Impactful Insights and Recommendations

Industry hype has been driving messages that predict a dramatic fall in Green Hydrogen costs by 2030, consequently fostering substantial demand growth. However, our industry analysis indicates a potential disparity between these forecasts and actual market realities. The continued high cost of renewable energy sources, coupled with inconsistent government policies and the current high cost of electrolyzer technology, cast doubt on the viability of the foreseen low-cost, high-demand Green Hydrogen economic landscapes. A healthy market is anticipated within the Green Hydrogen value chain. However, prudent stakeholders are advised to reconsider their ongoing investment strategies, potentially shifting focus areas, and devising alternative market approaches to accommodate more conservative growth, revenue, and margin estimations. We recommend thoroughly reviewing growth forecasts and strategic plans and aligning them with alternative economic models that account for lower demand and higher costs. Prospective market entrants should reassess their assumptions, considering the impact of sustained high production costs and slower demand uptake on critical financial metrics such as Return on Capital Employed (ROCE), Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and time to value, before committing to substantial investments.

Background

It is derived from renewable energy through electrolysis, which splits water molecules into hydrogen and oxygen. Its potential as a clean energy carrier holds promise for decarbonizing heavy industries, transportation, and power generation. Despite its touted benefits, the practical cost of Green Hydrogen raises significant concerns. Numerous industry analysts have forecasted a substantial cost decrease in Green Hydrogen by 2030, aiming to make it competitive with fossil-derived hydrogen. However, FutureBridge’s research suggests a cautious outlook. Anticipated cost reductions might not materialize as optimistically envisioned, with several underlying assumptions facing challenges in these scenarios.

Challenges to Green Hydrogen Costs

It’s heralded as a clean energy solution, faces significant challenges primarily concerning its cost efficiency. Understanding and addressing these cost-related obstacles is pivotal in unlocking the full potential of green hydrogen as a sustainable energy source.

