Ammonia, an infamous pollutant and a smog ingredient, which is perceived as a threat to the ecosystem could be a key element to realizing decarbonization in the coming times. With the discovery of new applications, green ammonia could play a pivotal role to tackle not only the existential challenges of decarbonizing the energy value chain but also in generating CO2-free energy.

While current markets drive most of the demand growth this decade, the emergence of new markets over the next few decades is expected to drive significant development for ammonia as a marine fuel, hydrogen carrier, and fuel for stationary power and heat. This article elaborates on the potential role of Ammonia in decarbonizing the maritime industry and the associated opportunities and challenges.

Why is Green Ammonia gaining popularity?

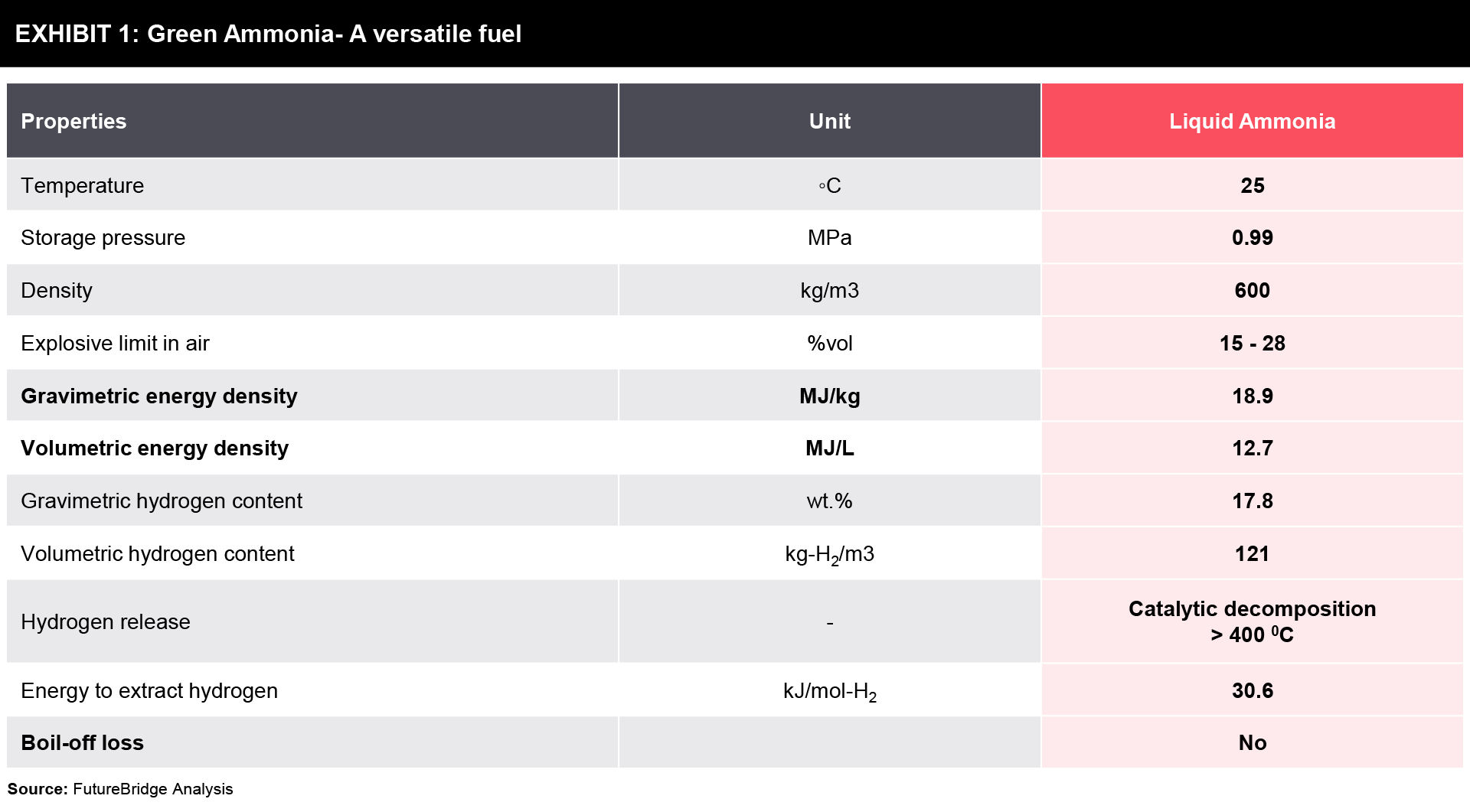

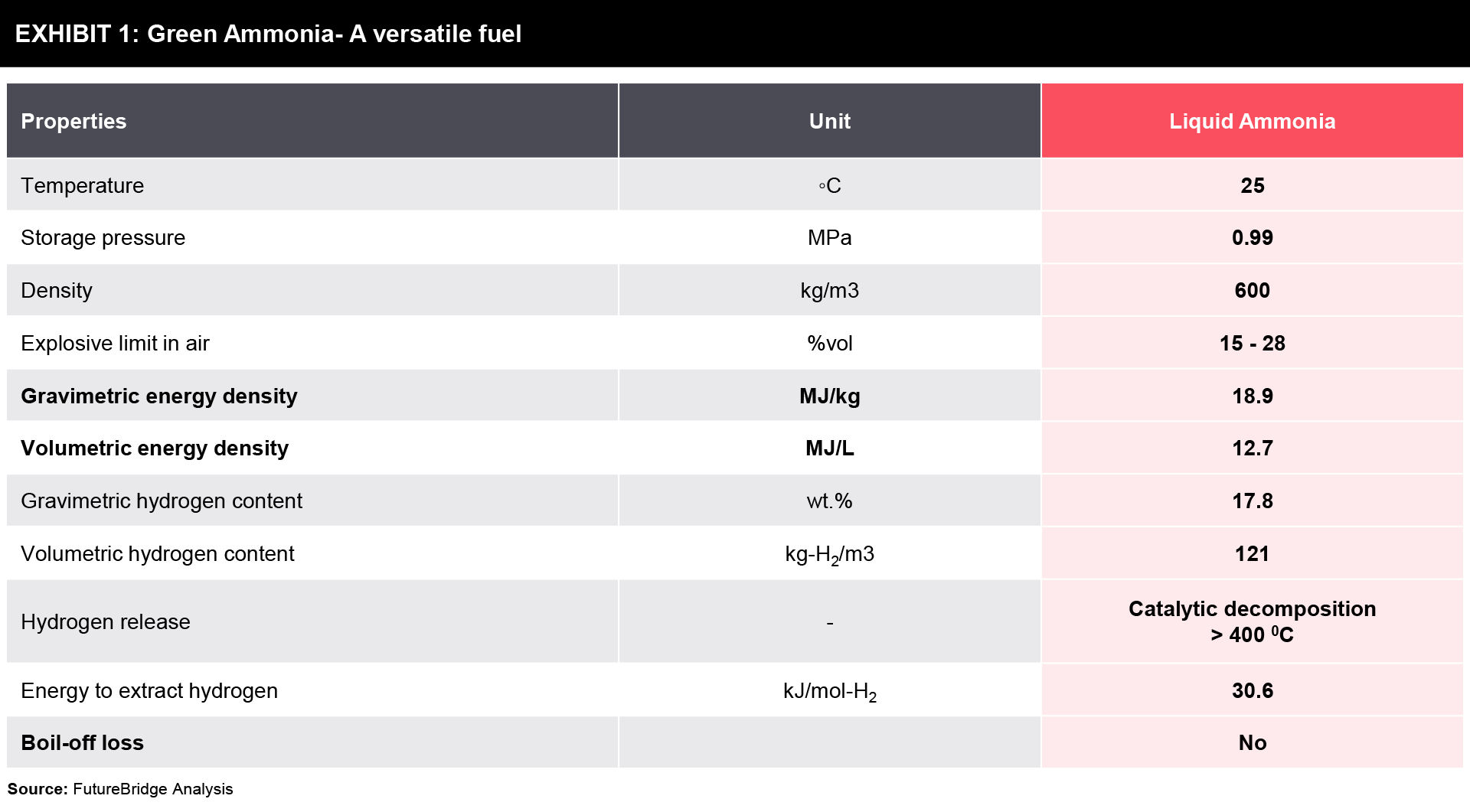

Green ammonia is seen as a versatile feedstock owing to the chemical properties due to which varied developments are foreseen across the value chain. Ammonia has a high volumetric hydrogen density of 107.3 kg H2 per cubic meter, because of its property to be liquefied by compression below ~1 MPa at 25° C. The vapor pressure of liquefied ammonia is similar to propane. Also, it has a high gravimetric hydrogen density of 17.8 mass% compared with solid-state hydrogen storage materials.

Green Ammonia has the potential to reduce carbon emissions in electricity generation and other sectors such as transportation and manufacturing. Several demonstration plants are using variable solar and wind energy in conjunction with electrolyzers to generate green hydrogen. The first green hydrogen feed to be tied into an existing ammonia plant became operational in December 2021 in Spain, and the first gigawatt (GW)-scale green ammonia plant, with a capacity of 1.2 Mt per year, is under construction in Saudi Arabia and is planned to begin operations in 2025. More than 60 green ammonia plants were announced during 2020 and 2021, while only 10 carbon fossil-based ammonia plants with CCS or with methane pyrolysis technology have been announced suggesting a strong shift towards green ammonia.

