Global Ethanol Outlook

Ethanol consumption has seen significant growth in the last two decades. It is a prominent alcoholic beverage found in cider, beer, spirits, wine, and ale, and it’s been also used in the industry as a solvent. However, primarily a growth driver for ethanol consumption is its use as a blending component in gasoline. The use of ethanol as a fuel blending component accounts for approximately 80 to 85% of the total ethanol market.

Amidst global oil price fluctuations, energy security has become a prime focus of countries. To comply with the Paris agreement, countries are exploring ways to reduce their CO2 footprint and pushing for stricter emission standards. The ethanol industry not only contributes significantly to the economics of countries but also helps in developing a robust energy security strategy and provides an option for countries to reduce carbon emissions.

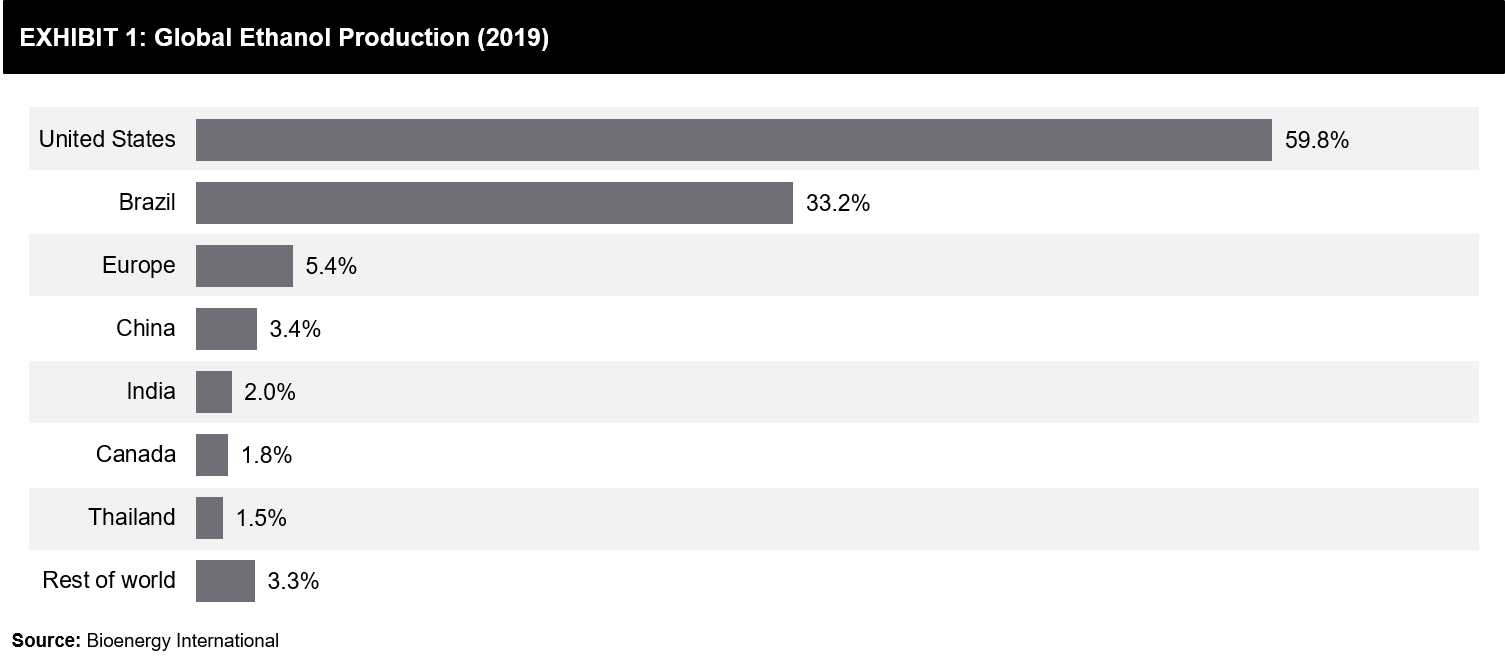

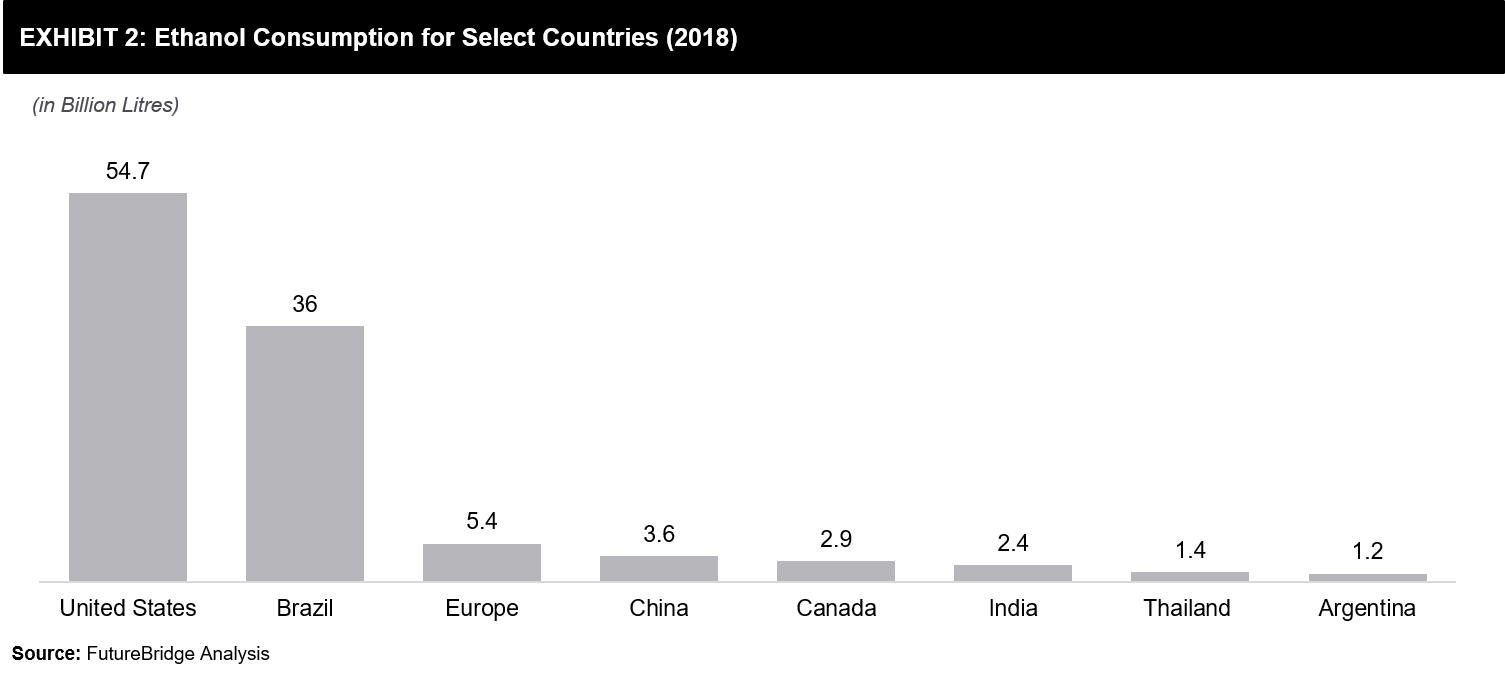

Exhibit 1 highlights the global production of ethanol for the year 2019. Exhibit 2 highlights the consumption of ethanol in select countries for the year 2018.

US: The US is a net exporter of ethanol and leads in terms of production and consumption of ethanol. It accounts for ~54% of the total ethanol consumption globally, and its consumption reached ~54 billion litres in 2018. Total ethanol production in the US reached 59 billion litres in 2019. Corn is the major feedstock used for ethanol production. The growth in the US is primarily driven by

- Increased corn production and relatively stable corn prices

- Higher Renewable Fuel Standard (RFS) targets

- Growth in the domestic motor gasoline consumption as ethanol is used as a primary blending component for motor gasoline production

Brazil: Brazil is the second-largest consumer and producer of ethanol. Its ethanol consumption reached ~26 billion liters in 2018. It is reported that Brazilian ethanol producers have optimized their production capacity to produce ~33 billion liters in 2019. Sugar Cane is the primary feedstock for the production of ethanol in Brazil. It is reported that Corn as feedstock is gaining traction in Brazil, accounting for ~9 billion liters of production in 2019. The growth of ethanol in Brazil is primarily driven by government support for the blending of ethanol in fuels and also technological innovation in vehicles allowing them to run a vehicle on 100% ethanol.