Renewable Energy Prices

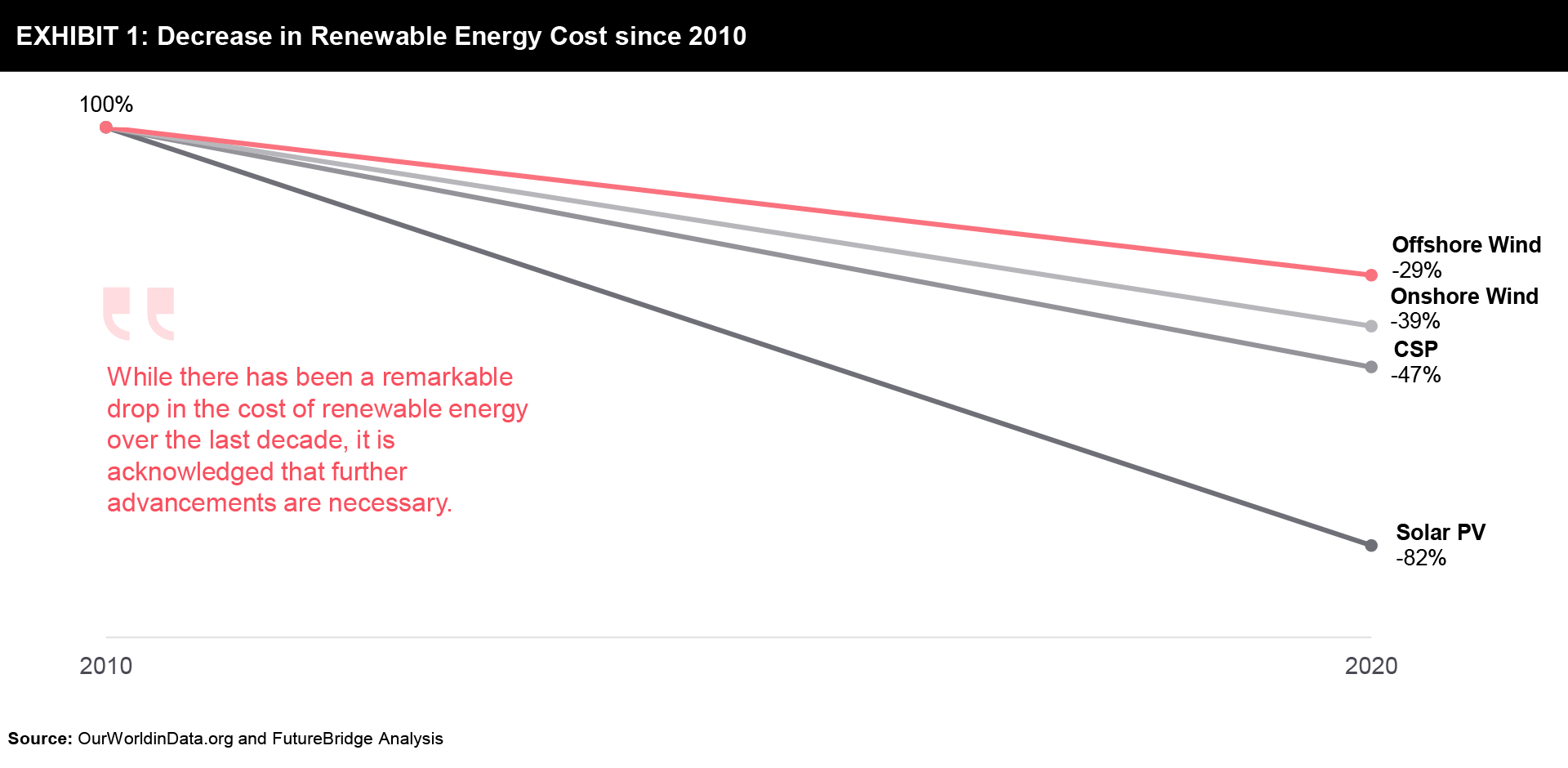

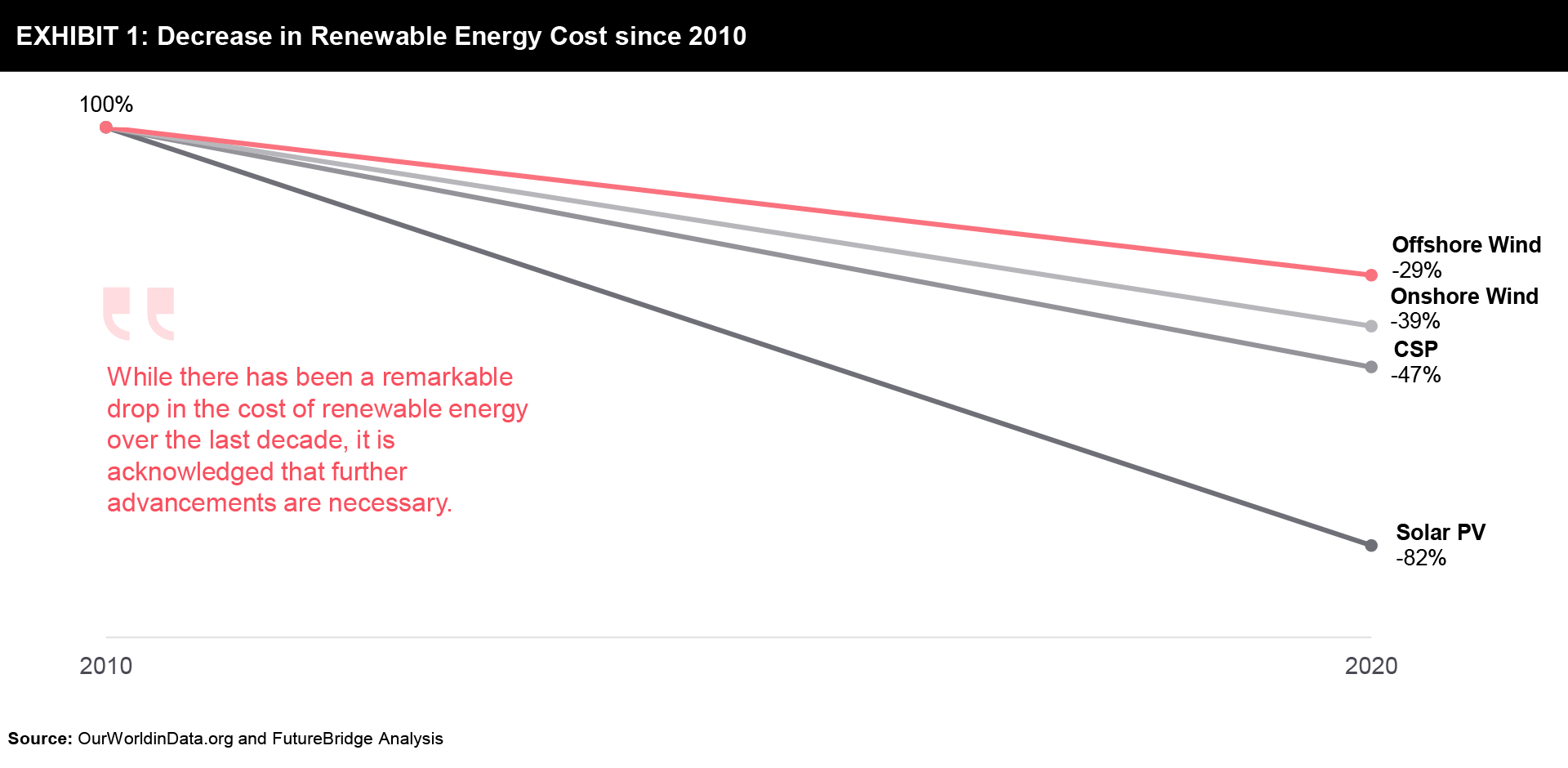

Many projections modeling hydrogen production costs are heavily reliant on the assumption that the cost of renewable energy, a crucial operating cost component in Green Hydrogen production will fall dramatically. Recent trends however indicate that a slower-than-expected decline in renewable energy source costs is more plausible. This creates a significant challenge to the ambitious cost reduction goals.

The primary renewable sources powering Green Hydrogen production (solar and wind energy), are experiencing fluctuations in their cost trajectories. While there has been a notable drop in prices since 2010, the pace of further reduction is not meeting the aggressive assumptions underpinning a Green Hydrogen cost model touted in the industry.

