Autonomy Delay: Current Challenges and Bottlenecks

Mobility

Mobility

Prelude to Current Scenario

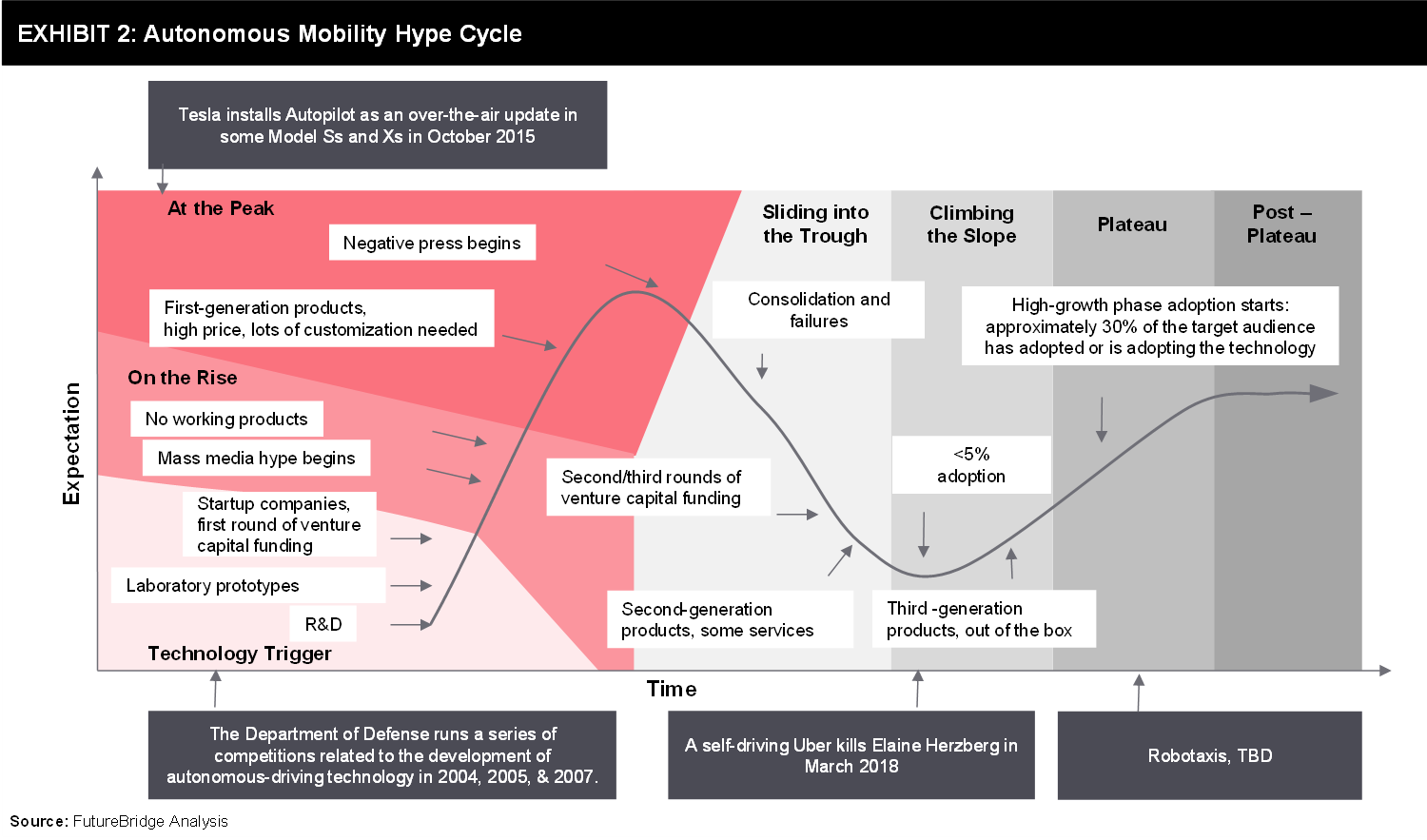

The year 2020 was supposed to be driverless cars’ introduction to the broader public. Not very long ago, we started hearing bold predictions of the robotaxi future, promised to arrive by 2020 or shortly after that. However, most autonomous technology developers aiming for Level 5 autonomy just a few years ago scaled down their full autonomy targets.