Asia-Pac: Demand from Asian countries like India, China, and Thailand is expected to increase in the near future. The increase in demand is driven by announcements related to increasing ethanol percentage in fuel blending by these countries.

Ethanol production routes

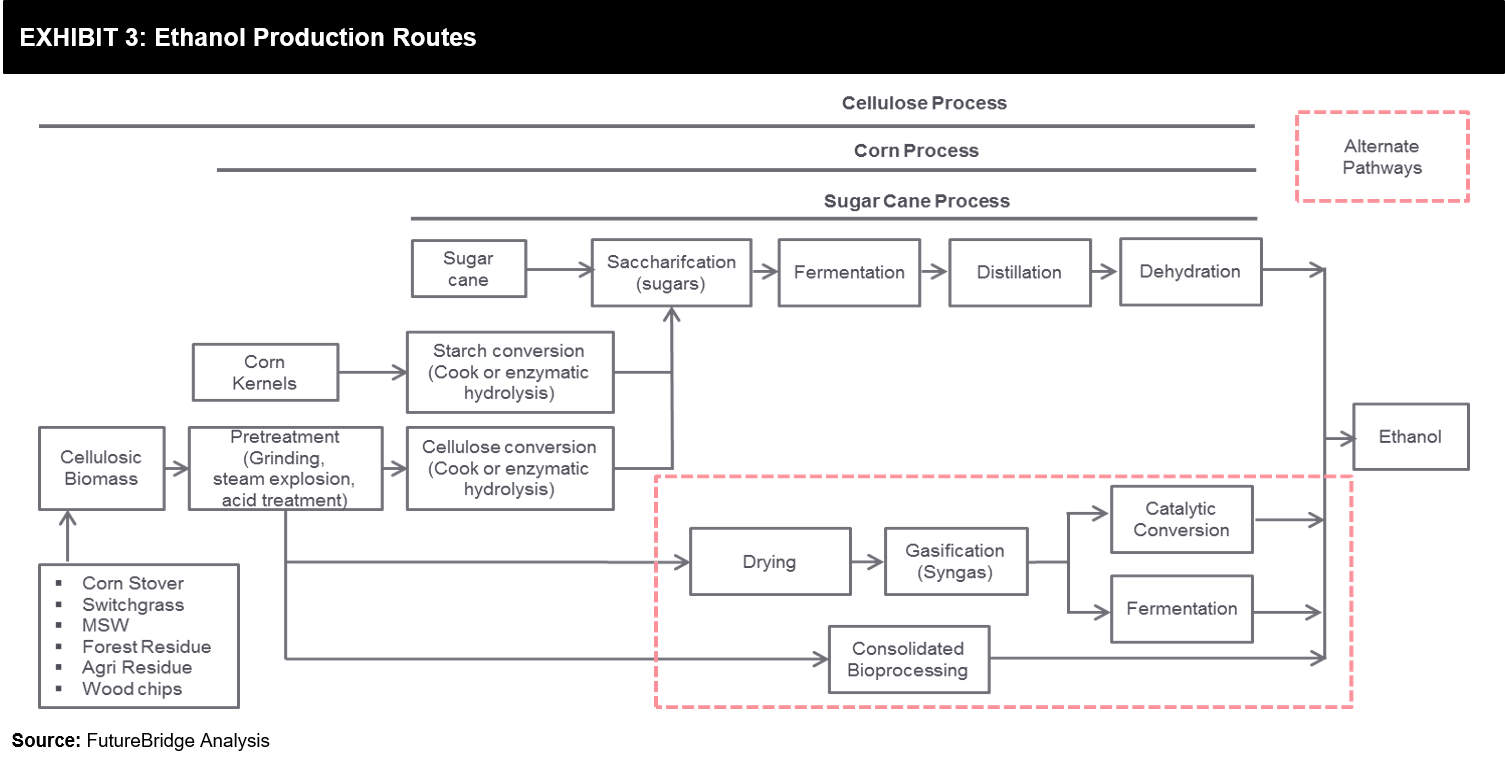

Ethanol is produced using different routes and using different feedstock. Exhibit 3 provides a view of different pathways used for the production of ethanol.

First-generation ethanol production (Corn and Sugar Cane): It involves the production of ethanol using first-generation feedstock like Corn, wheat, or sugar cane, which directly competes with the food supply chain.

