What is all the Buzz about Crude-to-Chemicals?

Crude oil is a primary source of energy, and oil refining is a key aspect of the global energy system. Transportation fuel (e.g., gasoline, diesel, and fuel oil) accounts for approximately 50% share of the products produced from refineries. Therefore, refinery margins that depend on the difference between the prices of crude oil and oil products are tied to the demand for transportation fuels. Refineries have experienced fluctuations in their margins over the last few years. Presently, refineries are facing an array of new challenges, some of which are elucidated below:

- Production of cleaner-burning fuels: This is a pressing challenge for refineries globally. With stricter regulations and environmental awareness, the production of cleaner-burning fuels has become a major concern, primarily for European refiners. The recent IMO regulation regarding sulfur limits for bunker fuel is having an impact on the market demand for High Sulfur Fuel Oil (HSFO), thereby propelling refiners to explore alternative markets (e.g., power generation, heating oil, etc.) for HSFO. It is also contributing to the significant upgrade of refineries.

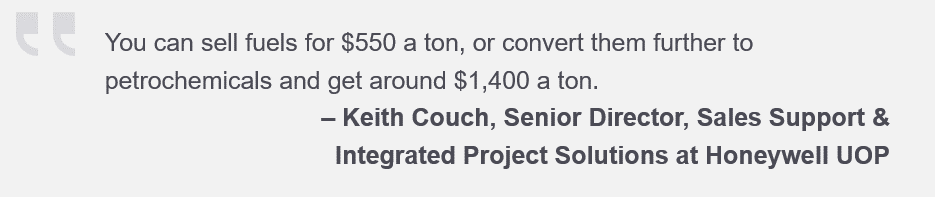

- Plateau in demand for transportation fuels: Based on the IEA forecast for oil demand, it is expected that fuel volumes will reach a plateau by 2030. One of the primary reasons for this is the penetration of electric vehicles and increased uptake of alternative drive technologies for commercial vehicles. With the decline in demand for transportation fuels and stricter regulations, refiners are forced to explore ways to improve the yield of high-value products from refineries to remain profitable in the near future. Therefore, refiners are emphasizing more on higher-margin chemicals than transportation fuel. Exhibit 1 showcases the future demand for crude oil products.

