The mining industry, which was long perceived as a low-tech and heavily polluting industry causing problems in environmental sustainability, is now seen as a critical part of the solution toward achieving Net Zero. Investors and consumers are beginning to recognize the industry as a necessary provider of critical raw materials needed for the global energy transition and thereby gradually moving over the perception as the first source of emissions in the value chain. In line with the ambitions of the Paris Agreement, the International Council on Mining and Metals (ICMM), which represents 28 mining companies and 35 commodities associations worldwide, recently committed to a goal of net-zero scope 1 and 2 greenhouse gas emissions by 2050 or sooner. Miners are under increasing pressure from various stakeholders to reduce emissions and address climate risk, which can have a negative financial impact on the company. Given the rapidly rising demand for metals such as copper, cobalt, aluminium, and nickel to help power the low-carbon future, this article discusses the opportunities for miners to transition to a low-carbon future thereby trying to throw some light on future mining and mineral industry’s role in the sustainable low to zero carbon transition.

Need for Emission Reduction in the Mining Industry

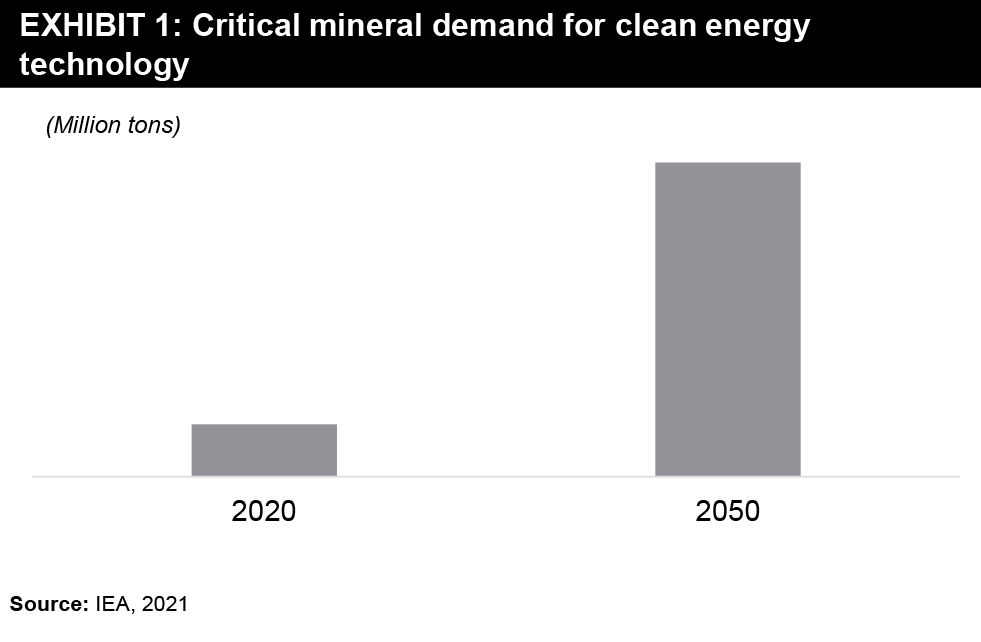

Since the mining industry is the first link in the value chain, it is probably more crucial than most hard-to-abate industries. The supply of raw materials is at the centre of the global decarbonization and electrification efforts of most other industries. Another issue for mining companies is the shifting demand for minerals. Significant growth of low-carbon technologies, such as wind turbines, solar photovoltaics, and electric vehicles, has heightened the demand for the raw materials needed for these technologies. Until the mid-2010s, the energy sector represented a small part of the total demand for most minerals, but the rapid deployment of clean energy technologies requires substantial quantities of minerals, and the total mineral demand like copper, cobalt, manganese, and various rare earth metals will grow manifold in NZE scenario by 2050 as shown in Exhibit 1. As per IGF, the global production of critical minerals used in low-carbon technologies is projected to rise by 965% for lithium, 585% for cobalt, 383% for graphite, 241% for indium, and 173% for vanadium by 2050.

Since the mining industry is the first link in the value chain, it is probably more crucial than most hard-to-abate industries. The supply of raw materials is at the centre of the global decarbonization and electrification efforts of most other industries. Another issue for mining companies is the shifting demand for minerals. Significant growth of low-carbon technologies, such as wind turbines, solar photovoltaics, and electric vehicles, has heightened the demand for the raw materials needed for these technologies. Until the mid-2010s, the energy sector represented a small part of the total demand for most minerals, but the rapid deployment of clean energy technologies requires substantial quantities of minerals, and the total mineral demand like copper, cobalt, manganese, and various rare earth metals will grow manifold in NZE scenario by 2050 as shown in Exhibit 1. As per IGF, the global production of critical minerals used in low-carbon technologies is projected to rise by 965% for lithium, 585% for cobalt, 383% for graphite, 241% for indium, and 173% for vanadium by 2050.

