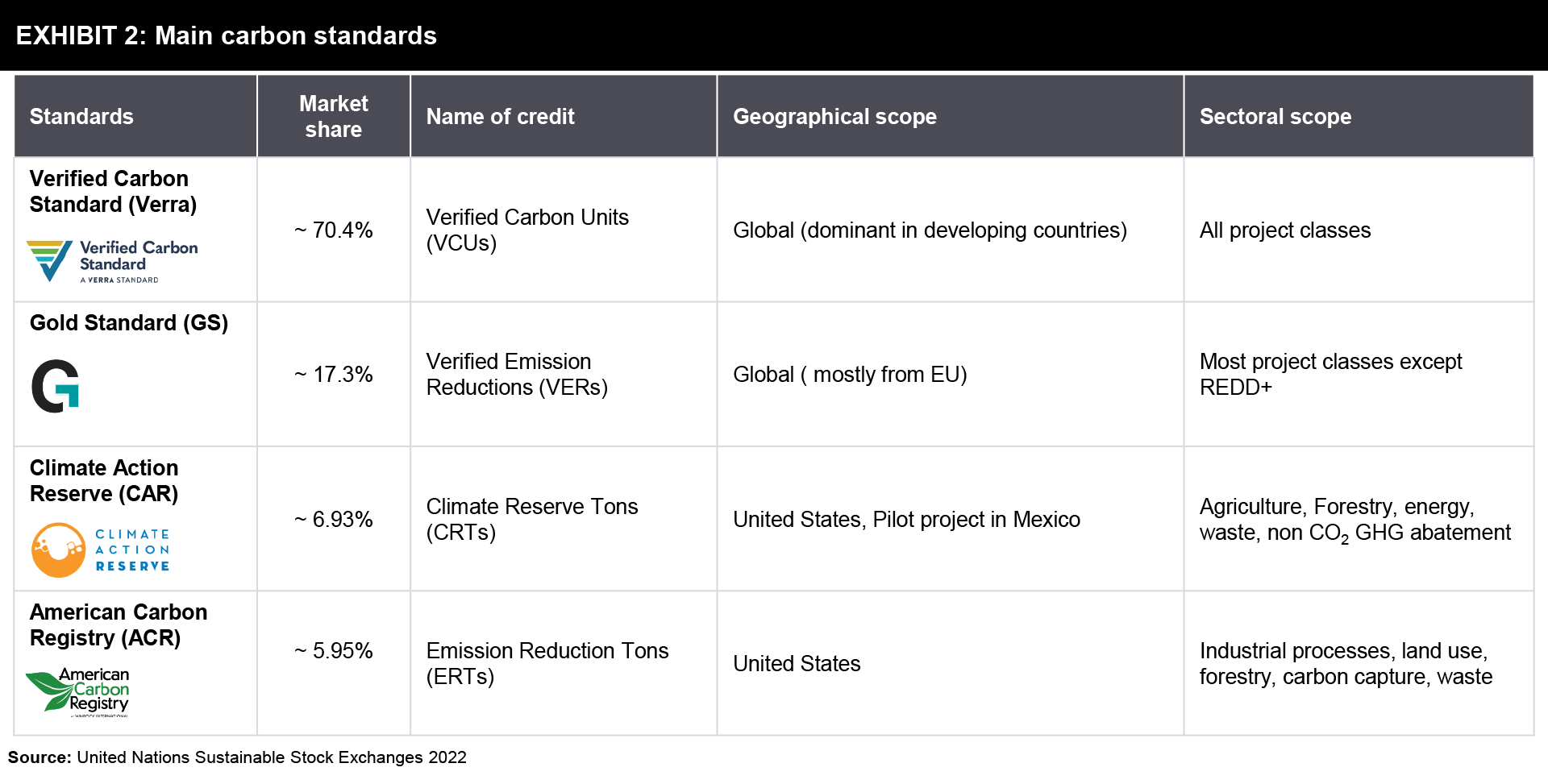

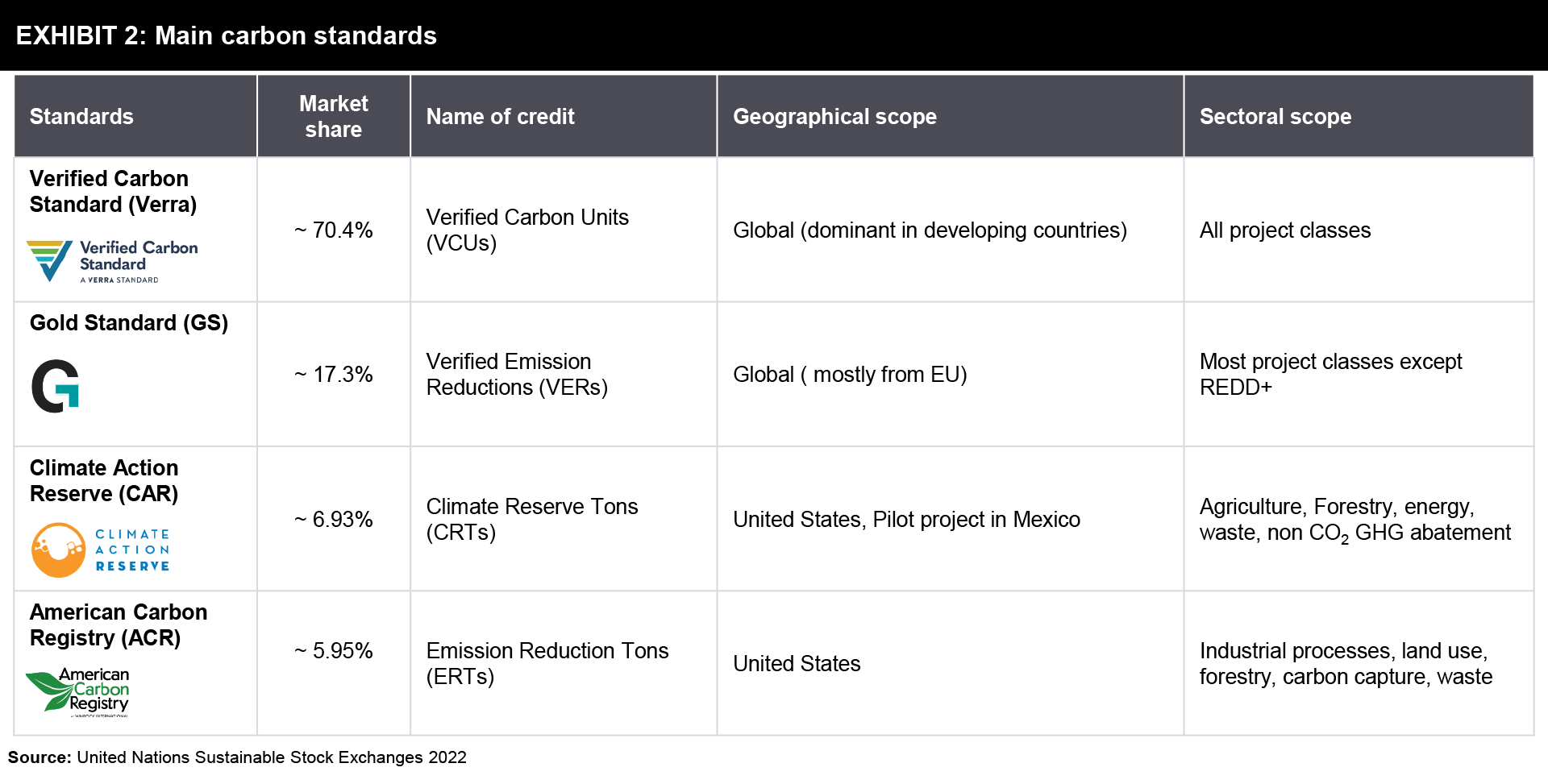

A carbon standard is applied to certify the emission reductions based on evidence of compliance being reviewed by an independent third party. When verified, credits are issued and made available for trade. Further, a registry agency maintains the record and labels the credit, tracks the owners, and makes information publicly available. Currently, there are four dominant carbon standard-setting bodies and these standards vary in their approaches, methodologies, and requirements. Apart from the four dominant setting bodies (Exhibit 2), there are also some smaller standards such as Plan Vivo, ART/TREES (Architecture for REDD+ Transactions, the REDD+ Environmental Excellence Standard), Carbon Fix and Climate, Community and Biodiversity Standard, Global Carbon Council (GCC), Climate Forward.

3. Trading:

Carbon credits can be sold, traded, and retired after the regulatory body of the carbon standard approves credit issuances. The registry of carbon standards transfers carbon credits to the generator account and enables the transfer of credit between accounts after its sale. Emission Reductions Purchase Agreement (ERPA) holds the terms and conditions of the sale. According to Sustainable Stock Exchanges, the credits can be traded on a physical or spot market (where funds and credits are exchanged immediately) or be applied as the underlying asset to carbon derivatives contracts for physical delivery. It is also common for projects to be pooled based on a suite of project-specific risk factors or specified characteristics. Such pools can be traded as tokens on a digital exchange (blockchain) in a similar way to how they can be traded on traditional trading platforms.

4. Retirement:

After the purchase of carbon credits, they are retired to enable the buyer to serve its main purpose- emission offset. Upon completing the entire transaction, the registry retires the relevant carbon credit to disable the use of the same carbon credit in the future.

Present status of global VCM

As per Sustainable Stock Exchanges, the global VCM environment grew to nearly $2 billion in value in 2021. The growth is being attributed to an acceleration of trading volume in nature-based solutions and global prices trending upwards. The report further shows that about 500 million carbon credits were traded in the same year, surpassing the previous year’s data by 66%. As a result, approximately 23% of global emissions are now covered by some form of carbon pricing (either VCMs or compliance markets).

