Here are the responses to the questions asked during the webinar “CCU: Turning CO2 from a Liability into an Asset” by the participants from leading F&N companies.

Q 1. I am of the impression that cement cures on CO2 from the air anyhow, if that is the case, why we counted it as an advantage?

A. FutureBridge Energy Consultant’s response:

CO2 is emitted as a by-product of clinker production during cement manufacturing. Also, CO2 is emitted during cement production by fossil fuel combustion. The CO2-cured cement or the Calcium Carbonate Aggregate produced using CO2 with cement acts as a carbon sink, just like the way CO2 is injected into the ground and the ground acts as a sink for captured CO2

Q 2. Are microbe-based processes like Lanzatech’s scalable? What would be a “typical” process time for a 1MT of CO2?

A. FutureBridge Energy Consultant’s response:

Yes, the microbial gas fermentation processes are scalable. It can provide a sustainable way to produce fuels like ethanol, jet fuel, and high-value chemicals that can serve as building blocks to products that have become indispensable in our lives. Regarding gas flexibility or feedstock flexibility, any CO: H2 ratio can be used in this process. It is estimated that approximately 350,000 metric tonnes of CO2 can be fermented per year to produce 62,000 metric tons of ethanol per year at the Lanzatech facility planned in Belgium.

Q 3. What is the return on investment for the startups and customer demand for these e-fuels? How long until market viability?

A. FutureBridge Energy Consultant’s response:

The advantages of eFuels are known to all industries these days. Now, these shipping companies, and airlines are investing in these startups to develop cost-efficient, carbon-neutral eFuels for their fleet. eFuels are expected to play a key role in the decarbonization of shipping and aviation and, if scaled successfully, startups like Prometheus Fuels, twelve will help address a key challenge of mitigating the CO2 emissions from these industries. Projects to commercialize eFuels are already underway. Regarding the development of CO2 in eFuels plants, Carbon Recycling International (CRI) has been a pioneer. The Shuni CO2-to-methanol plant, the George Olah renewable methanol plant, and MEFCO2 are some of their ongoing initiatives.

Q 4. Will e-fuels be able to replace the use of normal fuels (diesel) into industrial machines?

A. FutureBridge Energy Consultant’s response:

eFuels may be utilized with both renewable energy sources and in highly efficient oil and gas-powered condensing boilers. While synthetic fuel helps to save the environment, homeowners can still use their current, modern heating systems. Mineral oil and fossil gas are the most crucial raw materials for the chemical industry, in addition to being employed in the transportation and heating sectors. Entire industrial sectors can gain from this climate-neutral conversion by switching to eFuels in place of fossil-based raw materials.

Q 5. How long we can go on injecting CO2 into the underground system? Is it not going to imbalance our ecosystem?

A. FutureBridge Energy Consultant’s response:

Yes, there is a limit to how much CO2 the ground store. After a period, CO2 could leak out of these underground reservoirs into the surrounding air and contribute to climate change, but this happens after centuries. These leaks could impact our ecosystem. Hence, the utilization of captured CO2 is gaining momentum to mitigate the CO2 challenge, which we discussed in our webinar.

Q 6. To align with IPCC, could you maybe categorize the different usage of CO2 by low-term, mid-term, and long-term locked CO2?

A. FutureBridge Energy Consultant’s response:

Some products lock CO2 away for decades, but few are short-lived solutions, so the gas quickly ends up in the atmosphere. However, through the circular economy for these applications, it is possible to remove the net effect of this short locking period.

Lifetime:

- Short-term (months to decades): Fuels and Chemicals, Greenhouse Agriculture

- Mid-term (decades to centuries): Polymers, Building Materials

- Long-term (Centuries): EOR

Q 7. eFuels greatly depend on the availability of H2 are cost competitive rates. Do you think by 2030 H2 will be available at competitive rates for CO2 conversion to fuels and the relevant technology to convert CO2 at cost-competitive rates?

A. FutureBridge Energy Consultant’s response:

Yes, we anticipate that eFuels will be cost-competitive by 2030. With more advancements in technologies to reduce the cost of production of hydrogen, the cost of green hydrogen is expected to see dramatic cost reductions by 2030 as the cost of renewable energy and electrolyzers falls. The rates could then compete even with grey hydrogen without a carbon price. Since in eFuels production the main cost component is the cost of hydrogen, the CO2 conversion technologies would also see cost reductions by 2030 along with more advancements in the current technologies and with newly developed conversion technologies.