Integration of Petrochemicals with Refinery

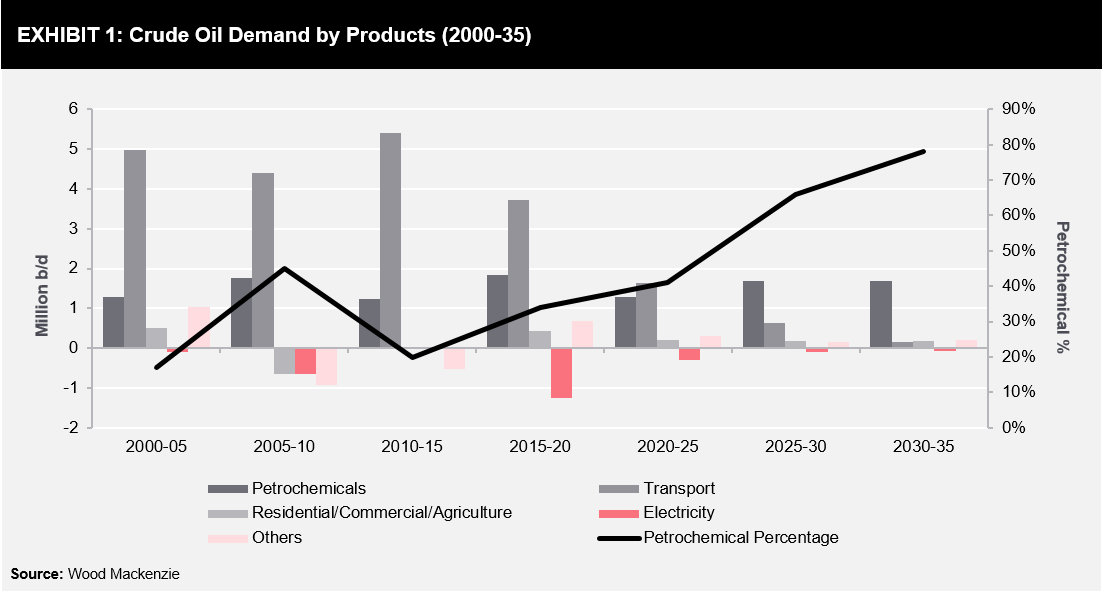

The petrochemicals segment accounts for 14% and 8% of the total primary demand for oil and gas, respectively. Refiners are exploring the integration of petrochemical complexes with the refinery, as the petrochemical industry is expected to grow in the near future primarily due to the increased demand for plastics in developing countries. The new refining capacity additions in the Middle East and Asia are focusing on integrating petrochemical complexes with refineries. Exhibit 2 showcases the block diagram of a typical, integrated petrochemical and refinery complex.

The yield of petrochemical feedstock depends on the complexity of the refinery. Integrated complex, such as Petro Rabigh or Sadara in Saudi Arabia, can achieve 17–20% conversion to chemicals. However, the crude oil-to-chemicals technology offers more than 40% conversion to chemicals.

Crude Oil-to-Chemicals

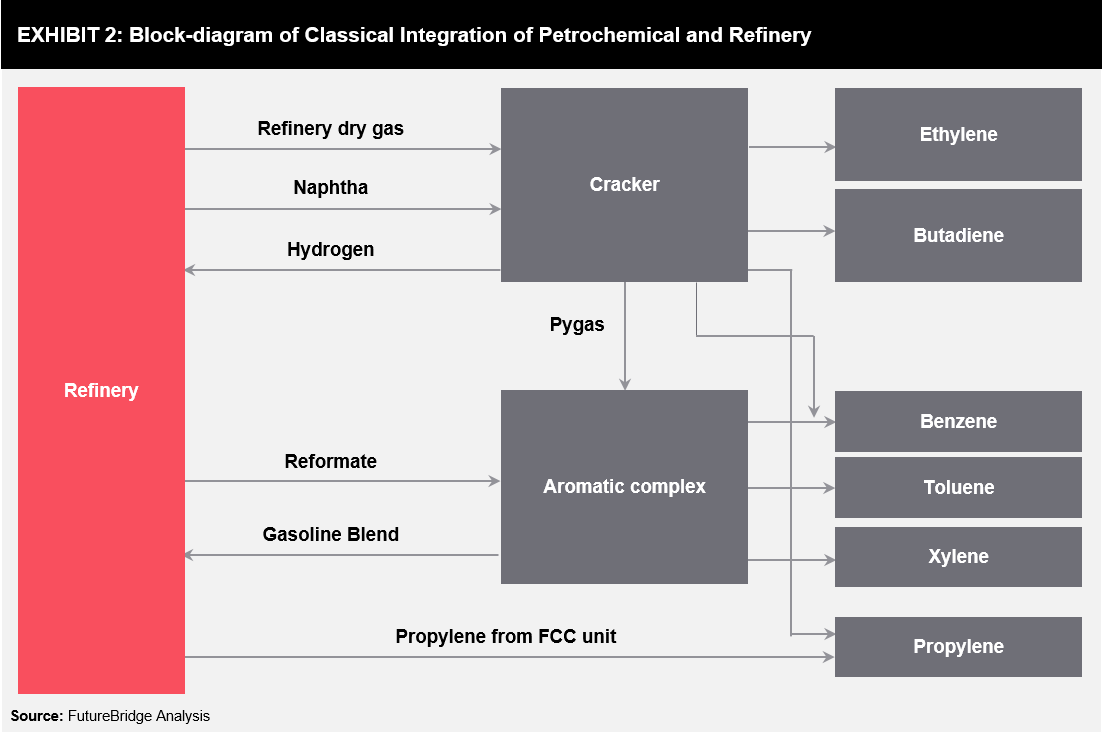

The conventional refinery set up was more focused on maximizing the production of transportation fuels. Crude oil-to-chemicals (COTC) technology allows the direct conversion of crude oil to high-value chemical products instead of traditional transportation fuels. It enables the production of chemicals exceeding 70% to 80% of the barrel producing chemical feedstock as opposed to ~10% in a non-integrated refinery complex. Exhibit 3 highlights the level of integration in refineries.

