Betting on Hydrogen has gone high: M&A

Hydrogen: A forward-looking story

Amongst the many decarbonization levers present in the society, hydrogen offers not only a great long-term potential but also versatility of usage. With today’s existing technologies, hydrogen can be produced, stored, and moved, allowing us to use energy in many different formats. Hydrogen demand has risen three-fold since 1975, accounting for ~70 million tons of pure hydrogen produced in 2018. This has obviously come at a huge environmental cost – its production resulted into ~830 million tonnes of average CO2 production per year, equivalent to combined CO2 emissions from the UK, and Indonesia. While, most of the hydrogen produced today use traditional feedstocks such as natural gas and coal, resulting into CO2 emissions, there is a growing momentum towards producing Green Hydrogen using renewable feedstocks such as solar, wind, and others.

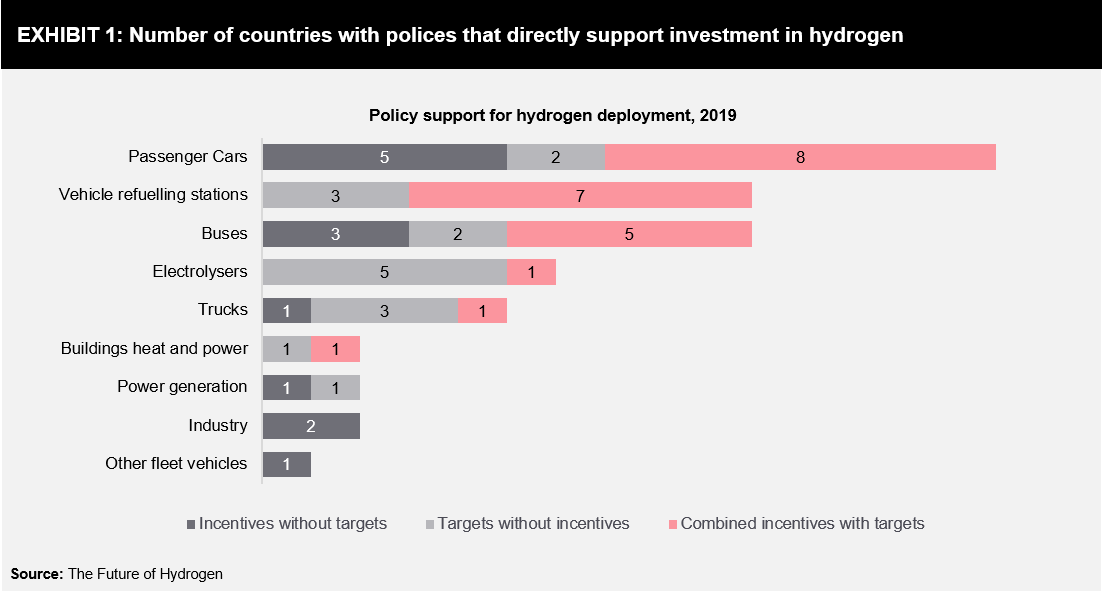

COP 21, held in Paris, 2016, did a phenomenal job in creating the required buzz for climate change which warrants keeping the global temperature to well below 2 degree Celsius above preindustrial levels. As a result, there has been a growing momentum in the number of countries with policies that directly support investment in hydrogen technologies; in mid-2019 the total number of targets, mandates and policy incentives in place globally to directly support hydrogen was around 50 (Exhibit 1). Technically speaking, the potential for hydrogen stands unmatched if such ambitious targets need to be met. It is a great source for storing the variable energy produced from many renewable sources, and can ideally store this energy for days, weeks and even months. Hydrogen based fuels can transport this energy over long/short distances, or it can simply be transformed back to electricity and methane for residential and industrial purposes, and fuels, for commercial and passenger vehicles.

Despite its potential, the hydrogen economy seems to have suffered many road-blocks for a smooth take-off. At present, many technical, as well as market adaption issues control the future of the industry. Hydrogen generation from clean sources is still 2-3 times costly as compared to natural gas/coal, and Blue Hydrogen generation (steam methane reforming + CCUS) has not really picked up. There hasn’t been enough traction on the development of hydrogen infrastructure, barring a few countries such as the US, Japan, South Korea, and few EU countries. Though, individual nations have increased their hydrogen R&D and demonstration plant spending, but, overall this is still below the peak achieved in 2008.

