2019 has been an exciting year so far, with a number of automotive OEMs increasing their focus on electric powertrains. Such a shift has had a ripple effect on the entire automotive ecosystem. The automotive industry has already been witnessing a decline in profits in 2019 due to the escalating trade tensions as well as increasing regulatory pressure. Automotive players are presently focusing their time and money on the development of a broad range of Electric Vehicles (EVs) with each company trying to innovate and bring in advanced features and functionalities in their vehicles. This shift in investment has also added considerable strain to the automotive industry. BMW, for example, announced in early 2019 that the company would have 25 EV models by 2023. Some of the interesting developments taking place in the automotive industry are necessarily not related to the vehicle in the true sense, but rather, what comes out of it, i.e., data. There is a common adage in the field of Information Technology (IT) that states, “Data is the New Currency.” IT firms have known this for quite some time and have capitalized on the use and transfer of data. Advertising companies purchase data to help market their products, while other firms purchase demographic data to identify what product would be best suited for a particular region. In a similar fashion, manufacturing firms are exploring various models, where they can purchase data to determine how efficient they are in comparison with the best group of companies within a sample. Looking at the IT industry again in particular, a number of companies have come up and grown substantially by simply connecting suppliers with potential customers. This has been a successful model for several companies, which can also be attributed to the availability and proper use of data.

Evaluating the automotive industry through the lens of a data provider, the industry seems to be lagging behind quite a bit in the “data economy.” A key question that prevails in the mind of automotive players is the necessity of exploring a new revenue model involving data, especially if a company has historically been a product manufacturer, and more importantly, doing quite well from the sales of its products.

In order to answer the above question, one must realize that any new business model with regards to services or data is going to attract and will certainly need other participants in the automotive ecosystem. With the entry of new and non-traditional participants in the ecosystem, there comes a need for greater cooperation and generation of new avenues for sales and marketing, as well as the requirement for expanding product offerings. As companies grow in terms of new and innovative offerings, customers too, will grow in terms of realizing the benefits associated with these offerings. In the long-term, these offerings would no longer be known as a value-added service but more of a prerequisite in the eyes of the customer. Partnership with other participants (technology developers, financial institutions, advertising firms, etc.) will further allow companies to expand their potential user base and vice versa.

Asset providers stand to gain more if they move up the value chain in the new data economy as service providers. Automotive OEMs are capitalizing on revenue models enabled by connected vehicles. Navigational and vehicle performance data are already captured and made available to drivers. A further upgrade from this has been the capturing of real-time traffic updates as well as automated contact of emergency services in case of an accident. In any case, the data is already present, and OEMs have a vast repository of information to provide. With this being said, there are still various bumps in the road that, unless resolved, will prevent automotive OEMs from adopting a data-driven business model. The market is well-positioned for new entrants to capitalize and provide value-added services. The key question rattling the OEMs is, who would be the owner of the data generated? Would it be the OEM, the driver, or even the service provider? In any case, until this question is answered, no one would be able to make any headway in the data-driven business model. In case of the data being owned by the end user/driver, the success of the business model becomes even more complicated for the OEM. Other questions relating to what should be the pricing model and whether a customer would be willing to pay for any services can be answered once the OEM is able to build the business model.

As is the case with most business models dealing with data, initial offerings are expected to be free, thereby allowing users to experience the advantage of such services. After enough time has passed for a user to become acquainted with these services, paid plans would emerge, offering different packages through either a subscription or a pay-as-you-go model. By this time, the user would be so dependent on services, which he/she has been using for free that they will be willing to pay for the service or at least some part of it. In any case, moderate pricing and high volume will be the initial strategy for any data-driven model.