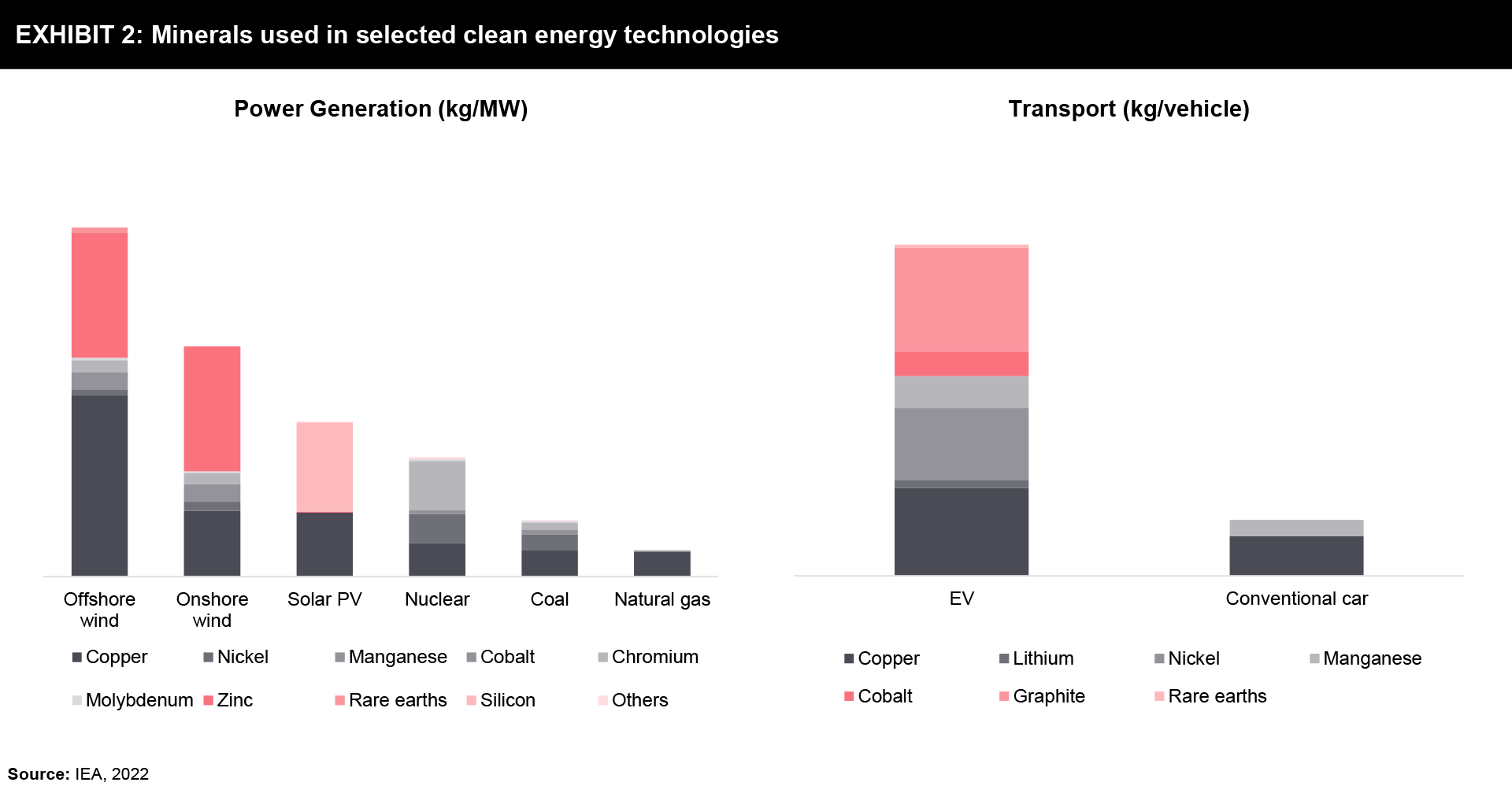

Copper, nickel, steel, and lithium are core components of electricity transmission and storage, electric vehicles, and renewable energy infrastructure. The move to a decarbonized economy will result in increased primary consumption of these mined commodities, even after factoring in recycling, so it is important that mining itself becomes more sustainable. According to IEA and as depicted in Exhibit 2, a typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired power plant. For the last decade, the rising share of renewables has been associated with a 50% increase in the average amount of minerals needed for a new unit of power generation.  Coal, the biggest source of CO2 emission from energy, is one of the most mined minerals in the world (around 50% of the global mining market). IEA predicts a decline in coal usage by 55% in the net zero emission (NZE) scenario by 2030. In pledges made at the COP 26 climate summit, more than 40 countries including Poland, Vietnam, and Chile have committed to shifting away from coal. Concerted efforts need to go towards decarbonizing the mining industry across the value chain in terms of technology shift, raising awareness amongst stakeholders, incorporating carbon accounting mechanisms, implementing energy efficient measures, extending financial support, etc.

Coal, the biggest source of CO2 emission from energy, is one of the most mined minerals in the world (around 50% of the global mining market). IEA predicts a decline in coal usage by 55% in the net zero emission (NZE) scenario by 2030. In pledges made at the COP 26 climate summit, more than 40 countries including Poland, Vietnam, and Chile have committed to shifting away from coal. Concerted efforts need to go towards decarbonizing the mining industry across the value chain in terms of technology shift, raising awareness amongst stakeholders, incorporating carbon accounting mechanisms, implementing energy efficient measures, extending financial support, etc.

Which Emissions are in a Mining Company’s Control?

