Introduction

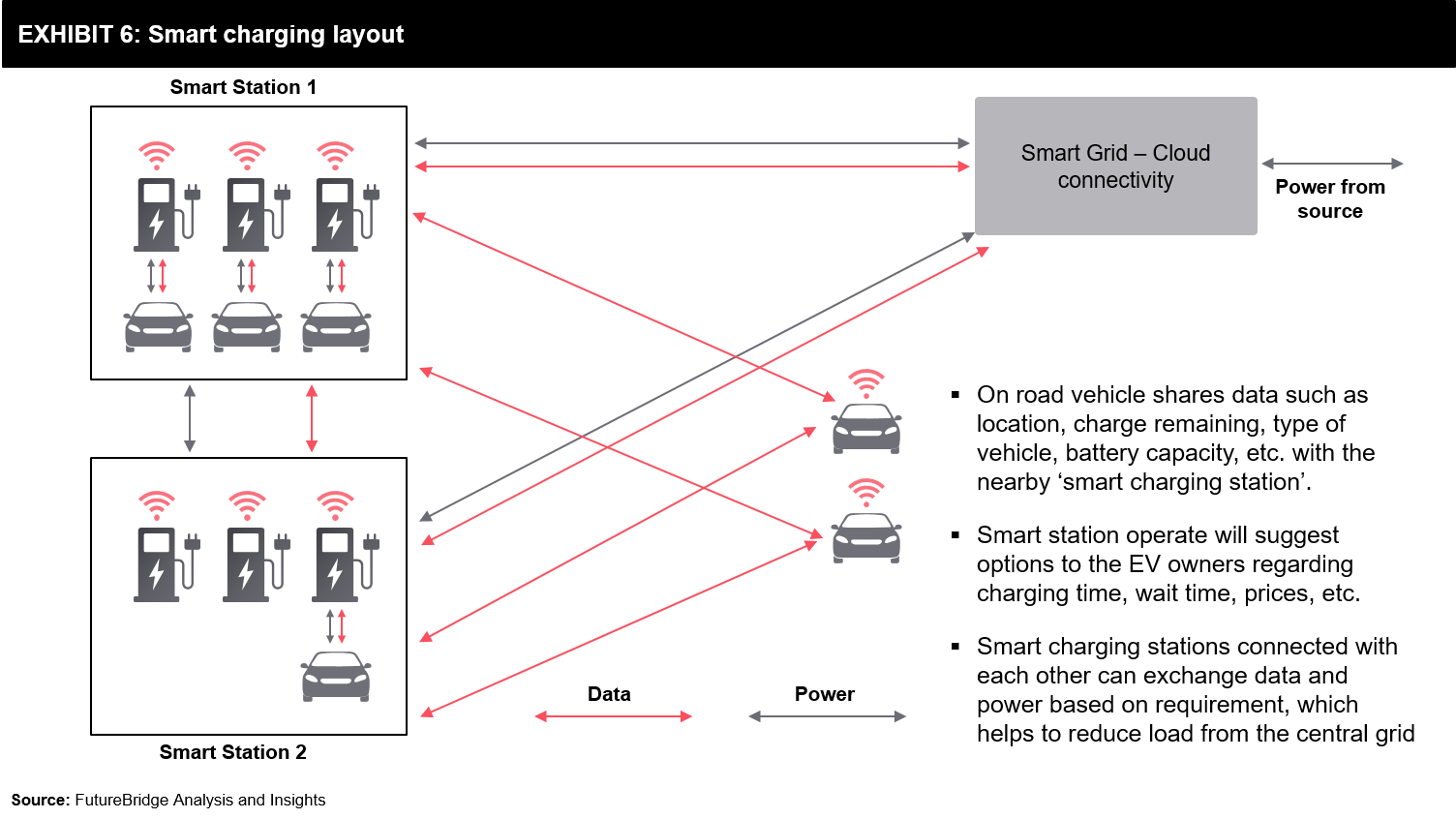

Conventionally, charging stations were mainly used to charge the batteries; however, increasing penetration of technologies such as artificial intelligence (AI), IoT, and cloud computing are changing how electric vehicle (EV) charging stations work. Currently, EV OEMs and supporting companies (battery manufacturer, power suppliers, etc.) are shifting their focus towards smart charging stations – where the stations and electric vehicles share a data connection, and the charging device shares a data connection with a charging operator. Smart charging requires digital identification from the electric car, and owner identification connects the EV, charging point, and the charging event. The customer is charged based on consumption, and money is deducted digitally from the customer’s account. Smart charging stations are connected via the cloud. Due to this, these are easy to manage and can play a crucial role in the adoption of onsite renewable energy generation.