Progress is on the way

In some forward-looking countries, progress is already on its way to adopt hydrogen economy as a part of the mainstream source of energy. Not always are these nations driven by the desire to replace their fossil fuel import bill such as China, Japan, and South Korea, but, also by the inherent desire to shift to a cleaner affordable source of energy, such as the US, Canada, Australia, and some others.

Though, 2018 witnessed lower installed electrolyser capacity of 20.3 MWe, as compared to 2017, which accounted for 33.1 MWe capacity, but, it was still a historic year as construction of the world’s largest 20 MWe PEM (Proton-Exchange Membrane) electrolyser kick-started in Canada by Air Liquide and Hydrogenics, and, a 100 MWe capacity electrolyser was announced. Large scale electrolysers can change the game for rapid adoption in industrial sectors, however, this change, at least in the next 3-5 years, will come a 1.5x-2x premium as compared to other conventional routes.

The story on the FCEVs (Fuel Cell Electric Vehicles) side is compelling too, with 2018 registering a massive 80% y-on-y growth accounting for ~4,000 units of FCEV sale. Thanks to California’s Zero Emission Vehicle mandate, which helped achieve a large portion of the growth story in 2018. This is one of the most advanced climate policies so far, and more such bold initiatives are required for the industry to take-off.

IEA and Fuel Cells and Hydrogen Joint Undertaking, predicts that by 2025-30 total number of operational hydrogen refueling stations will be ~1,000-4,000 from the current 376 stations, which will feed ~2.5 million FCEVs per year by the end of 2030. This is a significantly lower number as compared to BEVs (Battery Electric Vehicle), whose sale is expected to reach ~44 million in 2030 from 5 million in 2018. These numbers itself are not very encouraging for the Hydrogen economy, but, if one expands the horizon to how Green Hydrogen can be used for large industrial sectors, the equation can change, significantly. Transportation and heating sector show the nearest-term potential for Green Hydrogen adoption, while aerospace, marine, and power generation will witness as long-term opportunities, mostly materializing beyond 2030.

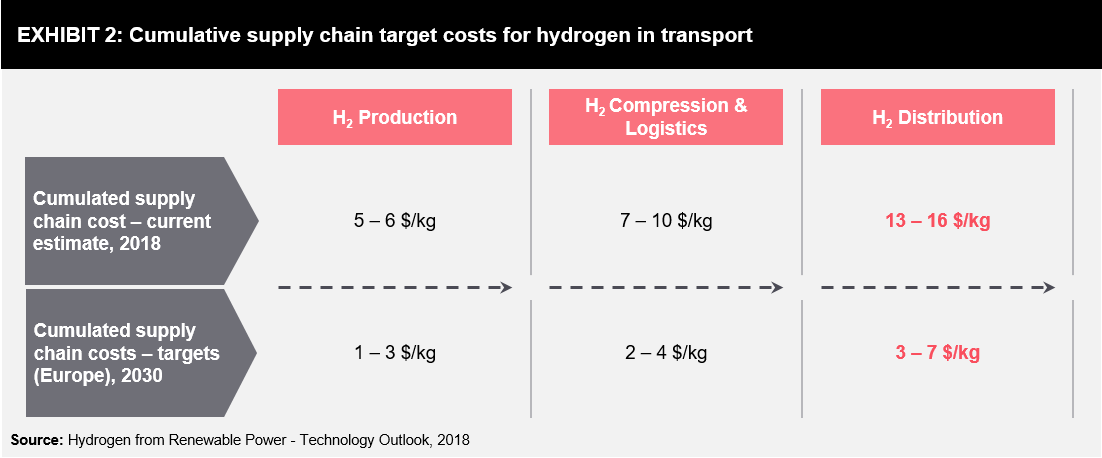

However, a lot depends upon how seriously regional governments ramp-up their plans to deploy hydrogen specific roadmaps and eventually start implementing things on the ground. As Proton exchange membrane (PEM) electrolysers and fuel cells reach technical maturity and mass acceptance, the cost of landed hydrogen is expected to further come down (Exhibit 2). Energy majors, such as Shell, BP, and Total, including, other industrial gases and equipment manufacturers are forming JVs, or, acquiring stakes in technology developers to make large-in-roads in this rapidly growing market, primarily with the intention of targeting large industrial consumers with established infrastructure.