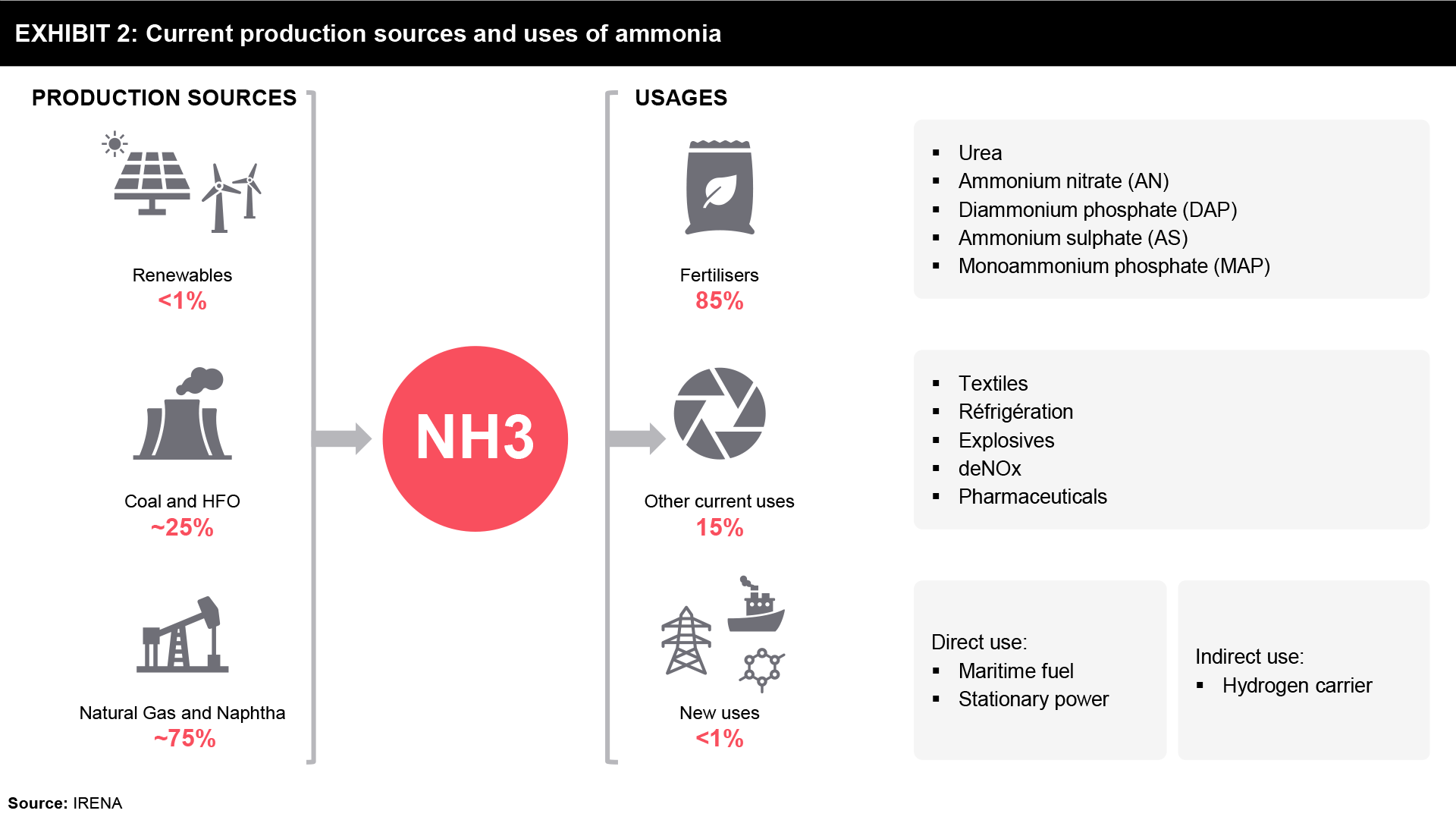

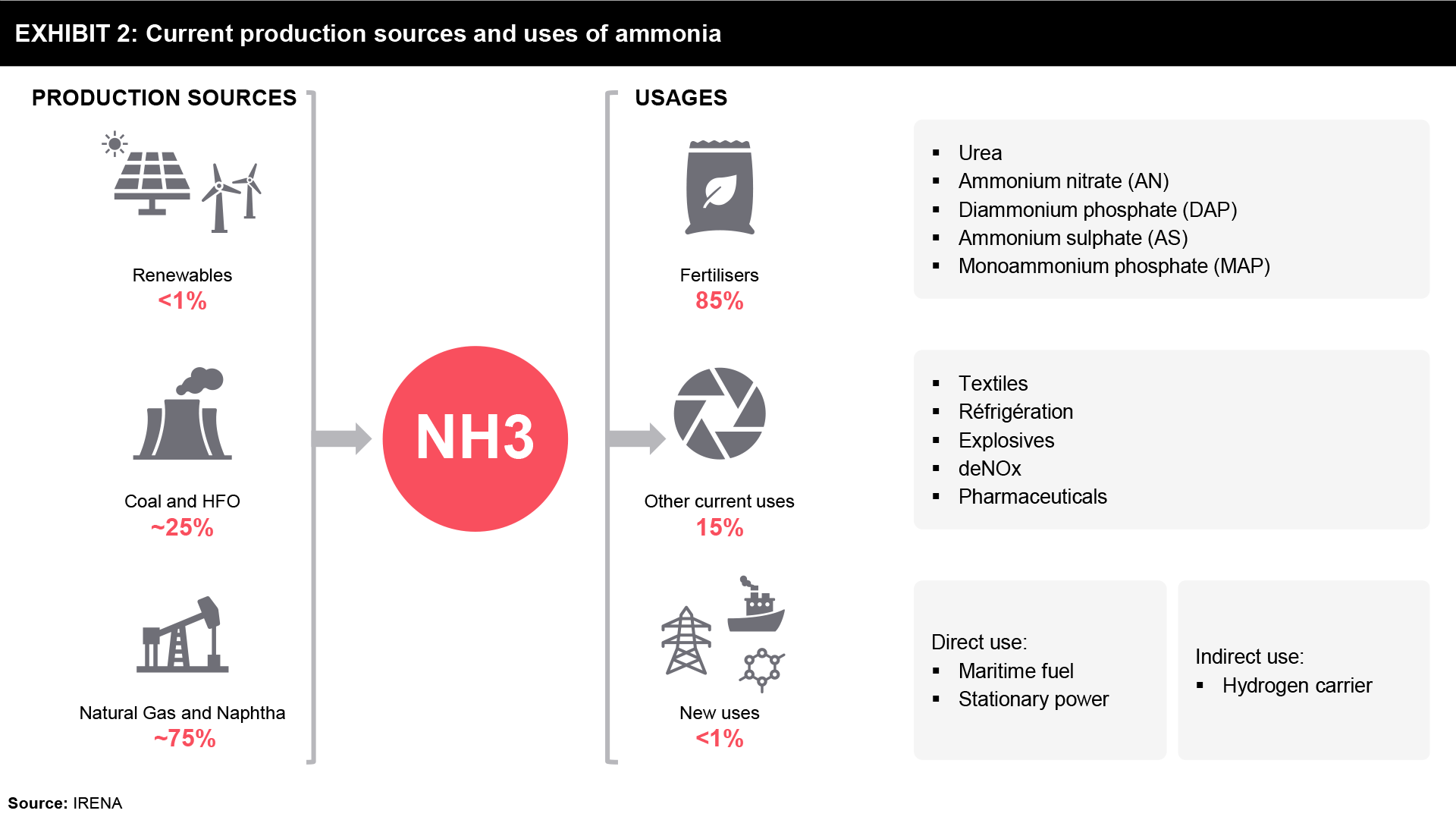

Green ammonia is expected to become a leading alternative fuel in both current and future markets, with various applications including serving as a hydrogen carrier, fuel for stationary power and heat, and as a transport fuel, particularly in the maritime industry. The current production pathways and usages of Ammonia are as shown below:

Nitrogen fertilizers account for around 80% of today’s total ammonia demand. Other markets include are manufacturing of chemicals, plastics, and textiles (acrylonitrile, melamine); the mining industry (low-density ammonium nitrate explosives, metals brightening processes); pharmaceuticals; refrigeration; waste treatment; and air treatment, such as abatement of nitrogen oxide (NOX). Despite its potential. less than 1% of ammonia is currently sourced from renewables and is not used for zero-carbon applications beyond research, development, and demonstration projects.

Ammonia as Maritime fuel

According to International Maritime Organization (IMO), the shipping industry’s annual Greenhouse Gas (GHG) emissions are over one billion tonnes, which is more than the emissions of any single country outside the world’s top five emitters – This highlights the urgency of decarbonization efforts.