Currently, EVs account for less than 1% of total energy consumption, but in the next 10–15 years, demand for electricity from EVs will increase exponentially. According to IEA, the global electric vehicle battery capacity was 170 GWh in 2019 and is expected to reach 1.5 TWh in 2030. Increased power demand from EVs might create a huge load on a grid, and smart EV charging will play a crucial role in protecting the grid. Smart EV charging stations will interact with local and national grid to balance the peak loads and offer information (such as charging time, rates, wait time, etc.) for a smooth charging experience.

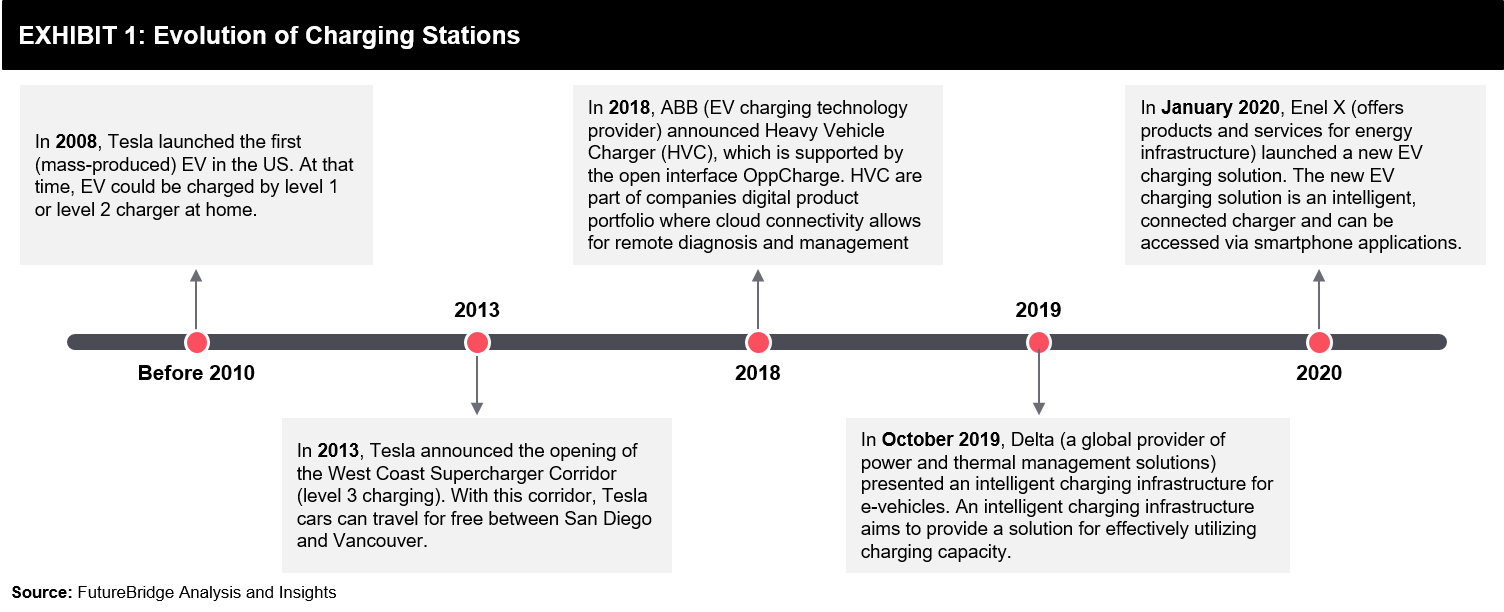

In the last ten years, EV charging stations have evolved rapidly, and currently, charging stations are capable of charging cars in short durations (20–30 minutes). Many technology providers such as ABB, Delta, and Enel X are focusing on developing next-generation EV charging technology, which includes cloud connectivity, AI, access via smartphone, etc. (Refer Exhibit 1).

