Impact of Policy Landscape on Future of EV Charging Infrastructure

Listen to this Article

mins | This voice is AI generated.

mins | This voice is AI generated.

Electric vehicles are being looked at as a key enabler of the decarbonization of the transport sector. Countries across the world are focusing on developing policies and incentive programs to foster the accelerated adoption of electric vehicles. As a result, the global electric vehicle fleet has expanded significantly over the last few years. Global electric car stock rose to 7.2 million in 2019 marking year-on-year growth of 40%.

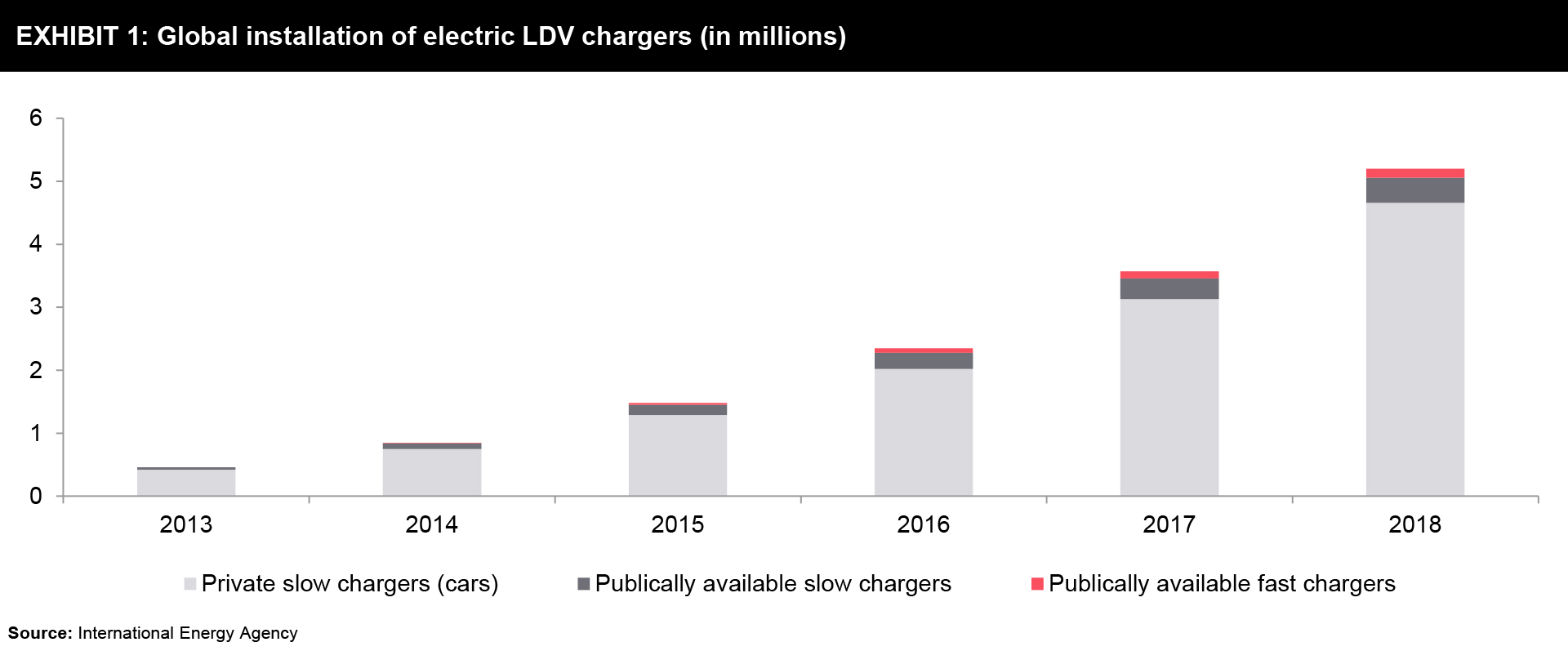

The critical link in the electric transport ecosystem remains the charging infrastructure. Hence, the infrastructure for electric vehicle charging has also expanded along with the EV fleet. There were around 7.3 million chargers installed worldwide in 2019. The growth of charging infrastructure is strongly connected to policies, regulations, and incentive programs.

