Software-driven Mobility Threatens Traditional Supplier Supremacy

Mobility

Mobility

Future chauffeurs, emotional car assistants and cyber bodyguards are under development

When we talk ‘cars of the future’, artificial Intelligence, software and big data analytics are the key enablers for the transition from assisted to highly-automated and intelligent driving. They are also critical for the monetization of emerging business models in the new era of mobility, such as predictive maintenance in an electrified future, Automated Mobility on Demand (AMoD), and humanized in-vehicle assistants.

Today’s applications already power multiple systems for safety and convenience. They include computer vision for camera-based driver assistance systems for motorway cruising, as well as passenger monitoring systems to mitigate driver distraction, which are increasingly becoming standard features in modern cars. In-vehicle HMI also utilizes AI and advanced algorithms for automatic speech recognition and natural language processing.

The transition to the next-level smarter, connected and emotional machines, will redefine our daily commute and our in-vehicle experience. It will unlock new revenue opportunities for players and requires mastery of new technological building blocks – in which companies like Google or Baidu have a competitive edge as vehicles join the Internet-of-Things.

Have major automotive suppliers got what it takes to fight the new mobility entrants?

The core competencies for success in future mobility are changing rapidly as the world’s biggest automotive suppliers strive to develop the software and data capabilities that threaten their dominance. New entrants with AI and software expertise as well as stronger financial muscles are gaining momentum.

For example, Bosch already operates “Schools for self-driving cars” where onboard AI computers collect, analyse huge amount of data (1 GB/s for self-driving) and use deep learning to “teach” cars to understand their surroundings and react appropriately. In 2017, the company announced its AI onboard computer for Level 4 autonomous driving which will be the cornerstone for its perception system for passenger cars and robotaxis – where Bosch is working together with Daimler.

Bosch, the world’s biggest automotive supplier by revenue is also committed to invest 300 million euros by 2021 in the development of the Bosch Center of Artificial Intelligence which already operates in India, the U.S. and Germany.

Continental also realizes that software is key for future mobility. The company will increase its workforce of software and IT experts from 19,000 today to 25,000 by the end of 2022. They are also expanding their global research network for AI with collaborations agreements with the University of Oxford, the DFKI (German Research Center for Artificial Intelligence) and the AI research group Berkeley DeepDrive (BDD) at the University of California.

How can legacy players get an edge in software-driven mobility business models?

As mobility continues its transition to software-driven business models, the auto industry’s competitive rules are being rewritten. While major automotive suppliers invest heavily to support the autonomous driving and connectivity roadmaps of carmakers, tech giants entering the mobility space seem to be closer to bring new services to the market.

Google’s spin-off Waymo beat GM and other carmakers to market with the launch of their Level 4 robo-taxi at the end of 2018. Although geographically constrained and still operating with a back-up driver, the commercial start of Level 4 robotaxis marks a new passenger experience which the rest of the industry is following closely. Their challenge is to amortize the cost of perception sensors and unlock new revenues.

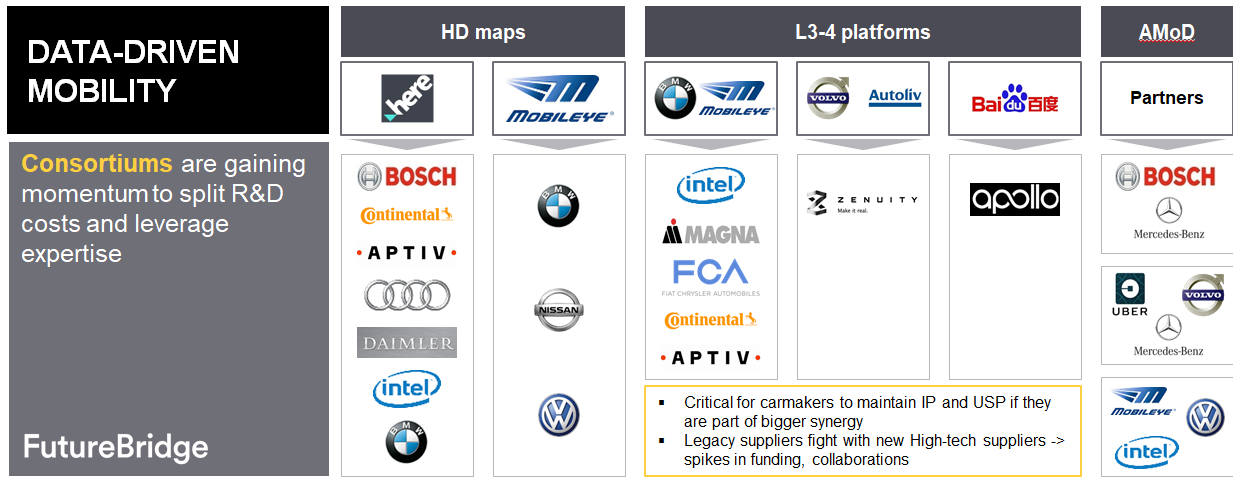

Legacy players are responding with increased level of collaboration, which so far has been unheard of. The world’s biggest automotive suppliers are expanding their role as system integrators by developing common L4 platforms for private cars and robotaxis. Recently, Daimler and BMW announced they will join forces to cut costs and shorten time to market for automated driving. This is just one of the consortiums already developing in the new mobility space and demonstrates a potentially faster route to market, as illustrated here.

Collaborative mobility business models to thrive

As value in future mobility shifts from product to service, collaborative business models will thrive for two reasons. Firstly, to close the technological gaps in perception systems for automated driving which cannot be achieved singlehandedly, while unlocking higher ROI in data-driven business models, such as Automated Mobility on Demand. Secondly, to leverage benefits of information and data sharing to enhance cyber security as the vehicle becomes a crucial part of the IoT.

4 min read

4 min read