Current Scenario

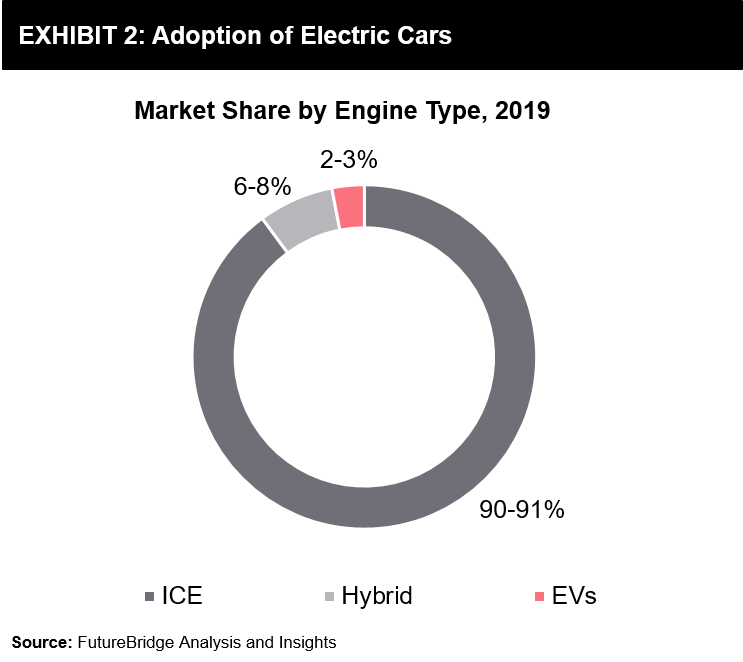

Currently, electric transport technology is in its early stages across the world. Countries such as the US, Canada, UK, Germany, France, China, and Japan are leading electric transport technology development. (Refer to Exhibit 2)

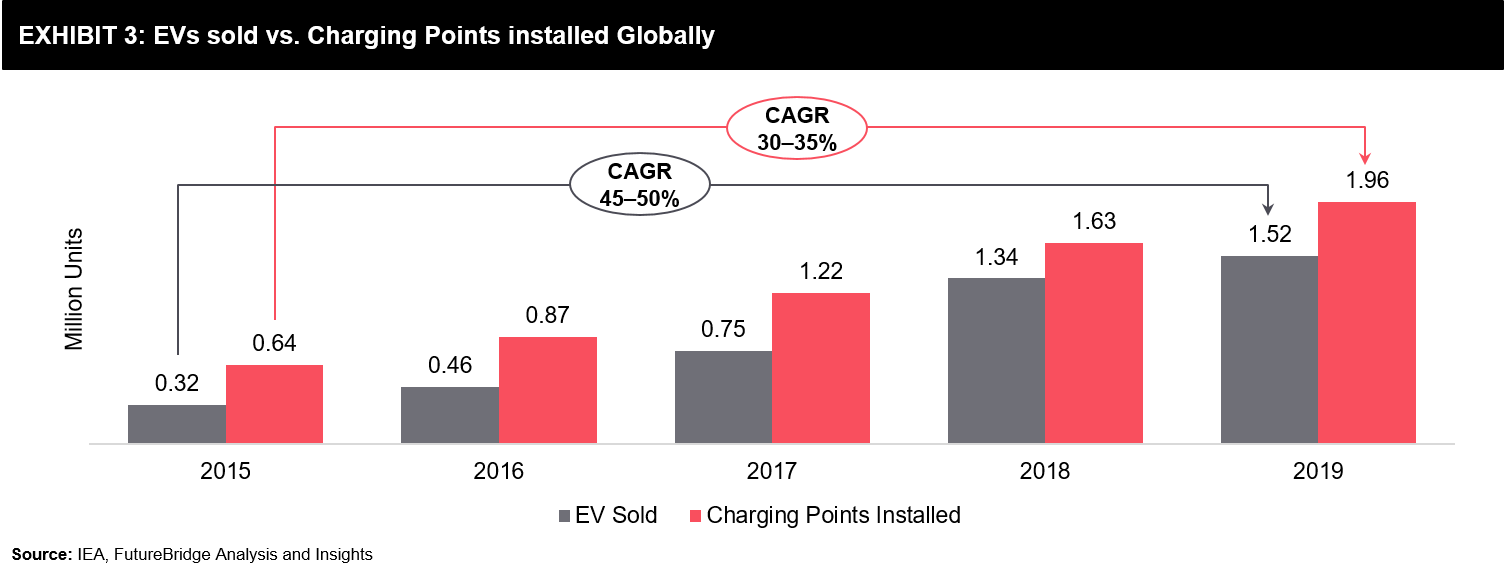

In the last five years, the EV market witnessed a CAGR of 45–50%, and ~1.52 million EVs were sold in 2019 compared to ~0.32 million EVs in 2015 (Refer Exhibit 3). According to IEA, there were ~4.8 million EVs on the road in 2019, and it is supported by ~7.16 million charging units (global installed base).