Infrastructure Costs

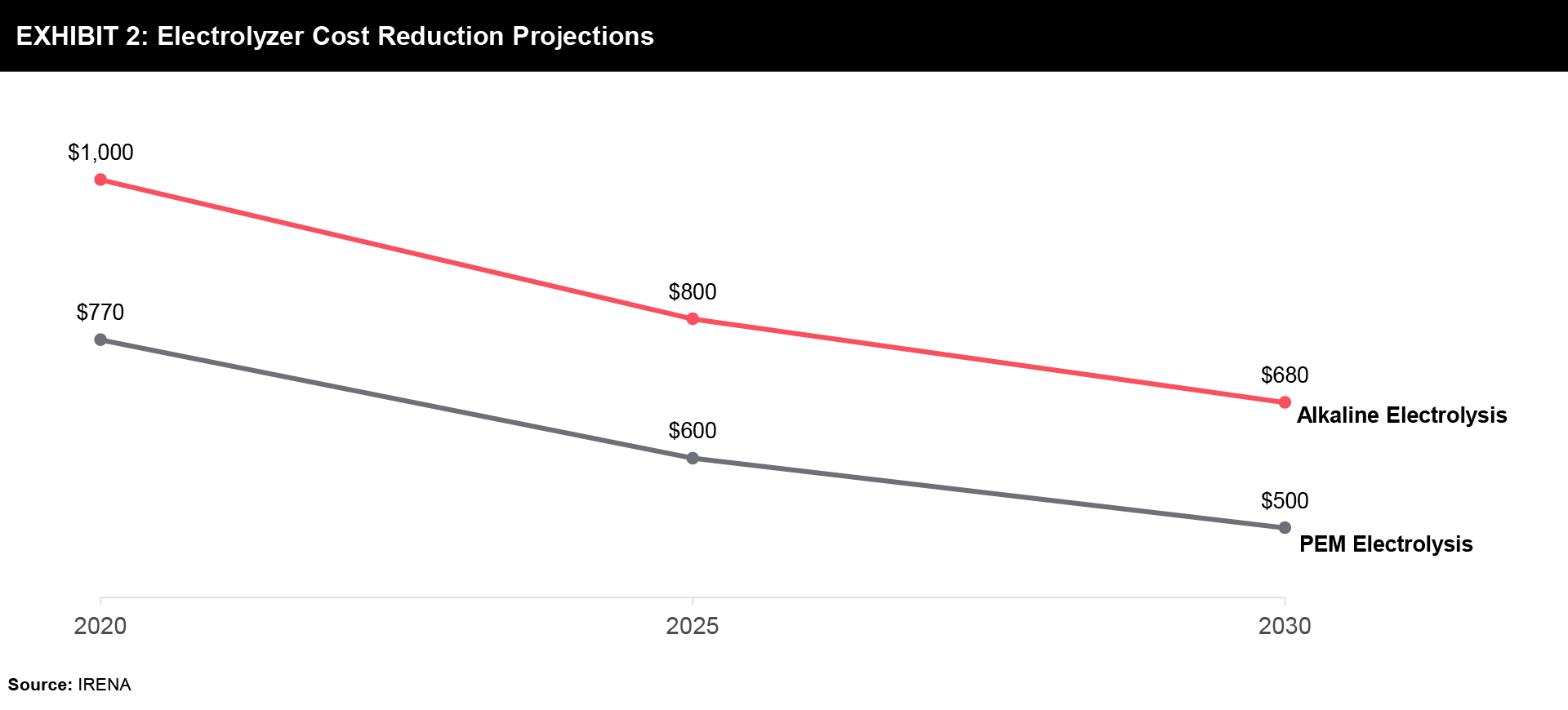

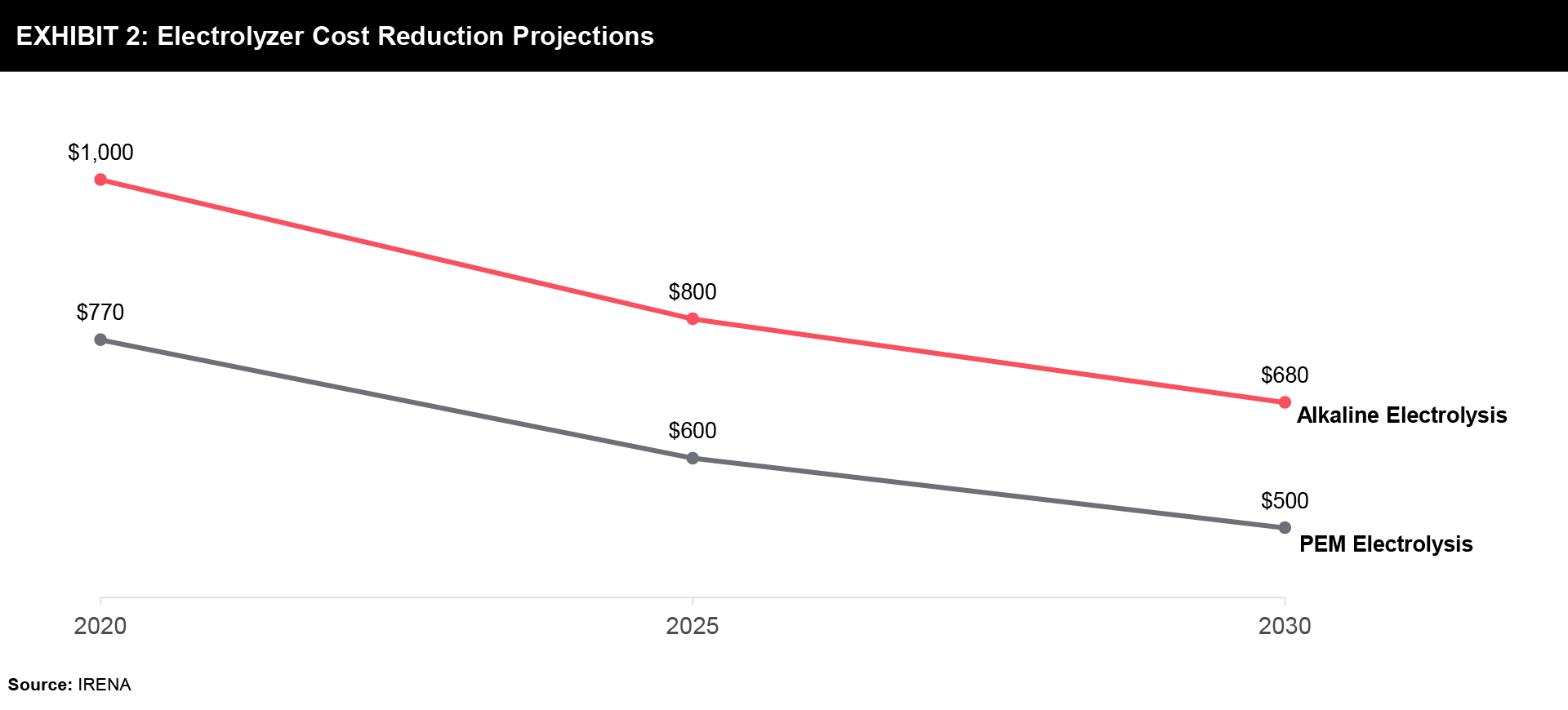

The cost of electrolyzers, a fundamental component of Capital Costs in green hydrogen production, hasn’t decreased as expected. Anticipated economies of scale and technological advancements haven’t delivered the projected cost reductions. Establishing production facilities demands substantial upfront capital. Financial models based on low-cost, high-volume Green Hydrogen demand may face challenges. Concerns regarding supplier viability and long-term purchasing contracts could arise in the renewable energy sector within the future of the green hydrogen economy.