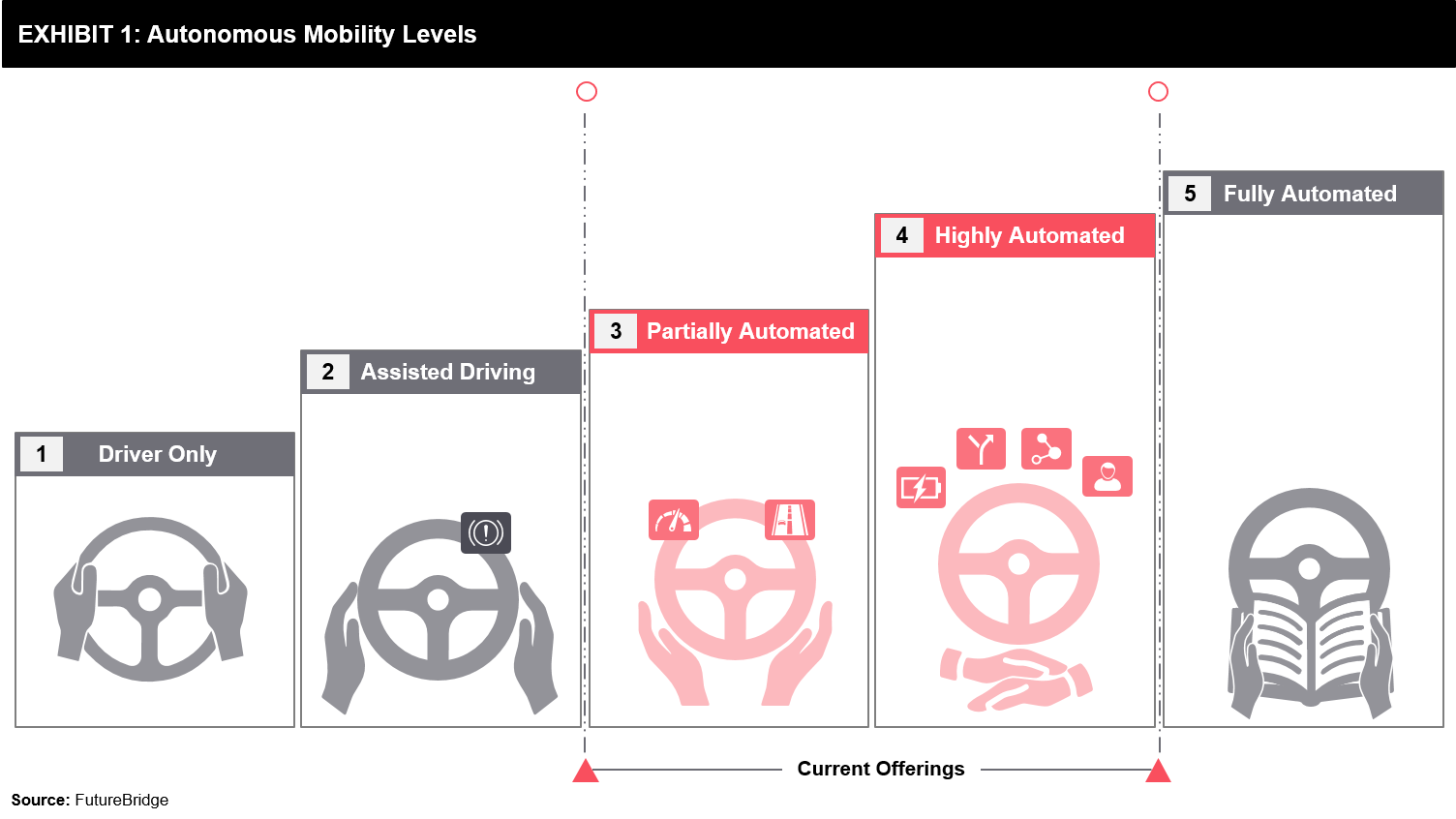

At the start of this decade, several developers revealed prototypes of Level 2 and Level 3 semi-autonomous vehicles and also provided their roadmap to level 5 vehicles. The initial era, stretching from 2010 to roughly 2015, was viewed as the early years of developing autonomous driving technologies. It was then followed by an exceedingly exciting but the shorter period from 2015 till 2018 when Level 5 autonomy seemed closer to reality. This optimism was because getting from Level 3 to Level 5 would take almost the same time as it took to get from Level 1 to Level 3.