Q 8. For those wishing to take a close look at the history of CCUS deployment, this paper is well worth a read – https://www.sciencedirect.com/science/article/abs/pii/S030142152100416X#:~:text=The%20results%20indicate%20that%20larger,of%20failure%20by%20nearly%2050%25.

A. FutureBridge Energy Consultant’s response:

Thank you for sharing.

Q 9. Is it possible to be used in post-treatment of potable water grade?

A. FutureBridge Energy Consultant’s response:

The use of CO2 in potable water treatment is not a much-known application. Although, it can be advantageous in this application since CO2 can remineralize the soft water, prevent corrosion of pipelines, is non-toxic, and can help in removing the polluting residue in water.

Q 10. Research has shown that since 1996, only around 200Mt of carbon dioxide has been permanently stored compared to the 56Gt emitted last year alone. Noting the IEA’s comment on the ‘woefully inadequate’ current deployment rates – will commercializing CO2 make a difference in climate change?

A. FutureBridge Energy Consultant’s response:

Carbon capture technology has been around for decades and is used to capture carbon from industrial emissions as well as remove carbon that’s already in the air. The short answer is that techniques for carbon capture and storage are not well developed and are too expensive to be practical so far. And that is the reason for lower rates of carbon storage. Carbon dioxide in the atmosphere warms the planet, causing climate change. Human activities have raised the atmosphere’s carbon dioxide content by 50% in less than 200 years. Hence, commercializing captured CO2 by developing new uses and products such as concrete, chemicals, and fuels could reduce GHG emissions by a billion metric tonnes yearly. According to the Global Carbon Initiative, with suitable incentives, the entire CO2-based product business might use 7 billion metric tons of CO2 annually by 2030, or around 15% of our existing global emissions. Thereby, generating revenue and protecting the environment.

Q 11. Wouldn’t the CO2 used to cure cement be absorbed from the atmosphere anyway, (over a longer period), so why is this a viable route to CO2 sequestration?

A. FutureBridge Energy Consultant’s response:

Cement doesn’t absorb CO2 from the air rather it emits CO2 during manufacturing. However, the CO2-cured cement or the Calcium Carbonate Aggregate produced using captured CO2 with cement acts as a carbon sink, just like the way CO2 is injected into the ground and the ground acts as a sink for captured CO2. This sequestration is a permanent one since the stored CO2 does not get emitted over decades.

Q 12. How mature is the calcination process? Can it be deployed at a large scale

A. FutureBridge Energy Consultant’s response:

The CO2 calcination process for carbon capture in the cement industry is still in the developmental stage (TRL7). The process has shown potential in capturing a high % of CO2 emissions from the air by generating a separate stream of suitable CO2 for further utilization. The promising results confirm the potential of the proposed process for future development and pilot testing.

Q 13. The Global CCS Institute has stated that around 70-100 new, large-scale CCS plants a year need to be deployed per year by 2050 at a total cost of between $650bn-$1.3tn. Will private capital, based on these uses of carbon dioxide, be willing or able to finance that?

A. FutureBridge Energy Consultant’s response:

The broad phrase used to describe financing used to purchase greenhouse gas emission reductions to offset emissions in the OECD countries is “carbon finance.” Since the first carbon purchases started less than seven years ago, carbon finance commitments for the purchase of carbon have grown rapidly. Carbon Finance provides a means of leveraging new private and public investments into projects for reducing GHG emissions. And now with the space for utilization of captured carbon growing with new and more applications/ pathways, these carbon capture projects are expected to continue growing as countries work to meet their commitments, and as national and regional markets for emission reductions are put into place, notably in Canada and the European Union.

Q 14. Can you give us some orders of magnitude please: CO2 sequestrated Vs. CO2 emitted by the volume of oil extracted thanks to that same volume of CO2-EOR?