A majority of COTC plants that have been planned or have started operations are based in China or the Middle East. The choices of technology for the COTC plant depend on the type of feedstock available for processing and end-products being produced in refineries. COTC plants are primarily focused on increasing the yield of light olefins or aromatics, such as benzene, toluene, and xylene. It is observed that following the three strategies listed below are being predominantly used in COTC plants.

Direct processing of crude oil in steam cracking: The steam cracking technology is used for the production of ethylene and a small portion of propylene. This technology has evolved over time, and developments are being made to process different feedstock, i.e., naphtha, gas oil, and ethane. The direct use of crude oil in steam cracking for the production of light olefin was not successful due to coke formation and fouling of crackers. However, recently there have been attempts made to use light crude oil in steam cracking. The process requires preconditioning of crude oil prior to it being fed into the steam cracker. ExxonMobil has implemented such technology in its refinery located in Singapore. Shell has patented a similar technology with modifications in the way to avoid coke formation on the walls of the steam cracker.

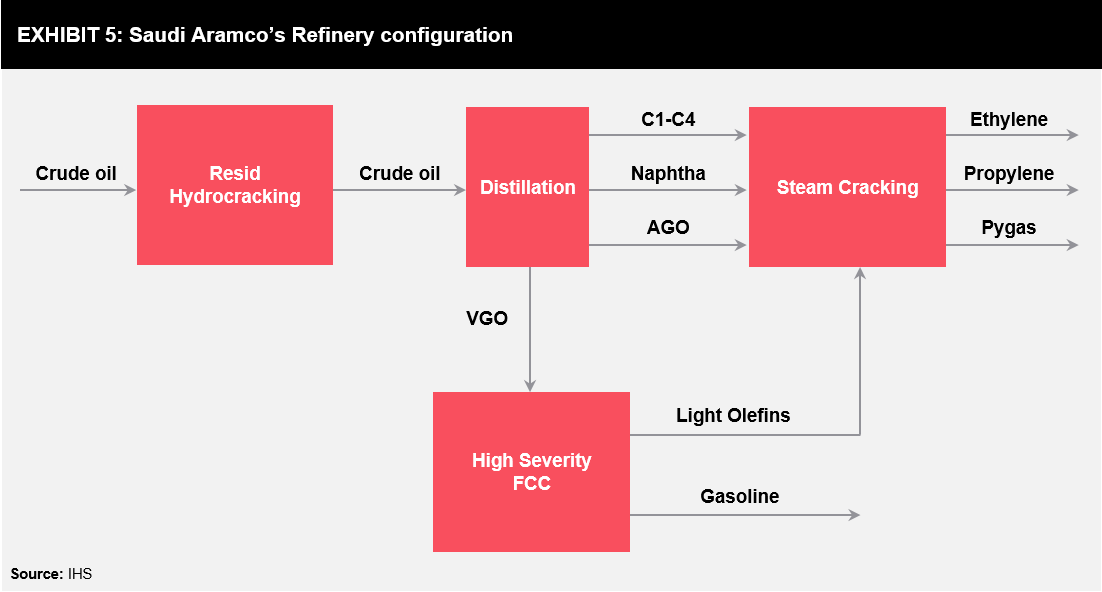

Integrated hydro-processing/de-asphalting and steam cracking: Saudi Aramco has filed patents focused on the integrated process for olefin production, comprising hydro-processing/de-asphalting and steam cracking. The hydro-processing/de-asphalting step produces highly paraffinic, de-asphalted and de-metalized stream, which can later be processed in the steam cracking unit.