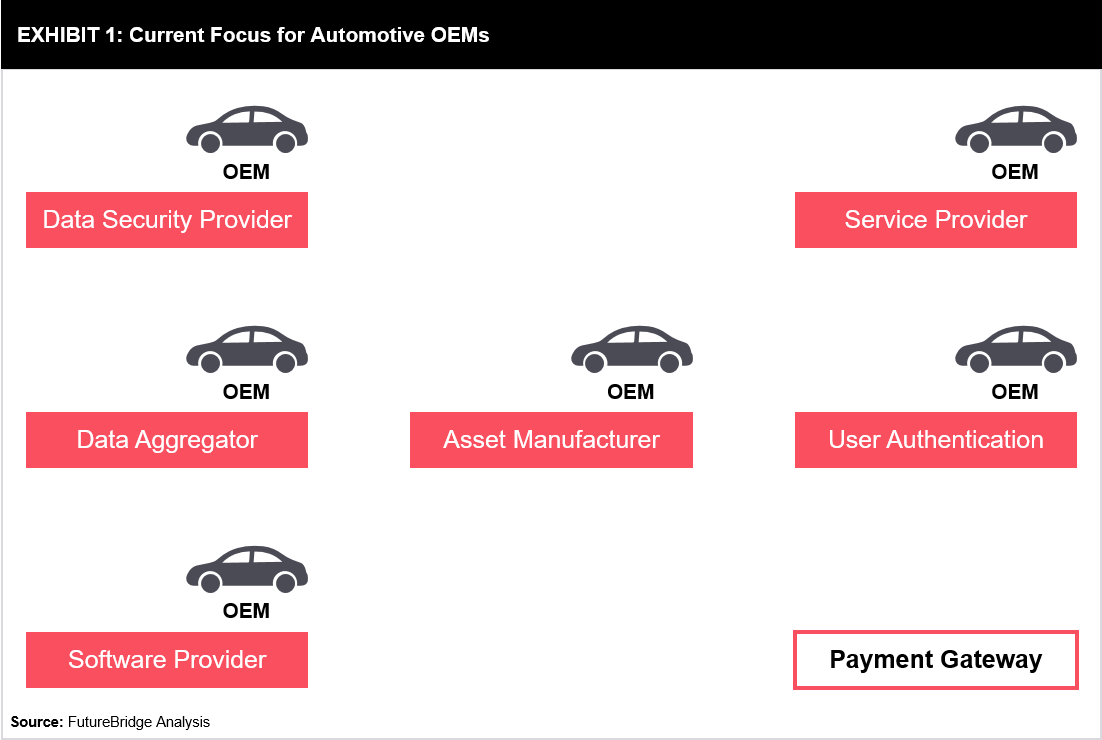

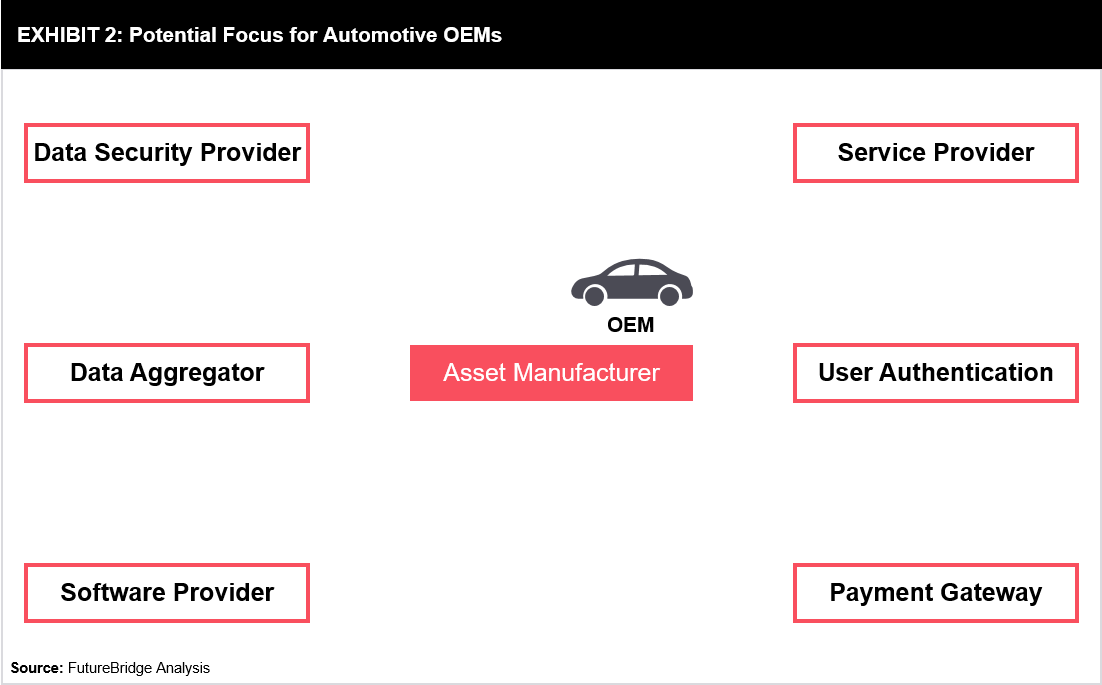

The exciting element for an automotive OEM at present is that when looking at a data-driven business model, as on date, it seems like the OEM can fit into only one part of the ecosystem. However, that is not necessarily the case. Automotive OEMs already realize the need to become more than an asset manufacturer, and with connected and autonomous driving being decisive technologies that will change the way mobility is defined, it is time to look at software as a key product offering. The Head of Software in Volkswagen Group, Christian Senger, recently stated that the automotive OEM is moving into the software space with the company looking forward to significantly increase the in-house share of software development for their vehicles – to more than 60% by 2025. Such a bold statement shows that automotive OEMs have already realized that to remain competitive, it is necessary to start looking at other areas of the mobility ecosystem and have components developed in-house. Moreover, in this regard, OEMs have already started partnering with service providers. For example, Hyundai partnering with Applebee and Xevo, and GM partnering with Shell and Dunkin Donuts for the development of in-car payment solutions. OEMs are also collaborating with companies on data security. For example, NVIDIA’s deep learning systems have been used by Tesla, Mercedes-Benz, Audi, Toyota, and Volkswagen for the protection of self-driving vehicles. Guardknox’s architecture is used by Porsche, where the technology protects against hacking attacks and also sets the first step towards real-time customization of vehicles. From partnerships, associations, and research that automotive OEMs are already investing, it becomes easier to imagine the OEM having a much larger share of the data-driven business model in the long-term.

Automotive OEMs have started taking necessary steps towards a data-driven business model; among them, some have already experimented in all parts of the new ecosystem, while others are testing waters. In any case, an individual need not look far to determine the success rate of a data-driven business model. With the emergence of various subscription packages/pay-per-use models, consumers are willing to pay for added-value services. However, the question of data ownership and privacy need to be answered for players in the automotive industry to capitalize on the new business model.

7 min read

7 min read