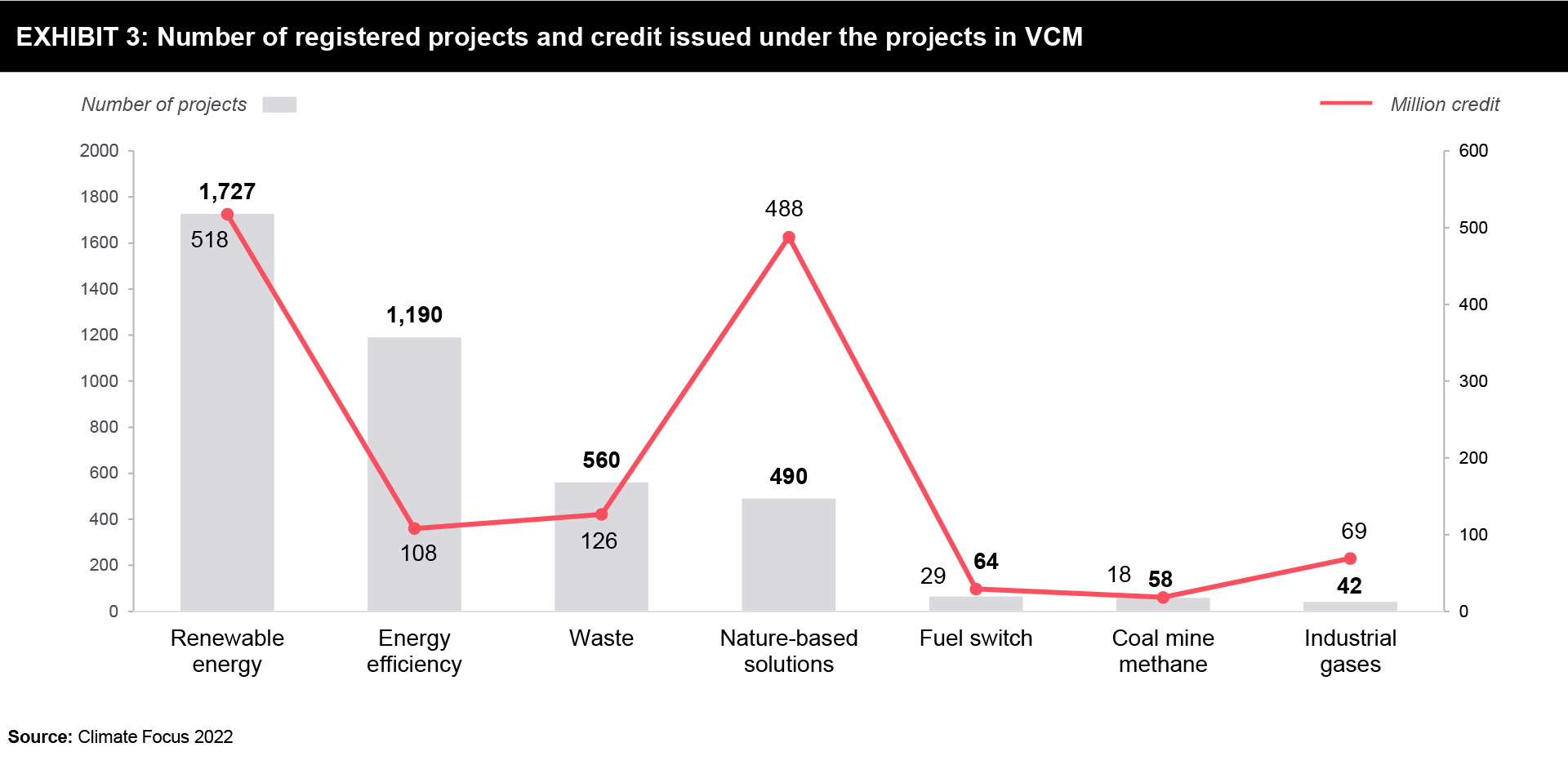

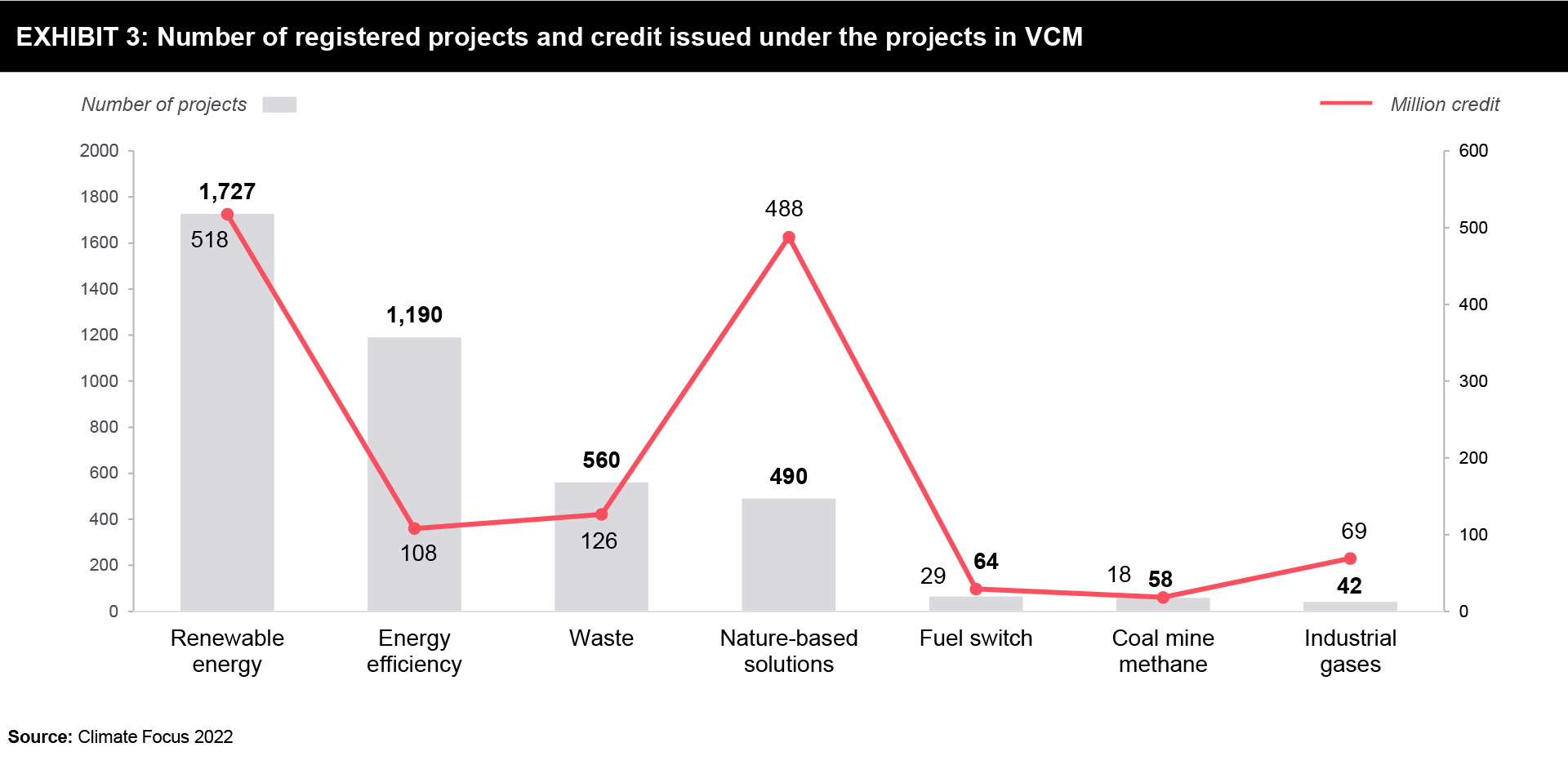

According to Climate Focus, currently, there are about 4131 projects under various sectors and about 1356 million credits already issued from those projects (Exhibit 3). Further, India has the highest volume of non-retired credits at about 123 million followed by China at 90 million and the USA at 88 million.