Exhibit 1 depicts the global installation of electric LDV chargers over the period of 2013 to 2018.

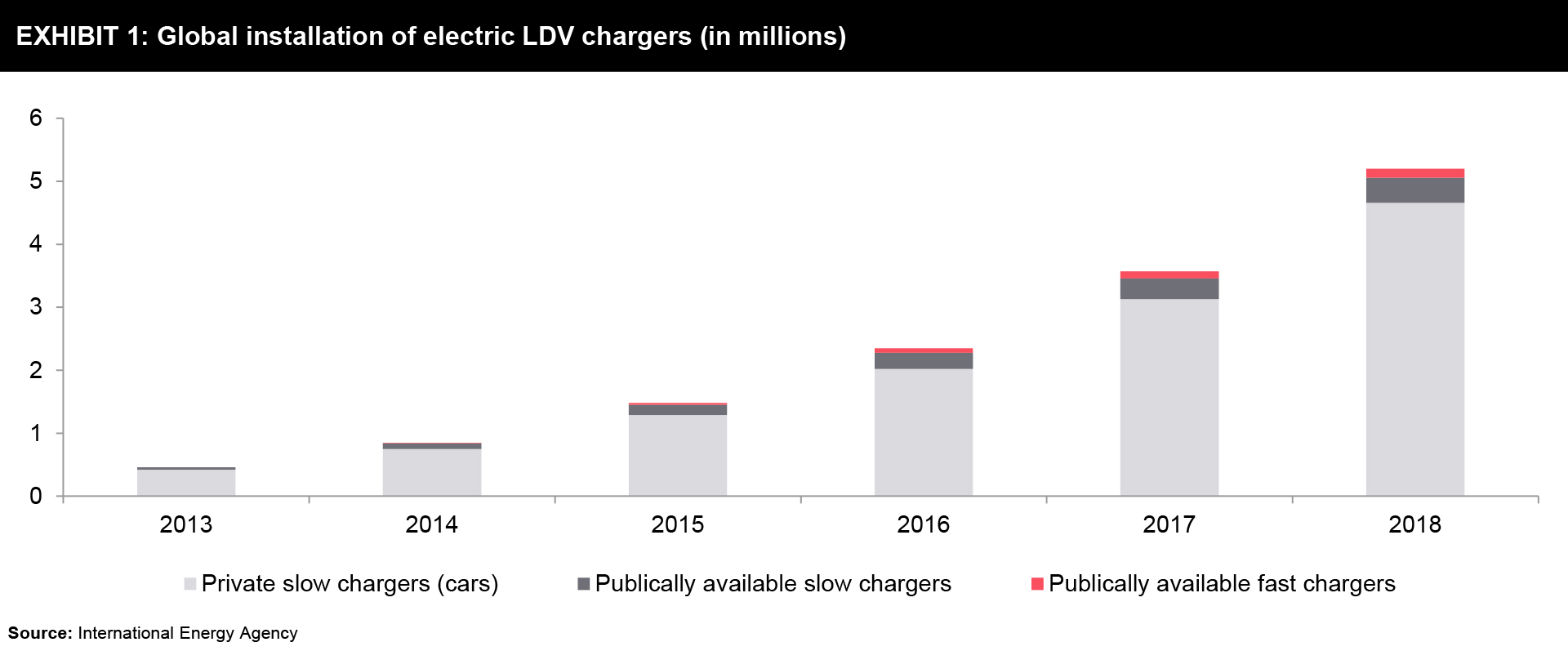

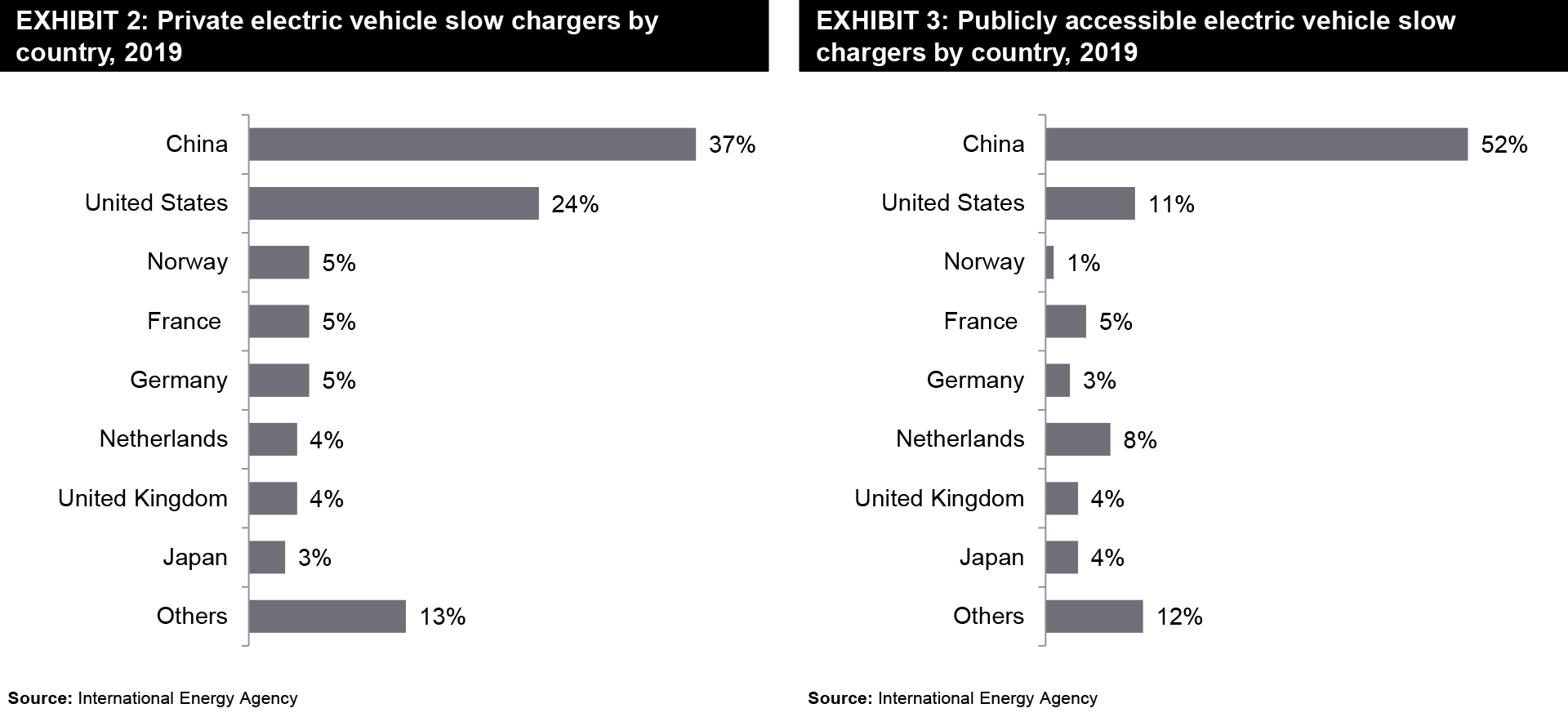

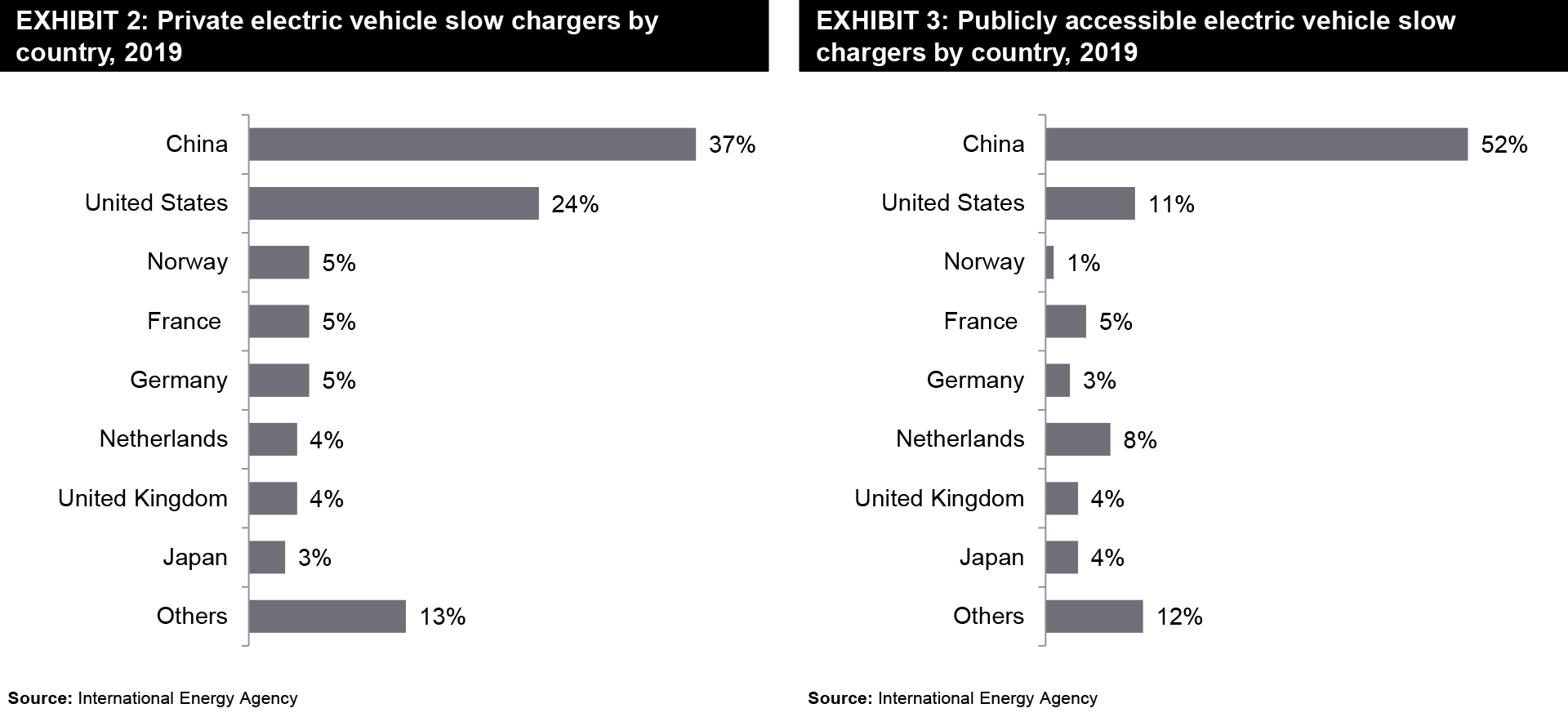

By the year 2019, there were nearly 7.3 million chargers installed worldwide out of which 6.5 million were private, light-duty vehicle slow chargers in homes, multi-dwelling buildings and workplaces. Publicly accessible slow chargers stood to be 598 thousand by 2019. Exhibit 2 and Exhibit 3 depict the number of chargers by country.

It can be seen from the exhibits that China is leading in both, public and private, charging infrastructure markets followed by the United States.

To allow higher penetration of electric vehicles, it is necessary to build the required charging infrastructure. Policies, regulations, incentive programs play a critical role to facilitate the accelerated deployment of charging infrastructure.

