Development of Electric Mobility

The market for Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) is growing rapidly. Both EVs and HEVs are expected to account for roughly 30% of all vehicle sales by 2025. In 2016, EVs accounted for less than 1% (<1 million vehicles) of global auto sales.

With declining battery costs and increasing vehicle models, including the extended-range vehicles with affordable purchase prices or leasing terms, along with various incentives provided by federal, state, or local judiciaries, plug-in hybrid cars are quickly approaching cost parity, which may lead to a lower cost of mobility for consumers.

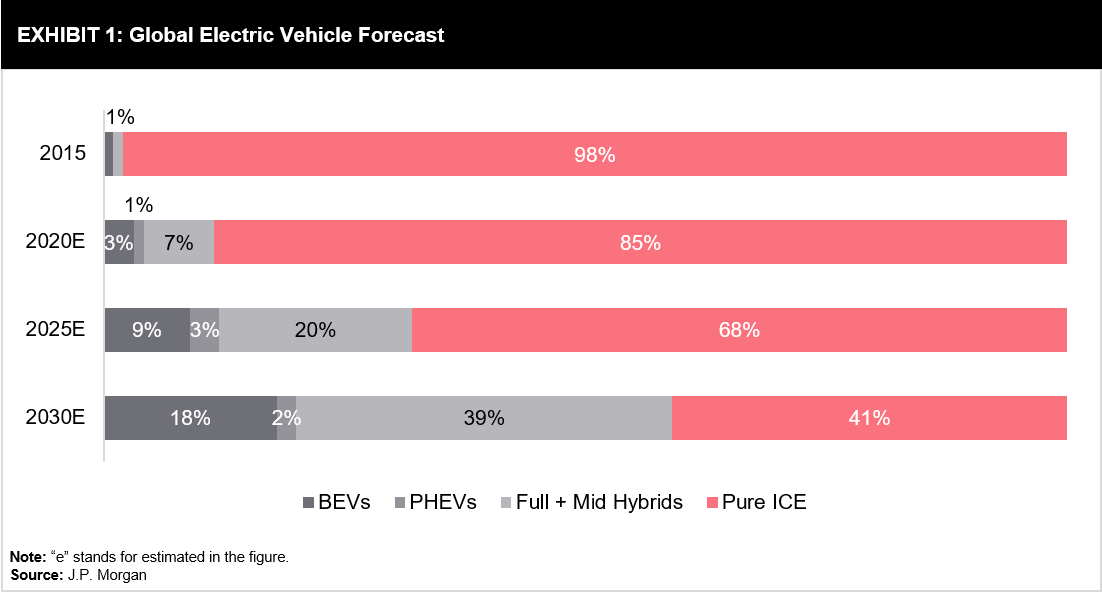

J.P. Morgan (a global leader in financial services) estimates that Battery Electric Vehicles (BEVs) will rise close to 8.4 million or will incur a 7.7% market share by 2025. While this jump is significant, it does not compare to the kind of growth expected in HEVs (cars that combine a fuel engine with electric elements). The BEV sector is projected to grow from 3% of the global market share to more than 25 million vehicles or 23% of global sales by 2025. This leaves Internal Combustion Engine (ICE) vehicles with around 70% of the market share by 2025, a decline of 40% by 2030, predominantly in emerging markets (refer Exhibit 1).

BEVs have presented itself as a viable option, and key automotive players need to collaborate to enable greater penetration by resolving challenges, such as charging time and infrastructure. Resolving infrastructure challenges provide an opportunity to create value for stakeholders in the automotive ecosystem by developing unique solutions and profitable business models.

Key Considerations for Utility Investment in Charging Infrastructure

Widespread installation of the charging infrastructure would be required to support the EV revolution. This is where utility players will have an opportunity to serve a very large market – potentially pouring in large sums of revenue for the players involved. At the same time, the current energy grids across the globe are not prepared to handle demands posed by EVs, mainly when the objective is to improve charging rates to make EVs more practical.

In the current grid architecture, centralized power plants produce electricity and transfer it across long distances to substations over high voltage transmission lines. Substations then transfer it over 6-20 kV lines to smaller transformers over distribution lines. These smaller transformers will step voltage further down for charging station applications.