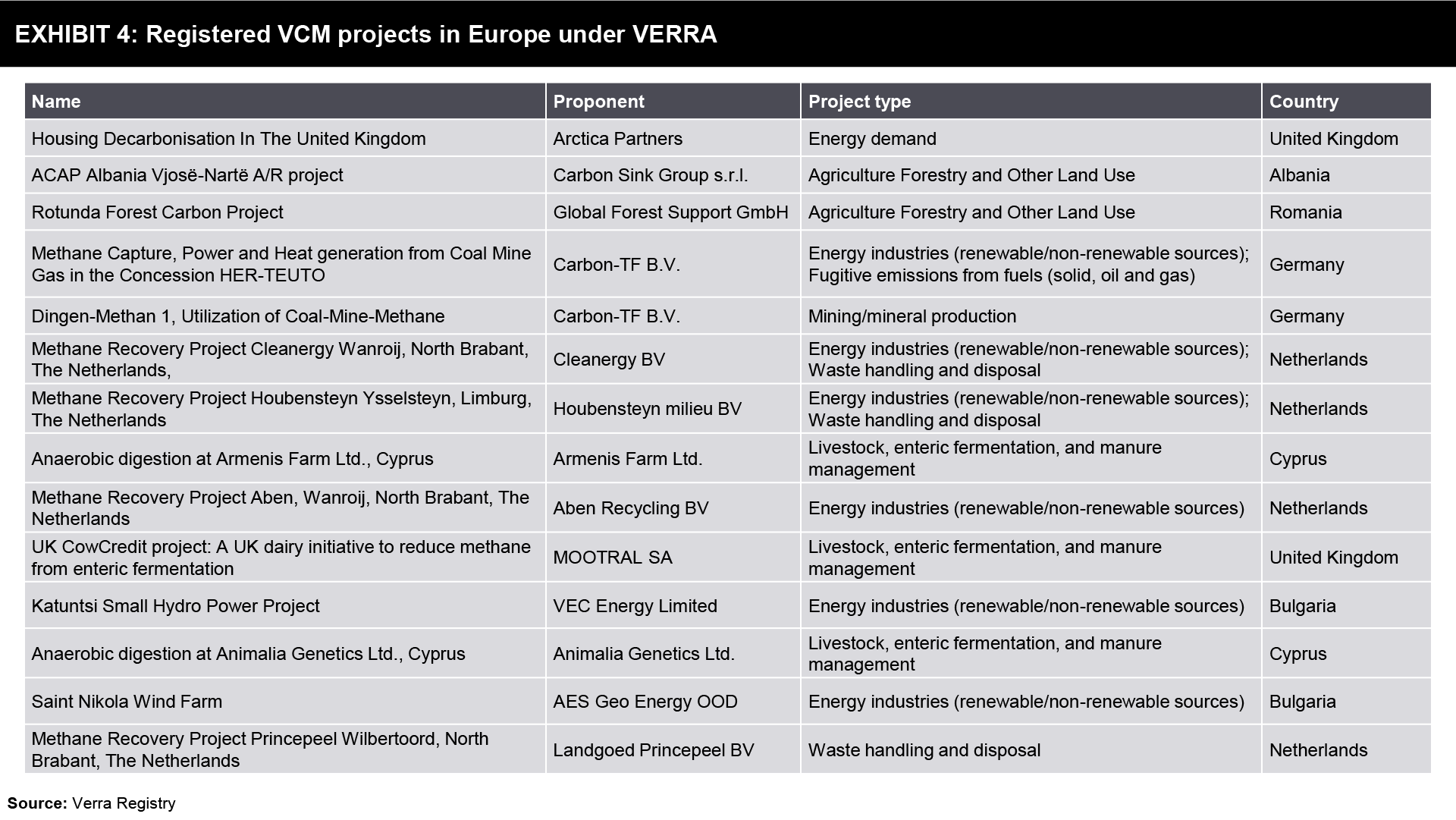

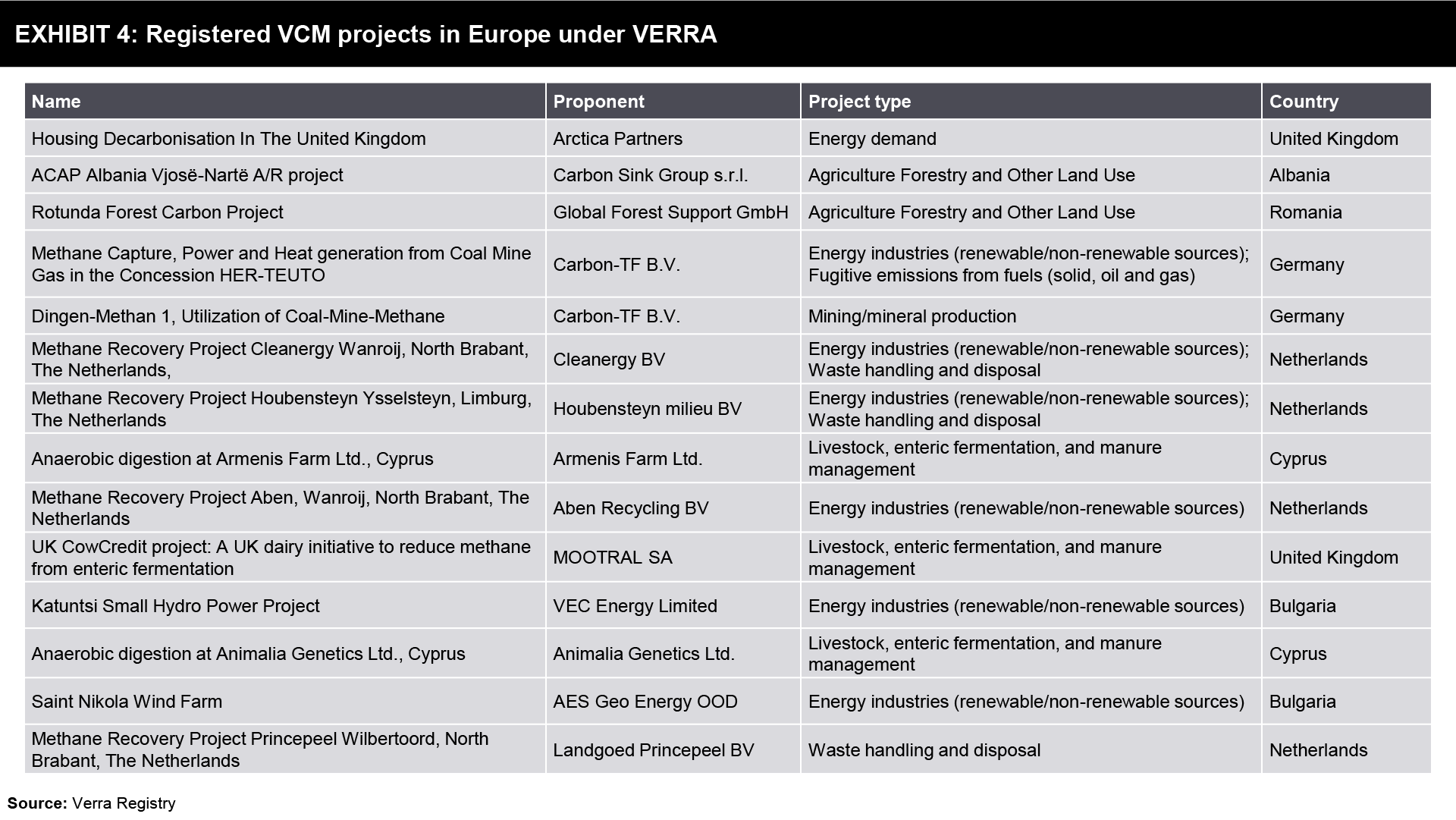

As per the report by Abatable, the largest carbon developer ecosystems were in Asia, The Americas, Africa, Europe, and then Oceania in 2022. Europe currently is lagging but to support the European Green Deal which aims to make Europe the world’s first climate-neutral continent by 2050, the region must scale up the removal of carbon from the atmosphere to balance out its emissions through compliance and voluntary markets. In the year 2022, the European Commission adopted a proposal for the first EU-wide voluntary framework to reliably certify high-quality carbon removals. The proposal would improve the EU’s capacity to quantify, monitor and verify carbon removals and ensure higher transparency. All these actions taken by the region will henceforth ensure that the voluntary carbon market grows fairly and rapidly in the region and helps to achieve the EU’s long-term climate objectives and make a green deal a reality.