In the last five years, the EV market witnessed a CAGR of 45–50%, and ~1.52 million EVs were sold in 2019 compared to ~0.32 million EVs in 2015 (Refer Exhibit 3). According to IEA, there were ~4.8 million EVs on the road in 2019, and it is supported by ~7.16 million charging units (global installed base).

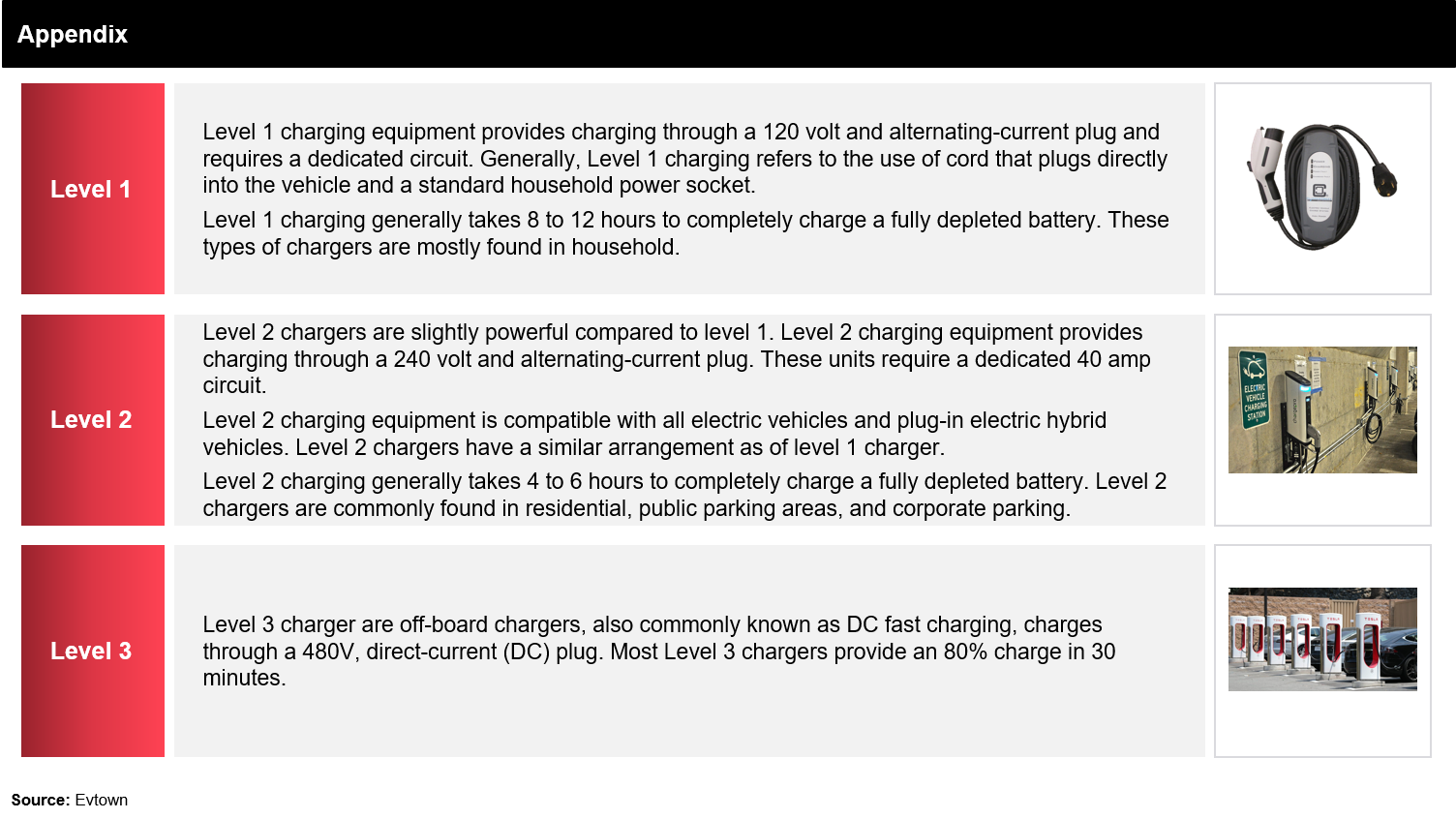

In 2019, ~1.96 million chargers were installed globally, out of which ~1.5 million chargers are of level 1 type and installed in households (Refer Appendix and Exhibit 3). In 2019, ~70,000 level 2 and ~30,000 level 3 chargers were installed. Most of these are conventional chargers with no cloud connectivity and IoT support. However, deployment of 5G (5th generation internet infrastructure) will boost the development and installation of smart recharging stations.

