Climate change is making frequent headlines in various reports and international protests are beginning to grab the attention. In this context, many political and environmental leaders have started promoting either the reduction in oil and gas usage or the gradual to complete removal of fossil fuels from the energy system. The oil and gas industry is under growing pressure from governments, investors, and the public to support the decarbonization of the energy system. One of the important ways to decarbonize the energy system could be through the growing usage of renewable energy – Solar, Wind, Biofuels, Hydrogen, etc. Biofuels are renewable, widely available, and contain less carbon content. It can be used with current infrastructure and also replace fossil-based fuels.

According to IEA (International Energy Agency), the biofuels sector is a very important means of reducing GHG emissions from the transport sector. In its report, Net-Zero by 2050, it states that 64% of renewable energy in the industry will come from the biofuels sector. To achieve this, the biofuels supply must increase by three times between 2019 and 2030. Currently, biofuels consist of only 3% of the total fuel consumption which means we have a long way to go.

Biomass availability

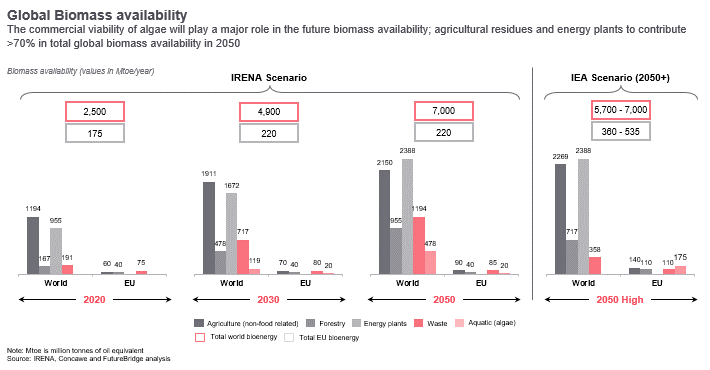

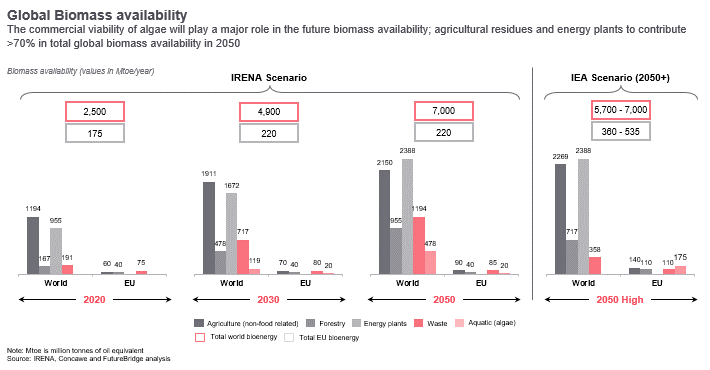

The World’s sustainable biomass availability is expected to increase continuously from a total of 2,500 Mtoe/y (Million tons of oil equivalent/year) in 2020 to 5,700–7,000 Mtoe/y by 2050. This will be mainly based on agricultural residues and energy plants (Second Generation) which will contribute more than 70% to the total biomass availability.

The IEA 2050+ scenario forecasts a lower potential availability compared to IRENA (International Renewable Energy Agency) as IEA is not certain about the future potential for algae, mainly due to the current efficiency levels and high cost.

Similarly, sustainable biomass in Europe is estimated to grow from 175Mtoe/y in 2020 to approximately 360–535Mtoe/y by 2050. With the realization of full algae potential, local biomass availability could move up to 535 Mtoe/y; but the high cost of algae may hinder it.

According to the European Commission, the production of feedstock in Europe will be lower by 2050 and could range from 210 to 320 Mtoe/y only (the majority coming from the waste sector). Mostly local biomass will be used; imports will be limited to 4–6% of the solid biomass used for bioenergy by 2050.

Biomass supply costs

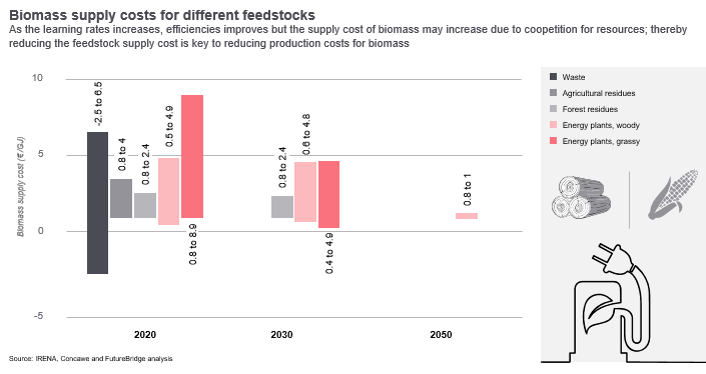

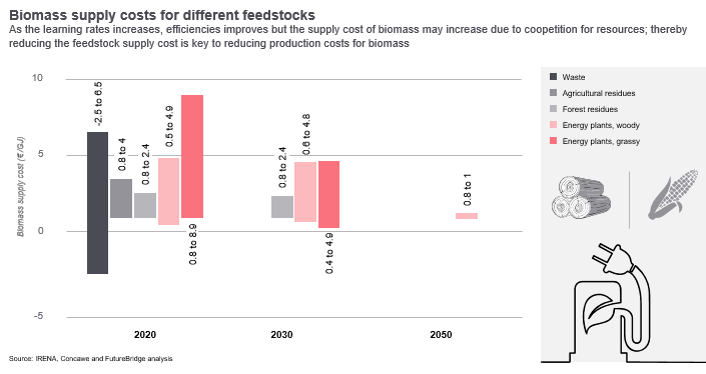

In the future, there will be competition for resources among different bioenergy sectors (including transport) so it is difficult to forecast the cost of biomass resources. However, according to IRENA, biomass costs could potentially range from -2 to 8 €/GJ depending on the origin of the biomass: the costs of producing energy crops as feedstocks are claimed to be highest, followed by agriculture residues and, forest residues. Moreover, the cost for waste could range between -2 to 6.5 €/GJ.