Types of Carbon offsets under VCM

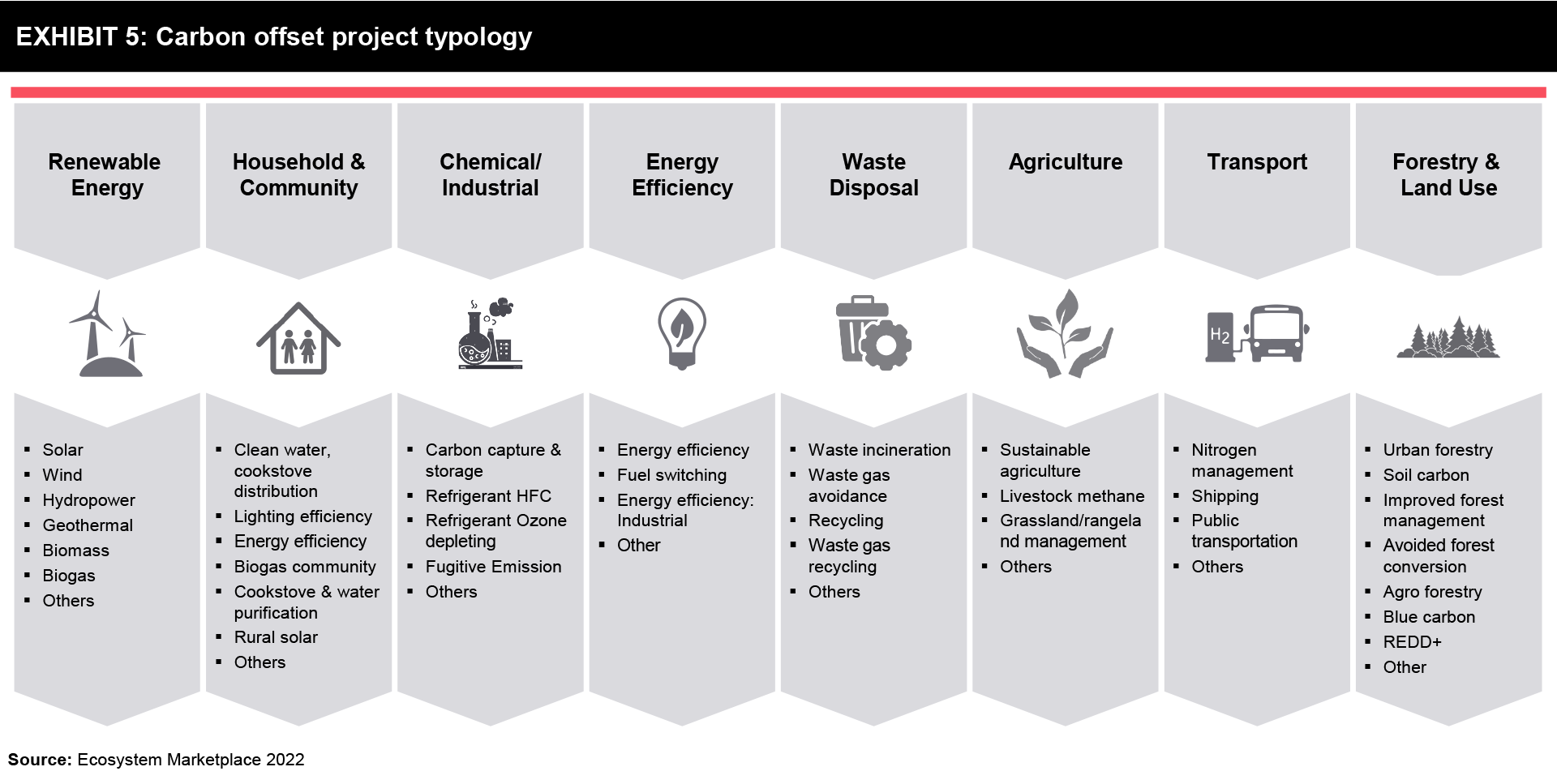

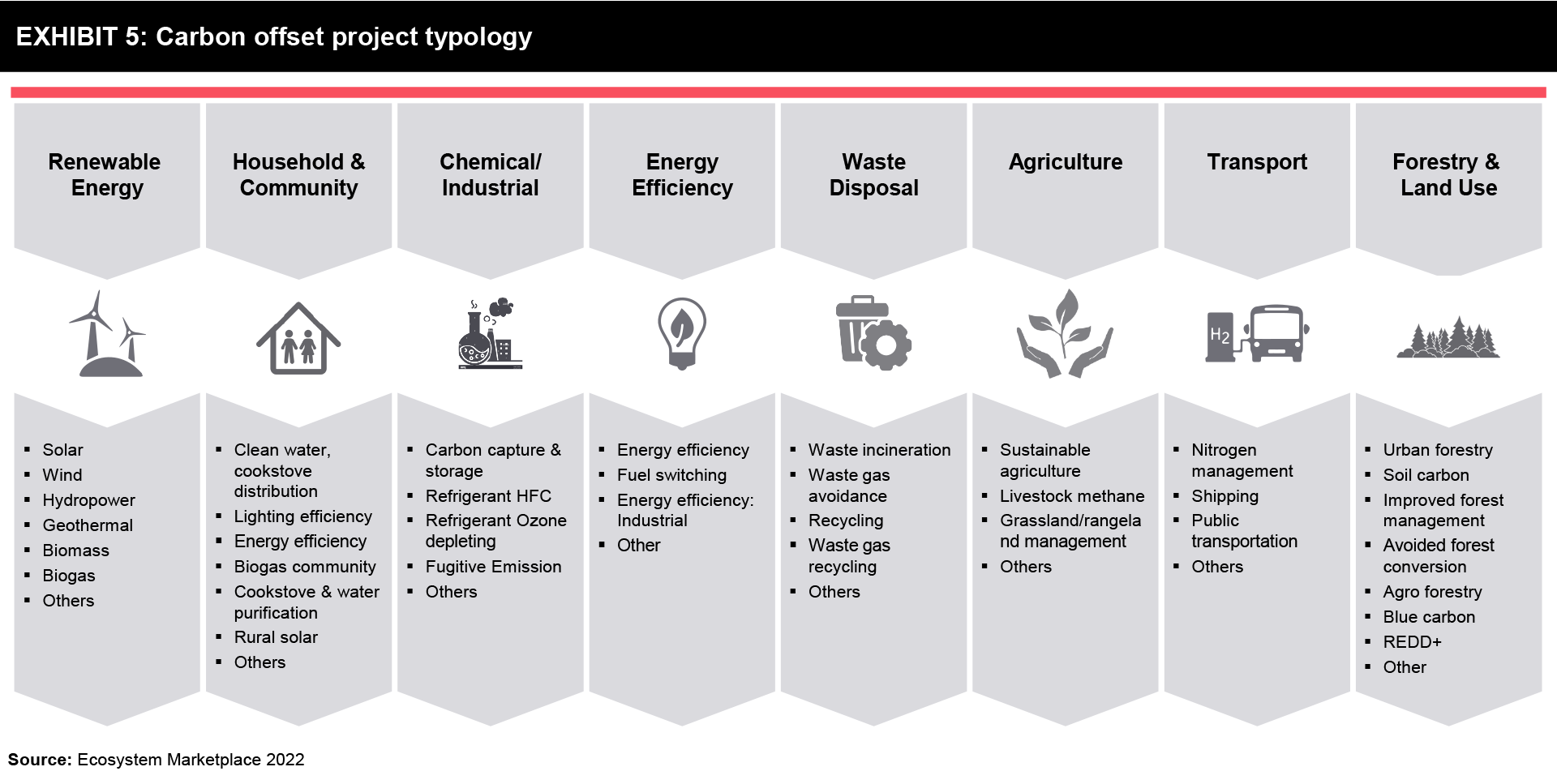

A carbon credit is a tradable unit that is generated by the activities of projects and programs that are certified by carbon standards. Exhibit 5 shows the different broad categories of projects that will result in carbon credits for VCM.