Second-generation ethanol production (cellulose or lignocellulose) involves the production of ethanol using second-generation non-food feedstock sources like forestry residue and lignocellulosic biomass, corn stalk, sugarcane bagasse, etc. Second generation production process involves the following steps:

- Pretreatment:Production of ethanol using second-generation ethanol is challenging due to the resistant nature of lignin to degradation, the inefficient breakdown of cellulose and hemicellulose. Therefore, pretreatment of the feedstock is required to make lignocellulosic biomass more amenable to biological conversion for complete substrate utilization. There are various types of pretreatment technologies have been explored for the ethanol production process. The pretreatment technologies are mentioned below:

- Treatment with concentrated or dilute acid

- Steam explosion

- Liquid hot water

- Ammonia fiber explosion

- Alkaline wet oxidation

- Organosolv

- Biological

It is observed that most of the currently operating plants are using steam explosion and dilute acid-based pretreatment processes.

- Hydrolysis or saccharification involves the breakdown of pretreated biomass to simple sugars using either acid hydrolysis or enzymatic hydrolysis. Enzymatic hydrolysis is preferred over acid hydrolysis because of the milder conditions and low energy requirement. However, it is also one of the challenging processes and contributes significantly to the production cost of second-generation ethanol.

- Fermentation: It involves the use of bacteria or yeast for fermentation of sugars to ethanol.

- Distillation: It involves the distillation of fermentation broth to produce ethanol.

The following processes are recently explored for ethanol production and are alternative to conventional process:

Thermochemical conversion: It involves gasification of second-generation feedstock to produce a syngas which can be catalytically converted or fermented to produce ethanol. This is a relatively new concept and has not received much attention.

Consolidated Bioprocessing: It involves conducting enzyme production, substrate hydrolysis, and fermentation in a single process step by lignocellulolytic microorganisms. It is also being explored for ethanol production.

Second Generation Ethanol Production Status

Globally almost all of the ethanol is produced from the first-generation feedstock like corn and sugar cane. Despite being a popular process for ethanol production, it has certain drawbacks, and therefore, alternate processes are being explored. The drawbacks associated with the first generation process are mentioned below:

- Competition with food supply chain particularly in developing countries like India and China

- Leads to deforestation as forest land is being converted to agricultural land to accommodate the increasing demand of feedstock