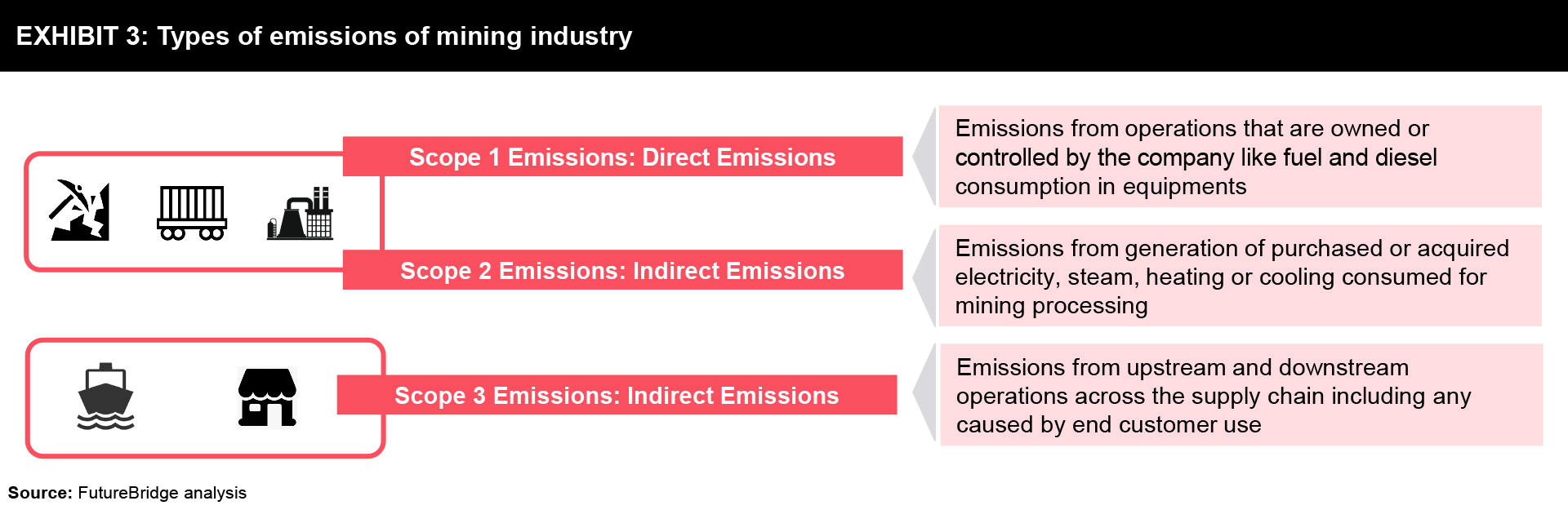

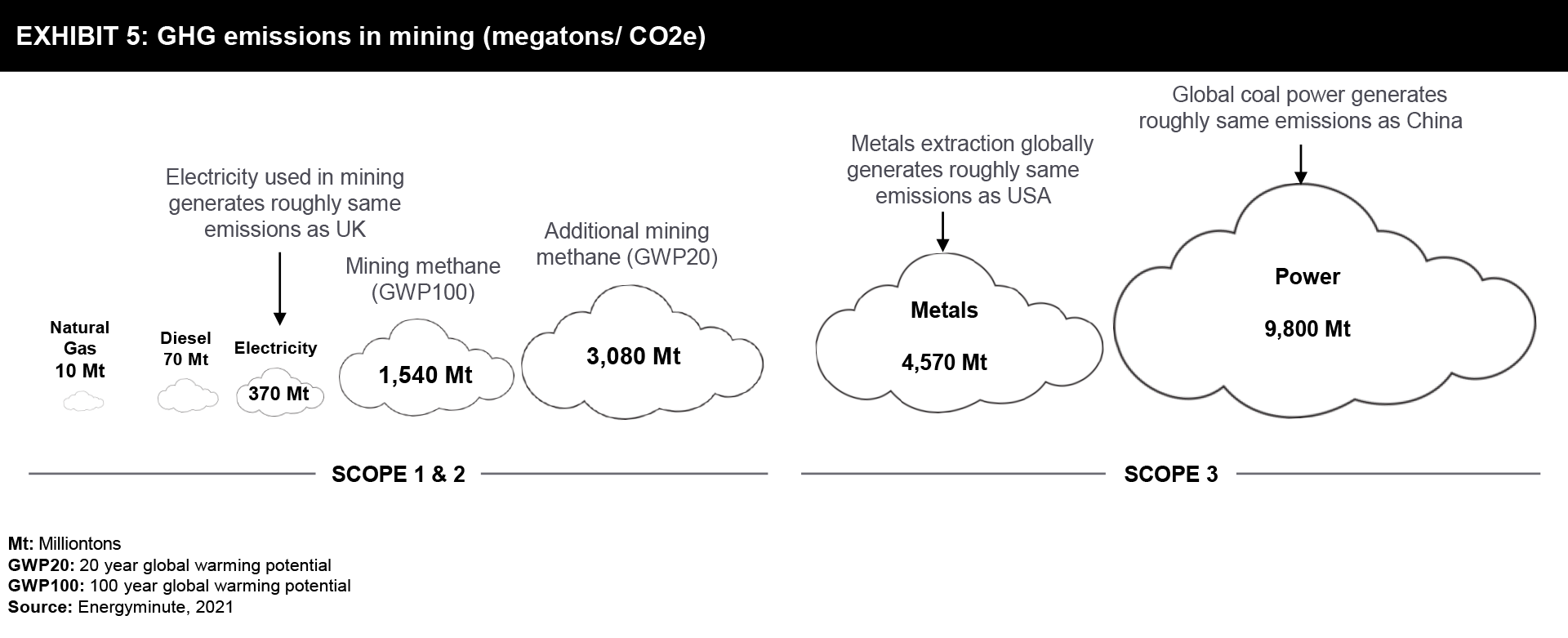

The mining sector is one of the largest industrial contributors to global greenhouse gas emissions — directly accounting for 4% to 7% of scope 1 and scope 2 emissions globally. According to one of the findings scope 3 emission holds the lion’s share of 28% of emissions including the combustion of coal. Operational emissions (i.e., Scope 1 and 2) are largely within a mining company’s control but the value chain emissions (i.e., Scope 3) are where it gets tricky.  This includes upstream suppliers, which provide copper, steel, and vast amounts of concrete to construct the mine site as well as downstream customers who use base materials and metals to construct virtually every heavy-duty product in modern society, ranging from ships to bridges, cars to buildings, and much in between. In mining, value chain emissions can be several times greater than operational emissions. The challenge for miners is that they have far less control over emissions from downstream producers and hence scope 3 emissions are the biggest decarbonization challenge for the mining industry. A more complex solution may be necessary to manage Scope 3 emissions in mining and beyond; principally the creation of a circular economy, whereby carbon-neutral ore is used to make carbon-neutral materials.