The power at substations is sufficient to handle power fluctuations caused by vehicle charging, as it is a tiny fraction of capacity. However, a typical fast-charging station having load of a few megawatts (1-5 megawatt) presents 5-10% of the capacity of the distribution line. Maintaining a grid standard with such high intermittent demand becomes difficult and requires separate distribution lines or upgrades of the transformer. Upgrades will also be required for smaller communities and commercial buildings with level 2 chargers, as this increases the power consumption significantly.

As a case example, in China, with 20% EV share, 21 of the 27 communities and 12 of the 21 commercial buildings are needed to upgrade distribution transformers. Upgrades are also required on distribution lines. These upgrades represent massive investments ranging from $40,000 to $400,000, depending on the fast-charging capacity in communities/plazas.

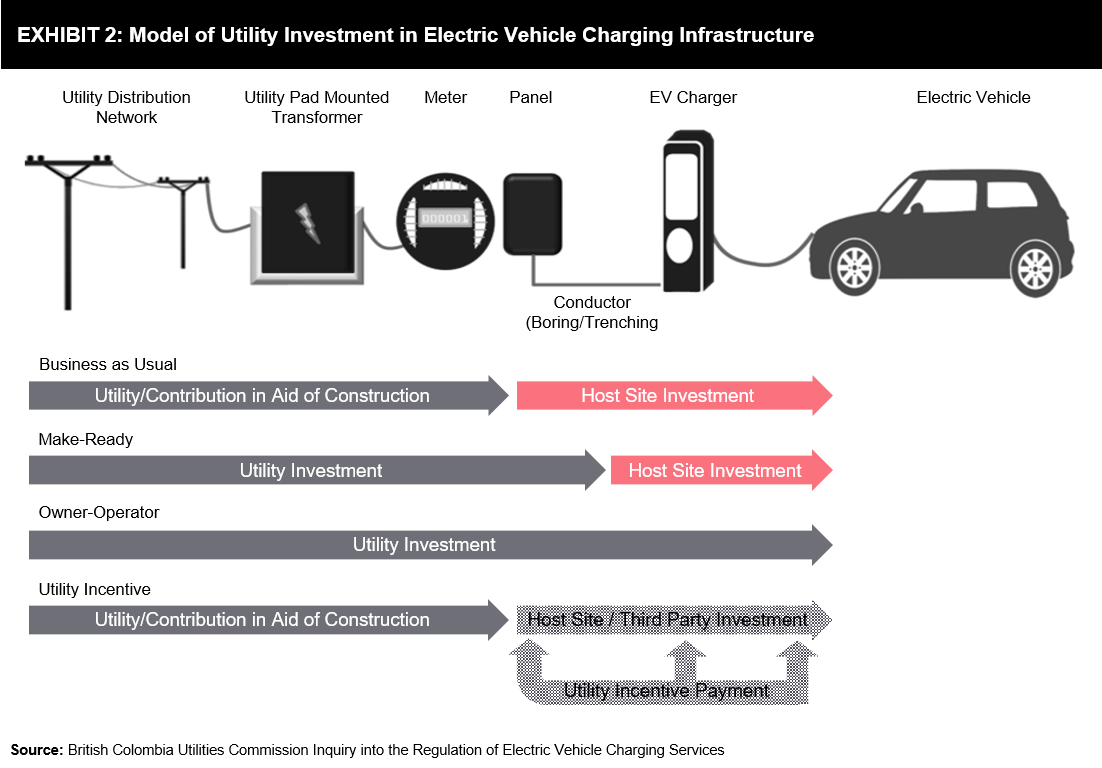

The charging infrastructure needs a considerable amount of investment to cater to the demand for EVs. There are several ways devised by utility players to satisfy this demand. They are:

Utility Investment Models (refer Exhibit 2):

- A utility could invest in make-ready installations, which include the electrical infrastructure required up to, but not including, the actual Plug-in Electric Vehicle (PEV) charging equipment.

- A utility could fully own and operate installations, which would include the make-ready components as well as the charging equipment itself, resulting in a single entity building and owning the electric infrastructure and vehicle charging equipment.

- A utility could provide host sites with financial incentives, such as rebates for the cost of the PEV charging infrastructure and/or the make-ready portion of the infrastructure.