Changing player landscape: Rise in M&A

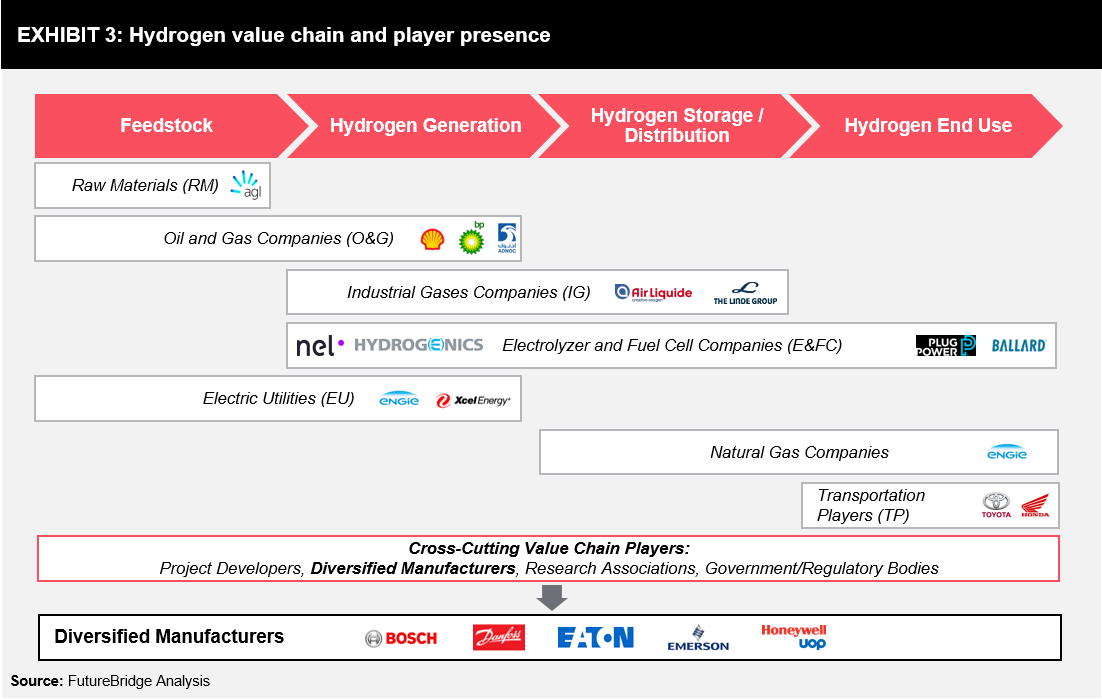

Recently, there has been a surge in the manner industry players across different industry segments have responded to accepting hydrogen as a key component in their overall portfolio. Deep-pocketed entities such as Shell, BP, and Toyota are looking to make inroads into the hydrogen space as the industry moves towards a cleaner energy mix in the future; increased activity via partnerships, and, mergers & acquisitions are expected in the coming years.

Different players across the value chain are collaborating to either, increase their know-how, or to fulfill their investment desires. It will be interesting to see how the player ecosystem is expected to evolve further, and, will the environment be conducive for such players, with less know-how (Exhibit 3).

The last couple of years has been extremely exciting for the hydrogen growth story, which witnessed many large players collaborating with technology developers to fulfill their growth ambitions in the Green Hydrogen space. What was unique in most of these deals was that the large player already had some pre-existing business position in the space of hydrogen, therefore, they were bullish in forging these ties. Naturally, it raises many question, such as:

- Why do large players see this as the most opportune time for a partnership or M&A?

- Did the technology developers realized that their capabilities are limited, in order to achieve the scale that they had anticipated?

- Or, is this the new normal, where we will increasingly see smaller companies tying-up with large players?

Discussed below are some recent deals (in the order of their acquisition timeline) in the space of Green Hydrogen, explaining why it made strategic sense for, both, the buyer and the seller, to forge such partnerships which is aligned with their strategic vision.