Business Models

Currently, Government bodies are collaborating with EV charging companies to increase charging stations’ penetration across cities. This initiative might improve EV adoption in the next 5–10 years and reduce CO2 emission. Until March 2019, EV charging was free of cost in Oslo, Norway. However, Oslo has now started converting its free charging stations (~1,300 public charging) to paid ones. This is done to discourage EV owners from using charging points as parking spaces.

Currently, most EVs are charged at the home by level 1 charger, and the vehicle owners pay the grid tariff. As the adoption of EVs across the globe increases, the number of public charging stations might increase. Cost of the level 1,2, & 3 charger is 100–300 USD, 500–10,000 USD, and 100,000–150,000 USD respectively. As the number of level 2 and level 3 chargers increase, companies might come with the business models to recover the investment. Currently, some of the companies are charging EV owners for power consumed or time of charge.

Smart Charging Technology

Current generation charging stations do not share data (instantaneous data sharing) with energy providers, grid operators, and charging station owners. However, smart charging technology enables data communication between charging stations, EVs, and the grid (refer to Exhibit 6). Currently, there are very few EV charging companies such as ABB, Delta, and Enel X that are investing in smart charging technology.

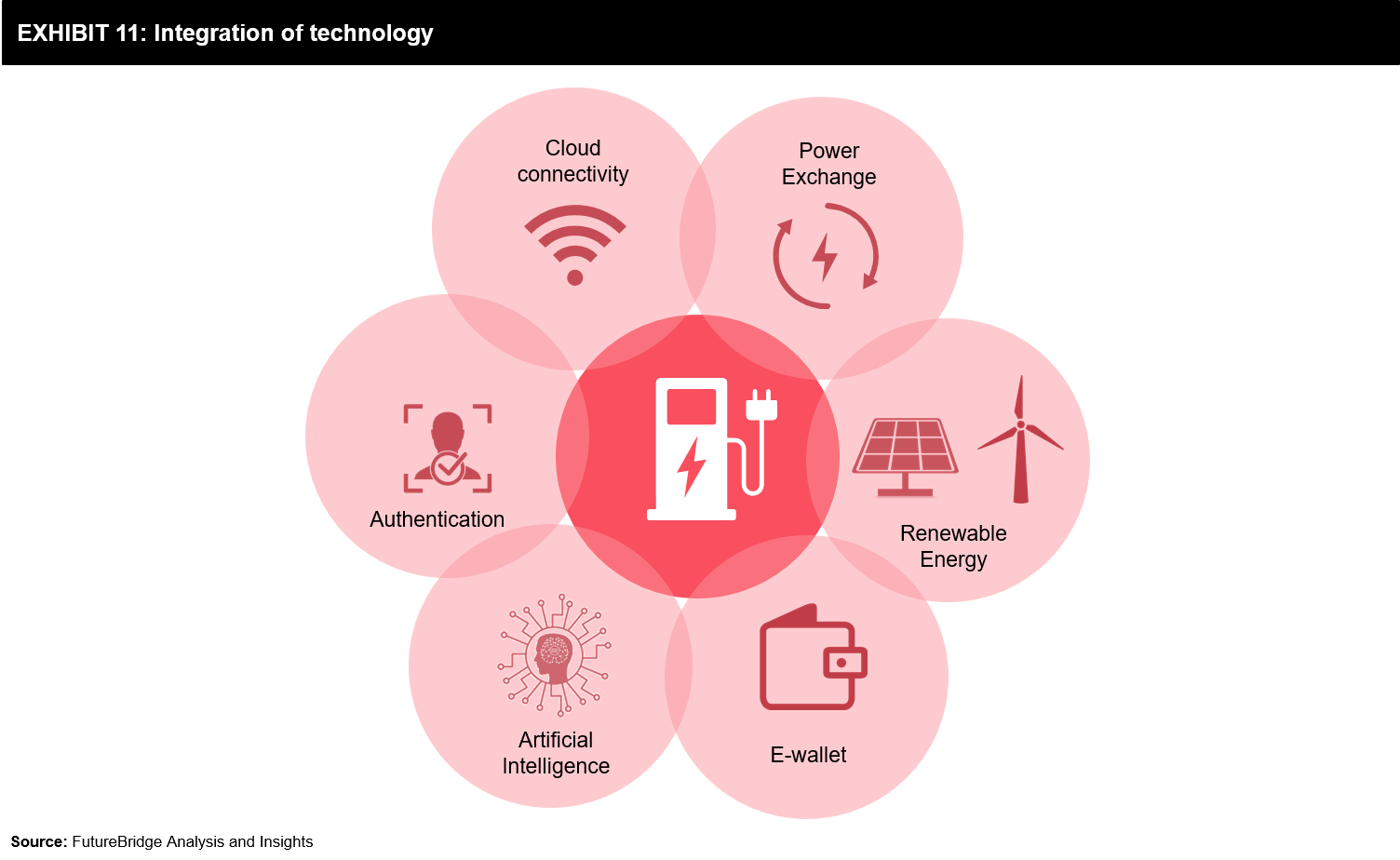

Smart EV charging refers to the scenario where customers are benefited from the use of cutting-edge technology such as cloud connectivity, AI, renewable energy, e-wallet, e-authentication, and power exchange with the grid. Currently, there are four broad categories of smart charging:

- Uncontrolled but with time-of-use smart charging: It is the basic smart charging type where users are encouraged to charge their EVs for a specific time of day to avoid high charges due to peak-demand.

- Unidirectional controlled charging (V1G): In this type, charging companies and EV adjust the rate of charging based on the control signal from the grid operator.

- Bidirectional smart charging: In this type, EV battery is used as a power source for home or building. The EV can be used for storing energy produced by an ‘onsite-renewable generation’ source. Later, the power from EV is used as back power in case of emergency or power outage.

- Vehicle-to-grid: In this type, EV batteries can send power back to the grid. Grid operators and utility companies might purchase power from EV owners in peak time and EV batteries can be used to balance the grid.

Road Ahead

EVs are getting traction in the global automotive market, mainly due to their ability to reduce CO2 emissions. However, the majority of the power currently is generated from fossil fuel sources. So, EVs will not be a green alternative to the IC engine unless powered by renewable energy sources such as wind and solar. To incorporate renewable energy through smart technology into the main grid, it needs to interact with the EV charging station and vehicle.