Key Considerations for Policymakers:

Policymakers will play an important role in ensuring that charging infrastructure investments are prudent and reasonable, as well as aligned with other policy goals and equitable to ratepayers, which, in turn, will result in a fair return on investment for utilities. They also help propose investments that are most efficient and beneficial for the energy grid and all customers. Policymakers need to balance several factors that determine whether it is appropriate to approve the use of ratepayer funds to enable and support vehicle charging.

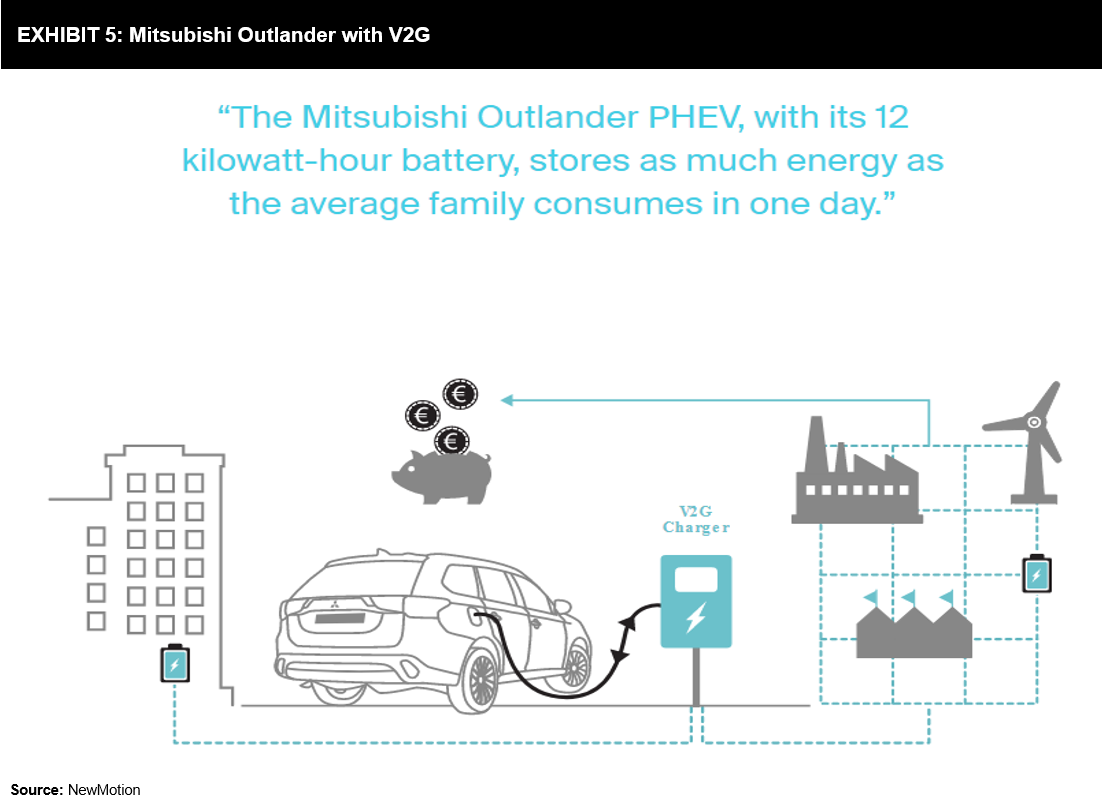

Vehicle to Grid (V2G) Energy Transfer

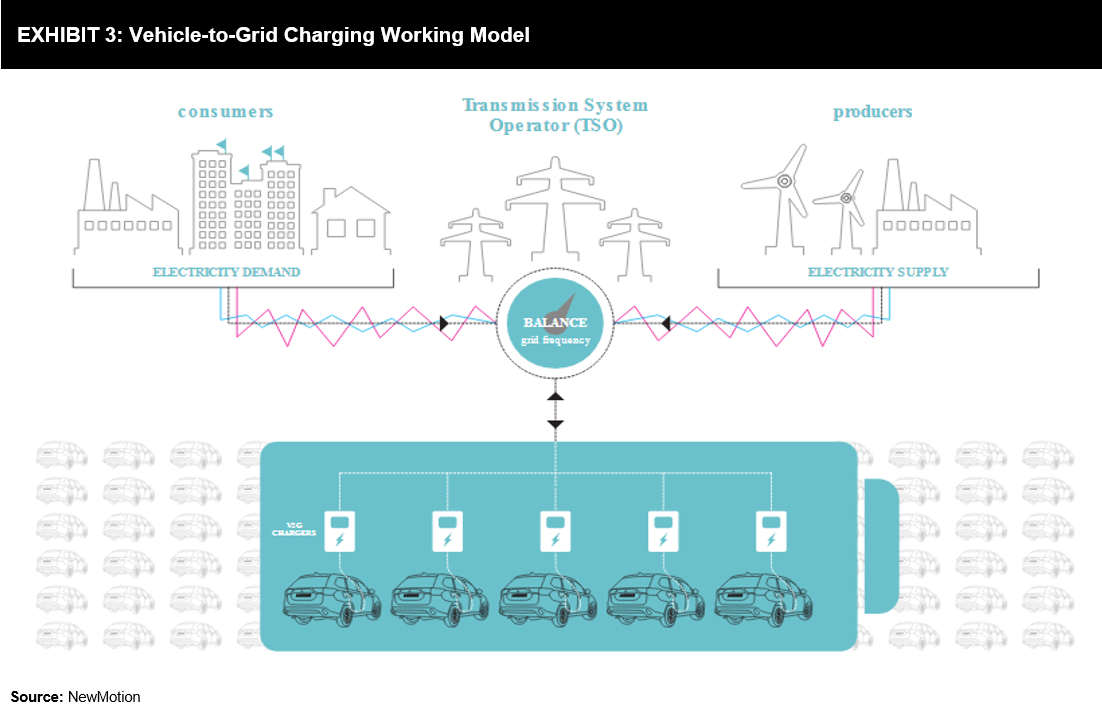

The Vehicle to Grid (V2G) concept (refer Exhibit 3) is currently under serious consideration as a smart grid application. This application uses suitably equipped electric vehicles to provide a load-leveling function or temporary energy storage for the electricity-generating utilities. The idea is to charge vehicle batteries at night when the demand is low, utilizing the utility’s excess generating capacity, so-called “valley filling” of the utility’s load profile and allowing the utility to draw energy back from the battery into the grid as required during the day when the demand is high to reduce the peak demand on the utility’s generating capacity, known as “peak shaving”. It may sound very attractive in theory, particularly for the utilities; however, it seems to be difficult in practicality.

Fermata Energy launched a V2G pilot project deploying a fleet of Nissan LEAFs in the US. Fermata Energy’s system is designed to work with any bi-directional charger or vehicle.