Indeed, among several leading developers, Uber had stacked up many autonomous miles with its Volvo modified test vehicles in numerous cities, before the unfortunate incident in the spring of 2018. Even Tesla Autopilot accidents continued to increase, sending a signal to the industry that Level 4 and 5 may take a much longer time to achieve. These developments did not help in building a definite acceptance for level 5 vehicles among the consumers.

Industry Pulling Back

Not just level 5, few industry players also scaled down their efforts in mid-level autonomous vehicles, indicating pullback or general delay for higher-level autonomy (Level 3 to Level 5).

- Magna and Lyftdissociated with each other on autonomous development

- Audichanged its plans to offer even Level 3 autonomy in the current A8 sedan

- PSAhas moved away from L4 automation, instead of focusing on L1 to L3 and ADAS, stating that the cost to achieve L4 would be very high and reduce its profit margin

- Waymo’s valuation slashed

Various other developers have a similar stance concerning development. Another reason for amplifying the challenges in the coming years is the current pandemic, which has severely hit the mobility industry. Several self-driving car companies have no revenue, and the operating costs are unusually high. Autonomous vehicle start-ups spend $1.6 million a month on average — four times the rate of financial tech or health care companies. Some of the more prominent names impacted by the pandemic include leading players such as Continental delaying autonomous investments in the cost-cut drive, and Ford postponing independent vehicle offerings until 2022.

Perpetual Challenges Limiting the Growth

Autonomous developers have recognized that standalone innovations in cameras, radar, and Lidar sensors will not lead to genuine autonomy if they don’t focus enough on the software stack and computing hardware. Besides, the holistic development with “Enabling Regulations” is not seen frequently in the industry, giving rise to a multitude of challenges. Some of these include:

Defining Suitability of Sensor Packages

A significant challenge in automotive software model development is understanding the full range of edge-cases with respect to sensor packages. The human eye has higher resolution, but even better, it can adapt to a wide variety of lighting, contrast, and calibration scenarios. On the other hand, the sensors are very brittle and work in limited operational ranges of these parameters. Some of the most common challenges on sight have been –

- Dealing with light coming into the camera

- Higher resolution for a detailed view of a small object (human fovea can focus on a specific part of the image and assess that in detail)

- Managing sensor redundancy

These are just some of the unresolved questions that are challenging the sensor technology developers.

Software and Training Data

In Autonomous vehicles, most systems depend on training data to learn about conditions they are likely to occur and how to respond/react to them. The more high-quality data the machine learning model has to train, the better the model will be. McKinsey Global Institute found that 1 out of 3 AI systems require model refresh at least monthly and sometimes daily.

A practical training data exercise should identify when an existing dataset makes a good sense and when it’s necessary to gather real-world experience. For instance, training the vehicle to anticipate inherent human behavior like a pedestrian crossing exterior of the crosswalk, or making a last-minute change without signaling, this training comes from real-world exposure to such scenarios. Virtual simulation and validation have made significant improvements in the last few years, but their efficacy depends on the ability to generate & process more and more edge cases continuously.

However, there are only limited players with resources to gather high volume real-world data – this is indeed a chicken and egg problem.

Product Liability Risk

Autonomous vehicle manufacturers must prepare for potential product liability risk when individuals or property are damaged by or in the circumstances surrounding autonomous vehicles (AV).

As the responsibility for accidents shifts away from drivers and towards the entities that design, manufacture, and maintain AVs. The list of companies potentially liable for accidents will deepen the complexity of deciphering who should be taking the blame.

One of the most critical challenges will be to assess whether software or hardware caused a particular occurrence, which will require petitioners and courts to delve into, among other, reasonably novel/unknown subjects. These interactions take place between the systems. It may prove to be troubling for companies within the supply-chain that lack access/knowledge to proprietary source code.

Privacy and Security Concerns

Today’s vehicles can collect, store & transmit – data on drivers, vehicles, passengers, and nearby pedestrians on the road. The protection of data is critical to the growth of the global AV industry. To prevent data-related disruptions, governments in the EU and the US have introduced legislation and AV industry-focused guidance on cybersecurity and data privacy.