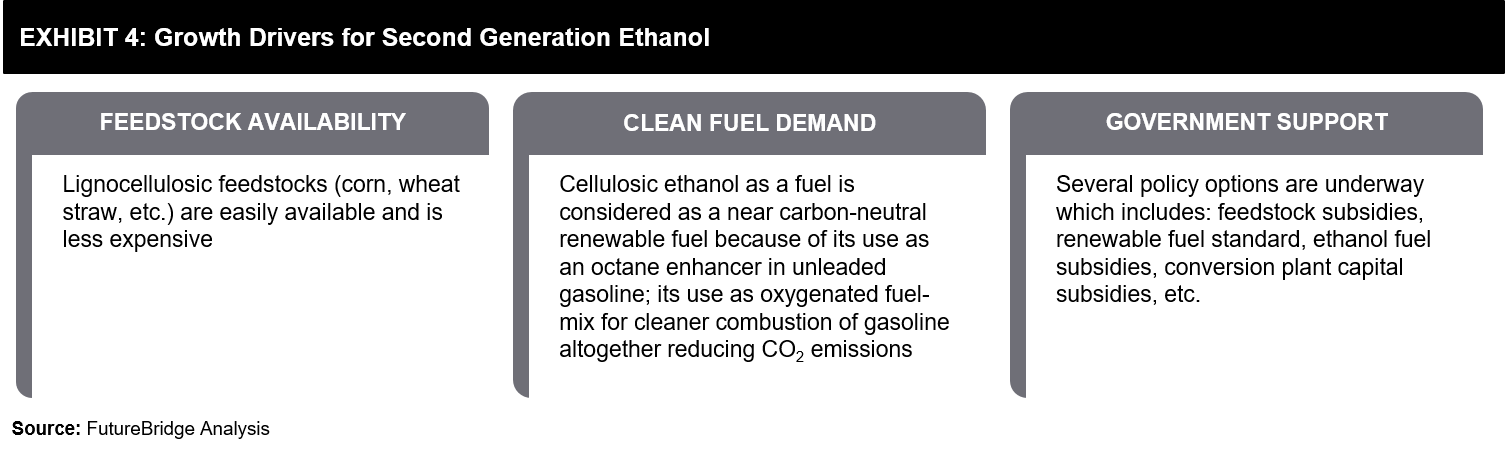

The second-generation process using agricultural residue, forestry residue, and lingo-cellulosic biomass is explored as an alternative to the first-generation process. Research around second-generation ethanol production has been carried out for the last decade. However, it is failed to deliver on the potential it promised for over the decade. However, the industry started gaining momentum around 2013 when several commercial plants had opened around the world. Exhibit 4 highlights growth drivers for second-generation ethanol.

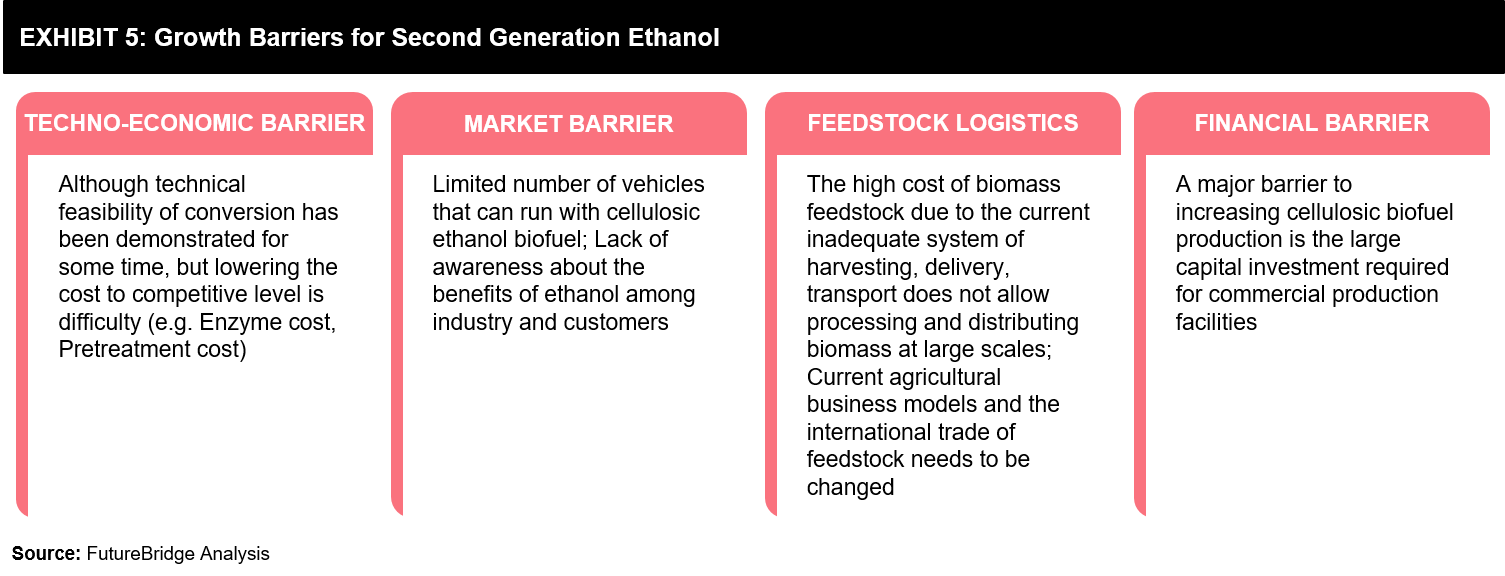

The industry again received a setback when several of commercial plants failed to deliver at commercial scale. Exhibit 5 highlights barriers for growth of second-generation ethanol.