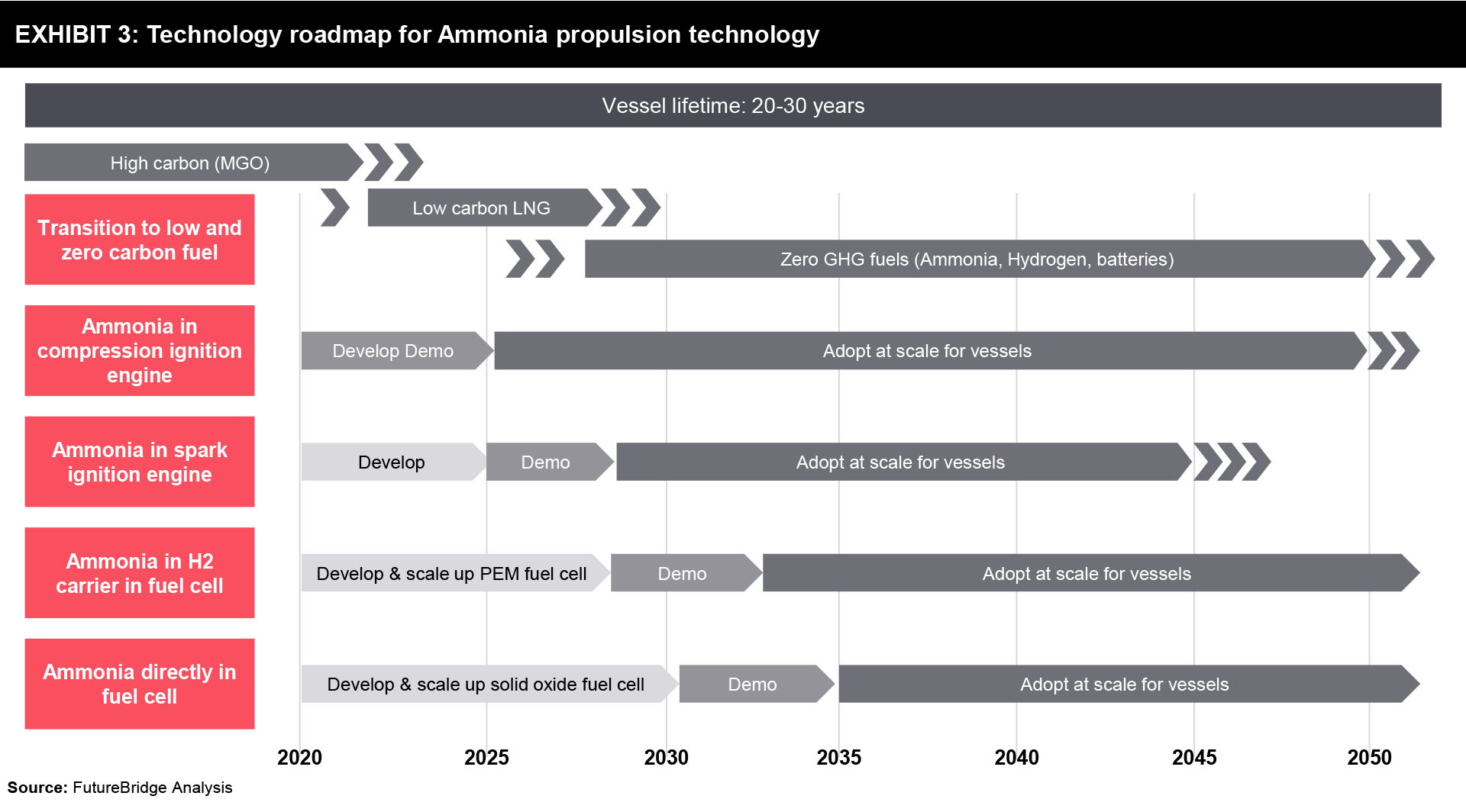

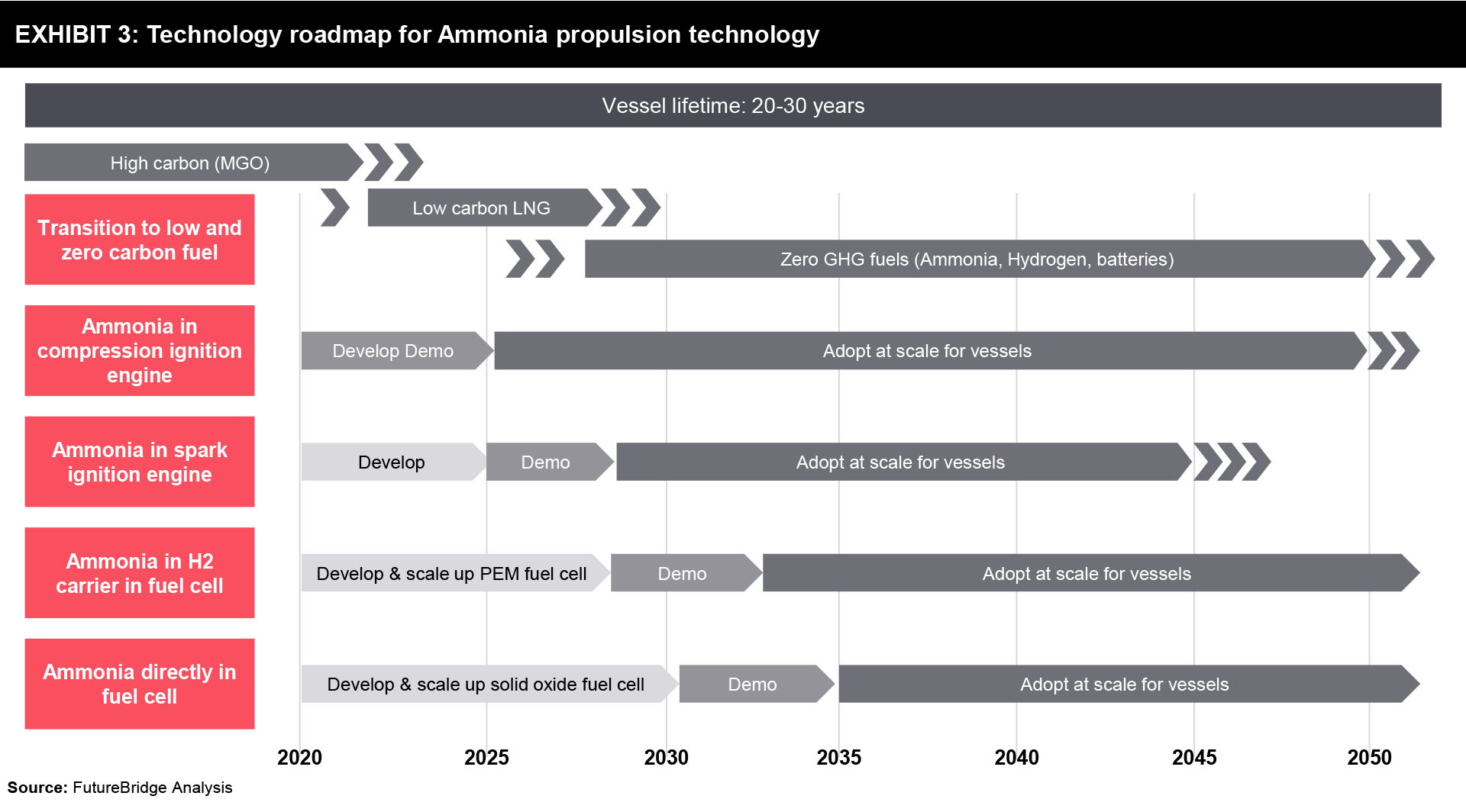

As per IMO regulations, the shipping industry has set a course with the goal of reducing at least 50% of total annual greenhouse gas (GHG) emissions from international shipping by 2050, compared to 2008 levels. At the same time, considering the surge in demand, the shipping industry needs to address its fuel requirements sustainably. Therefore, its imperative carbon-neutral fuels, such as new, advanced biofuels and green hydrogen-based fuels (including e-methane, e-methanol, e-ammonia, e-hydrogen, etc.) be introduced into the fuel mix, to reach ambitious reductions agreed by the IMO. Ammonia is seen as the preferred alternative for the shipping sector as it has more similarity to conventional fossil fuel sources in terms of physical characteristics and is simple to store and transport. The validation of ammonia engine designs by 2023 will be a key milestone in unlocking the use of renewable ammonia. Exhibit 3 depicts the technology roadmap for ammonia propulsion technology.