This includes upstream suppliers, which provide copper, steel, and vast amounts of concrete to construct the mine site as well as downstream customers who use base materials and metals to construct virtually every heavy-duty product in modern society, ranging from ships to bridges, cars to buildings, and much in between. In mining, value chain emissions can be several times greater than operational emissions. The challenge for miners is that they have far less control over emissions from downstream producers and hence scope 3 emissions are the biggest decarbonization challenge for the mining industry. A more complex solution may be necessary to manage Scope 3 emissions in mining and beyond; principally the creation of a circular economy, whereby carbon-neutral ore is used to make carbon-neutral materials.

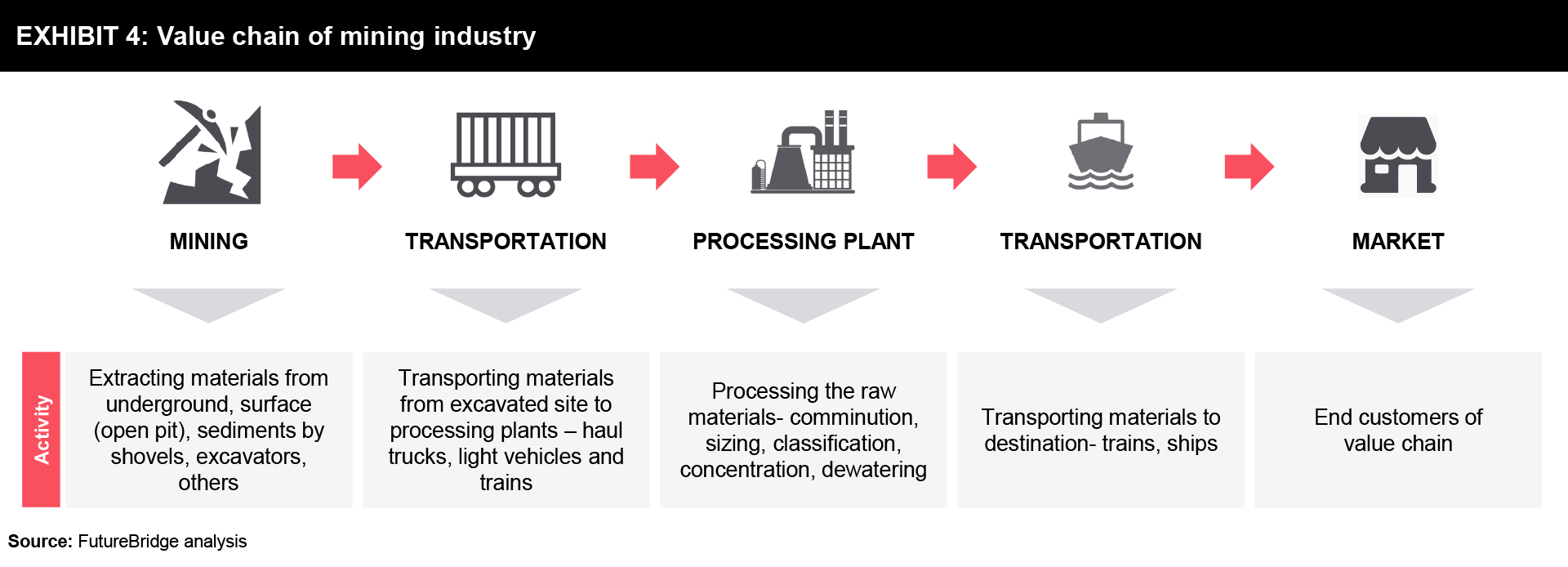

The mining value chain as depicted in Exhibit 4 includes extracting raw material (drilling and blasting), loading, transportation, processing, and delivering products to end consumers. All these operations make the mining industry one of the most energy-intensive sectors, generating between 1.9 and 5.1 gigatons of CO2e of GHG emissions annually and the emissions from global mining and resource extraction cause up to USD 3 trillion in environmental damages each year.

A study by Energyminute infers that if the mining industry were a country, its emissions would be equivalent to the combined emissions of the top 4 emitting countries (China, USA, India, and Russia). Operational emissions (Scope 1 & 2) can be generally easily mitigated except for fugitive emissions from coal mining (estimated to be ~ 3 to 6 %) because there are still not widely available economically viable solutions for controlling the leakage of methane.