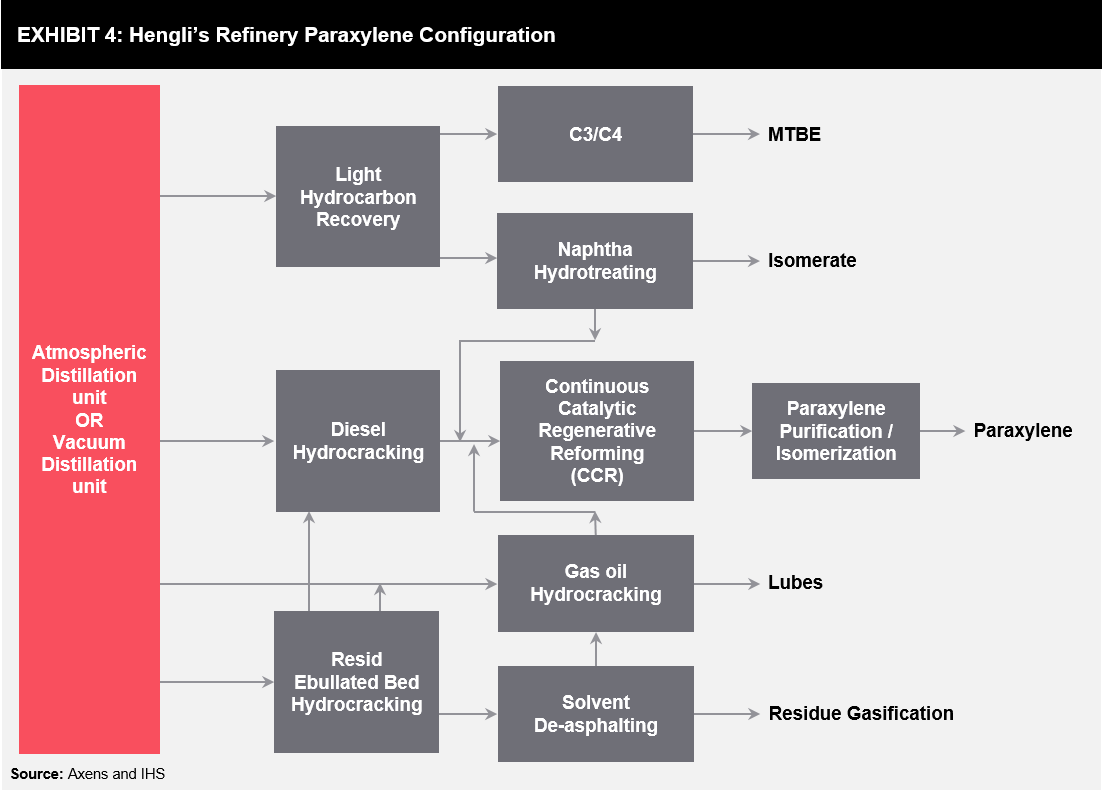

Processing of middle distillates and residues using hydrocracking technology: This type of processing strategy is adopted by Hengli Petrochemical Ltd. It involves hydrocracking of diesel and products from the vacuum distillation unit to produce naphtha range stream, which can later be processed to produce aromatic compounds.