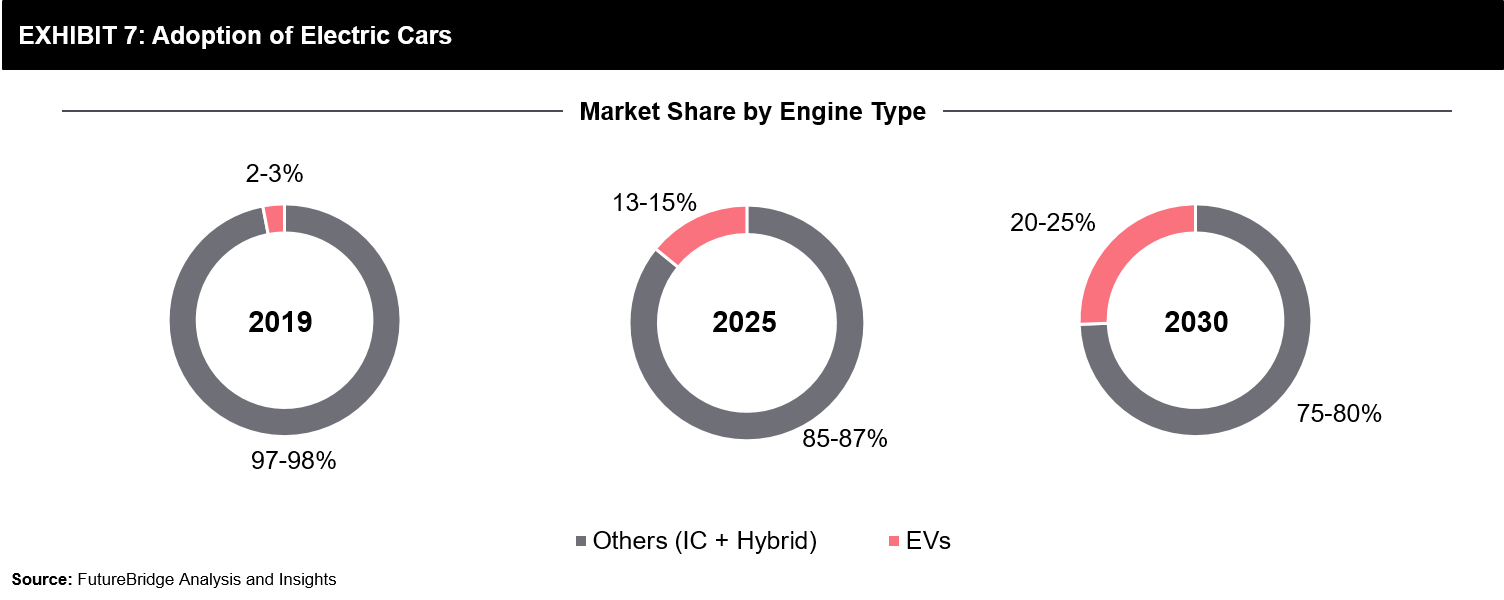

According to FutureBridge estimates, by 2030, around 25% of the vehicle sold globally will be plug-in EVs (refer Exhibit 7). Electric passenger cars will represent the largest market share, followed by buses, trucks, and vans. By the end of 2030, there might be 100–110 million EVs on the road globally, and to cater to their energy demand, EVs charging infrastructure needs to be strengthened.

In the next 10–15 years, there will be significant investment in strengthening the EV charging infrastructure. New players, new business models, and new technologies (adoption of emerging technologies from other industries) will transform conventional EV charging into smart charging.

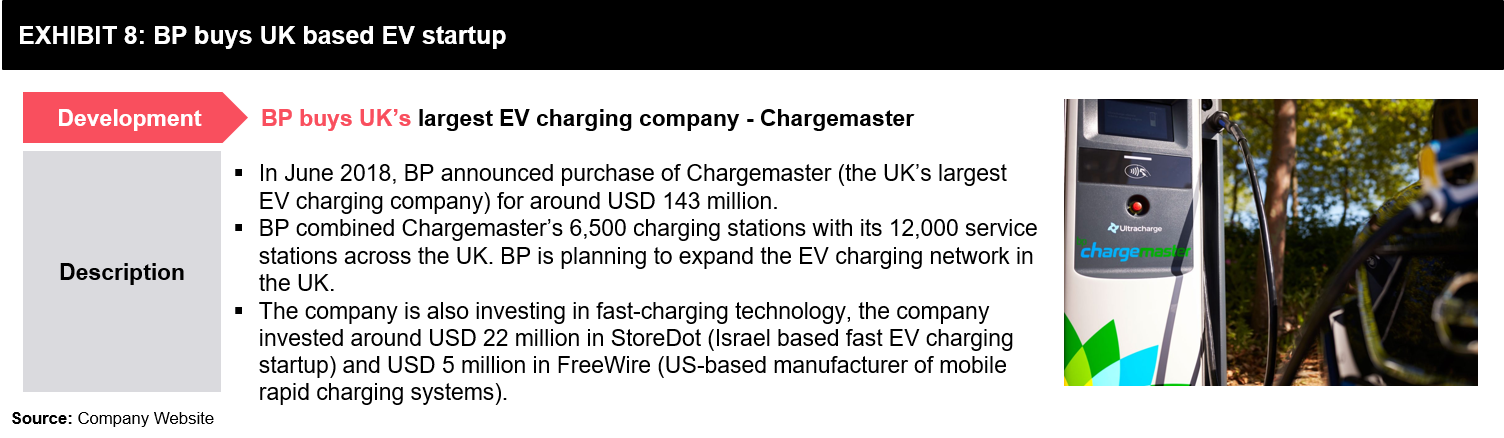

New Players

As the electrification trend is picking up, oil companies are scouting different markets for investment. Many oil companies such as BP, Exon, and Shell are investing in EV charging technology. These companies are acquiring and funding start-ups in the EV charging space and plan to turn their existing gas stations into EV charging stations. Oil companies are further investing in renewable energy technologies and planning to integrate these with EV charging infrastructure. Oil companies will also invest in ultra-fast charging, vehicle-to-grid, e-wallet, AI, cloud connectivity, etc. and transform their EV charging network into smart charging infrastructure. (Refer to Exhibit 8 and 9).

Electric hardware manufacturers and technology providers (datacenter solution, energy management systems, etc.) such as ABB, Eaton, Schneider Electric, and Siemens are also investing in the EV charging infrastructure. As these companies offer Building Energy Management Solutions (BEMS), they are planning to integrate EV charging solutions with existing BEMS by installing EV charging points at parking. (Refer to Exhibit 10).

New Business Models

As the EV charging technology becomes mature in the next 10–15 years, new business models will emerge in the market to attract more customers.