An essential piece of the European strategy on AVs is creating a common European mobility data space, which is to being developed in the Q4 ‘Smart and Sustainable Transport Strategy’. Several related EU legislative initiatives would further seek to regulate the handling of data critical to the AV space.

Regulatory Landscape

Since AV technologies are an emerging field, its legal landscape, i.e., both the overall understanding and its implications, is still evolving. Autonomous vehicle manufacturers, as well as entities designing and building AV-related systems, and all related suppliers must be aware of potential product-liability risks, and the shift of liability with AVs that takes away certain user-centric legal defenses that have traditionally been available.

Customer Acceptance will be the Key

Another critical obstacle to look out for will be customer sentiments. The public’s acceptance, adoption, and perceived view of AVs’ safety is currently a challenge. High-profile incidents, such as the Tesla Autopilot accidents have raised some serious concern on how safe they are to ‘drive.’ At the time of the accidents, the Level 2 system was engaged. However, the drivers were either not paying attention or weren’t ready to take back control of their vehicles at the critical moment.

Irrespective of what these vehicles were able to do, these accidents have reduced the consumers’ confidence.

Customer Education

The challenge is to ensure that consumers know what they need to do when interacting with autonomous vehicles. For instance, if a robotaxi is picking you up, users will need to use an app and follow an exact location – you can’t call the driver and tell him that you’re waving at him. There are use case twists that need to being sorted out, holding back wide-scale deployment.

Autonomous Road Trials

Test vehicles have covered lots of miles on highways, however self-driving cars have significantly less experience dealing with the more chaotic conditions of urban traffic. There’s still not enough practical testing to ensure the safety of children, cyclists, and older people. Or dealing with stop-and-go traffic and busy intersections all scenarios requiring a V2X connection via LTE-V, or shortly 5G-V2X.