Overview of COTC Projects/Plants

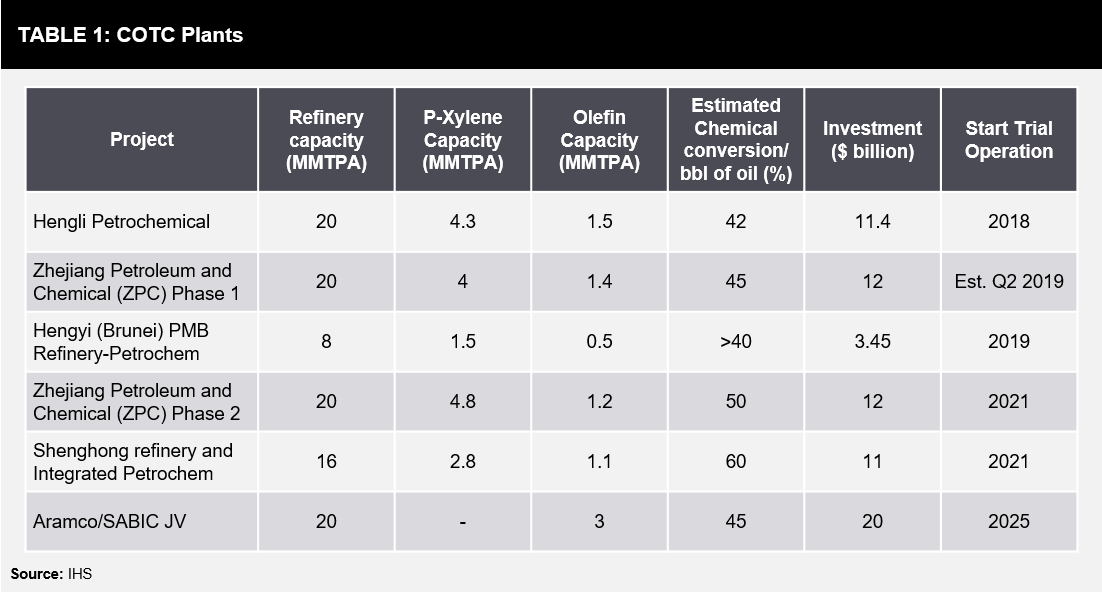

Most of the COTC plants/projects that have started operations or are planning to start operations are based in China and the Middle East. The plants based in China are more focused on the production of paraxylene. Table 1 highlights the current status of COTC plants.

ExxonMobil COTC: ExxonMobil uses its proprietary technology that allows the processing of light crude oil directly in the steam cracker, producing high-value petrochemical feedstock. It was officially launched as the world’s first chemical unit that processes crude oil in Singapore in 2014. The process involved pre-heating of the crude oil, partially vaporizing the heated crude in a flash tank and feeding the vapor from the flash tank to the steam cracker to produce ethylene, propylene, and related products. This process allows ExxonMobil to take advantage of the crude-naphtha spread. It is economically viable, mainly in the case of light crudes with low resid content. The key advantage of the process is that it requires low capital investment per project. However, the amount of chemicals produced are limited in comparison to plants/projects that are being operational or planned in China and the Middle East.

Hengli’s Refinery-Paraxylene Complex: The plant started by Hengli Petrochemical maximizes the production of paraxylene. It has achieved a full trial operation in May 2019. The plant is capable of processing 20 million bbl crude oil per year. The following technologies for Hengli’s refinery complex are supplied by Axens.

- Ebullated Bed Hydroconversion (H-Oil RC) technology for processing of vacuum residue, combined with a Solvahl de-asphalting unit for processing of unconverted residue

- Hydrocracking (HyK) technology for processing straight run vacuum distillate and those produced by the H-Oil RC unit, along with the de-asphalted oil from the Solvahl unit

- Hydrocracking technology for processing atmospheric gas oil in maximum naphtha production mode; hydrotreating technology for naphtha processing

- Continuous Catalytic Regenerative (CCR) reforming process to maximize aromatics production from naphtha

- Paraxylene purification combined with the technology for full isomerization of other C8 aromatics into paraxylene

- Announced investment cost for COTC complex that is approximately 11.6 billion

Exhibit 4 showcases the configuration of Hengli’s refinery paraxylene complex.

Saudi Aramco and SABIC COTC: Aramco and SABIC are partnering for the establishment of a COTC plant, which will process 400,000 barrels per day of Arabian Light crude oil to produce approximately 9 million tons of chemicals per year. The plant, considering its crude oil processing capacity and chemical production rate, is expected to have a 50% conversion rate. The plant is scheduled to start operations by 2025. The estimated investment cost for the plant is approximately $20 billion.