A. FutureBridge Energy Consultant’s response:

In most cases, when high-pressure CO2 is injected into the reservoirs for EOR, most of it, around 90 to 95 percent, stays there, trapped in the geologic formation where the oil was once trapped. The rest 5 to 10% of CO2 is recycled and injected back into the reservoir. This way, most of the volume of CO2 is permanently sequestered in these wells. The main issue with CCS is that there is no incentive to implement it. In the absence of a very high carbon price, making it is challenging to attract private money to participate in it. The only method of extensive, long-term, or permanent carbon sequestration that generates a profit right now is EOR. The profit-making drive could be used to bury carbon under the correct policy framework. EOR could aid in scaling up CCS and lowering costs throughout the process.

Q 15. Purpose of CCS is to fight Climate change. The usage of CO2 for EOR is to help increase the productivity of fossil fuels. is it really in line with IPCC conclusions? is your GHG image considering the burning of the fuel?

A. FutureBridge Energy Consultant’s response:

Yes, the GHG emission chart includes all types of processes from all sectors that include burning or use of fuels in transportation, industrial, refining, etc. The usage of EOR is largely for increasing the oil recovery from an old oil reservoir or well. But the process yields in two ways: additional recovery of oil and permanent storage of CO2 injected. It is found that almost 90-95% of CO2 is sequestered after the EOR process in these wells in saline formations and other rock pores. This permanent sequestration of CO2 is beneficial for the climate.

Q 16. What is the expected percentage of CO2 that can rebound to the surface along with produced oil in CO2-EOR? Also, can CO2-EOR be applied to condensate/gas fields?

A. FutureBridge Energy Consultant’s response:

It is found that almost 90-95% of CO2 is sequestered after the EOR process in the wells in the saline formations and other rock pores. This permanent sequestration of CO2 is beneficial for the climate. Therefore, the rebound CO2 is only about 5-10% along with additionally recovered oil. But this CO2 is again injected into the well after careful separation. Regarding the depleted gas condensate fields, these are important targets for CO2 sequestration and EOR. Retrograde condensate is deposited in the pore system once it has been depleted below the dew point. By re-pressurizing or maintaining reservoir pressure and enhancing liquid re-vaporization, CO2 injection in the depleted gas condensate reservoirs may enable greater gas recovery. Furthermore, it is mentioned that the process of CO2 miscible displacement, which is composition-sensitive, requires an accurate fluid characterization.

Q 17. The IEA has noted that CCS deployment “remains woefully below the level required in the Net Zero Emissions by 2050 Scenario”. Could you reflect on whether commercializing CO2 in these ways will make a difference to that?

A. FutureBridge Energy Consultant’s response:

Carbon capture technology has been around for decades and is used to capture carbon from industrial emissions as well as remove carbon that’s already in the air. The short answer is that techniques for carbon capture and storage are not well developed and are too expensive to be practical so far. And that is the reason for lower rates of carbon storage. Carbon dioxide in the atmosphere warms the planet, causing climate change. Human activities have raised the atmosphere’s carbon dioxide content by 50% in less than 200 years. Hence, commercializing captured CO2 by developing new uses and products such as concrete, chemicals, and fuels could reduce GHG emissions by a billion metric tons yearly. According to the Global Carbon Initiative, with suitable incentives, the entire CO2-based product business might use 7 billion metric tons of CO2 annually by 2030, or around 15% of our existing global emissions. Thereby, generating revenue and protecting the environment.

Q 18. In EOR, isn’t the CO2 injected into the oil reservoir mixing with water and transformed into acid?

A. FutureBridge Energy Consultant’s response:

There is no acid formation during the EOR process. The CO2 is injected into the well at a pressure and density high enough for the project. The injected CO2 flows through the rocks’ pore spaces, encounters any remaining crude oil droplets, and becomes miscible with the oil, generating a concentrated oil bank that is swept in the direction of the producing wells. These wells then can recover these oils with the help of four or more oil producers per well. The CO2 injected remains underground and gets permanently sequestered in the saline formations after the process.

Q 19. EOR is hardly compatible with Net Zero. Given that 20 of the 26 large-scale CCS plants operating globally rely on this to be commercially viable, can you reflect on how realistic the other methods are likely to be in encouraging investment in CCS?