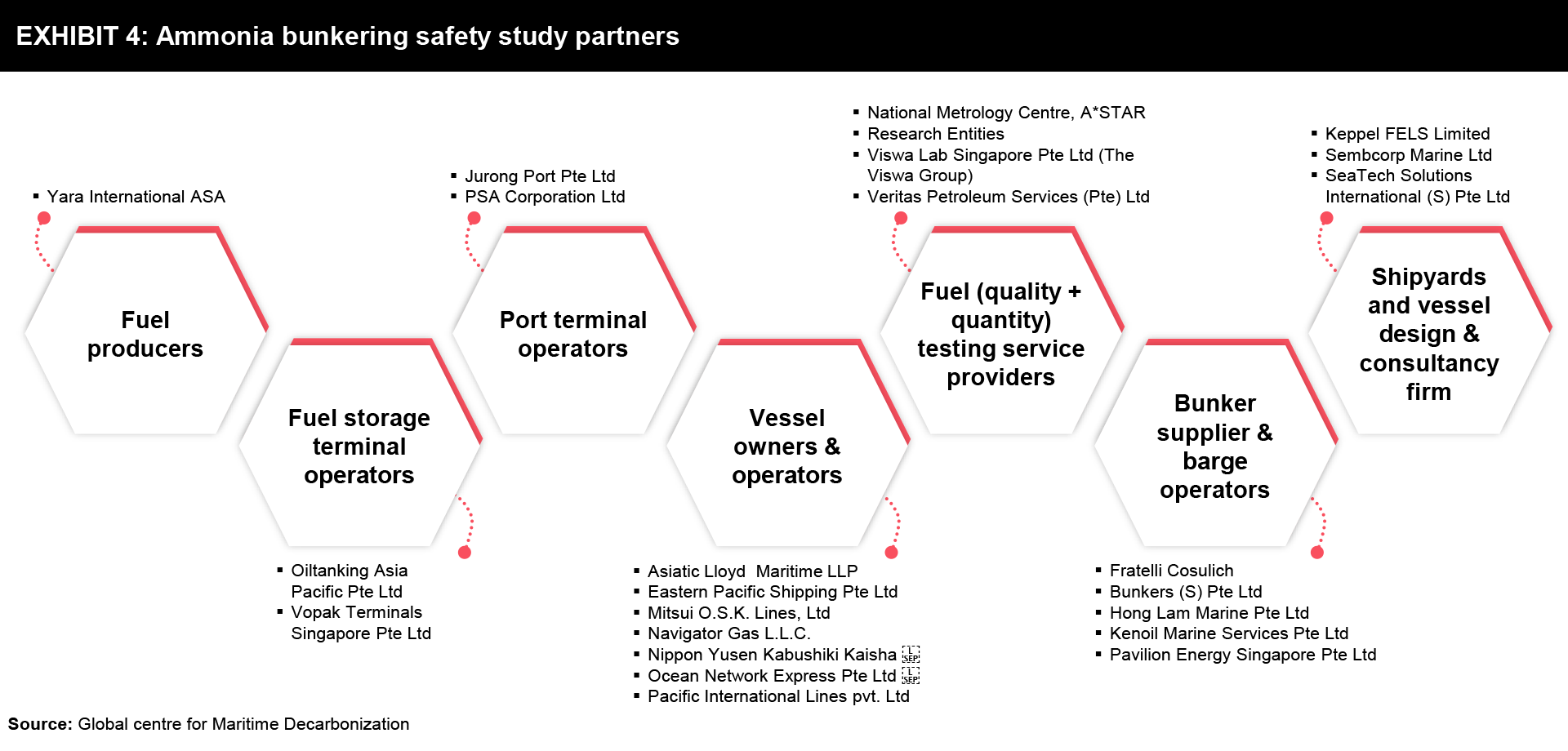

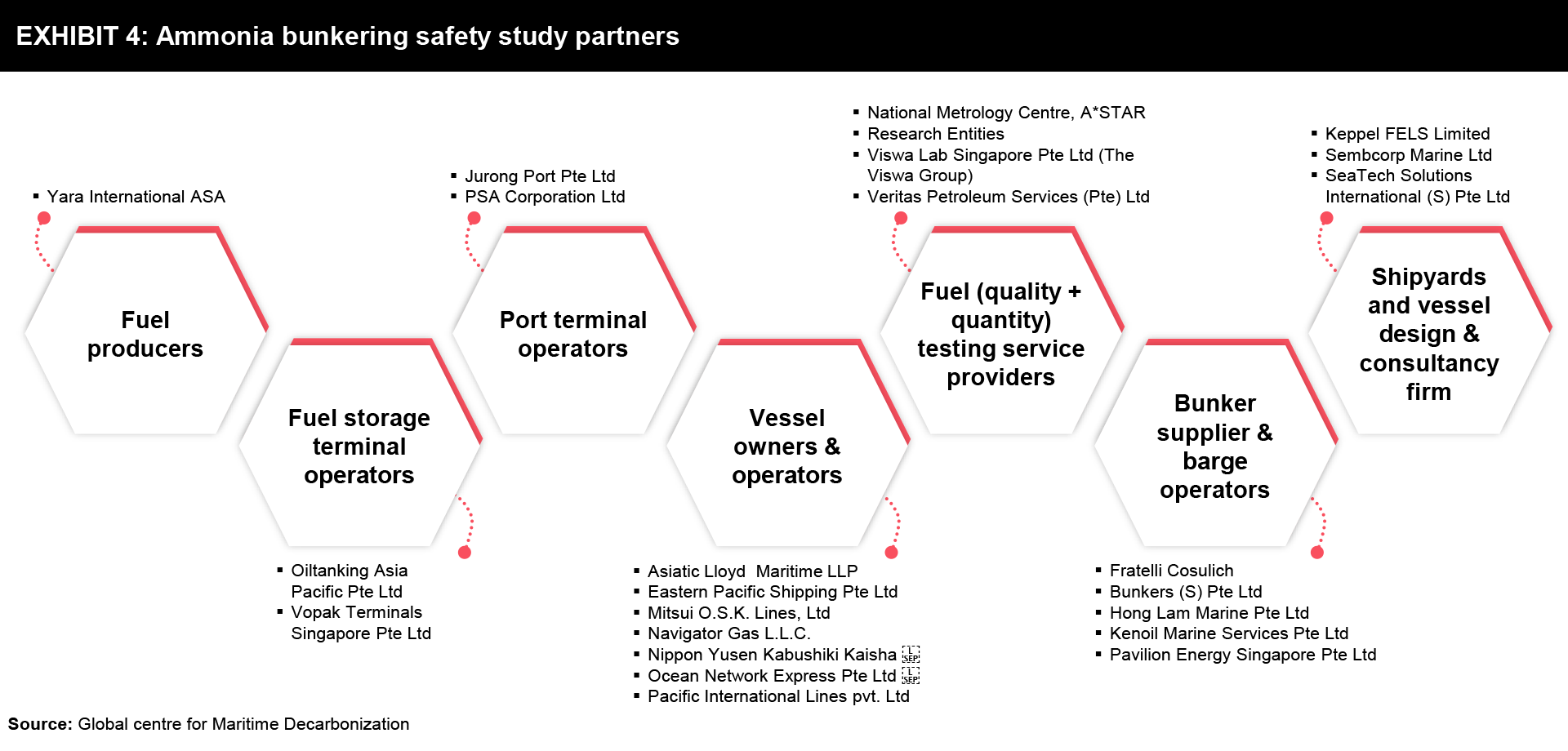

While ammonia is corrosive and highly toxic if inhaled in high concentrations, it has been handled safely for over a century, and should not be a major barrier to its use. The upcoming development of the ammonia engine by renowned engine manufacturers like Wartsila, and MAN Energy Solutions will have a very positive impact on the sector and unlock an attractive market for renewable ammonia producers. However, supply chain-related gaps need to be addressed before green ammonia can be safely used by the maritime industry. These include global green production capacity and supply, bunkering standards and procedures around safety, operations & the environment, bunkering infrastructure, the availability of ammonia-fuelled vessels, and its overall impact on the marine environment. A successful trial of ammonia as a marine fuel in the port of Singapore has set a high bar and instilled confidence that bunkering of this alternative fuel can be carried out in other seaports around the world. Also, the American Bureau of Shipping (ABS) has published a new, comprehensive guide to ammonia-fuelled vessels in the year 2021.