Ways to Reduce Emissions in the Mining Industry

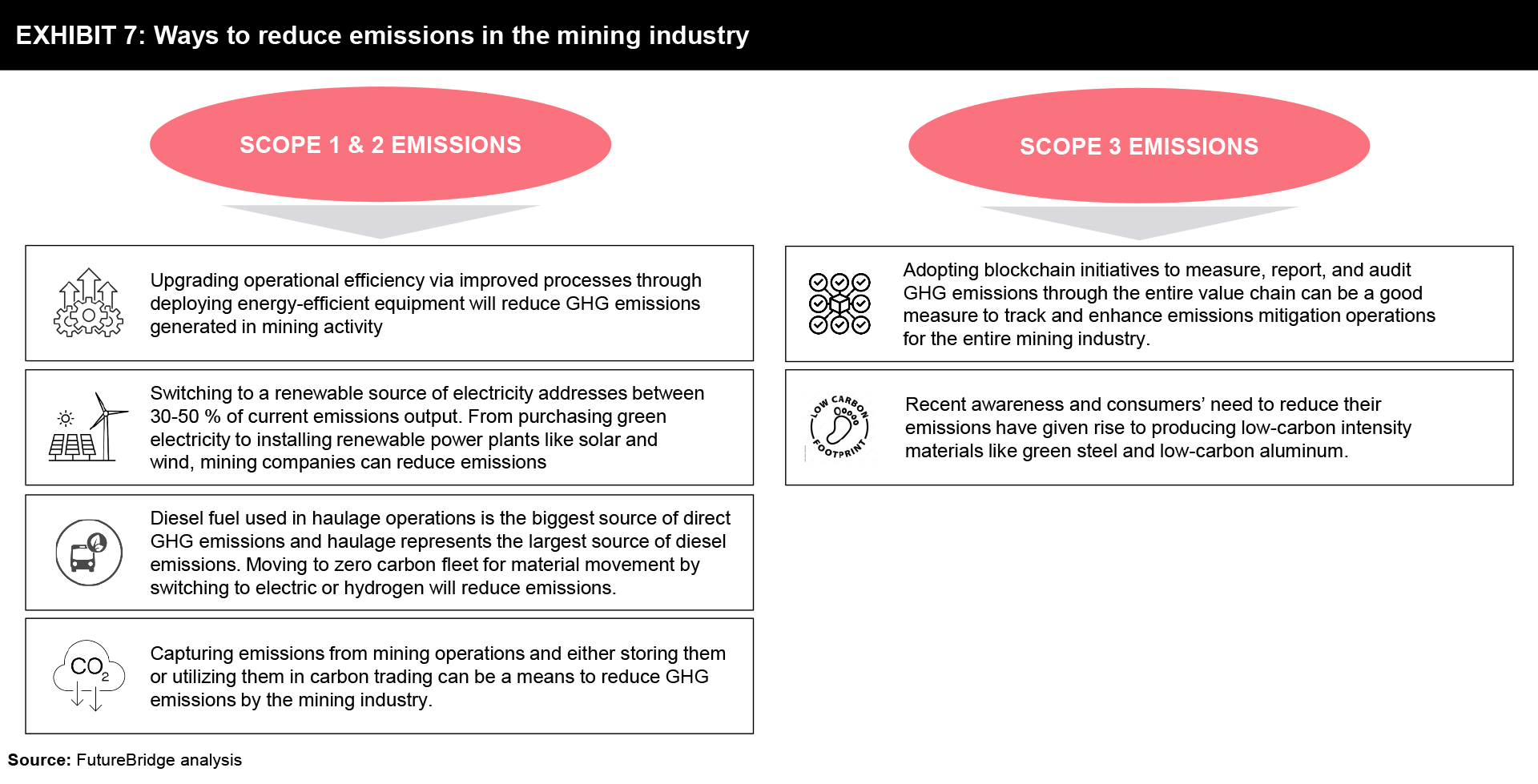

Depending on the mine, Scope 3 emissions can account for up to 95% of a company’s total emissions. This means that any mining products being processed by another industry, such as steel production and automobile manufacturing, are part of the mine’s Scope 3 emissions and account for the lion’s share. Thus, the mining industry does not have direct control over a significant portion of its Scope 3 emissions and must be innovative to address this challenge. To target Scope 3 emissions, mining companies must engage with suppliers and customers by setting supplier engagement targets, monitoring progress regularly, and creating incentives for action. Mines can invest in low-carbon technologies and collaborate with customers to reduce the carbon intensity of downstream production, such as with steelmaking. This would also facilitate the development of greener products to reduce lifecycle emissions. Focusing on less carbon intensive and more fuel-efficient methods during shipping and transportation of raw materials can also contribute to meeting Scope 3 targets.