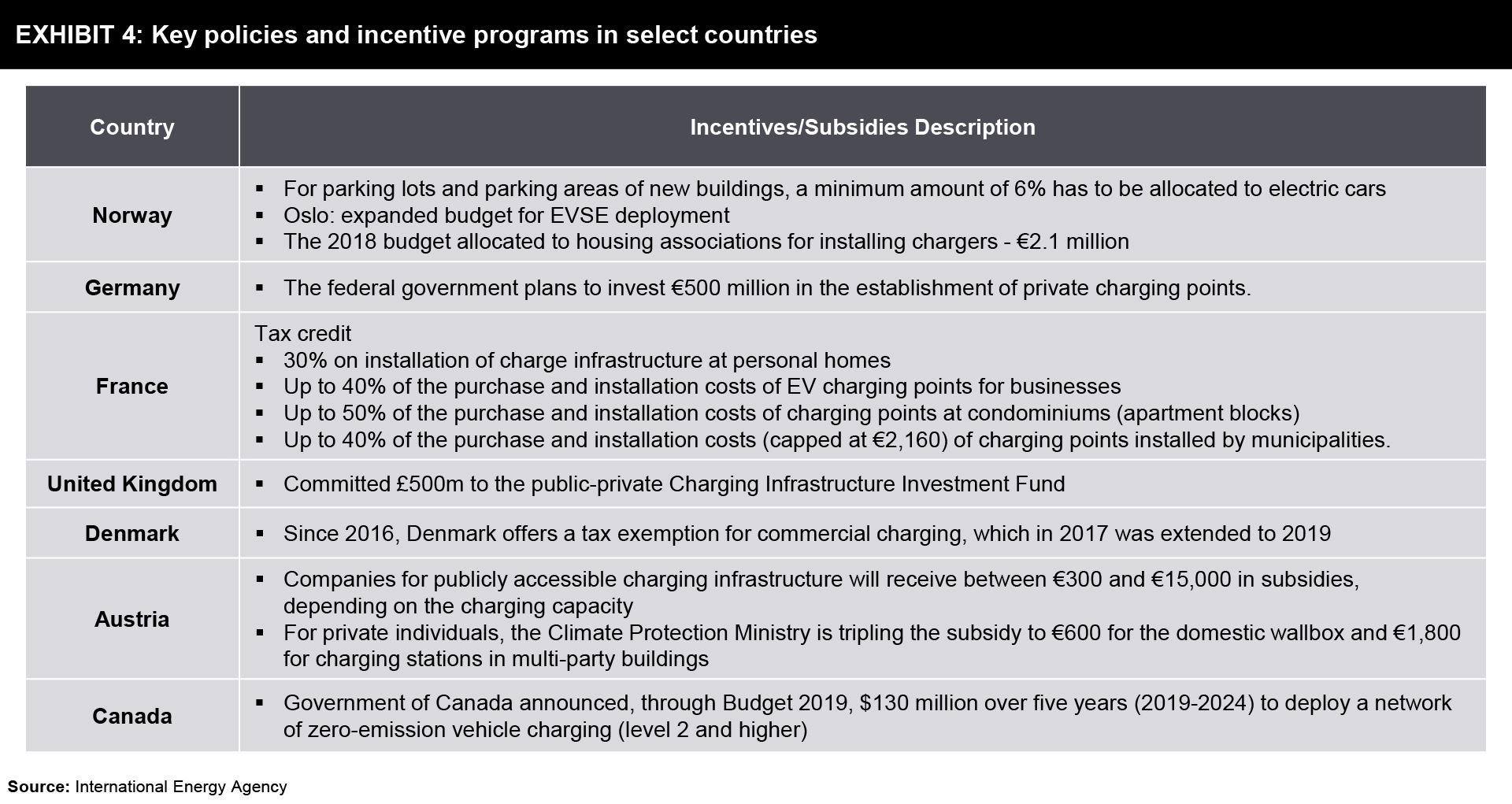

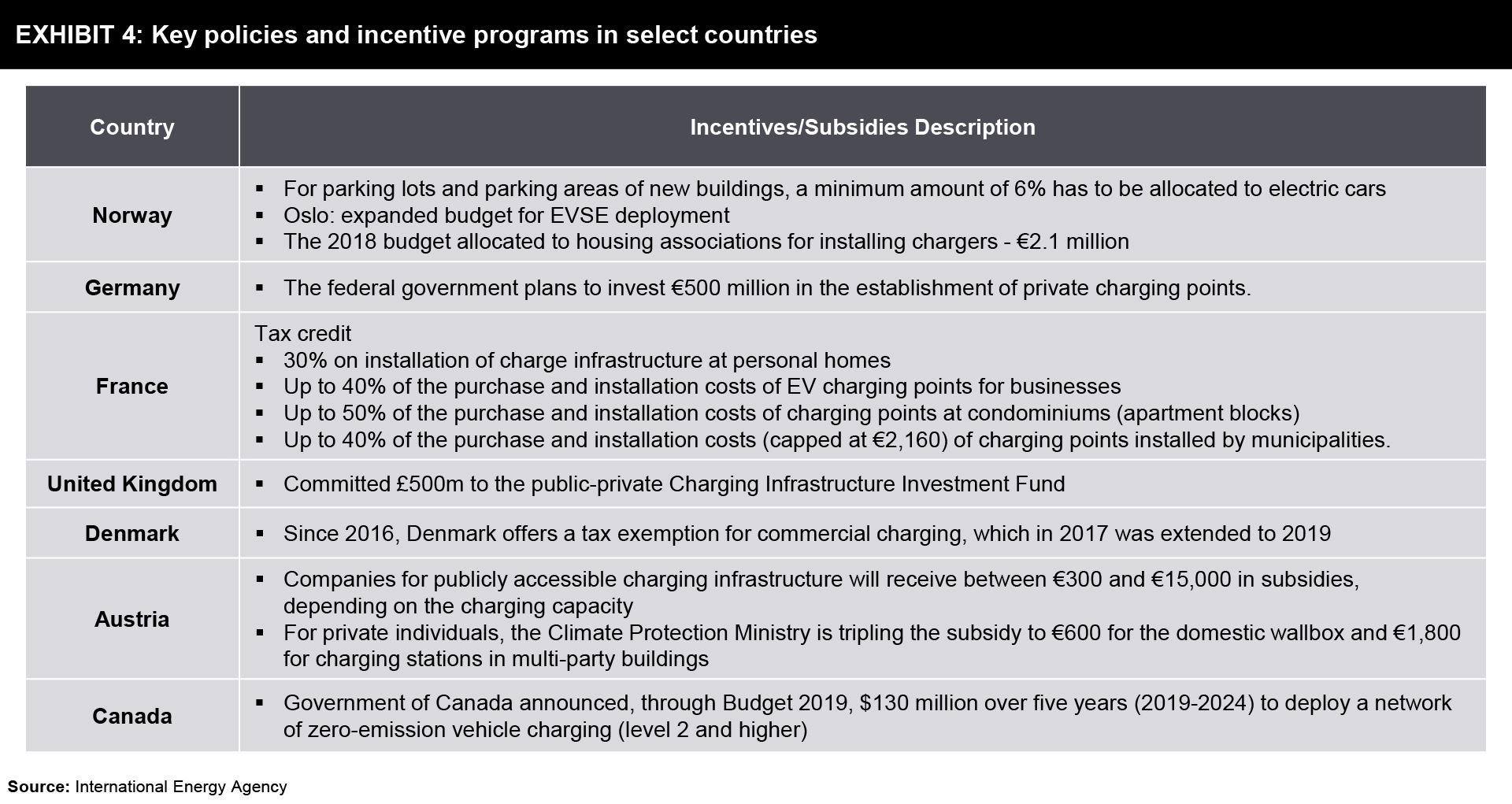

Exhibit 4 summarizes key policies and incentive programs in select countries.

While many countries are coming up with incentives for EV charging infrastructure, it is important to have a look at the policy landscape of China and the United States, the leading regions for EV charging infrastructure.