Ongoing Activities and Drivers for Autonomous Driving

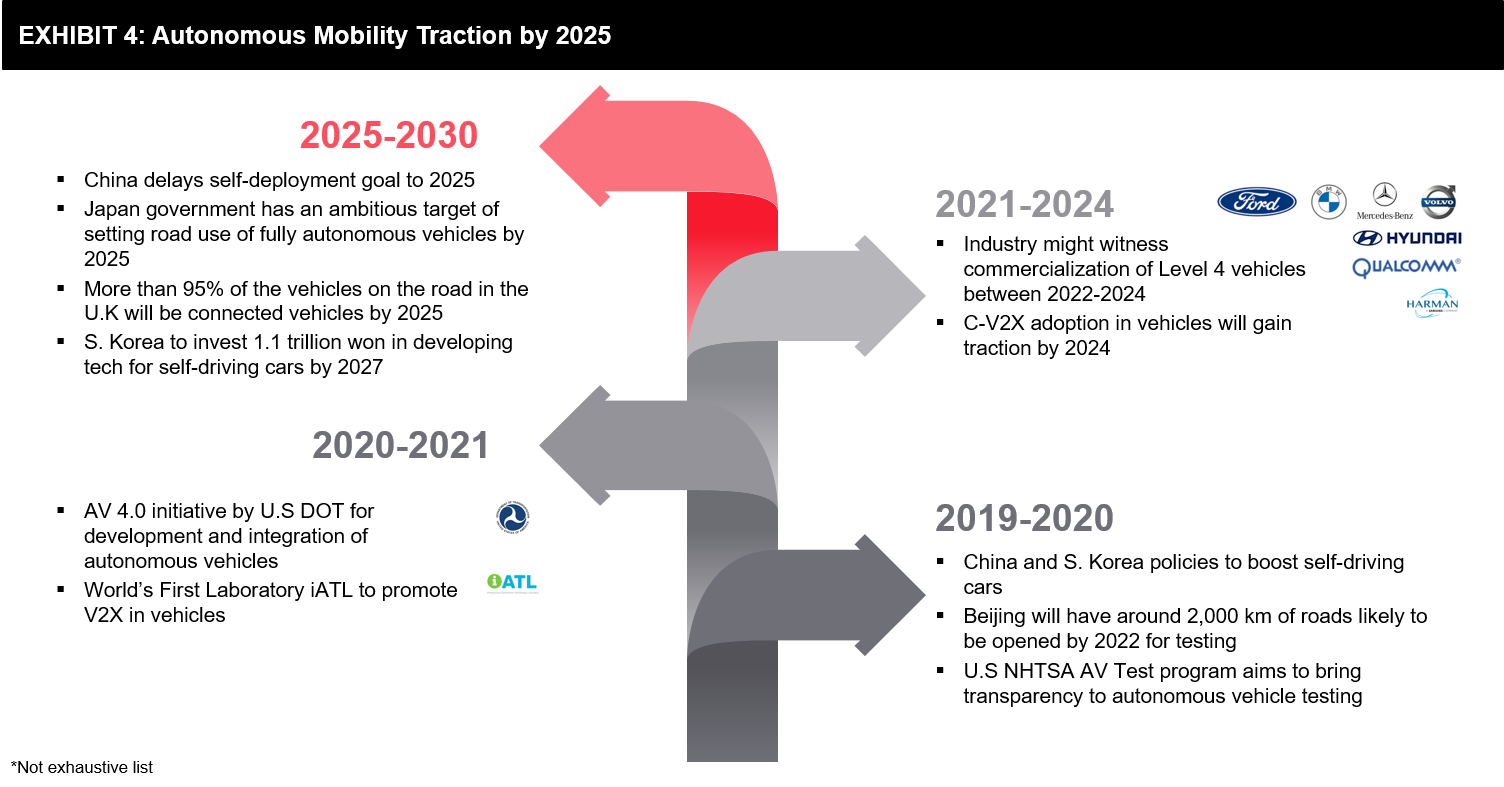

ADAS technology (< L3) adoption could pick up pace in the next five years, mainly pushed by regulatory mandates from the UN, EU, US, etc.

- ADAS adoption will increase rapidly in the coming five years, led by countries like the US, Europe, Japan, etc.

- Regulatory mandates will enhance the adoption like the US and EU is making AEB and FCW mandatory by 2020-23

- The changing automotive market with increasing ADAS systems offers new opportunities for players to generate premiums

- General improvement in autonomous software (machine vision, sensor fusion) and ML algorithms across industries and applications

