Beyond Meat discusses future developments while Quorn Foods starts to feel the pressure

This year’s World Food Innovate Summit fell appropriately in the month of “Meatless May” as various speakers in this field took to the stage to share their company’s story. The Chief Innovation Officer of Beyond Meat, Dariush Ajami, opened the Summit in which he discussed the company’s success to date and where the future focus of the company lies. Tim Hannigan from Quorn Foods followed by stressing the need for change to achieve a sustainable food future and the brands efforts to stay relevant as the meat-free market heats up.

Let’s now take a look at some of the key learnings from our World Food Innovate Summit Series with a focus on Alternative Proteins.

Beyond Meat pushes boundaries

Beyond Meat pushes boundaries

It’s been a busy month for Dariush Ajami, Chief Innovation Officer of Beyond Meat. After ringing the bell at Wall Street he hopped on a plane to travel to Amsterdam to open this year’s World Food Innovate Summit. You could hear by the tone of his voice he was both exhausted and exhilarated after becoming the first plant-based, meat-alternative company to IPO last week. And so far, the market has responded positively.

Beyond Meat, which is committed to producing sustainable plant-based burgers and sausages, began trading at $25 a share on the Nasdaq stock exchange and ended the day at $65.75. This jump of 240 percent in value is one of the biggest in recent I.P.O. history. Beyond Meat now has a market value of about $4.9 billion and counting. Stock prices are now valued at around $81. The vegan meat brand will be listed on the Nasdaq as “BYND”.

It’s hard not to think about Tyson Foods Inc. at this time, one of the biggest meat producers in the US, who missed out on the upswing after recently selling its 6.5% stake before the listing as it sought to develop its own alternative protein offerings. Assuming it was sold at the IPO price, it would have received about $100 million for its holding. That stake is now worth about $260 million more today.

Mr. Ajami highlighted that the brand will use proceeds raised from the IPO to invest in current facilities, expansions and research and development. After building up a strong presence in the US market, he said their sights are now firmly set on expanding into Europe. This expansion is already evident with Beyond Burger landing on the shelves of the Netherlands largest food retailer, Albert Heijn, at the end of April.

Beyond Meat has rapidly grown since its launch in 2016, with their products now available in over 33,000 supermarkets, restaurants, fast-food chains and universities. The startup, based in the Los Angeles area, is utilizing ingredients like pea protein and beet juice to mimic the taste, texture and the overall look of real meat. Dariush filled his slides with alarming statistics and inspirational quotes to accentuate the environmental and health benefits that come with cutting down or cutting out meat in your diet.

A peer-reviewed Life Cycle Analysis (LCA) conducted by the University of Michigan compared the environmental impact of The Beyond Burger to a ¼ lb. U.S. beef burger. The study concluded that Beyond Burger uses significantly less water, less land, generates fewer Greenhouse Gas Emissions (GHGE), and requires less energy than a beef burger.

Quorn recognizes the risk of falling behind

“Please don’t forget Quorn to the Beyond Meats and Impossible Foods of today” is how Tim Finnigan, Chief Scientific Advisor of Quorn Foods, started his talk which looked at – Why we need Healthy New Proteins with a Low Environmental Impact. He went on to highlight Quorn Foods being one of the first companies to provide meat alternative products dating all the way back to the 1960’s when food shortages were a serious issue. When conventional farming couldn’t keep up with demand, Lord Rank discovered a microorganism in the fungi family called Fusarium venenatum.

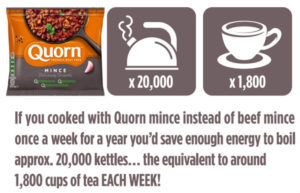

This same fungi is used by Quorn today through a fermentation process which converts carbohydrate into protein, producing ‘mycoprotein’: a protein-rich, sustainable food source that is packed with fiber, low in saturated fat, and contains no cholesterol. Today, the Quorn brand offers a wide range of meat-free products including sausages, chicken pieces and minced meat.

It seems Quorn Foods is becoming aware of the need to innovate in order to stay relevant as competition heats up by investing £7 million in a meat free innovation center last year. This new site will enhance the company’s capabilities in protein fermentation, which is at the core of the business’ success, along with providing the innovation for a new range of products.

Similar to Deriush Ajuri, Tim highlighted how “Quorn’s story is a good example of what has to be done and, importantly, what continues to be done” to provide proteins that have a low environmental impact to help address a sustainable food future. He went on to discuss how our demand for cheaper and more plentiful food is unsustainable and our addiction to meat is essentially costing the earth. One of the more alarming statistics that Tim provided us with was that “over 20% of global non communicable disease is now attributed to poor diets which is worse than smoking”. To understand more about these negative impacts and how startups are reinventing the industry you can read our article Meat 2.0: How novel technologies are disrupting the meat industry.

Similar to Deriush Ajuri, Tim highlighted how “Quorn’s story is a good example of what has to be done and, importantly, what continues to be done” to provide proteins that have a low environmental impact to help address a sustainable food future. He went on to discuss how our demand for cheaper and more plentiful food is unsustainable and our addiction to meat is essentially costing the earth. One of the more alarming statistics that Tim provided us with was that “over 20% of global non communicable disease is now attributed to poor diets which is worse than smoking”. To understand more about these negative impacts and how startups are reinventing the industry you can read our article Meat 2.0: How novel technologies are disrupting the meat industry.

Timing is everything

While the two companies, Beyond Meat and Quorn, are on the same mission to provide sustainable meat-free products, there are some differences when it comes to how these products place in the market.

It may have been a case of bad timing for Quorn as it’s slowly pushed off the alternative meat radar by the Beyonds and Impossibles of today. Millennials and Generation Z are becoming the exciting new target demographic for the food industry, and their food choices show striking differences from their predecessors. Quorn Foods did not have this consumer base when it first reached the market back in 1985 and could feel dated or not trendy enough to the forward thinking consumers of today. On the other hand, Beyond Meat is the new disruptive player on the scene and it is clear that by partnering with fast-food giants and universities that they are targeting this growing flexitarian and vegan consumer base.

Beyond Meat continues to pump investment into research and development to test emerging, innovative ingredients in their products. Their most recent Beyond Burger 2.0 which was launched in January 2019 uses a blend of pea, mung bean, and rice proteins that deliver a more fibrous and chewy texture. In contrast, Quorn is committed to using Mycoprotein as the core ingredient in all their products. It will be difficult for Quorn to fight for shelf space in retail stores as disruptive startups like Beyond Meat continue to take risks and surprise the market to attract the Gen Z and Millenials of today. Is it time for Quorn to start taking risks? Are Beyond Meat and Impossible Foods too far ahead in the race for other players to really compete?

6 min read

6 min read