China

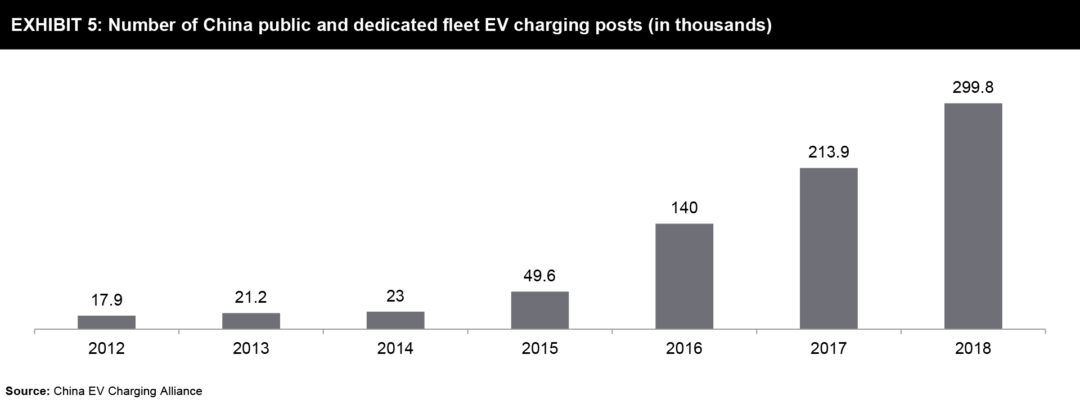

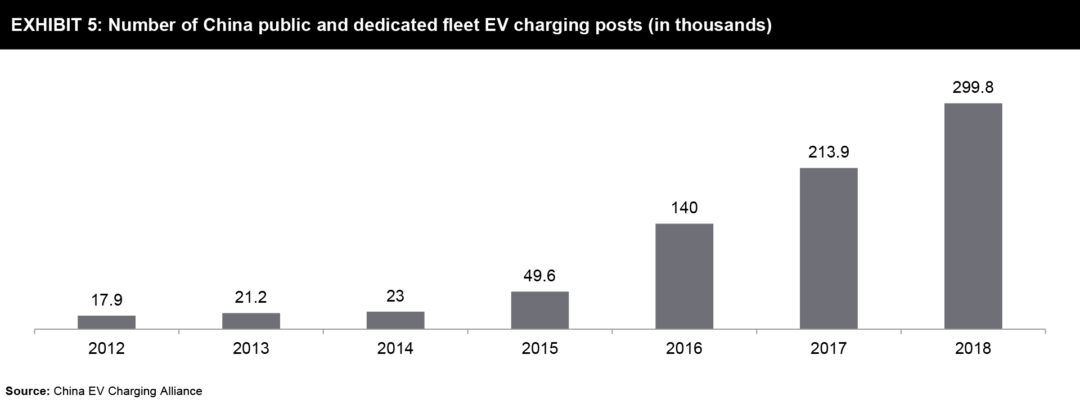

With an 81% share in the world’s publically accessible electric vehicle fast chargers and a 52% share in publically accessible electric vehicle slow chargers, China leads the public EV charging market. At the same time, the country is also lading private EV charging market with 37% share in world’s total installed private electric vehicle slow chargers. Exhibit 5 indicates the growth of China’s EV charging infrastructure from 2012 to 2018.

The development of EV charging networks is considered a matter of national policy by the Chinese central government. In September 2015, the State Council issued the Guidance on Accelerating the Construction of Electric Vehicle Charging Infrastructure. The guidance suggests that all new residential construction should be equipped with EV charging and 10% of parking spaces in large public buildings to be available for EV charging. While suggesting that at least one public charging station be available for every 2,000 EVs, the guidance called for charging infrastructure sufficient for 5 million EVs by 2020. The public-private partnership to develop charging infrastructure at public places and incentivization of these installations were suggested by the guidance. In October 2015, National Development and Reform Commission (NDRC) issued the Guidelines for Developing Electric Vehicle Charging Infrastructure (2015–2020). The guidelines called for at least 120,000 EV charging stations and 4.8 million EV charging posts by 2020. In January 2016, the National Energy Administration released a notice summarizing five new national standards for electric vehicle charging interfaces and communications protocols. In the same month, funding of RMB 90 million was announced through 13th Five Year Plan for New Energy Vehicle Infrastructure Incentive Policies to install charging infrastructure. In July 2016, NDRC published a Notice on Accelerating Residential EV Charging Infrastructure Construction, setting out standards and procedures for residential charging.

Along with the central government, many provincial and local governments also support EV charging with financial incentives, requirements with respect to new building construction, and other policies. Utility Rate Design is yet another factor to facilitate EV charging infrastructure development. In 2014, NDRC classified EV charging rates into three categories –

The regulations were set for these tariffs. Time-of-use rates for EV charging remained yet another driver. As a result of all the above initiatives, deployment of EV charging infrastructure was boosted in the year 2015-2016.