Moreover, emerging technologies like anion exchange membrane electrolysis and membrane-free electrolyzers are garnering attention, signaling potential shifts in the hydrogen production paradigm. To explore these innovations further, check out our article on Green Hydrogen Generation or connect with us for latest insights into new hydrogen production technologies.

The infrastructure costs linked to expanding green hydrogen production are frequently overlooked in optimistic projections. Building an efficient hydrogen supply chain necessitates substantial investments in constructing electrolysis plants and transportation and storage infrastructure.

Regulatory Landscape

Despite political statements a lack of well-defined and supporting regulatory structures continues to be the norm in most countries. This will continue to limit the rapid adoption of Green Hydrogen technology. Under high growth conditions and absent significant market-driven changes to production costs, the momentum will rely heavily on Governments adopting a more active role. They need to introduce policies promoting Green Hydrogen production and usage while penalizing carbon-intensive alternatives. Evidence indicates that policy changes of this nature will take several years to come into effect. In the interim, a stable and supportive regulatory environment will be the key component to encourage the necessary investments and technologies to minimize costs.

Perspectives Unveiled

A leading energy economist from the United Kingdom observes:

While the initial projections were optimistic, the reality of slower-than-expected declines in renewable energy costs and electrolyzer expenses have become apparent. Achieving the anticipated cost competitiveness by 2030 requires a concerted effort in advancing both renewable energy technologies and electrolysis processes.” While the initial projections were optimistic, the reality of slower-than-expected declines in renewable energy costs and electrolyzer expenses have become apparent. Achieving the anticipated cost competitiveness by 2030 requires a concerted effort in advancing both renewable energy technologies and electrolysis processes.” |

Quote by an investment analyst specializing in clean energy on the financial aspects:

Investors are keen on supporting green hydrogen initiatives, but uncertainties around project economics and return on investment are inhibiting larger-scale investments. Clearer financial incentives and reduced risks are necessary to attract the level of capital required to drive down costs and make green hydrogen competitive with traditional alternatives.” Investors are keen on supporting green hydrogen initiatives, but uncertainties around project economics and return on investment are inhibiting larger-scale investments. Clearer financial incentives and reduced risks are necessary to attract the level of capital required to drive down costs and make green hydrogen competitive with traditional alternatives.” |

The CEO of a prominent renewable energy company highlights the challenges faced by corporations in meeting green hydrogen cost targets and states:

Our commitment to green hydrogen production is unwavering, but the expected economies of scale in electrolyzer manufacturing have been slower to materialize. Governments and industry players need to collaborate more closely to create an environment that fosters innovation and accelerates cost reduction initiatives.” Our commitment to green hydrogen production is unwavering, but the expected economies of scale in electrolyzer manufacturing have been slower to materialize. Governments and industry players need to collaborate more closely to create an environment that fosters innovation and accelerates cost reduction initiatives.” |

Critical Success Factors

Addressing the challenge of high electrolyzer prices involves bolstering R&D efforts and investment. Electrolyzers must undergo further refinement for enhanced efficiency and cost-effectiveness. Strategic investments in breakthrough technologies, coupled with collaborative partnerships between the public and commercial sectors, are pivotal to accelerating electrolysis advancements. Caution is advised, as the proliferation of startups promoting breakthrough technology suggests that not all may prove financially viable, relying on acquisition by major players for survival.

Moreover, securing the production and availability of key materials like rare metals and catalysts is imperative for electrolysis. Diversification and resilience building within the global supply chain for these critical components are necessary to prevent bottlenecks that could hinder the scalability of green hydrogen technologies.

Conclusion

Though the vision of a hydrogen-powered future remains steadfast, achieving cost competitiveness for green hydrogen by 2030 presents unforeseen challenges. Initial optimism has tempered, leading us to foresee a more realistic cost range between $3 and $4 per kilogram for green hydrogen by 2030.The interconnected nature of renewable energy costs, infrastructure development, regulatory frameworks, and technological advancements require a holistic and collaborative approach.

Recalibrating expectations, addressing challenges head-on, and fostering international cooperation are all critical to realizing green hydrogen’s potential in the pursuit of a more sustainable and cleaner energy future.

To uncover deeper insights and actionable strategies for a sustainable energy future, contact us to consult with our expert analysts.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.