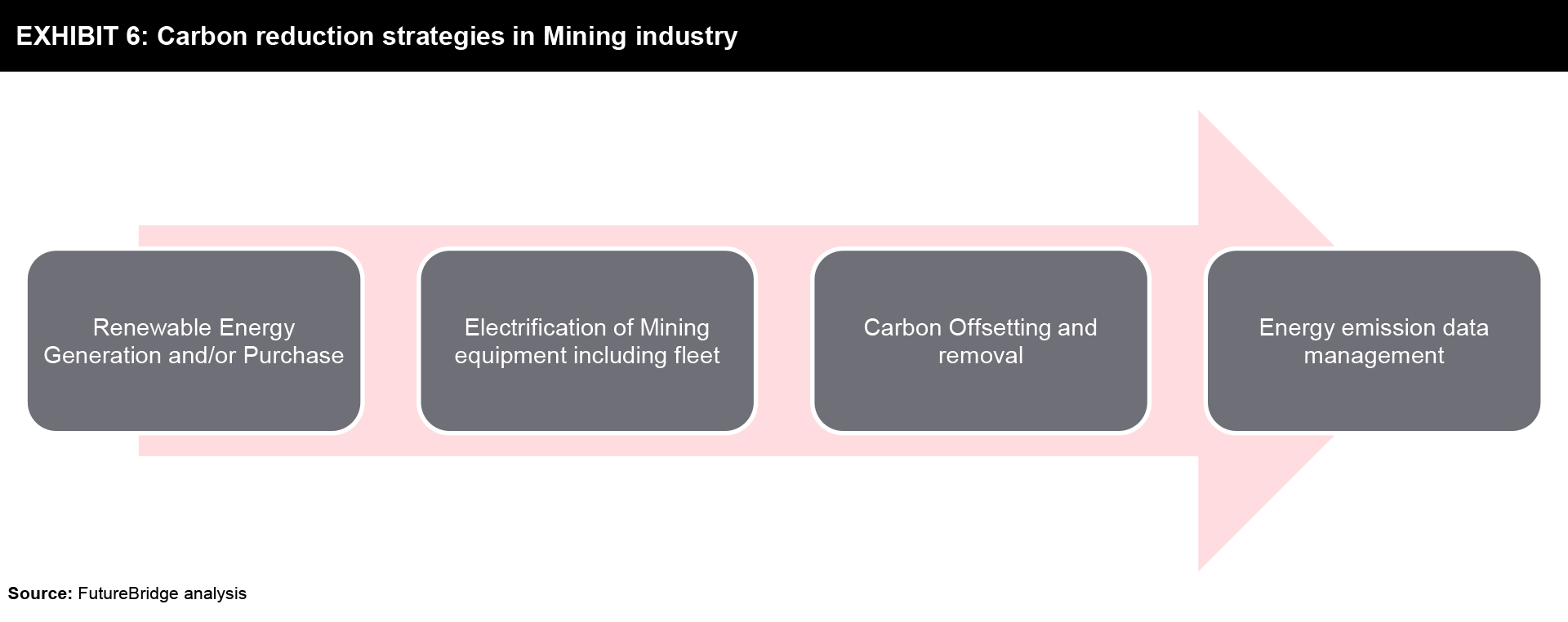

As depicted in Exhibit 6, Mining companies can successfully decarbonize through a combination of solutions such as renewables, corporate power purchase agreements (PPAs), electrification, carbon offsetting, data management, and ensuring data integrity in environmental, social, and governance (ESG) reporting.

1) RE Generation and/or Procurement

More miners are investing in renewable energy solutions to help decarbonize their operational emissions and lower current and future carbon-price exposure. Wind, solar and other renewables are also increasingly viable options for miners to increase their energy independence and control their own power supplies. There’s also potential for miners to use excess land to develop renewables, particularly in remote locations where energy supply is a challenge. Another opportunity for miners is bundling renewables with energy storage solutions to balance supply and demand. Any excess power generated by renewables can also be sold to utility companies to help generate revenues and offset costs. Few developments are as listed below:

- The Zaldívar copper mine in Chile will be the first mine in Latin America to operate with 100% renewable energy. As a result of a 10-year deal to buy renewable power from Chilean utility Colbun, the mine will reduce its emissions by 350,000 metric tons per year.

- The Vametco mine in the Northwest province of South Africa recently announced that it will use vanadium redox flow batteries (VRFB) to store energy from a 3.5-MW solar PV plant. The microgrid will supply just under 10% of the mine’s electrical needs at any time. VRFB technology can offer almost unlimited energy capacity by using larger electrolyte storage tanks.

2) Electrification: Miners are also investing in the electrification of their vehicle fleets to reduce emissions, reduce costs and improve the health and safety of workers. While location and life-of-mine and design considerations will need to be factored into the decision to go electric, there is a cost-reduction potential for moving to battery electric vehicles. Research shows the total cost of ownership of a battery electric vehicle for mining could be around 15% to 20% lower than diesel trucks due to lower maintenance and fuel costs. Some notable examples are:

- Newmont Goldcorp’s Borden mine- Canada’s first all-electric operation and the world’s first diesel-free hard rock mine: Newmont Goldcorp’s Borden mine uses a full range of electrified equipment, including load haul dump trucks, drills, bolters and personnel carriers.

- Rio Tinto announced Phase out on the purchase of diesel haul trucks and locomotives by 2030

3) Carbon Offsetting and removal: Many miners are navigating the rapidly changing landscape for carbon offset targets, especially over the past year as the long-disaggregated market becomes more standardized, regulated and transparent. There are concerns about ‘greenwashing’ with the use of carbon offsets, which miners will need to consider. Still, offsets are expected to become an important part of long-term net-zero and decarbonization targets, particularly with hard-to-abate emissions.

- One of the world’s biggest mining companies, BHP, is exploring generating carbon credits from its waste products through a process called “carbon mineralization”

- Australia’s Clean Energy Regulator is now considering the introduction of a new carbon credit offset methodology under the country’s Emissions Reduction Fund.

4) Emission data management: Data management and integrity in ESG reporting are increasingly critical in the mining industry as investors and governments pay closer attention to climate change risk. There will be even greater demand for data as the reporting environment evolves. Miners will need to continuously improve the quality of the data to keep up with the evolving standards, including tracing its origin and making it available in real-time.

- The Greenhouse Gas Emissions Management Tool has been developed to map and track carbon emissions and energy consumption within mining operations.

- EarthSoft has more than two decades of experience in developing technology solutions to manage environmental data throughout a project lifecycle from inception to closure and reuse.

- Envirosuite: Groundbreaking software for mining environmental management. Optimises plans for weather risks and maintain compliance while meeting production targets.