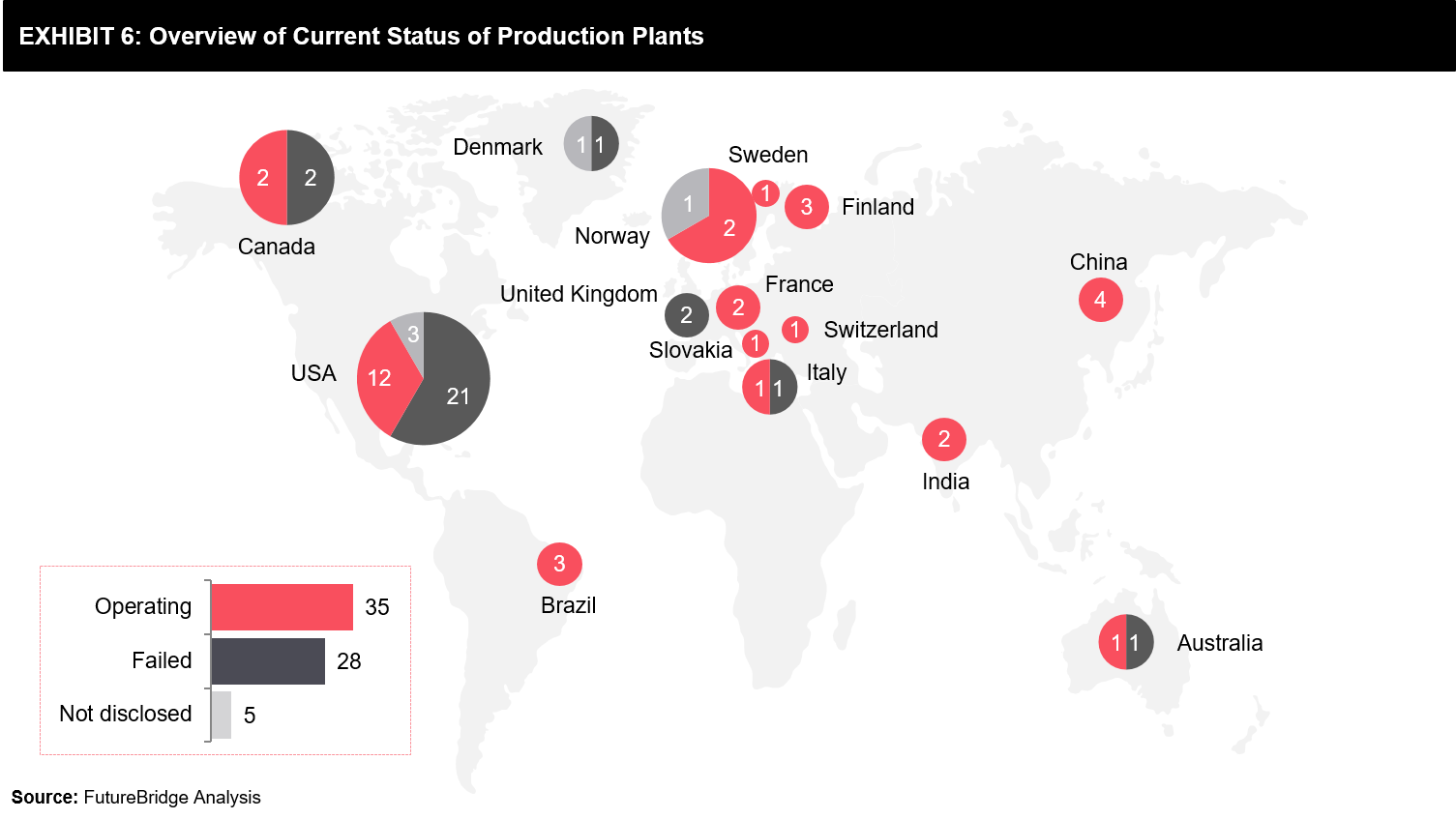

However, some of the operating plants have established the fact that the second-generation process can deliver high yield products. Second-generation ethanol plants are also started receiving attention in countries like India, China. For example, Chempolis is building a plant for ethanol production in association with the Numaligarh refinery in India1. The Australian Renewable Energy Agency (ARENA) announced funding for Australian biofuel company Ethanol Technologies Limited (‘Ethtec’) to complete the development and demonstration of its groundbreaking advanced biofuel technology2. Exhibit 6 provides an overview of the current status of production plants:

External Factors Affecting Large Scale 2G Ethanol Production

Low oil prices have resulted in low gasoline prices, which are making life difficult for cellulose ethanol producers. It is imperative that government policies and support is needed for cellulosic ethanol production to be successful at commercial scale: For example, the US has Renewable Fuel Standards (RFS) program to reduce GHG emissions and expand renewable fuel sector. As per the RFS program, obligated parties, including refiners and fuel importers, can purchase cellulosic waiver credits (CWC). The current cost of this option is about $1.77 per gallon for 2019. 3The average gasoline prices in the US for 2019 were $ 2.60 per gallon4. The maximum that obligated parties will be willing to pay for cellulosic ethanol is the total amount obtained by combining the gasoline cost per gallon and the cost of cellulosic wavier credits. As per the calculations, the maximum amount that refiners and fuel importers will be willing to pay is ~4.37 per gallon. The minimum ethanol selling price (MESP) of ethanol from sugarcane bagasse is in the range of 4.52 to 4.90 per gallon5. Therefore, in this current low price scenario, cellulosic ethanol producers are finding it difficult to recover their total cost and need government support in terms of favorable policies and tax wavier credits.

Technical Trends and Barriers for Large Scale 2G Ethanol Production

It is observed that claims have been made that technology for production of 2G ethanol is economically viable and is available at a commercial scale. Most of the investments were focused on scaling and commercialization of technology with little focus on technology development. However, it turned out that efforts are required on technology developments for scale-up and commercialization of technology. This is corroborated by the lessons learned from some of the commercial-scale operating plants. POET DSM, the first cellulosic ethanol production plant owner, has highlighted that they have redesigned their pre-treatment system6. Here are the challenges and recent technology trends across the entire steps of ethanol production.

Biomass pre-treatment: Composition of lignocellulosic biomass makes pretreatment step challenging, some of the challenges are mentioned below

- Challenges:

- Recalcitrance of lignocellulosic feedstock to chemicals or enzymes

- Complete delignification and impact of lignin concentration on enzymatic hydrolysis

- Generation of inhibitors

- Lower sugar yields

- Recent trends:

- Genetically modified plants with reducing lignin content or modifying lignin composition or bonds between lignin and carbohydrate by regulating genes involved in lignin biosynthesis

- Use of wild plants which show naturally low recalcitrance

- Pretreatment condition modifications

Enzymatic hydrolysis: Enzymatic hydrolysis is also one of the major barriers for commercial-scale production of ethanol.

- Challenges:

- Cost of enzyme

- Effect of solid loading

- Lignin binding

- Recent trends:

- New enzymes/fungal enzymes

- Designed enzyme preparations

- In-situ enzyme generation

Fermentation: C5 sugar co-fermentation is one of the major challenges faced by ethanol producers.

- Challenges

- Co-fermentation

- Rates of sugar uptakes

- Tolerance of ethanol-producing bacteria for high substrate, inhibitor, and product concentration

- Recent Trends:

- Engineered microbes/yeast to ferment C5 sugars

Silver-lining for 2G Ethanol Producers:

Recently, ASTM International revised ASTM D7566 Annex A57—the Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons. It will allow the use of ethanol as an approved feedstock for producing alcohol-to-jet synthetic paraffinic kerosene (ATJ-SPK). This revision in ASTM standards helps move faster towards decarbonization of the aviation industry as ethanol can be produced using a variety of feedstock and might help address feedstock supply constraints related to vegetable oil and used cooking oil (UCO).

FutureBridge analyst believes that this revision in ASTM standards could act as silver-lining for 2G ethanol producers as it will provide access to premium fuels and can accommodate the higher cost of 2G ethanol productions.

Players working on the ethanol to jet fuel technologies are mentioned below:

- PNNL and LanzaTech:

- Vertimass

Future Outlook for 2G Ethanol:

- Though the overall ethanol industry has hit by COVID 19 pandemic. The last couple of years have been good on the front of policies and government ambitions for the use of biofuels. For example, China, India, and European countries (RED II) have announced policies for increasing the blending mandate of biofuels. However, FutureBridge analyst believes that stricter implementation of these policies along with support for financing the activities related to second-generation ethanol will drive the second generation ethanol production industry

- Technical difficulties and high production cost make 2G ethanol uncompetitive with starch-based ethanol production or fossil fuels; therefore R&D efforts needed to address the technical hurdles and also develop low-cost alternatives

- Recently, Chempolis and Clariant announced plans for commercial production of the second-generation of ethanol. The successful operation of these projects/plants will drive the growth of second-generation ethanol

- Developments towards ethanol to higher-value premium products like jet fuels provide options to ethanol producers for accommodating the higher production cost; Such developments will drive 2G ethanol production and provide a necessary financial cushion for exploring low-cost alternatives

References

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.