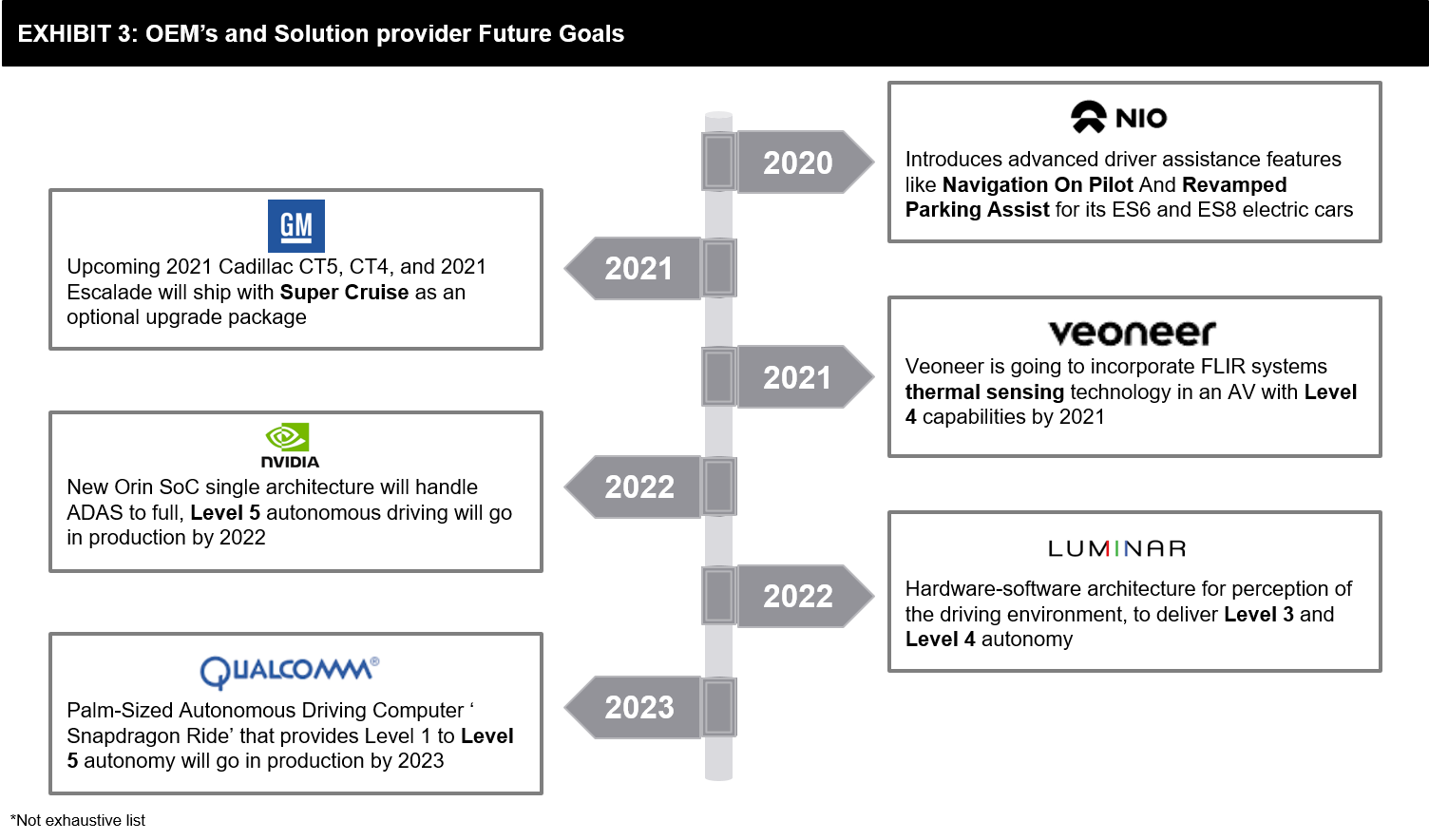

Though these activities will take us to a fully self-driving future in the longer term, the self-driving vehicle players have started defining new targets for the next three to five years. Exhibit 3 indicates some of the players bringing back their focus on the lower level of autonomy and driver-assist features.

Level 5 skepticism and a reconsideration

Launching an autonomous vehicle will require relentless effort on all technology fronts. As funding for autonomy projects dries up at legacy automakers, the new players & outsiders may pick up the baton and lead the technology front. With enough money already in, and with hundreds of start-ups and researchers working on developing the solutions, the progress might be few software upgrades away and might surprise the skeptics.

Considering the current turmoil, we still believe that autonomous technology will mature for deployment by 2025-2030, and countries like China would start deployment for mass use. For the rest, deployment in the latter half of the coming decade will be an optimistic scenario. In the next decade, most likely, we will have to be content with the V2X and smart infrastructure technologies that are now reprioritized by OEMs and regulators alike before we get to ride a self-driving car.

Launching an autonomous vehicle will require relentless effort on all technology fronts. As funding for autonomy projects dries up at legacy automakers, the new players & outsiders may pick up the baton and lead the technology front. With enough money already in, and with hundreds of start-ups and researchers working on developing the solutions, the progress might be few software upgrades away and might surprise the skeptics.

Considering the current turmoil, we still believe that autonomous technology will mature for deployment by 2025-2030, and countries like China would start deployment for mass use. For the rest, deployment in the latter half of the coming decade will be an optimistic scenario. In the next decade, most likely, we will have to be content with the V2X and smart infrastructure technologies that are now reprioritized by OEMs and regulators alike before we get to ride a self-driving car.

References

- Continental delays autonomous investments in cost cut drive

- Ford postpones autonomous vehicle service until 2022

- Full Self-Driving Cars Are Still A Long Way Off – Here’s Why

- China delays self-driving car deployment goal to 2025

- Self-Driving Cars Are Taking Longer to Build Than Everyone Thought

- Here’s Why Our Gleaming Self-Driving Future Has Been Delayed Indefinitely

- Solving the Data Challenge for Autonomous Driving

- How the race to autonomous cars got sidetracked by human nature

- This Was Supposed to Be the Year Driverless Cars Went Mainstream

- The challenges of developing autonomous vehicles during a pandemic

10 min read

10 min read