Moving the entire supply chain to green operations is a big hurdle but recent initiatives are being taken to reduce Scope 3 emissions for the mining industry as well. Exhibit 7 depicts pathways to reduce emissions in the mining industry categorized across all the 3 scopes of emissions as follows:

While the above measures will certainly play a prominent role in decarbonising mining industry but there are also challenges that are foreseen in the execution of some. As stated, switching to RE source of electricity (procuring or captive plants) and adopting electric fleet will cut down the emissions significantly but the feasibility seems challenging given the remote, off grid locations of mines thereby limiting decarbonisation choices for mine operators. Without access to grid power, operators have limited choice but to use polluting and expensive oil-fuelled generators to supply the power they need. In this scenario, Hybrid microgrids (hybrid energy systems comprising solar generation and energy storage) can be a plausible solution to start with the journey for decarbonisation. Microgrids deliver cheaper and predictably priced low-carbon electricity, as well as autonomy from the grid and improved supply resilience and hence hybrid microgrid solar power systems offer mining companies a commercially viable pathway to increase their use of renewable energy and begin their decarbonization journey. Electrification of mining equipment, such as trucks and excavators, is at an early stage currently. Today, only 0.5% of mining equipment is fully electric. However, cost of ownership of battery electric vehicles compares favourably with internal combustion engine vehicles. Fuel cell vehicles that run on green hydrogen are another zero-emission option to decarbonize a mining operation, especially for large plant vehicles that would otherwise require huge (and heavy) batteries to provide sufficient power.

Present status and outlook of emission reduction by mining companies

Keeping in pace with the ongoing climate targets, mining companies are making bold commitments to reduce their business risks and help mitigate climate change. World Bank’s Climate Smart Mining Facility, a first-of-its-kind fund designed to bring together governments, industry, financial institutions, and private investors together to support responsible mining and minimizing social, environmental, and climate footprints was set up by the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development and Netherlands’ Ministry of Foreign Affairs. The ministry had committed USD 1 million to the facility with plans to increase the fund to USD 5 million.

- In the year 2021, The International Council on Mining and Metals (ICMM) has committed to a goal of net zero Scope 1 and Scope 2 GHG emissions by the year 2050 and intends to set up targets on Scope 3 GHG emissions by the end of 2023

- In January 2023, the UK government announced to offer of 600 million pounds to British Steel and Tata Steel UK to help Britain’s two biggest steelmakers move towards green operations.

- Primetals Technology and Tata Steel have also signed an MoU to intensify their collaboration on projects and technology related to green steel and decarbonization.