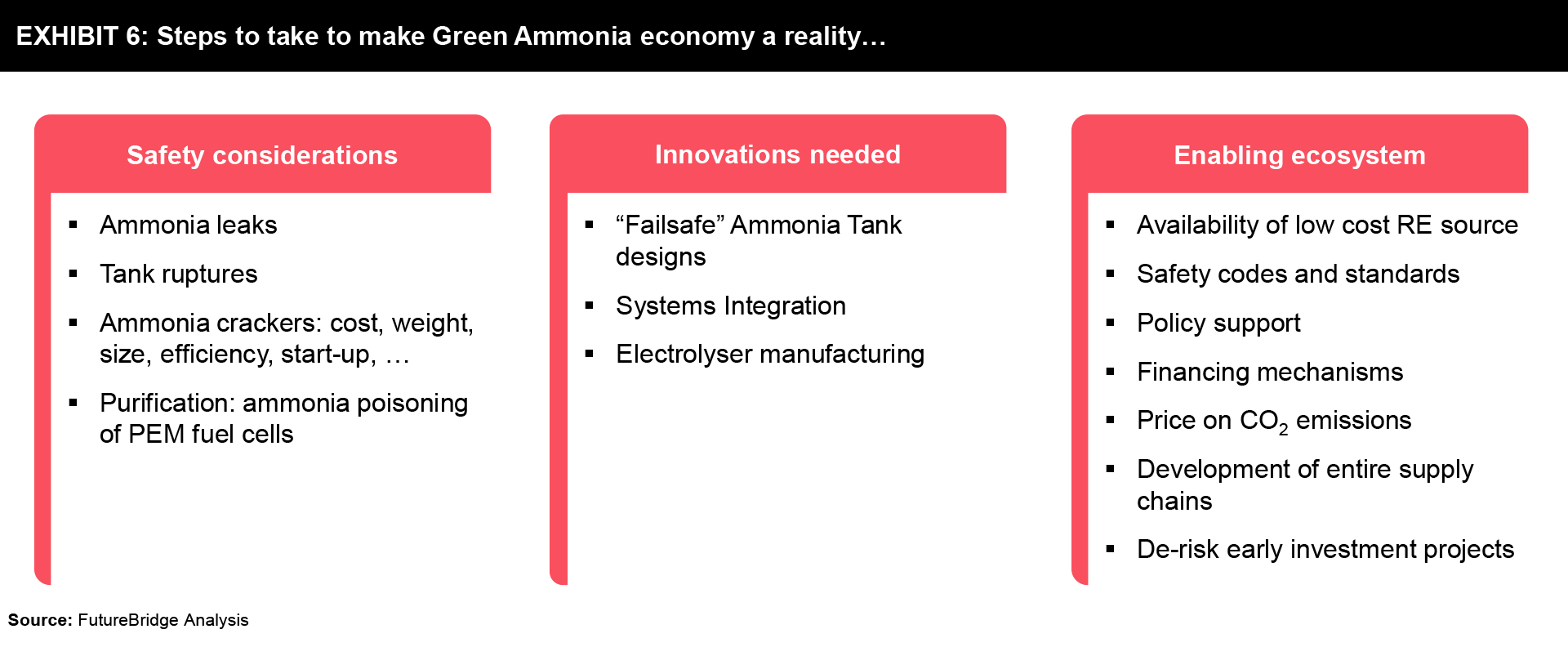

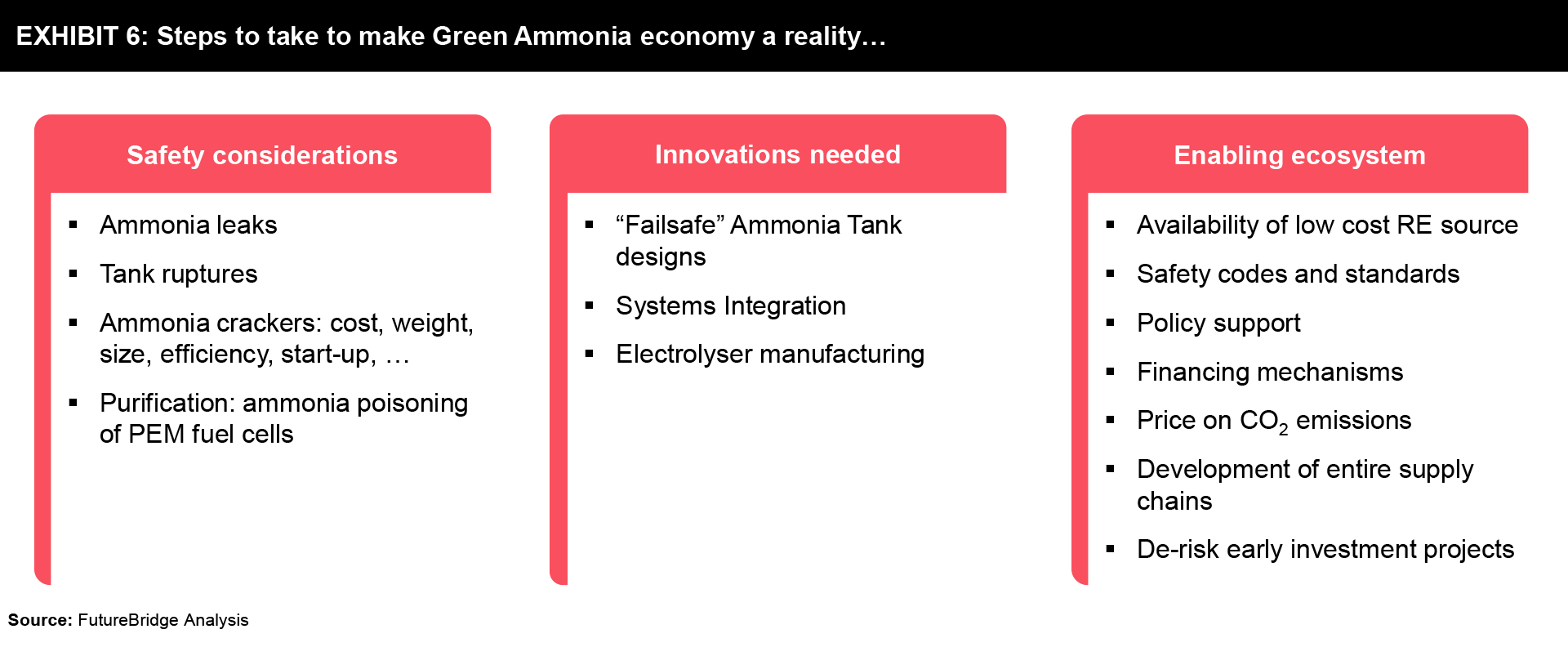

Stakeholders involved: Maritime industry is a complex interplay of multiple stakeholders involved across the supply chain. In order to make the green ammonia economy a reality, strong coordination is needed among the stakeholders from different spheres,

Challenges involved in using Ammonia as a marine fuel

- Ammonia is not currently approved as a fuel by the IMO either under the International Code of Safety for Ships using Gases or other Low-flashpoint Fuels (IGF) or the International Code of the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC) Code. Hence, as of now, every ship needs individual approval to use ammonia as a fuel

- The key safety concerns for using ammonia as fuel include its toxic effects, both for shipboard and nearby personnel and to marine life (in case of release)

- Risk of an explosion, although ammonia is hard to ignite, it may create an explosive atmosphere in the storage tanks

- No existing vessels of any size are equipped to use ammonia as a fuel

- Ammonia’s energy density is half that of diesel, meaning that twice as much liquid ammonia would be required by producers, and ships will need to accommodate larger storage tanks to accommodate it

- To use ammonia fuel, ships will need additional safety equipment, such as emergency ventilation and gas-absorption systems

- Boosting fuel supplies and building fuel-distribution infrastructure are the biggest challenges to ammonia-powered shipping

Future Outlook

Despite the current low production and limited energy application of green ammonia, demand and production are likely to increase in the coming years due to the focus on reducing carbon emissions. Although ammonia has the potential to be used as a clean fuel, considerable effort is required in developing and scaling new green ammonia production technologies, as well as inventing efficient and innovative ways to harness the energy it stores. Currently, around 25-30 Mt of ammonia is transported annually across land and sea but new energy markets would require greatly expanded ammonia infrastructure, capable of transporting over 300 Mt per year. Hence, coordinated policies and investment support across regions and sectors will be advantageous. These would include mandates, direct carbon pricing, carbon taxes, and low- and/or zero-carbon fuel standards. Further, new financing mechanisms and short-term financial support such as through investment in foundational infrastructure, and subsidies to encourage end-user adoption are also critical to attracting and de-risk investment in this sector.

To stay ahead on the technology curve, propel your growth, identify new opportunities, markets, and business models, and get answers to your unknowns, speak to our experts today.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.