Weichai Power Co. acquires 19.9% in Ballard Power Systems

Chinese automotive and equipment manufacturer Weichai Power Co. on August 29th, 2018, decided to purchase ~20% stake in Canada based Ballard Power Systems. The total value of the deal stands at $163 million. In addition to this, Ballard Power will also receive an additional funding of $20 million from its other Chinese investor, Zhongshan Broad-Ocean Motor Co. Ltd.

Ballard designs, develops, manufactures and sells proton exchange membrane fuel cell products that can be used in heavy power systems, including passenger cars, trucks, light rails and ships. With this acquisition Weichai aims to expand its footprint in the growing Chinese market by offering products with superior fuel cell technologies in the commercial vehicle, and forklift industries. Both companies also aim to establish a JV company in the Shandong province to support China’s Fuel Cell Electric Vehicle market.

MAN Energy Solutions acquires 40% stake in H-TEC Systems

On March 26th, 2019, MAN Energy acquired a 40% stake in GP Joule subsidiary H-TEC Systems headquartered in Augsburg, Germany for an undisclosed amount. H-TEC System is a leading producer and seller of PEM electrolyzers and PEM stacks. With this acquisition MAN Energy Solutions gets its entry in the green hydrogen business, and, access to two board seats in the newly established H-TEC Systems advisory board.

Man has historically been a leading supplier of methanation reactors, and an early entrant into the power-to-X technology, but, with this acquisition it paves its way open to a variety of synthetic fuels using its proprietary P-to-X technology and hydrogen. It is also a significant step forward towards achieving MAN’s strategic goal, set in 2017, to generate a large portion of its revenue from sustainable technologies, by 2030.

Cummins completes acquisition of Hydrogenics Corporation

On Sep 9th, 2019, the US based, Cummins Inc. decided to purchase a majority stake of ~81% in Canada based, fuel cell and hydrogen production technologies provider, Hydrogenics Corp. The deal was valued at $290 million. The remaining ~19% shares of the company are still being held by Air Liquide, a French industrial gases major.

With this acquisition, Cummins, a world leader in the design, manufacturing, and distribution of engines, filtration, and power generation products, has decided to switch gears to a sustainable, renewable method of transport. The company for the past 20 years has been working on the fuel cell based technology, and this acquisition further consolidates its position in the rapidly transforming mobility space, where hydrogen based fuel cell systems are giving a tough competition to BEVs. According to NREL, it is expected that the running cost of a FCEV will come down from $0.21/mile in 2019 to $0.12/mile by 2025.

Hydrogenics will report under the recently formed Cummins Electrified Power Business Segment, drawing synergies from its existing operations. Cummins newly formed business already delivers fully electrified and hybrid powertrains, along with innovative components and subsystems to six markets and several application areas.

Linde acquires 19% stake in ITM

On Oct 23rd, 2019, German industrial gases group, Linde, acquired a minority stake of ~19% in ITM, a British manufacturer of polymer electrolyte membrane (PEM) electrolyzers. With this newly formed JV, the focus is to target large scale industrial users of hydrogen, such as metals and glass, electronics, refinery, chemistry, and steel industries, who are willing to shift to more green sources of hydrogen production. The JV also claims to shorten lead times, improve execution, and reduce the overall cost of setting-up such projects purely driven by synergies of a large scale EPC, through Linde, and, technical expertise of ITM Power.

The overall acquisition was worth EUR 45 million, where Linde UK Holdings acquired 95 million ordinary shares of ITM Power. The newly formed JV will be headed by Andreas Rupieper, the former group head of Linde R&D.

Given Linde’s extensive global market outreach and pre-existing capabilities in the hydrogen business, it is a significant step forward towards energy transition. The company will soon be able to capitalize on this opportunity at a global level by using its marketing network for both, existing Linde customers, as well as new ones. For ITM, which brings 18 years’ worth of experience in developing a successful commercial technology, it will be benefitted by scaling-up its electrolyzer capacity even further, and at the same time reducing costs. Cash flow from the deal will be used by ITM to shift to a new larger facility allowing for a larger annual production of 1,000 MW.