A. FutureBridge Energy Consultant’s response:

CO2 injection for EOR is a mature market technology, but when this technology is used for CO2 storage, it is only economically feasible under specific conditions. Also, the other utilization pathways discussed are compatible and in line with the net-zero targets. eFuels is a well-known CO2 utilization pathway and mitigates CO2 emissions from the transportation and industrial sectors. CO2-cured construction materials deliver a product with superior performance and lower cost than conventional building materials. It can serve as a carbon sink, once scaled up. Hence, these utilization pathways are likely to encourage more investments since these can offset CO2 emissions and create a positive impact on climate change.

Q 20. If CO2 is captured (good) and then converted to an e-fuel, isn’t it then emitted again? How well would that work to address the overall CO2 emissions? Could you please talk about the energy efficiency of those processes?

A. FutureBridge Energy Consultant’s response:

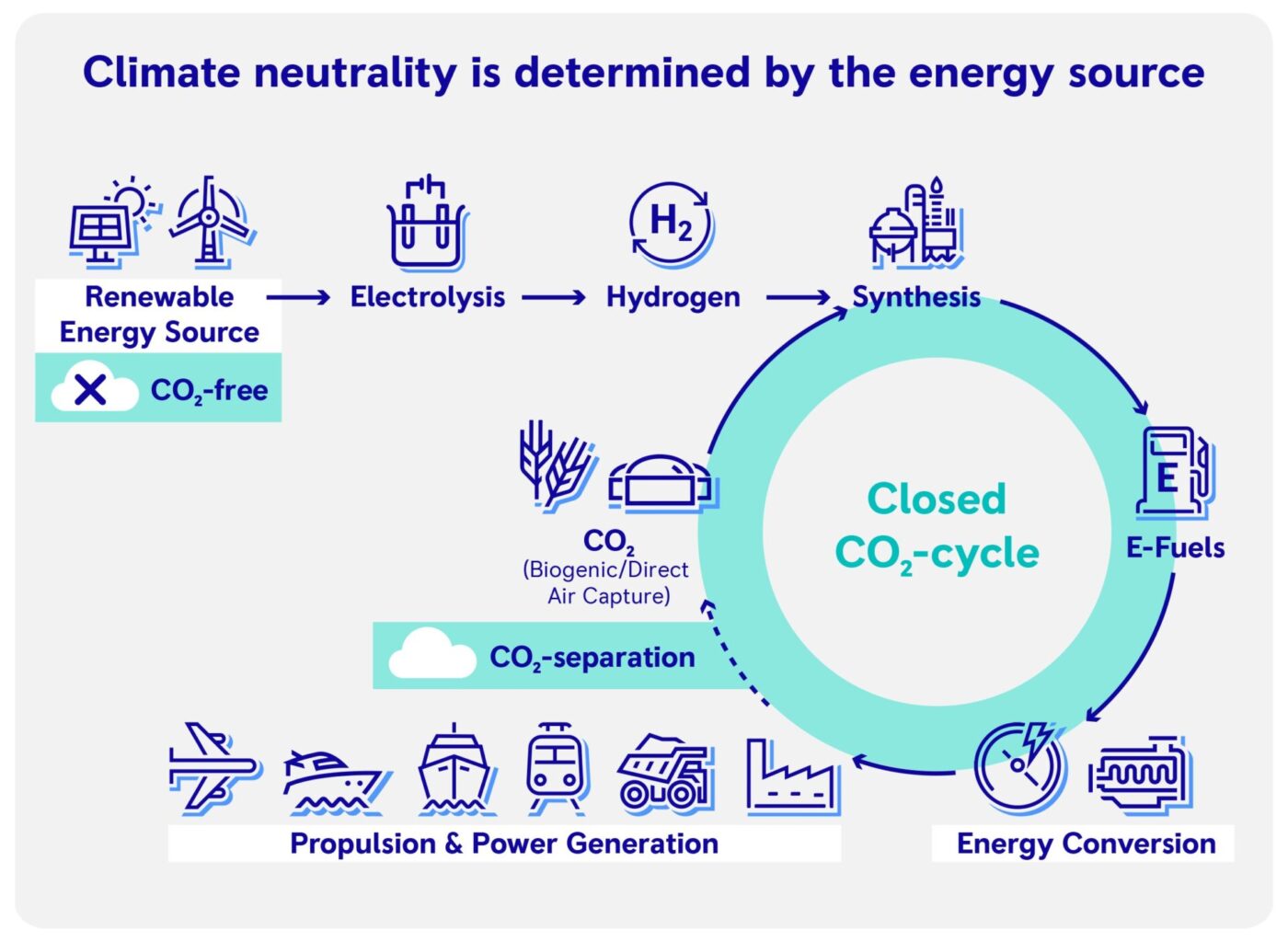

The captured CO2 is mixed with green hydrogen and undergoes a conversion process for producing eFuels. And yes, the CO2 converted to fuel can emit CO2 again during its applications. However, these emissions have much less effect on climate due to the absence of sulfur content in these fuels. the closed CO2 cycle can play a critical role here. The CO2 emissions from these application sectors can be captured again, synthesized, and again converted into eFuels for further usage. This way, eFuels can address the issue of CO2 emissions.

And regarding the efficiency of these conversion processes, it is approximately 70-80% for all processes. However, you can send us a BO for a detailed assessment.

(image credit: MTU-Solutions)

Q 21. Who are the main role players in CO2 capturing around the world?

A. FutureBridge Energy Consultant’s response:

The key players operating in the global carbon capture, utilization, and storage industry include Royal Dutch Shell PLC, Fluor Corporation, Mitsubishi Heavy Industries, Ltd., Linde Plc, Exxon Mobil Corporation, JGC Holdings Corporation, Schlumberger Limited, Aker Solutions, Honeywell International Inc. and Halliburton. Other players operating in this market include C-Capture Ltd., Tandem Technical, Carbicrete, Hitachi, Ltd., Siemens AG, General Electric, Total S.A., and Equinor ASA. If interested, we, FutureBridge, can give you a detailed assessment of players in this ecosystem.

Q 22. Electricity and H2 can also be used as fuel, so why use the detour using e-fuels? The CO2 in the end will not be removed from the atmosphere as the combustion in an engine will release it again. Wouldn’t a direct use of electricity or H2 be more energy efficient?

A. FutureBridge Energy Consultant’s response:

All these technologies can significantly contribute to lowering GHG emissions and controlling climate change; hence, they should be marketed accordingly and not against each other. Neither one will serve as the magic bullet for achieving all our environmental and climate goals. Only a technologically open approach will help achieve the highest degree of success – all the while promoting innovation and competition. Technically, some industries, like air traffic or heavy goods transport over long distances which, technically, are practically difficult to electrify. This existing fleet can be made climate-neutral by utilizing eFuels. This would particularly help lower-income households contribute to climate protection without having to pay additional conversion expenses. We, therefore, see the use of eFuels as complementary to e-mobility, not incompatible with it.

Q 23. What is the CO2 output from eFuels produced by the Fischer Tropsch process?

A. FutureBridge Energy Consultant’s response:

Fischer Tropsch is a conversion process for converting CO2 into eFuels. This process can produce e-jet fuel, e-petrol, and e-diesel for further applications in the transportation sector.

Q 24. If the options are either store CO2, which would cost, or utilize CO2 where value products are formed, do you think companies utilizing CO2 will need to pay for CO2 or would they offer to take it away for less money than it costs to store?

A. FutureBridge Energy Consultant’s response:

The CO2 utilized for producing value-added products is generally the captured CO2 from various industries. These industries tend to pay more for proper sequestration of CO2. The captured CO2 can be sold to these utilization companies for further conversion into value-added products and used to generate revenue from CO2 utilization.

Q 25. Is there any project storing CO2 with feedback on the projects these days?

A. FutureBridge Energy Consultant’s response:

The CO2-EOR project in China – Jilin Oil field project is operational since 2018. There was a significant increase in the oil recovery from the reservoirs approximately by 15% with CO2-EOR in this field. In 2020, the oil production due to EOR reached 3.95 million tonnes.

Q 26. Is the cost of 31,5 $ for each ton of CO2 calculated for the full lifetime of CO2 in the atmosphere or per year of CO2 in the atmosphere?

A. FutureBridge Energy Consultant’s response:

The cost for each ton of CO2 discussed in the slide is per year cost, which would increase in the coming years if the CO2 emissions were not controlled and mitigated properly. The proper mitigation and reduction of CO2 emissions will reduce this cost however, if not controlled the cost is going to increase by 200% by 2030.

Set up a meeting here to engage FutureBridge Energy consultants in your CCU implementations.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.