IRENA also claims that feedstocks used in most pathways account for 40–70% of production costs, using typical wood or agricultural residue cost assumptions. Even with an increase in learning rates and improved efficiencies, the contribution of feedstock costs to overall costs may increase over time because of competition for resources. So, reducing feedstock supply costs is the key to reducing production costs.

By scaling up the plant size, capital costs can be reduced in the range of 20-30% of the capital costs, and operating costs can be reduced by ~10% by enhancing plant performance, reducing costs, and increasing coproduct values.

Opportunities to promote investment in Biofuels sector

Energy Security: Biofuels can be an economical alternative to volatile fossil fuel-based energy and since it is sourced locally, it reduces dependency on imports of fossil fuels.

Climate change: Biofuels market is driven by an environmental factor as it releases less greenhouse gas concentrations. With COP26 initiatives, the market and need for alternate sustainable fuels are projected to be high. This will increase the level of development in the biofuels sector and drive growth. Demand will also create an opportunity for production scale-up and innovation in the market.

Carbon Capture: An average GHG emission (Mt CO2-eq) is expected to increase from 2,296 in 2018-20 to 2,358 in 2030. Therefore, the integration of biofuels production with carbon capture technology may contribute to negative carbon emissions; i.e. carbon sequestration process may help realize the set emission targets.

Waste production: A huge emphasis is given to the research and development of the technology that can process various types of feedstocks. Agricultural/municipal wastes are available abundantly that are organic and can be converted to biofuels.

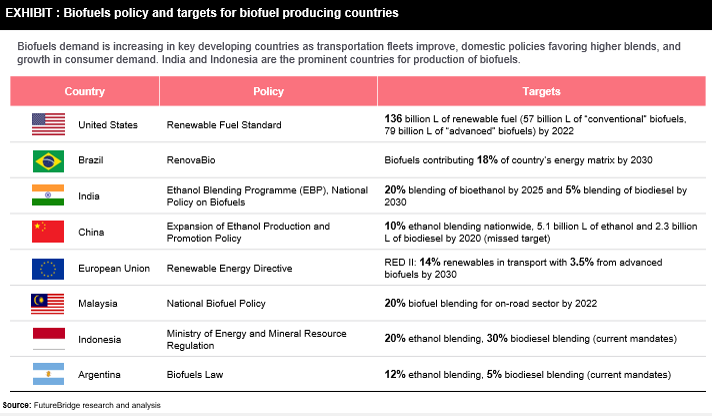

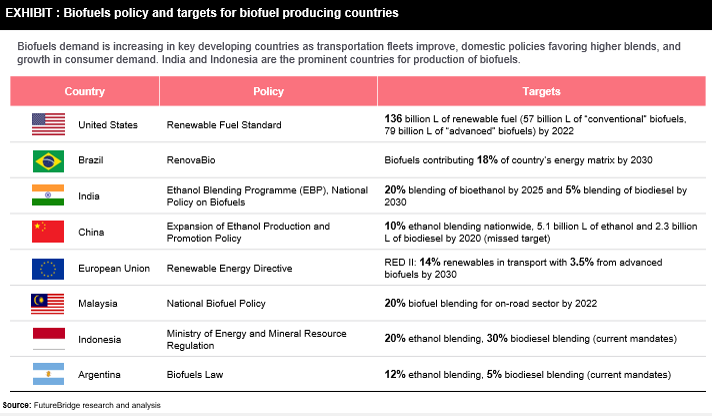

Regulatory support: Around 64 countries in the world have a Biofuels blending mandate; there are 27 countries in the EU, the Americas region has 13 countries, Asia-Pacific has 12 countries, Africa & Indian Ocean have 11 countries and the non-EU region has 2 countries.

Challenges to overcome for investment in the Biofuels sector

Supply chain: The availability of biomass is dependent upon the production of crops which is seasonal; any unforeseeable event in agriculture can lead to the scarcity of biomass.

Technology: The technology used in first-generation biofuels production is mature; however, for some of the advanced biofuels production, the technology requires innovation and development.

Policies: Regulatory uncertainty poses the most critical obstacle to investment in advanced biofuels. Low subsidy levels, high financing costs, and limited availability of finance are seen by many investors as barriers to entry/sustainability in the market.

Alternatives to biofuels: Decarbonisation in the transport sector has several alternate fuels – battery storage, hydrogen, etc. which pose competition for biofuels.

Environmental degradation: The biomass plantation depletes nutrients from the soil, promotes aesthetic degradation, and increases the loss of biodiversity, leading to the loss of ecosystems preservation and the homes of indigenous species.

Biofuels policy and targets

Regulatory targets are the most critical support for the biofuels sector. The important countries’ targets are mentioned in the given Exhibit.

Way forward

Despite various challenges in the sector, it is possible to overcome many of them. There is no dearth of biomass availability but the judicial collection of biomass will be the game-changer. Supply chain challenges can be overcome by integrating various stakeholders like biomass suppliers, producers, transporters, technology providers, consultants, investors, etc. Numerous agencies are collecting real-time biomass availability data, information, and various other insights which may prove instrumental to a newcomer in the industry. South Asia has a lot of second-generation biomass availability and some global investors are looking to garner this opportunity.

References

- International Energy Agency (IEA)

- International Renewable Energy Agency (IRENA)

- Concawe report and FutureBridge analysis

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.