VCM functions as a regular market driven by demand and supply. The sellers of carbon credits provide incentives to their buyers to directly offset their greenhouse gas emissions. To mobilize the VCM value chain, developers design a project/program consulting with local government entities, and which complies with all the carbon standard requirements to receive certifications and thereby sell credits to buyers or to intermediaries (operating on both demand supply sides by investing in projects and purchasing carbon credits). The final user of the VCM market chain is mostly private companies that voluntarily engage in climate mitigation activities and governments, NGOs, universities, and even individual investors. If an individual has taken a long flight and wants to buy carbon credits to offset emissions resulting from their activities, they can participate in VCM as many airlines are listing the amount of CO2 emitted by the flight and allowing the customers to fly net zero for a price. Thus, VCM is open to anyone who wants to participate.

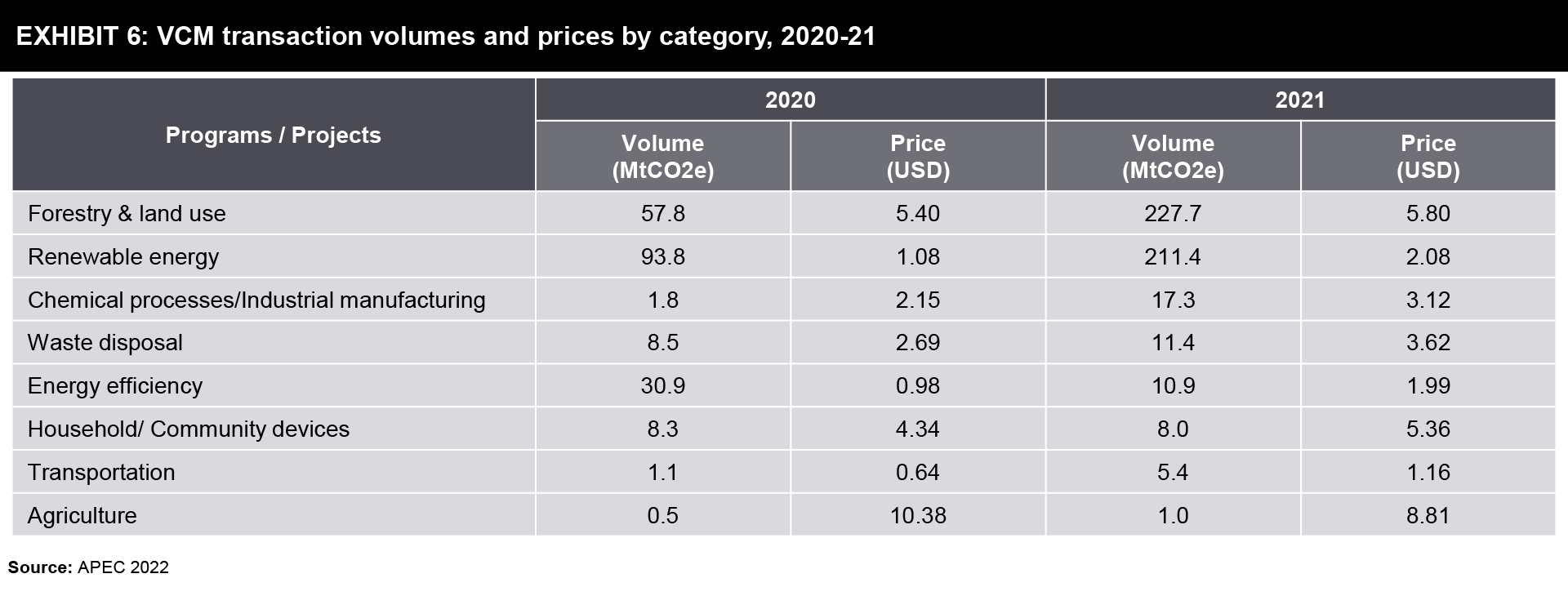

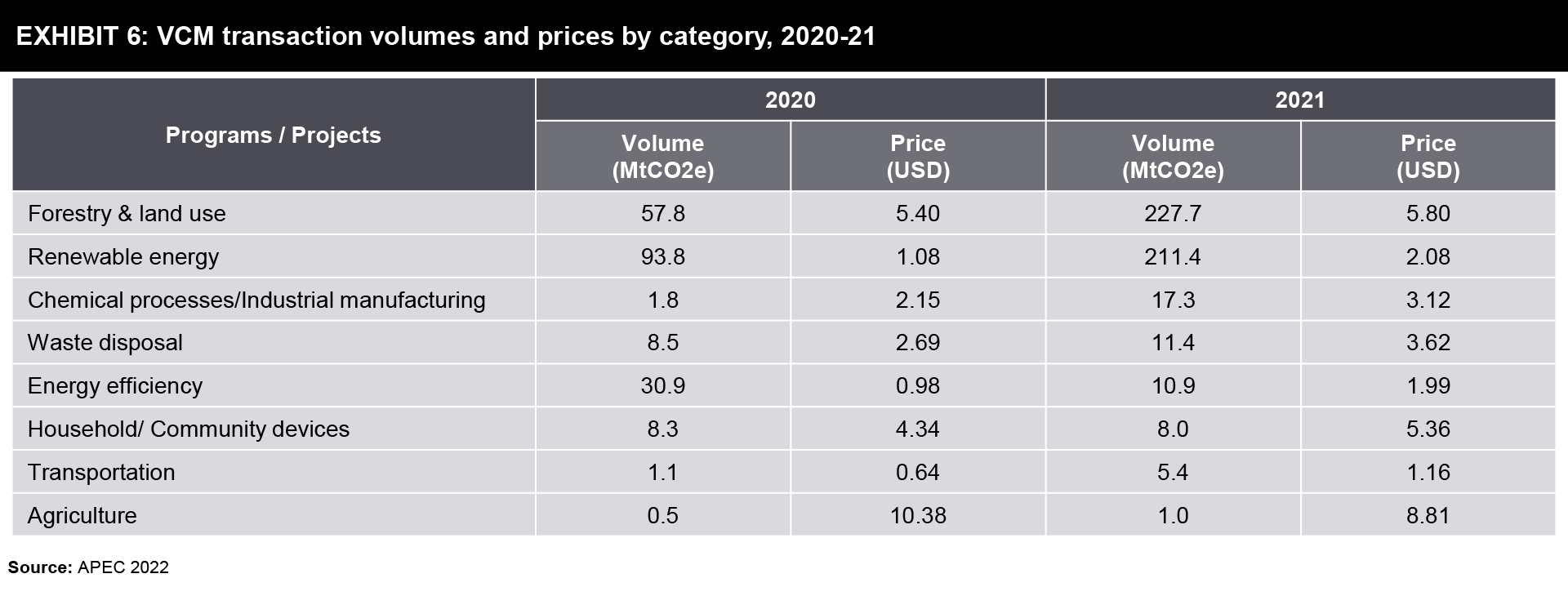

As in a regular trade flow, the price for carbon credits is essential for both sides. On the demand side, it gives a clear picture of the costs of meeting corporate climate targets and on the supply side, it brings light on whether it is worth developing VCM projects or not. As per S&P Global, currently, the mechanism to set prices is not transparent and as of November 2021, the price per carbon credit may vary from a few cents per MtCO2e to (15-20) USD/MtCO2e for afforestation or reforestation projects and (100-300) USD/ MtCO2e for tech-based projects like carbon capture and storage. As can be seen in Exhibit 5, the price of carbon credits differs greatly based on the project type and other factors as well which are explained below:

Project type: As already discussed, the type of project greatly determines the price of carbon credits. For instance, a project developer for solar PV installation will surely charge a different price for carbon credit than someone engaged in forestry activities like planting trees. As mentioned earlier, the two main project types of VCM are avoidance and removal. The projects under removal are currently in a higher credit position than the avoidance type because of higher investments and are also believed to be a better tool to fight climate change.

Time log of credit: The year in which carbon credit is issued is called its vintage. Carbon credits with newer vintages are commonly valued higher in the market because they are issued according to the more recently updated methodologies and standard requirements.

Geographical spread and reputation: Carbon credits from a project developed by a reputed/ branded developer in a developed economy are priced higher than projects developed elsewhere.

Additional certifications: Projects which have additional social and environmental certifications bring in extra premium as they certify not solely environmental but also social impacts.

Challenges in VCM

