Read More About the Challenges

Rising Interest Rates

In response to post-COVID inflation, central banks globally hiked borrowing rates, with the US Federal Reserve notably raising them 11 times to a 22-year high. This has particularly impacted the offshore wind sector, which is characterized by prolonged project timelines (typically 8 – 13 years) compared to onshore wind projects (4-7 years). The high lead times of offshore wind farm construction are due to its inherently challenging nature. Steps such as securing environmental clearances and laying foundations in the sea are more demanding. For instance, the delay at Yunlin was caused by a third incident of monopile foundation spillage in the loose seabed soil, while the government consent for Ørsted ‘s $10 billion, 2.4GW Hornsea 3 megaproject was delayed for nearly a year due to concerns raised by conservation NGOs about its impact on the endangered Kittiwakes.

Supply Chain Problem

High supply chain cost inflation emerges as a critical challenge in offshore wind development. Material-intensive components such as giant turbines, steel foundations, substations, and sub-sea cables contribute to the escalating costs. With a surge in offshore wind projects, demand has outpaced the supply chain’s ability to keep up, evident in the scarcity of specially built turbine installation vessels.

Adding to the supply problem are government restrictions such as local content requirements (LCRs) that mandate developers to procure most of their equipment from local manufacturers and employ local companies to provide construction services. While beneficial in the long term, these policies disrupt developers’ existing supply chains, increasing project costs.

The impact is further exacerbated by past procurement policies, where developers secured heavy discounts for bulk orders to win auctions, leading to razor-thin margins for suppliers, especially wind turbine manufacturers. With inflation driving up labour and material costs, manufacturers are now passing more of these expenses to developers, challenging the financial viability of projects.

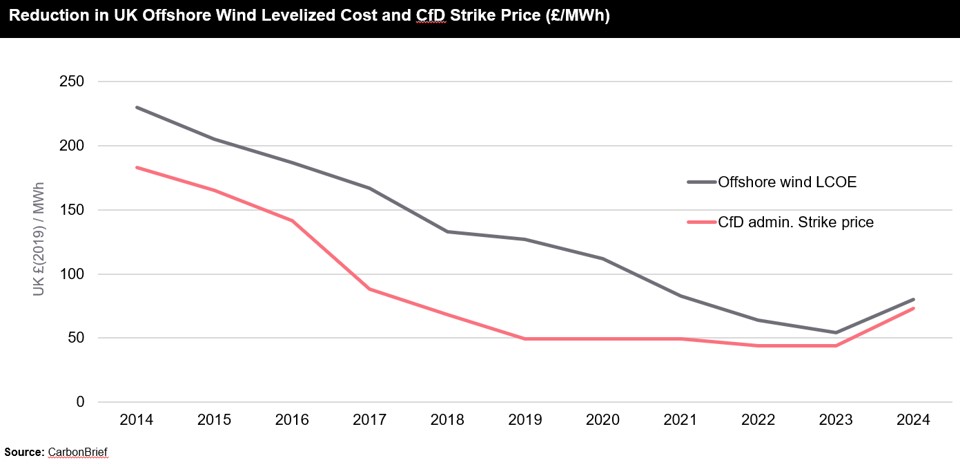

Reluctance to Adjust Prices

In the face of escalating supply costs, wind developers encounter a unique challenge—long-term contracts stipulating fixed power prices, set during auctions, limit their ability to offset these increases by raising prices. While this fixed-price model fosters investor confidence by providing a stable projection of future returns, it now poses a threat to ongoing projects due to aggressively rising costs.

Most governments are unwilling to increase the power procurement price as any increment would have to be passed down to the public that is already grappling with inflation, which would possibly create a politically tense situation. A denial to adjust prices by the New York Public Service Commission was cited by Ørsted as a major factor in their decision to exit their US project.