Note:

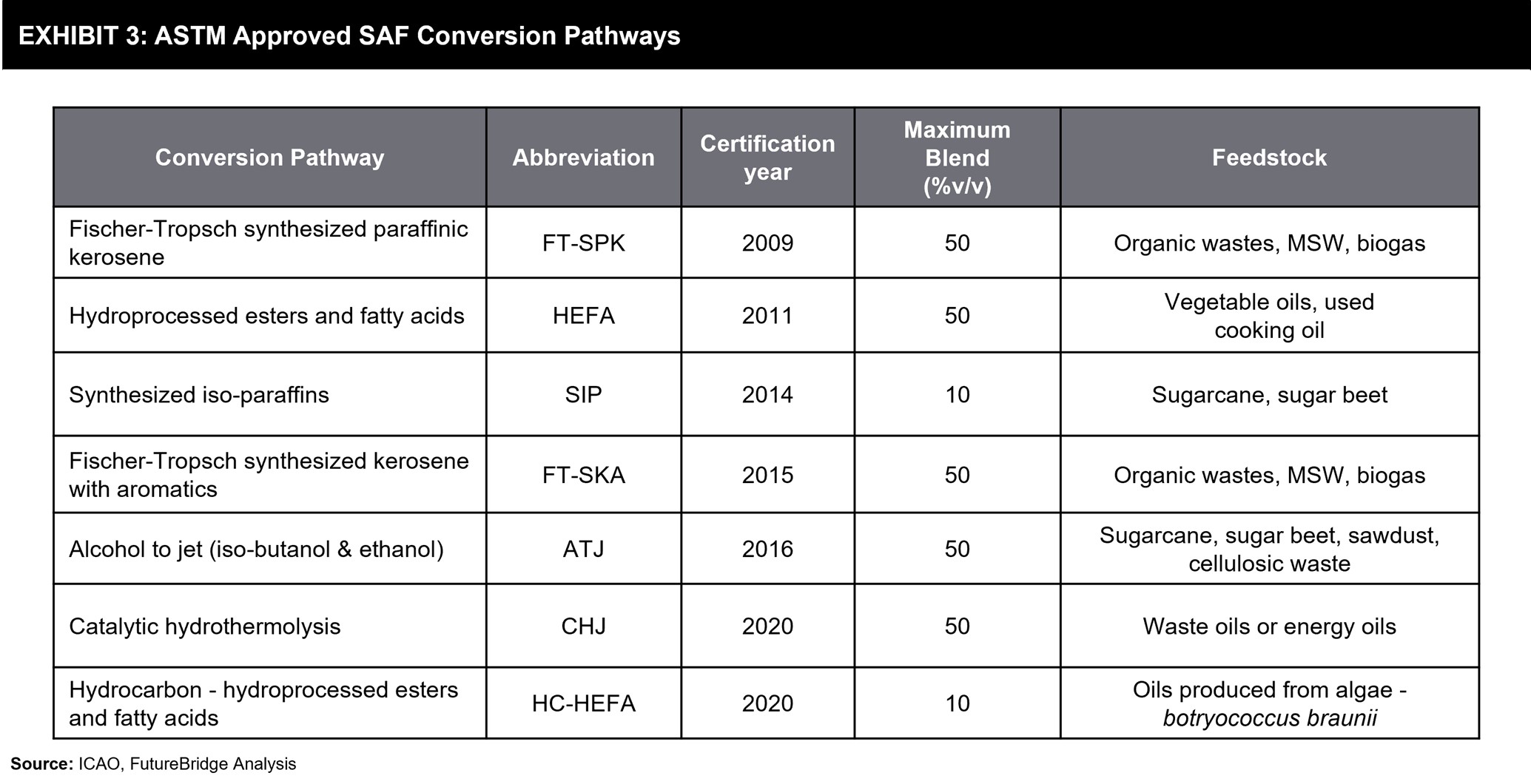

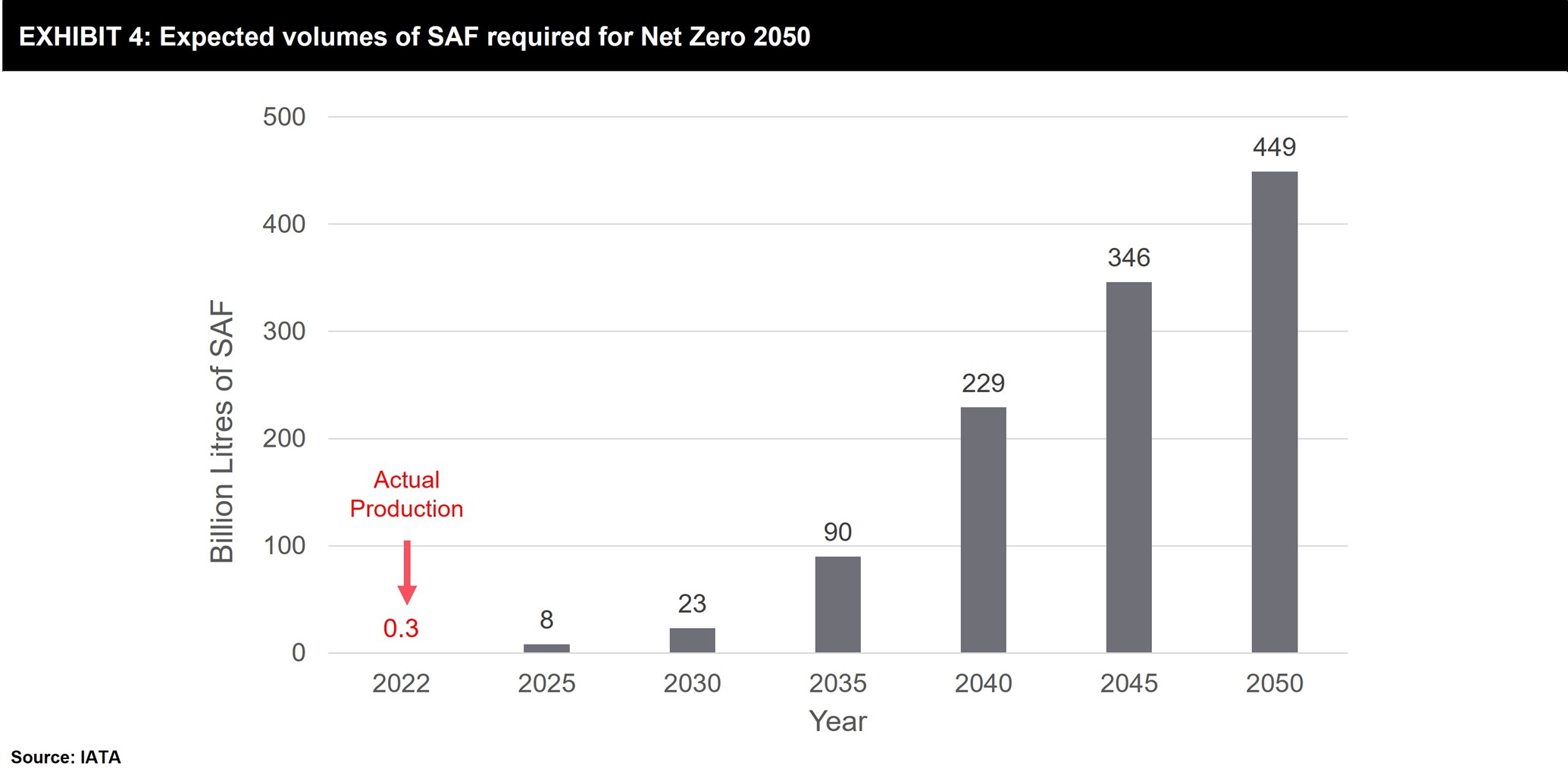

Thankfully, a notable surge in offtake deals has functioned as a clear signal for SAF producers to embark on substantial investments for amplifying production scale. Presently, these offtake agreements aggregate to an impressive 42.5 billion liters, and United Airlines spearheads this demand by committing to 10.5 billion liters. The biofuels industry has responded positively to this demand by announcing 206 new SAF facilities with a total annual capacity of 71 billion liters by 2030. This trend is anticipated to accelerate in the 2030s as policy support becomes global and SAF becomes cost-competitive with fossil jet kerosene. In final consideration, the limitation imposed on blending could potentially hinder the realization of Sustainable Aviation Fuel’s (SAF) complete potential, consequently posing a challenge to the overarching Net Zero objective. The certification authorities have mandated a cap on blending, set at a maximum limit of 50%, despite certain SAF variants having the capability to fully substitute fossil jet fuel. This is being done to avoid engine degradation due to variability in the SAF type used. But we expect more standardization as the industry matures, enabling 100% replacement. Despite the hurdles posed by these challenges, the undeniable potential benefits of sustainable aviation fuel remain steadfast. With the current momentum, industry willingness, and favorable policies, we anticipate that Sustainable Aviation Fuel (SAF) will overcome these obstacles and smoothly transition into a mainstream aviation fuel.