The biggest challenge of the Voluntary Carbon market is the lack of integrity and transparency. The market lacks robust quality controls, oversight, or transparency. One carbon credit is meant to represent a tonne of CO2 emissions but the calculations and assumptions which go behind estimating the CO2 emissions are not standardized and acceptable to all the stakeholders. Once sold, a consolidated view of the public record of credits remains a challenge. There is no information on who owns hundreds of active credits on the market. Registries are used to record credits that have been used as offsets (‘retired’), but frequently do not contain sufficient information on the owner or beneficiary, nor the details of the specific projects, making quality assessment challenging. We envisage that blockchain technology can specifically address this challenge.

Greenwashing is another major issue where in many investigations, it was found that companies were overstating their CO2 emissions avoided or reduced. VCM is commonly criticized for enabling greenwashing in climate action as corporates seek to create an overly positive image. These misleading commitments have been mirrored as corporates have failed to establish credible emission reduction programs despite claiming carbon neutrality through questionable investments in carbon projects with overestimated amounts of carbon credits.

The lack of a universal standard, one centralized regulatory entity, and lack of transferability of carbon credits between registries cause market fragmentation and in turn, pose a big challenge to the growth of VCM.

What is in it for Companies?

Businesses and companies need to be able to tell their stakeholders that they are now positively contributing to the global pathway of Net Carbon Zero while doing their business. VCM offers a wide variety of environmental projects to interested investors and the projects may range from small community-based activities such as clean cookstoves to the large industrial type of projects. Through community-based projects generate small volumes of carbon credits still they generate more socio-economic and environmental co-benefits. Recent growth in the VCM market indicates that they are more amenable to a market-based approach such as VCM. In today’s world where extreme climate events have become a norm, investors including hedge and VC funds have a deliberate interest in the goal since if not committed their portfolios will be exposed to increasing levels of climate risk. Investors can promote global decarbonization efforts by investing in the reduction or removal of carbon credits, either directly or through third-party funds. To prioritize decarbonization and share best practices, they can also exert a significant influence on their portfolio companies.

We believe that despite being a very nascent market with all the challenges of a new emerging market, companies should view the Voluntary Carbon Market as a potential game-changer and should look at it as one more lever on their quest to become Net Carbon Zero. Manufacturing companies can think of offering green products (bundling their product line with carbon credits) as well as monetizing opportunities for captured CO2 in their plants. At the same time, project companies can look at a new pipeline of projects which are focused on carbon offsetting as private investment may grow with leaps and bounds on that. We at FutureBridge are already seeing a lot of traction among our clients on this.

Would you like to discuss your VCM need with our experts today? Click here to connect with us.

References

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.