Exhibit 5 showcases the configuration of Saudi Aramco’s refinery.

Aramco is also exploring other technologies for producing chemicals from crude oil. The company partnered with Chevron Lummus Global (CLG) and CB&I (presently known as McDermott) to integrate CB&I’s ethylene cracker technology, CLG’s hydroprocessing technologies, and Saudi Aramco’s Thermal Crude-to-chemicals (TC2C) technologies, with a target of converting 70-80% per barrel of oil to chemicals.

Key take-away points

- COTC helps refiners to tackle the current market dynamics and remain profitable.

- COTC requires immense capital investment for plants that are focused on configuring the whole refinery to produce chemicals.

- Key technology components of the COTC plant are resid hydrocracking, hydrocracking, hydrotreating, and steam/thermal cracking.

- Refiners should consider the following points prior to investing in a COTC complex.

- Feedstock availability and advantage

- Choices available for refinery configuration and capital efficacy

- Operational reliability

- COTC plants produce a large volume of chemicals, thereby disrupting the supply-demand dynamics of end-product chemicals; end-product market dynamics are likely to play a major role in assessing the feasibility of the COTC plant.

- The large-scale adoption of COTC provides opportunities for operational integration in refineries to align themselves with the emerging trend of expanding business portfolios into petrochemicals. However, the type and level of integration are primarily driven by feedstock advantage, and thus, are likely to vary from region to region. For the US and the Middle East, which are not dependent on crude oil imports and have sufficient availability of cheap NGLs, direct production of crude oil to chemicals is the prevailing option. However, for regions, such as Europe and Asia, which are dependent on crude oil feedstock import and have limited availability of NGLs, the adoption of crude-to-chemicals technology will be governed by capital efficiency of the project and demand for the petrochemicals project.

- China has an increased number of projects focused on crude-to-chemicals due to the huge demand for petrochemicals in this country and the surrounding regions, capital efficiency, and low export cost.

- The risk of oversupply is associated with investments in the COTC complex. The scale at which products are produced using COTC is increasingly high. The combined capacity of xylene production from a Chinese COTC plant is roughly around 11 million tons per annum. As per the report from Argus media, the Asia-Pacific aromatics market is facing an extended period of oversupply as the new Chinese production comes on stream this year. This is exerting pressure on the margins for paraxylene production. As a consequence of this, Japan’s JXTG Nippon Oil & Energy plans to cut production of the product by up to 20pc.

References

- https://www.iea.org/reports/the-future-of-petrochemicals

- https://www.gpca.org.ae/2018/08/01/how-will-crude-oil-to-chemicals-reshape-the-global-petrochemical-industry/

- https://patents.google.com/patent/US6632351

- https://www.axens.net/news-and-events/news/386/axens-awarded-the-first-crude-to-paraxylene-complex-in-china.html#.Xfc48WQzaUk

- https://ihsmarkit.com/research-analysis/crudeoil-chemicals-projects.html

- https://ihsmarkit.com/research-analysis/crudeoil-chemicals-projects.html

- https://www.argusmedia.com/en/news/1892752-jxtg-to-cut-px-production-by-up-to-20pc

- Wood Mackenzie: https://www.woodmac.com/news/editorial/crude-to-chemicals-opportunity-or-threat/

- IHS: https://cdn.ihs.com/www/pdf/0519/COTCBrochurePEP.pdf

- Axens: https://www.axens.net/news-and-events/news/386/axens-awarded-the-first-crude-to-paraxylene-complex-in-china.html#.Xfc48WQzaUk

- IHS: https://seekingalpha.com/article/4195645-crude-oil-to-chemicals-projects-presage-new-era-in-global-petrochemical-industry

- IHS: https://scic.sg/images/2017/4-RJ_Chang-Technology_Developments_.pdf

9 min read

9 min read