Annual Contract

In this model, EV charging companies focus on offering service to large customers (large IT parks, 3PL centers, schools, etc.) with its fleets of vehicles. These customers tend to have dedicated parking lots for fleets, and it can be used to install EV charging points. The Depot model solves many problems (land availability, customer availability, financial risk mitigation, etc.) and for EV charging companies.

EV charging companies can enter into an annual contract with large customers offering them service at lower charges. EV charging companies can utilize the client’s space for renewables energy generation applications (solar and wind) and battery storage applications. EV companies can offer vehicle-to-grid options to these large customers and utilize vehicle battery capacity to balance the grid load. The EV charging companies can incorporate additional ‘smart charging’ features such as e-authentication, e-wallet, cloud connectivity, etc. to serve their premium customers better. Smart charging features are expected to reduce the wastage and bring down the cost of EV charging for large customers.

In the next 10–15 years, many large customers are expected to have a dedicated EV charging partner for reliable power supply.

Free Service Model

Some EV companies such as Volta are offering ‘free charging’ for EV customers in the US. Volta’s business model generates revenue from advertising that runs along with its physical assets. With these business models, the company installs its EV charging infrastructure (level 2 chargers, which take around 4–6 hours for full charging) at a premium location. The premium location attracts advertisements, and the EV customers can view that.

In some cases, Volta is partnering with grocery stores, pharmacies, shopping centers, hospitals, and movie theaters to install EV charging stations. Free charging from Volta attracts more customers towards those commercial establishments.

According to FutureBridge, in the next 3–5 years, there might be several start-ups offering free charging for EV customers across the globe. Many retail outlets, movie theatres, hotels, and restaurants might partner with EV companies to provide free charging service for their customers. As more players emerge in the market, the competition will grow, and these companies may shift towards smart charging by offering a vehicle/mobile app (for free charging service) for EVs.

Vehicle-to-Grid

EV charging companies are planning to use EVs as an energy storage medium. So the companies are investing in vehicle-to-grid technology that enables energy to be pushed back to the power grid from the battery of an EV.

The majority of the personal vehicles are only operational at 10–15% of the day, and the remaining time they are idle. In the case of EVs, they are operating at 10–15% of the time, on charge at 10–20% of the time, and the rest of the time idle. EV companies are exploring ways of utilizing the energy storage capacity of the EVs at idle time. Currently, companies such as Nissan and Virta are experimenting with vehicle-to-grid technology.

According to industry experts, the vehicle-to-grid business model largely depends on customers’ willingness to allow their cars as energy sources. Currently, there is a minimal incentive for EV owners to act as an energy storage system; however, as business models become popular and feasible many EV companies might offer the vehicle-to-grid option to its customers.

Technology Integration

EV charging technology is at the nascent stage, and it is evolving continuously. Traditional EV companies were focusing on improving the charging time of the EV. In the last 5–10, technology start-ups are emerging in the EV charging market and integrating technologies such as cloud connectivity, AI, renewable energy, e-wallet, e-authentication, and power exchange with the grid.

- Currently, ABB is working with Microsoft to launch a next-generation EV charging solution powered by Microsoft’s Azure platform and it’s Cortana Intelligence Suite.

- Similarly, Moxia (UK-based energy technology company) is working with Alfen (the Netherlands based energy storage-solution provider) to reduce energy bills of end-user by deploying AI-backed smart grid technology. The company is planning to create a smart-charging plan for the end-users using AI-backed software. In the future, many EV companies will operate a smart grid based on AI technology.

- In e-authentication technology, ABB is partnering with Elatec (Germany based RFID manufacturer) to deliver mobile-enabled electric vehicle charging. With this technology, ABB EV charger user’s identity can be verified by mobile/watch applications.

Currently, EV charging companies are focusing on integrating one or two smart features in a charging solution. As the technologies such as vehicle-to-grid, bi-directional smart charging, AI, e-wallet become mature, more advanced and efficient charging solutions will emerge in the next 10–15 years.

Appendix

References

- Global EV Outlook 2020 – IEA

- Charging the Future: Challenges and Opportunities for Electric Vehicle Adoption

- Electric Vehicle Smart Charging

- EV Charging Trends: Solar Absorption, Demand Response, Green Charging

- EVAdoption

- Smart Charging

- Financing EV charging infrastructure

- Robotics and Automation

- Green Car Reports

Additional Material

Join us for an upcoming webinar on Top-20 Carmaker by Market Leadership in Electrification on 29 April 2021. Register here.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.