Economic Benefits of V2G

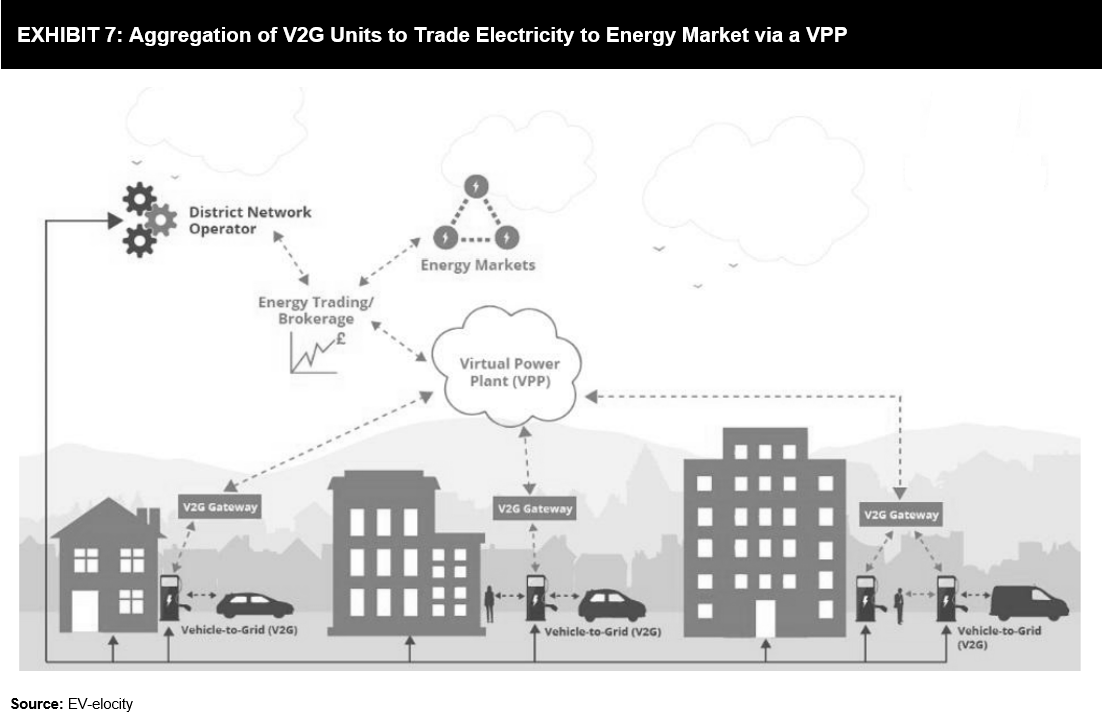

The introduction of V2G offers a plethora of potentially beneficial business models, which primarily focus on providing stability services to the energy grid and optimizing the economic benefits of owning an EV. Within these overarching categories, it is likely that several niche business models will emerge, as the current V2G concept includes the integration of intermittent renewable energy into the grid, reduction of peak load, charging optimization, and regulation of participating capacity.

The most important feature is the balancing of five market factors to create a profitable business case, as it makes V2G move from a potential revenue generator to a profitable business.

In a vehicle to grid experiment involving 100 electric cars and truck owners in Europe and Enel, one of Europe’s largest utility companies, the owner of the electric Nissans earned an average of $1,530 a year from the program, which is more than the cost of charging vehicles for a year’s worth of use.

The Journey to Commercialization of V2G

Four factors that need to be considered to predict the success of V2G are mentioned below:

- Duty cycle of the EV: When is the EV available for V2G, and how predictable is this? Fleet applications may be fruitful in early markets.

- Volume: What is the potential when EV batteries are stacked up? How many will be available simultaneously?

- Customers: How many are there, and are they willing to contribute?

- Value streams: Is V2G suitable for grid-level balancing or providing service at a more localized level (cities or homes)?

On the basis of these factors and their timing, the future of V2G will be decided. As commercial vehicles are less likely to have the time to contribute to the grid, personal vehicle fleets are likely to lead the adoption of V2G technology. Therefore, business models for individual car owners are most likely to work. Although privately-owned cars plugged into distributed networks of domestic chargers could ultimately offer higher stacked value, the stack itself can take longer to develop. By this point, static or unidirectional charging solutions may be too powerful to compete against with V2G.

Feasibility of V2G and its Future

V2G technology is evolving steadily, and developments are taking place at several levels, especially on the power electronics side of the design, where power-efficient components are paramount for a successful V2G implementation.

Although there are real possibilities of V2G becoming the next disruptive technology in the power sector, not all players in the automotive sector are convinced, which is slowing down the adoption of V2G. Technologies to make this a reality are here and still improving with many projects and research efforts at all levels, from economic and social studies to much more complex technical studies. Manufacturers and owners of EVs are questioning the stress on batteries, which is one of the most expensive parts of the EVs. Mass implementation of V2G is achievable but will require more time to make the economics of vehicle ownership more attractive. Developments are required in battery chemistry/management technologies to enable a longer cycle life, which will be the key breakthrough for triggering the transition towards V2G.

References

- https://www.fermataenergy.com/post/nissan-taps-fermata-energy-for-nissan-energy-share-pilot

- https://newmotion.com/en/the-future-of-ev-charging-with-v2x-technology

- https://enrg.io/vehicle-grid-plan-pays-off-electric-car-drivers-europe/

- https://www.ev-elocity.com/cenex-release-understanding-the-true-value-of-v2g-report/

- https://www.nissan-global.com/EN/ZEROEMISSION/APPROACH/COMPREHENSIVE/ECOSYSTEM/

8 min read

8 min read