United States of America

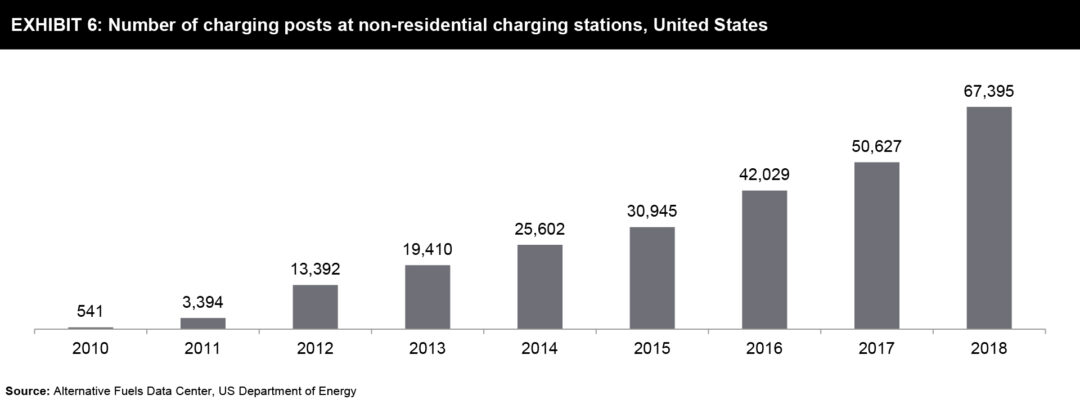

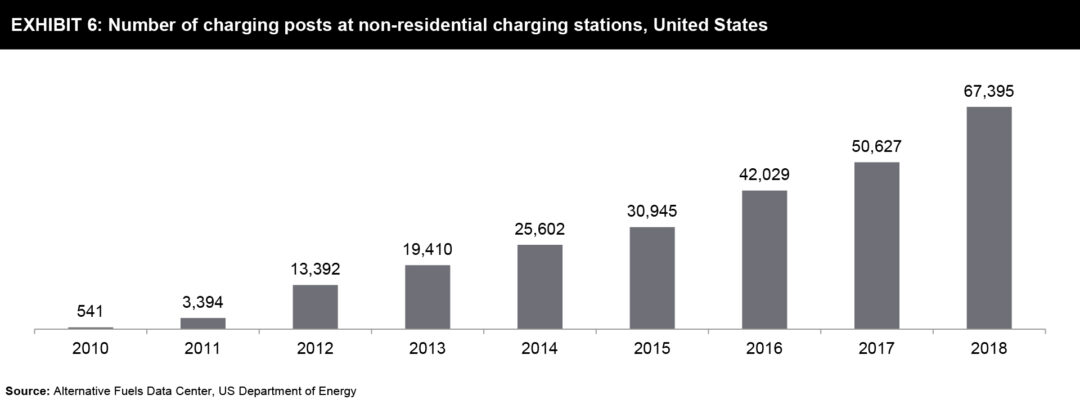

USA stands second in EV charging infrastructure deployment, after China. The yearly number of non-residential charging posts in the USA is indicated in Exhibit 6.

In the USA, state and local governments play important roles with regards to the development of charging infrastructure than the US federal government. While many states and city governments offer incentives such as rebates, tax credits, tax exemptions, grants, and loans for the installation of EV charging equipment, Federal policies also include benefits like a tax credit, voluntary programs to support workplace and municipal EV charging run by the US Department of Energy, the designation of EV charging corridors on US highways, etc.

Apart from fiscal incentives, standards, mandates, and codes are being promoted by states. State governments are also playing a key role in preparing highway corridors for EV charging.

Time-of-use pricing for EVs and demand response programs where EVs can participate in the wholesale market are yet other drivers of EV charging in the USA.

From the examples of China and the USA, it is clear that EV charging infrastructure deployment is strongly connected to government policies and incentives. For the successful deployment of electric vehicles, it is imperative to have charging infrastructure in place. Policies play a critical role in this development.

Policymakers will need to send out appropriate signals for the growth of charging infrastructure. EV charging infrastructure operators can be facilitated to participate in grid service businesses. Enabling new viable business models in the EV charging domain to create additional sources of income for charging station operators will promote the new market players to enter into this business. This can also lead to more economically viable EV charging services for EV owners. Demand response programs and time-of-day tariffs can help facilitate smooth EV integration into power grid operations.

Fiscal and non-fiscal incentives, standards of EV chargers, and mandates will remain the key drivers of EV charging infrastructure in near future. Central and local governments in different countries will be the important players to drive the growth.

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur long-standing clients include some of the worlds leading brands and forward-thinking corporations.