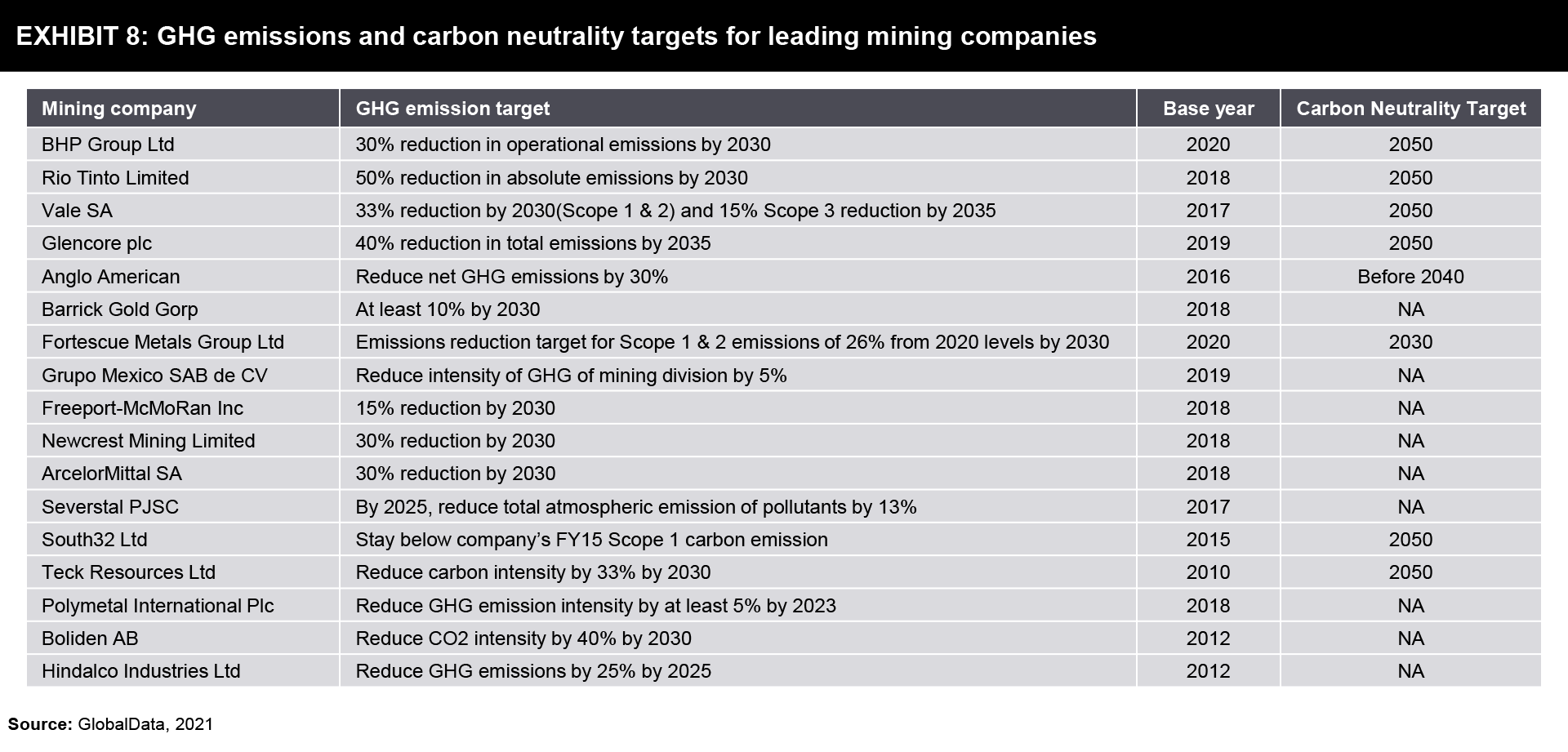

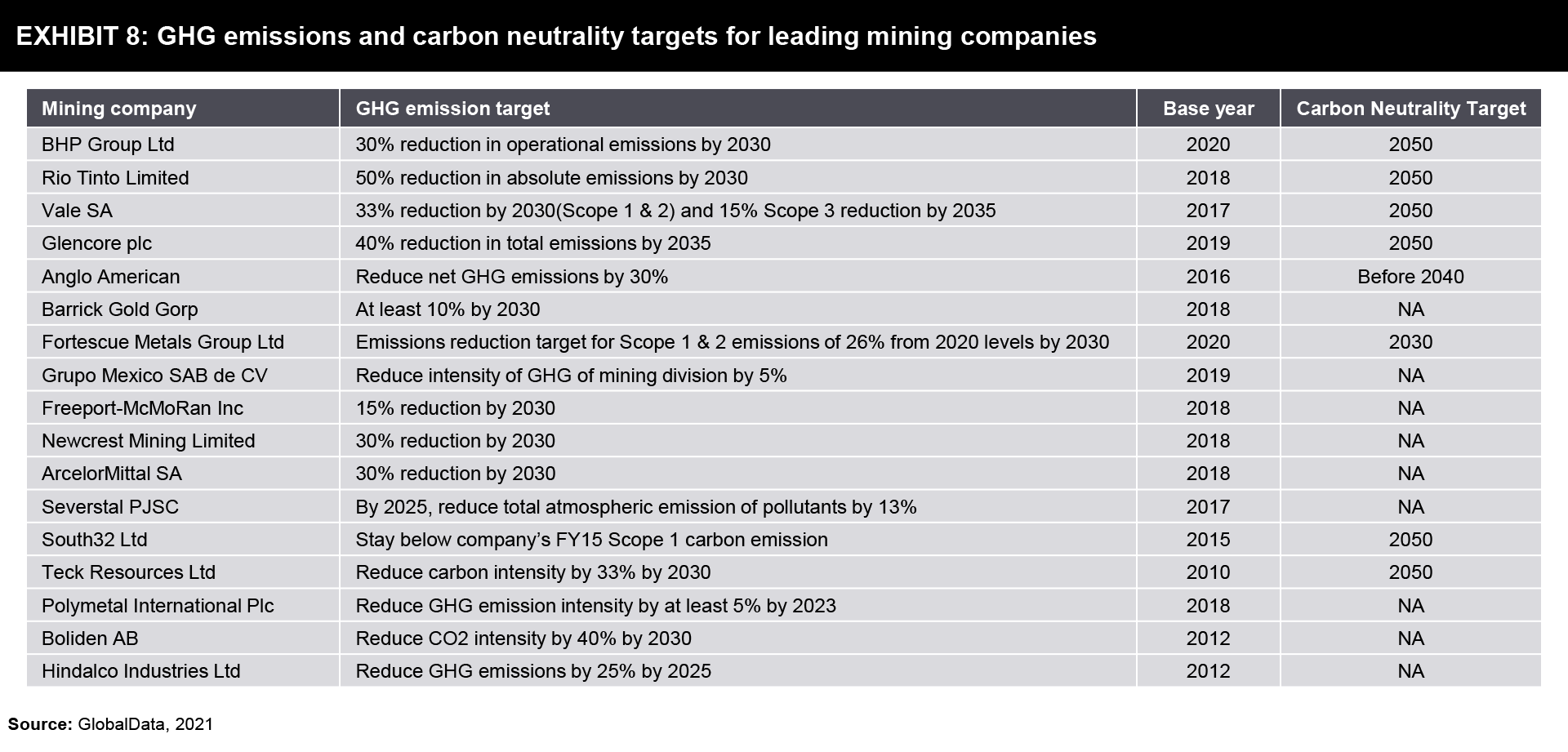

In the year 2020, Glencore became the first mining company to announce NZE including Scope 3 emissions by 2050 and thereby many mining companies have come forward with their GHG emissions and climate neutrality targets.

What is in it for Companies?

Global decarbonization is largely dependent on the sustainable mining of minerals and raw materials. We at FutureBridge are of an opinion that the mining industry has reached a very interesting point now where it has begun to shed its bad image regarding the environment and slowly emerging as a champion due to its vital role in providing raw materials necessary for the green energy transition. Today, miners have various technology-based alternatives for decarbonisation than ever before. They can evaluate and deploy a variety of low- and zero-carbon energy sources such as renewables, (e.g., large-scale solar and wind, electric vehicles, low-carbon fuels, and hydrogen), paired with associated technologies such as battery storage and fuel cell technology while also paving way for other emerging technologies such as hydrogen power, direct air capture, electrification. The objective here would be to evaluate the trade-offs of these technologies to ensure that a cost-effective, reliable pathway to Net-Zero is achieved. These measures will get the industry part of the way there but to fully achieve Net Zero, miners – and the world in general – will need to embrace technologies that are not yet fully developed.

Miners can sustainably achieve their carbon reduction goals through the development of tailored road maps that focus on successful investments and implementations of new and existing technology solutions that best align with their operational needs and corporate objectives. At this juncture, we at FutureBridge believes that despite being a very nascent market with all the challenges of a new emerging market, sustainable mining can be a potential game-changer in realising Net Zero targets; and we are already seeing a lot of traction among our clients on this.

FutureBridge brings in the unique ability to support our clients to grasp the complex forces reshaping the industry and craft the right strategies and operating models to meet new imperatives. Discuss your objectives with our experts here >

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.